Global and China Automated Guided Vehicle (AGV) Industry Report, 2019-2025

-

Oct.2019

- Hard Copy

- USD

$3,200

-

- Pages:172

- Single User License

(PDF Unprintable)

- USD

$3,000

-

- Code:

BXM132

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,500

-

- Hard Copy + Single User License

- USD

$3,400

-

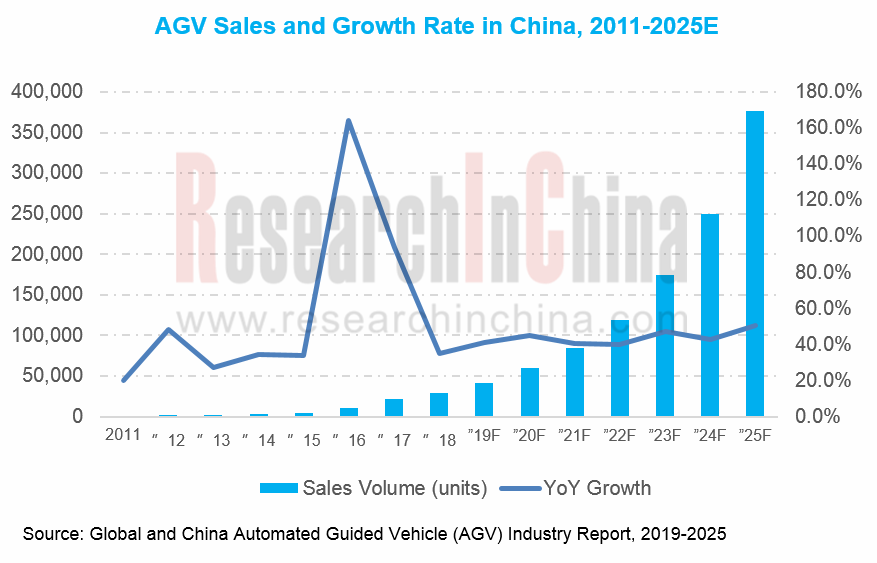

China’s AGV industry ushered in explosive growth along with new technologies and new scenarios in recent years, with its AGV sales surging to 29,600 units in 2018 from 1,260 units in 2011, showing a CAGR of up to 57.0%.

In China, AGV navigation technology has been upgraded to the third generation. The first generation technology is magnetic tape guidance, a shrinking market; the second generation technology is QR code, a market that has matured and become saturated; the third generation technology is laser + vision, which has been used and promoted by several companies. Laser + vision technology will be more promising than other AGV guidance technologies in application.

As concerns scenarios, ecommerce warehousing and smart logistics are fields for which capital and manufacturers compete over the years. They are also the moving force of growth during the AGV boom. In 2018, ecommerce and express delivery commanded over 1/3 of AGV market in China, and typical companies included Quicktron, GEEK+, HikRobot and Libiao Robotics.

Comparably, factory scenario where circumstances are complicated and technical barriers remain high, attracts powerful players in capital and technology. Examples include SIASUN Robot & Automation, an automotive AGV leader in China and Kunming Shipbuilding Equipment which sweeps 70-80% shares in tobacco industry. Manufacturing transformation and upgrading, digital factory and more flexible demand in recent years are conducive to AGV expansion. Yet, as digital factory is still a “concept” and factory scenario requires high stability robots, AGV use in the scenario still desires to be verified. By one estimate, it takes about 3 or 5 years to popularize AGV in industrial manufacturing.

In the Chinese AGV market, local companies rule the roost with a combined share of 90% or so. Among them, SIASUN, SCG, Yonegy and Jaten are first-echelon players, with annual shipment of over 1,000 units apiece. As a whole, there is still no one leading the market, so players are in a price war in perfect competition.

The severer competition in logistics/ecommerce AGV market will lead to a reshuffle in the AGV industry; AGV manufacturing market will heat up and soar in the upcoming years. The report forecasts that China’s AGV market will sustain a CAGR of roughly 40% between 2019 and 2025.

