ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Automotive Radar

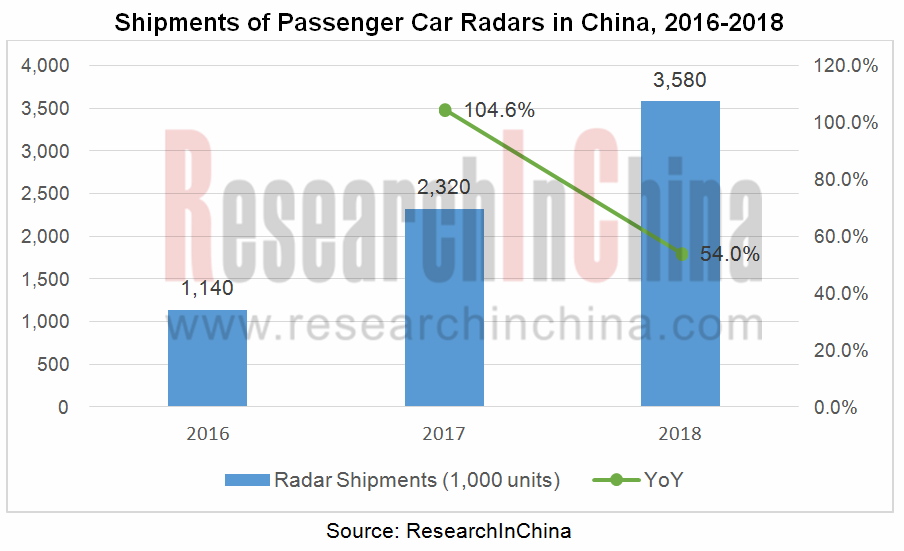

China’s passenger car radar market gathered pace from 2017, with shipments approaching 2.32 million units in the year, an annualized spurt of 104.6%. The growth trend continued in the first half of 2018 but slowed markedly in the second half due to a decline in automobile sales, leading to a much lower full-year growth in shipments. In 2018, the shipments of passenger car radars reached 3.58 million units in China, up by 54% versus 2017.

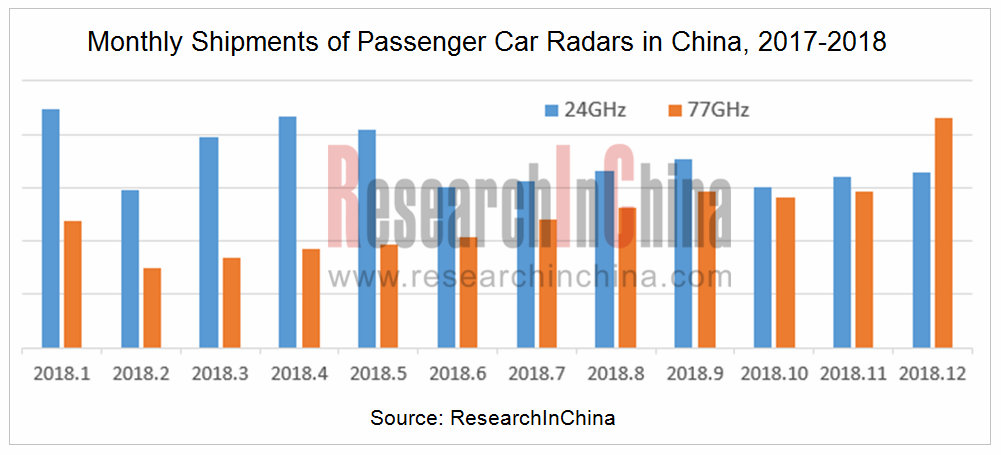

According to our monthly study of radar, 77GHz radar was narrowing its shipment gap with 24GHz radar in recent years, and came from behind at last in December 2018, two years earlier than we expected.

It also comes as a surprise that Chinese radar chip vendors have sprung up. Main players include Xiamen IMSEMI Technology Co., Ltd., Radaric (Beijing) Technology Co., Ltd., SGR Semiconductors Inc., Calterah Semiconductor Technology (Shanghai) Co., Ltd., Nanjing Citta Microelectronics Co., Ltd. and Hangzhou Andar Technology Co., Ltd.

In 2017, Calterah Semiconductor Technology (Shanghai) Co., Ltd. released Yosemite (2T4R/4T8R), a 77GHz transceiver chip series for CMOS-based automotive radars; in 2018 Xiamen IMSEMI Technology Co., Ltd. rolled out SG24TR12, a 24GHz 1T2R chip and SG24TR14, a 24GHz 1T4R chip.

Radaric (Beijing) Technology Co., Ltd. founded in 2010 with the background of Tsinghua University, designed a CMOS-based 77GHz multi-channel monolithic integrated radar chip. SGR Semiconductors Inc., the successor of RFIC Division under Shanghai Industrial μTechnology Research Institute (SITRI), closed series A funding of RMB80 million in 2017 and finished capital increase in the A-round in 2018.

