Global automotive LiDAR sensor market was USD300 million in 2017, and is expected to reach USD1.4 billion in 2022 and soar to USD4.4 billion in 2027 in the wake of large-scale deployment of L4/5 private autonomous cars.

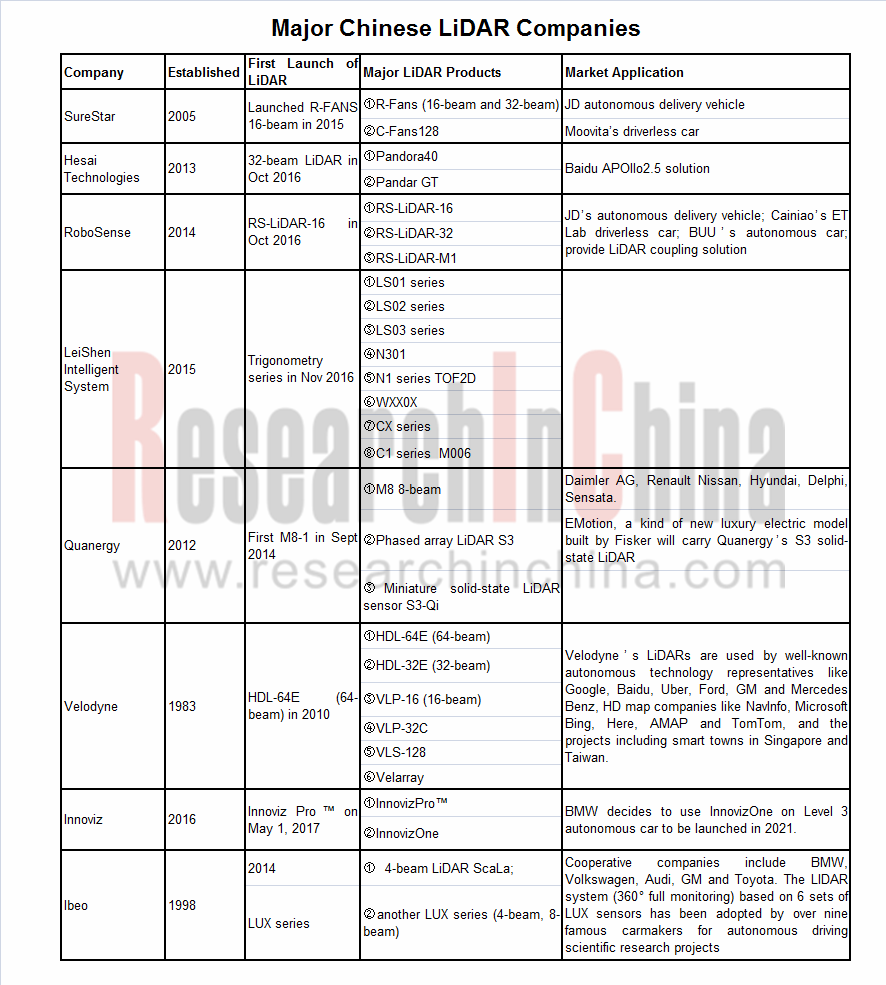

Being subject to autonomous driving technologies as well as laws and regulations, the autonomous driving companies has limited demand for LiDAR as yet. Mature LiDAR firms are mostly foreign ones, such as Valeo and Quanergy. Major companies that have placed LiDARs on prototype autonomous driving test cars are Velodyne, Ibeo, Luminar, Valeo and SICK. There are four firms that have already brought or plan to bring products to the market, specifically;

Continental SRL1: State-of-the-art LiDAR for Advanced Driver Assistance Systems, single-beam solid-state LiDAR, installed on Volvo XC60 and S60L;

Valeo SCALA Gen.1, mechanical 4-beam LiDAR, installed on Audi A8/A7/A6;

InnovizOne (MEMS solid-state LiDAR), will be installed on L3 autonomous car to be launched by BMW in 2021;

Quanergy S3 (OPA LiDAR), will be installed on new luxury electric model- Emotion built by Fisker.

Chinese LiDAR companies lag behind key foreign peers in terms of time of establishment and technology. LiDARs are primarily applied to autonomous logistic vehicles (JD and Cainiao) and self-driving test cars (driverless vehicles of Beijing Union University and Moovita). Baidu launched Pandora (co-developed with Hesai Technologies), the sensor integrating LiDAR and camera, in its Apollo 2.5 hardware solution.

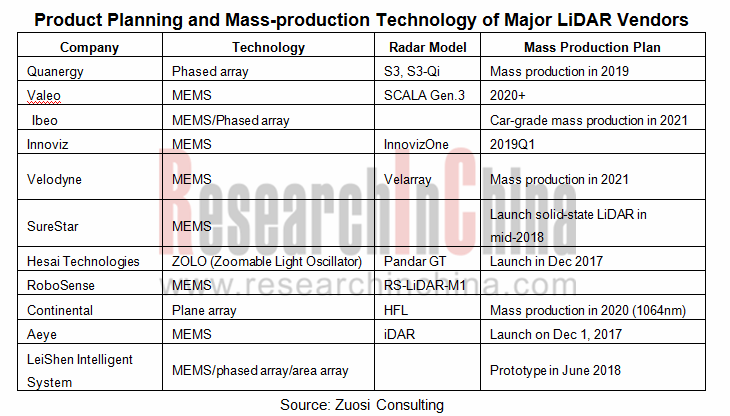

LiDAR will become smaller, solid-state and more cost-effective in the future. Solid-state LiDAR needs no rotating parts and hence is smaller and easily integrated in car body. Moreover, the reliability is improved and the costs can be reduced in great measure. So, the solid state of LiDAR will be an inevitable trend.

Most mainstream LiDAR vendors plan to launch solid-state radar around 2020, following technological routes of MEMS, OPA and Flash.

According to ADAS and autonomous driving plans of major OEMs, most of them will roll out SAE L3 models around 2020. Overseas OEMs: PAS SAE L3 (2020), Honda SAE L3 (2020), GM SAE L4 (2021+), Mercedes Benz SAE L3 (Mercedes Benz new-generation S in 2021), BMW SAE L3 (2021). Domestic OEMs: SAIC SAE L3 (2018-2020), FAW SAE L3 (2020), Changan SAE L3 (2020), Great Wall SAE L3 (2020), Geely SAE L3 (2020), and GAC SAE L3 (2020). The L3-and-above models with LiDAR are expected to share 10% of ADAS models in China in 2022. The figure will hit 50% in 2030.

Global and China In-vehicle LiDAR Industry Report, 2017-2022 focuses on the followings:

In-vehicle LiDAR market (status quo of application, market size forecast);

In-vehicle LiDAR market (status quo of application, market size forecast);

Leading in-vehicle LiDAR companies at home and abroad (development course, profile, financing, LiDAR products, product planning & technical direction, partners, etc.);

Leading in-vehicle LiDAR companies at home and abroad (development course, profile, financing, LiDAR products, product planning & technical direction, partners, etc.);

Trends of LiDAR Technologies and Costs.

Trends of LiDAR Technologies and Costs.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...