Global and China Automated Guided Vehicle (AGV) Industry Report, 2019-2025 highlights the following:

Global AGV market (size, demand structure, competitive pattern, development in main regions, etc.);

Global AGV market (size, demand structure, competitive pattern, development in main regions, etc.);

China AGV market (development history and model, size and concentration, structure by product/region/application, price, financing, competitive pattern by technology/product/company, development trends and forecasts);

China AGV market (development history and model, size and concentration, structure by product/region/application, price, financing, competitive pattern by technology/product/company, development trends and forecasts);

Core components and applied markets of AGV in China;

Core components and applied markets of AGV in China;

9 global and 20 Chinese AGV companies (operation, AGV products, typical application, etc.).

9 global and 20 Chinese AGV companies (operation, AGV products, typical application, etc.).

1. Overview

1.1 Definition

1.2 Classification

1.3 Industry Chain

2. Global AGV Market

2.1 Market Size

2.2 Demand Structure

2.2.1 By Application

2.2.2 By Region

2.3 Competitive Landscape

2.3.1 Corporate Competition

2.3.2 AMR VS AGVs

2.4 Regional Development

2.4.1 Japan

2.4.2 Europe

2.4.3 United Sates

2.4.4 India

3. Chinese AGV Market

3.1 Status Quo

3.1.1 Development History

3.1.2 Development Features

3.1.3 Development Mode

3.2 Market Situation

3.2.1 Market Size

3.2.2 Sales Volume

3.2.3 Ownership

3.2.4 Industrial Concentration

3.3 Market Structure

3.3.1 By Navigation Technology

3.3.2 By Product

3.3.3 By Application

3.4 Price

3.5 Competitive Pattern

3.5.1 By Type of Enterprise

3.5.2 Market Shares of Enterprises

3.5.3 M&A

3.6 Fundraising

3.7 Development Trend

3.7.1 Market Trend

3.7.2 Technology Trend

4. Upstream and Downstream Industries of AGV

4.1 AGV Core Parts

4.1.1 Development Overview

4.1.2 Drive Device System

4.1.3 AGV On-board Control System

4.1.4 Navigation/Guidance System

4.1.5 AGV Battery/Energy System

4.1.6 AGV Master Control System

4.2 Downstream Industries of AGV

4.2.1 Automobile Manufacturing

4.2.2 Parking

4.2.3 Power Patrol Inspection

4.2.4 Tobacco Logistics

4.2.5 Heavy Load

5. Major Global AGV Players

5.1 JBT

5.1.1 Profile

5.1.2 Operation

5.1.3 AGV Business

5.1.4 Presence in China

5.2 Daifuku

5.2.1 Profile

5.2.2 Operation

5.2.3 AGV Business

5.2.4 Presence in China

5.3 Dematic

5.3.1 Profile

5.3.2 Operation

5.3.3 AGV Business

5.3.4 Presence in China

5.4 Swisslog

5.4.1 Profile

5.4.2 Operation

5.4.3 AGV Business

5.4.4 Presence in China

5.5 Meidensha

5.5.1 Profile

5.5.2 Operation

5.5.3 AGV Business

5.5.4 Presence in China

5.6 Oceaneering AGV Systems

5.6.1 Profile

5.6.2 Operation

5.6.3 AGV Business

5.7 Grenzebach Corporation

5.7.1 Operation

5.7.2 AGV Business

5.7.3 Presence in China

5.8 Elettric 80

5.8.1 Profile

5.8.2 Operation

5.9 Rocla

5.9.1 Profile

5.9.2 Operation

6. Key Chinese AGV Companies

6.1 Shenyang Siasun Robot & Automation Co., Ltd. (300024)

6.1.1 Profile

6.1.2 Operation

6.1.3 AGV Robot Business

6.1.4 Development Strategy

6.2 Yunnan KSEC Intelligent Equipment Co., Ltd.

6.2.1 Profile

6.2.2 Operation

6.2.3 Typical Cases

6.3 Machinery Technology Development Co. Ltd.

6.3.1 Profile

6.3.2 Operation

6.3.3 AGV Business

6.4 CSG Smart Science & Technology Co., Ltd.