In February 2019 Hangzhou Andar Technology Co., Ltd. unveiled ADT2001, a phased array architecture-based 16T16R 77GHz radar chip with CMOS process and ADT1002, a 2T2R radar chip.

Though there are radar chip start-ups in China, they commit themselves to the development of RF transceiver modules. Their transceiver units play a small role in the whole radar system and cost not much. China-made radar chips are still not provided with the core function of algorithms about processing radar signals.

Foreign chip leaders are heading towards integration and high precision. In June 2018, Texas Instruments (TI) announced mass production of AWR1642, a highly integrated ultra-wideband radar sensor boasting remarkable technical superiorities as it integrates microcontroller (MCU) and digital signal processor (DSP). Many a start-up uses AWR1642 to develop “4D radar” (4D=3D position + 1D speed).

High resolution imaging, 79Ghz and CMOS hold the new trends for radars.

CMOS-based chip ecosystem has yet to be built even if a radar with CMOS process will be a typical one in the future. Chinese radar start-ups face challenges of immature technology and unverified products in spite of a large number. For automotive industry with a high demanding on mature and reliable technologies, the long-used silicon germanium process still prevails, so the giants like Bosch, Continental, Aptiv, Denso and Veoneer still rule the roost. In 2018, the top three players in China’s passenger car 77G long-range radar (LRR) OEM market seized a combined 80% share.

In 2018, new radar entrants in China grew up fleetly by resorting to the strategy of “encircling the cities from the rural areas”.

Wuhu Sensortech Intelligent Technology Co., Ltd. was invested by security giant Hikvision and affiliates of BAIC and GAC, with team members growing to over 300 persons. In 2018, Sensortech shipped more than 100,000 radars, generating the revenue of nearly RMB100 million. Security and transportation were main markets using around 70% of Sensortech’s radars.

Quite a few start-ups in China apply the business model: polishing products in other markets whilst forging ahead in automotive market. Sensortech’s radars will be available to 10 models in 2019 after being used in two mass-produced passenger car models in 2018. Sensortech targets to earn RMB200 million in 2019, including 40% from automotive business.

Sensortech also plans to expand its team members to 1,000 in the next two years from the current 300 with the help of Hikvision.

Suzhou Millimeter-wave Technology Co., Ltd. saw shipments of 2,000 sets of 24Ghz automotive radars in OEM market in 2018 before expectedly shipping 50,000 sets for passenger cars in 2019 as it becomes a designated supplier of two automakers for five of their models.

In August 2018, Shenzhen Anngic Technology Co., Ltd. announced the closing of RMB50 million series A rounds. Its products get utilized in automobiles, drones, security, transportation, etc..

The trend for high precision forces not only Chinese radar start-ups but time-honored brands to have stronger competence in radar signal processing algorithms. For instance, Analog Devices, Inc. (ADI), a 15-year-old company managed in March 2018 to acquire Germany-based Symeo whose RF and sensor technologies enable real-time position detection and distance measurement. ADI will leverage Symeo’s signal processing algorithms to offer customers a radar platform with significant improvements in angular accuracy and resolution.

Vision-radar Fusion Solutions

It grows a trend that vision and radar get fused safer and more reliable ADAS capabilities. Take Volvo S90 city safety system as an example. The Aptiv RACam system for it combines a 77GHz radar and a monocular camera mounted at the top of the windshield to deliver such functions as FCW, AEB and ACC.

Suzhou Millimeter-wave Technology Co., Ltd. is creating a radar and camera all-in-one. With pre-fusion technology for pixel-level fusion of two sensors, the device becomes much more aware of surroundings and robust in object recognition.

Sensortech and Hikvision team up to develop pixel-level radar and vision fusion technologies.

ADAS and Autonomous Driving Industry Chain Report, 2018-2019 of ResearchInChina covers following 17 reports:

1)Global Autonomous Driving Simulation and Virtual Test Industry Chain Report, 2018-2019

2)China Car Timeshare Rental and Autonomous Driving Report, 2018-2019

3)Report on Emerging Automakers in China, 2018-2019

4)Global and China HD Map Industry Report, 2018-2019

5)Global and China Automotive Domain Control Unit (DCU) Industry Report, 2018-2019

6)Global and China Automated Parking and Autonomous Parking Industry Report, 2018-2019

7)Cooperative Vehicle Infrastructure System (CVIS) and Vehicle to Everything (V2X) Industry Report, 2018-2019

8)Autonomous Driving High-precision Positioning Industry Report, 2018-2019

9)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Processor

10)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Automotive Lidar

11)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Automotive Radar

12)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Automotive Vision

13)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Passenger Car Makers

14)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– System Integrators

15)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Commercial Vehicle Automated Driving

16)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Low-speed Autonomous Vehicle

17)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– L4 Autonomous Driving

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...