The report covers the following:

1. Composition and function of automotive seating

2. Size and Trends of global and Chinese automotive seating market

3. Competitive landscape and trends of global and China’s automotive seating industry

4. Automotive seating supply chain of major global and Chinese carmakers

5. Global and Chinese automotive seating manufacturers

Automotive seating industry, seemingly without technological barriers, is actually a capital-intensive business that does with high-tech expertise. First, automotive seating plants are usually adjacent to car factories, for the products are too large to be transported easily. Therefore, as carmakers add a new production base, automotive seating manufacturers need to follow up. In this case, substantial funds become a must. Second, safety, comfort, and light weight- three requirements on automotive seating- need rich technological accumulation and present high technological threshold. Moreover, a huge number of employees in automotive seating industry pose great challenges to managerial competencies.

Global automotive seating market has grown steadily on account of the two aspects. First, higher barriers in automotive seating industry lead to high market concentration and little competition. Automotive seating manufacturers have a greater say which enables them to raise prices constantly. Second, consumption is upgraded, a phenomenon starkly seen in China where consumers have higher requirements on automotive seating. Automotive seating saw an ASP of USD723 in 2010 with a market size of USD54 billion. The figures for 2015 were USD790 and USD70.1 billion. It is expected the market size will be valued at USD72.9 billion in 2016, and USD84.3 billion in 2020 when ASP arrives at USD865.

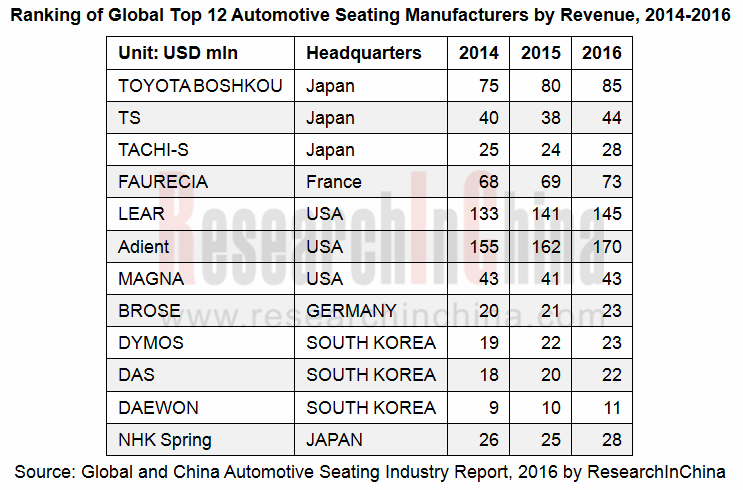

In automotive seating industry, Adient (a spin-off of Johnson Controls) and Lear are in the first camp, together holding about 48% of passenger car market. Adient has a broad customer base with almost all carmakers being its customers, while Lear provides products mainly for Ford, GM, BMW, and FCA and operates chiefly in North America and Europe but gets far less involved in the Asian-Pacific region. Adient seizes a dominant position in China with a market share of 40%.

Toyota Boshoku (a member of Toyota Group) and Faurecia (a subsidiary of PSA) fall into the second camp. Toyota Boshoku has been actively developing new customers outside Toyota in recent years. Faurecia serves mainly VW, PSA, and Renault-Nissan with its operations concentrated in Europe.

In the Chinese automotive seating market, almost all American cars and German cars are equipped with automotive seats from Adient and Lear, and among Japanese cars, all Honda cars carry automotive seats from TS, the majority of Toyota cars with automotive seats from Toyota Boshoku, and Nissan cars with automotive seats from a number of suppliers. Most of Chinese car brands use seats from joint ventures. Great Wall, BYD, Chery, and Geely adopt the model of partial own production and partial purchase from joint ventures. The joint ventures deliver cost-competitive products with better performance by relying on economy of scale and complete supply chain, while local brands retain their seating businesses just for enough say in negotiation with JVs and greater resilience in supply chain.

Most of Great Wall car seats come from its own seating business division and a few are provided by the joint venture between Great Wall and Yanfeng Johnson Controls. BYD’s car seats are largely supplied by its No. 16 business division and partly by Tachi-S, a three-party joint venture. Chery has low-end seats furnished by Wuhu Ruitai Auto Parts (a subsidiary of Chery) and high-end seats by Lear, making less and less purchase from Johnson Controls and GSK. Major suppliers of seats for Geely are Johnson Controls, Zhejiang Xindaimei Automotive Seating, and Zhejiang Jujin Automobile & Motor-cycle Accessories. Cooperation with South Korean Das provides solid support for Zhejiang Xindaimei Automotive Seating to gain a foothold in Geely. Zhejiang Jujin Automobile & Motor-cycle Accessories has investment from Geely and is also backed by Tachi-S.

As consumers pursue high-quality products, the ratio of home-grown seats will gradually fall, while that of JV seats will rise.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...