6.4.1 Profile

6.4.2 Operation

6.4.3 AGV Business

6.5 Guangdong Jaten Robot & Automation Co., Ltd.

6.5.1 Profile

6.5.2 Operation

6.5.3 AGV Business

6.5.4 Main Cases

6.6 Greek

6.6.1 Profile

6.6.2 Operation

6.6.3 OpenBox and Smart Factory Solutions

6.7 Quicktron

6.7.1 Profile

6.7.2 Operation

6.7.3 Applied Cases

6.8 Zhejiang LiBiao Robot Co., Ltd.

6.8.1 Profile

6.8.2 Operation

6.9 Hangzhou Hikrobot Technology Co., Ltd.

6.9.1 Profile

6.9.2 AGV Business

6.10 Yonegy Logistics Automation Technology Co., Ltd.

6.10.1 Profile

6.10.2 Operation

6.11 Zhejiang Noblelift Equipment Joint Stock Co., Ltd.

6.11.1 Profile

6.11.2 Operation

6.11.3 AGV Business

6.11.4 Output and Sales Volume

6.11.5 Development Strategy

6.12 Guangzhou Jingyuan Mechano-Electric Equipment Co., Ltd.

6.12.1 Profile

6.12.2 Operation

6.13 Shanghai Triowin Automation Machinery Co., Ltd.

6.13.1 Profile

6.13.2 Operation

6.13.3 AGV Business

6.14 Shenzhen Casun Intelligent Robot Co., Ltd.

6.14.1 Profile

6.14.2 Operation

6.14.3 AGV Business

6.15 Guangzhou Sinorobot Technology Co., Ltd.

6.16 Shenzhen OKAGV Co., Ltd.

6.17 Guozi Robot

6.18 CIZON

6.19 Standard Robots

6.20 Suzhou AGV Robot

Architecture Diagram of AGV

Composition of AGV System

Operating Scene and Communication Mode of AGV

Classification of AGV

Structure of AGV Software

AGV Industry Chain

AGV Production Line VS Traditional Production Line

Global AGV Sales Volume and YoY Growth, 2014-2025E

Global AGV Market Size and YoY Growth, 2014-2025F

Global AGV Market share by Application, 2018

Growth Rate of Global Demand for AGV, 2019-2024E

Financing and M&As of Major Global AGV Companies, 2016-2018

Competition Pattern of AGV Companies Worldwide

World-renowned AGV Companies and Their Fundraising Investments

Global Mobile Robot (AGV & AMR) Sales (by Products), 2017-2018

Global AMR Sales, 2017-2018

Global Mobile Robot (AGV & AMR) Sales Growth Rate (by Regions), 2018

AMR Investment, 2016-2018

AGVS/AGV Sales Volume in Japan, 2012-2018

AGVS Sales Structure in Japan by Category, 2014-2025F

AGV Demand Structure in Japan, 2017-2018

European AGV Market Size, 2017-2023E

American AGV Manufacturers

AGV (by Type) Market Size in India, 2014-2025E

Development History of AGV in China

Development Model of Major AGV Producers in China, 2019

AGV Market Size and YoY Growth in China, 2014-2025E

AGV Sales Volume and YoY Growth in China, 2011-2019

AGV Ownership and YoY Growth in China, 2015-2025E

Concentration Ratio of Chinese AGV Industry, 2018

AGV Structure in China by Navigation Mode, 2018

Chinese AGV LiDAR Companies

Difference between AGV and AGC

AGV Sales Structure in China by Product, 2015-2025E

Major Global and Chinese AGC Producers, 2018

AGV Demand Structure in China by Sector, 2018

Average Price of AGV in China, 2016-2025

AGV Price of Major Global and Chinese Producers in China, 2018

Market Share of AGV Companies in China by Country, 2014-2025E

Market Share of Major Global AGV Producers in China, 2017- 2018

Market Share of Major Global AGV Producers in China, 2016

Financing and M&As of Major AGV Producers in China, 2014-2019

Financing in Chinese AGV Industry, 2018-2019

AGV Sales Volume and YoY Growth in China, 2018-2025E

Application of Trackless Navigation AGV in China

Development Trends of AGV

Number of Motors, Drivers and Speed Reducers of Per Unit AGV Drive System by Drive Mode

New Demand for AGV Motors in China, 2016-2025E

New Demand for AGV Speed Reducers in China, 2016-2025E

Composition of Laser Guided AGV On-board Control System

New Demand for AGV On-board Controllers in China, 2016-2025E

Major Chinese Controller Producers, 2018

Classification of AGV Navigation Modes and Core Components

New Demand for AGV Laser Scanners in China, 2016-2025E

Main AGV Obstacle Avoidance Sensors in China

Major Chinese AGV Sensor Companies, 2018

Operating Principle of Magnetic Navigation Sensor for AGV System

Cycles of AGV Batteries

Contactless Power Supply AGV System

Supercapacitor Power Supply AGV System

Batteries as a Percentage of AGV Projects in Europe, 2015

Structure of AGV Batteries in China by Product, 2015

Main Charging Methods of AGV Batteries

Classification of Global AGV Software Systems

AGV Software Systems Used by Global and Chinese AGV Producers

China’s Automobile Ownership, 2014-2025E

China’s Automobile Output and Sales Volume, 2014-2025E

Production and Sales of New Energy Vehicle in China, 2011-2019

Features and Configurations of AGV Systems for Car Production Lines

Density of Use of Car AGVs in Major Countries

Major Car AGV Producers in China

Car AGV Sales Volume in China, 2017-2025E

Global and Chinese AGV Products for Parking

Global and Chinese AGV for Parking Projects, 2018

Merits of Patrol Robot

Power Industry’s Demand for AGVs in China, 2017-2025E

Acquisition Mode of Power Patrol Robots in China, 2015-2017

State Grid’s Tenders for Intelligent Patrol Robot in Recent Years

Performance Comparison of Products of Key Chinese Producers of Power Patrol Robot

Development History of Tobacco Logistics in China, 2003-2019

Competitive Pattern of AGV for Tobacco Logistics

Siasun’s Intelligent Logistics System for Tobacco Industry

Use of AGVs in Some Tobacco Factories in China

Heavy Load AGV Producers by Purpose

Businesses of JBT

Subsidiaries of JBT, 2019

Revenue and Net Income of JBT, 2013-2019

Order Backlog of JBT by Product, 2013-2019

Revenue Breakdown of JBT by Product, 2013-2019

Revenue Breakdown of JBT by Region, 2012-2018

Revenue Structure of JBT by Region, 2018

AGV Locations of JBT

JBT’s Subsidiaries in China, 2019

Global Network of Daifuku

Business Structure of Daifuku

Net Sales and Net Income of Daifuku, FY2013-FY2019

Order Intake of Daifuku, FY2015-FY2019

Sales Structure of Daifuku by Business, FY2014-FY2018

Sales Structure of Daifuku by Sector, FY2014-FY2018

Sales Structure of Daifuku by Region, FY2018

Main AGV Clients of Daifuku

AGV Systems of Daifuku

Daifuku’s Sales in China, FY2013-FY2019

M&As of Dematic, 2010-2019

Revenue of Dematic, 2014-2018

Advantages and Application of Dematic’s AGV System

Dematic’s AGV Series

Typical Clients of Dematic in China

Milestones of Dematic’s Suzhou Plant

Businesses and Products of Swisslog

Businesses and Products of Swisslog

Operation Data of Swisslog, 2015-2018

Revenue and Order Structure of KUKA Group, 2017-2018

AGVs of Swisslog

Customers of AGVs of Swisslog

Companies of Swisslog in China

Business Structure of Meidensha

Net Sales and Net Income of Meidensha, FY2014-FY2018

Net Sales Structure of Meidensha by Business, FY2017-2018

FY2019 Results Forecasts of Meidensha by Business

Main Products and Clients of Meidensha’s Industrial Systems

Meidensha’s Industrial Systems Business Plan, FY2018-FY2020

AGV Products and Features of Meidensha

Transport Weight and Applicable AGV Model of Meidensha

Guidance Systems of Meidensha

Meidensha’s Subsidiaries in Mainland China, 2019

Business Segments of Oceaneering

Revenue and Net Income of Oceaneering, 2016-2019

Revenue Structure of Oceaneering by Business, 2016-2018

Revenue Structure of Oceaneering by Region, 2017-2018

AGVs of Oceaneering AGV Systems

Grenzebach’s Facts, 2018

Business Members of Grenzebach

Grenzebach’s Subsidiaries by Country/Region

AGV Products of Grenzebach

Partner and References of AGV Business of Grenzebach

Elettric 80’s Fact, 2019

Products of Elettric 80

Development Course of Rocla

Rocla’s AGV Series

Applied Cases of Rocla’s AGV

Revenue and Net Income of Shenyang Siasun Robot & Automation, 2015-2019

Operating Revenue Structure of Shenyang Siasun Robot & Automation by Product, 2017-2019

Gross Margin of Shenyang Siasun Robot & Automation by Product, 2015-2019

AGVs of Shenyang Siasun Robot & Automation

Main Partners of Shenyang Siasun Robot & Automation

AGV Development History of Yunnan KSEC Intelligent Equipment

AGVs of Yunnan KSEC Intelligent Equipment

Revenue and Net Income of Machinery Technology Development, 2013-2019

Operating Revenue Structure of Machinery Technology Development by Business, 2017-2018

Major AGV Products of Machinery Technology Development

Revenue and Net Income of CSG Smart Science & Technology, 2013-2019

Revenue Structure of CSG Smart Science & Technology by Product, 2017-2019

AGVs of Huaxiao Precision (Suzhou)

Revenue and Net Income of Huaxiao Precision (Suzhou), 2016-2019

Development History of Guangdong Jaten Robot & Automation

Operation of Guangdong Jaten Robot & Automation, 2016-2019

Typical Self-developed AGVs by Guangdong Jaten Robot & Automation

Financing of Geek+

Development History of Quicktron

Major Products of Quicktron

Service Network of Zhejiang LiBiao Robot Co., Ltd. in China

Mobile Robot Series of Hangzhou Hikrobot Technology

Development History of Yonegy Logistics Automation Technology

AGV Products of Yonegy Logistics Automation Technology

Main Clients of Yonegy Logistics Automation Technology

Revenue and Net Income of Zhejiang Noblelift Equipment, 2011-2019

Operating Revenue Breakdown of Zhejiang Noblelift Equipment by Product, 2013-2018

Operating Revenue Breakdown of Zhejiang Noblelift Equipment by Region, 2013-2018

Gross Margin of Zhejiang Noblelift Equipment by Product, 2013-2018

Milestones in AGV-related Business of Zhejiang Noblelift Equipment, 2015-2019

Capacity, Output and Sales Volume of Zhejiang Noblelift Equipment by Product, 2013-2018

Revenue and Net Income of Guangzhou Jingyuan Mechano-Electric Equipment, 2013-2018

Revenue and Net Income of Shanghai Triowin Automation Machinery, 2012-2019

Revenue Structure of Shanghai Triowin Automation Machinery by Product, 2015-2018

Revenue Breakdown of Shanghai Triowin Automation Machinery by Region, 2012-2018

Applications of Shanghai Triowin Automation Machinery’s AGV Robots and Main Clients

Revenue and Net Income of Shenzhen Casun Intelligent Robot, 2013-2019

Revenue Structure of Shenzhen Casun Intelligent Robot by Product, 2016-2018

Gross Margin of Shenzhen Casun Intelligent Robot by Product, 2013-2018

Applications of Shenzhen Casun Intelligent Robot’s AGVs and Main Clients

Main Automotive Clients of Shenzhen Casun Intelligent Robot

Main Clients of Shenzhen Casun Intelligent Robot in Electronic and Home Appliances Industries

AGV Business Milestones of Guangzhou Sinorobot Technology, 2014-2019

AGV Series of Shenzhen OKAGV Robotics

Typical Application of OKAGV’s AGV

Revenue and Net Income of Zhejiang Guozi Robotics, 2014-2019

Characteristics of Zhejiang Guozi Robotics’ AGV Systems

Applied Cases of CIZON’s AGV

Major Products of Standard Robots

Non-reflector Laser Navigation Forktype AGV of Suzhou AGV Robot

Partners of Suzhou AGV Robot

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...