V2X (Vehicle to Everything) and CVIS (Cooperative Vehicle Infrastructure System) Industry Report, 2019-2020

5G+V2X CVIS will be a strong driver for highly automated driving.

The V2X industry is thriving with advances in automotive connectivity, to which great importance has been attached by car producing powers worldwide, and it is vigorously promoted and deployed about which the development plans, laws & regulations, technical criteria and pilot construction are in full swing in different countries.

Till 2025, the intelligent vehicles with conditional autonomy will be spawned in China, LTE-V2X and other networks will be regionally viable, 5G-V2X will be progressively available on expressways and in some cities, and the high-precision spatial-temporal datum service network will be fully covered, according to the Strategy for Innovative Development of Intelligent Vehicles circulated by National Development and Reform Commission (NDRC) in February 2020. An intelligent vehicle system with Chinese standards will be established between 2035 and 2050.

Two V2X technology roadmaps prevail worldwide, i.e., IEEE802.11p (DSRC) and C-V2X (Cellular-V2X). Application layer standards are drafted differently by countries.

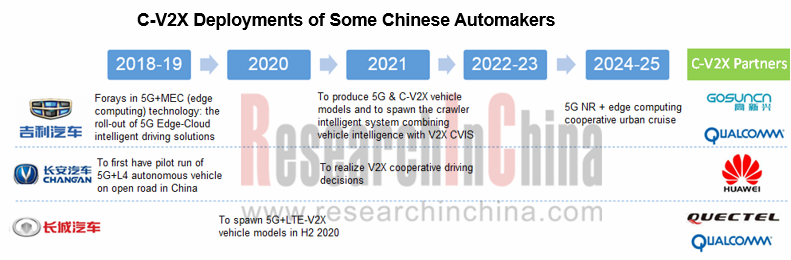

C-V2X springs up and wins the hearts of industry insiders since it is far superior to DSRC. C-V2X, encompassing LTE-V2X and 5G-V2X, gets energetically promoted in China.

In December 2019, Federal Communications Commission (FCC) passed a resolution with one accord that most spectrums of 5.9GHz band will be reallocated and they will be dedicated for the unlicensed spectrum technology and the C-V2X technology. Over the past two decades, 75MHz in the 5.9GHz band was used for DSRC, but FCC seeking to revise the rules pointed it out that DSRC is at a standstill for many years, particularly in April 2019 when Toyota stopped using DSRC V2X technology.

5G NR based V2X will boost the development of fully automated vehicles.

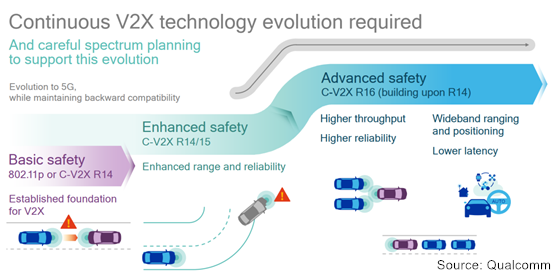

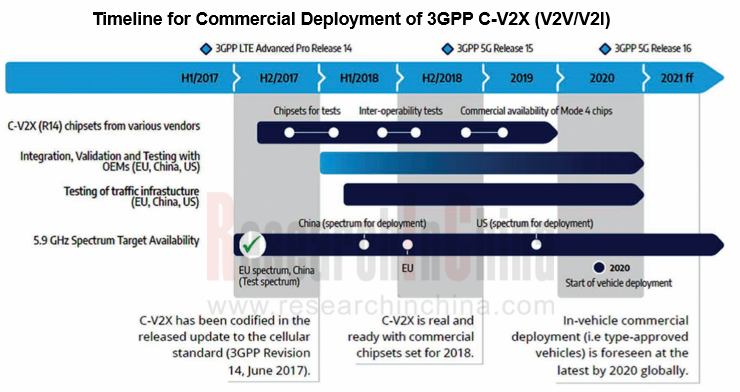

C-V2X (incl. LTE-V2X, 5G-V2X) is based on 3GPP specifications. LTE-V2X evolves towards 5G-V2X.

3GPP R14 standards supporting LTE-V2X was issued in 2017; 3GPP R15 standards that support LTE-V2X enhanced (LTE-eV2X) were formally completed in June 2018; 3GPP R16+ standards supportive for 5G-V2X started to be studied in June 2018.

LTE-V2X is designed mainly to enable driver assistance, improve road safety, efficiency and comfort. NR-V2X, a fusion of communication technologies, big data, artificial intelligence, among others, suffice autonomous driving and other new features better. 5G NR V2X standards are rapidly under way and physical layer specifications plan to be nailed down in March 2020.

Among the 25 projects about Rel-17 that were established at the 3GPP RAN Meeting held in Spain in December 2019, a standardization project -- 5G new radio sidelink enhancement -- will be a souped-up version of Rel-16 NR-V2X sidelink. Also, the technology roadmap of 3GPP 5G 3rd edition (Rel-17) was made explicitly during the Meeting. Noticeably, Chinese operators initiated and joined many projects of criteria constitution about 3GPP RAN R17.

Progress in C-V2X deployment

It is put forward in the Strategy for Innovative Development of Intelligent Vehicles to build a full-fledged intelligent vehicle infrastructure system, including (1) to build smart roads and next-generation national traffic control network, to expedite 5G construction and combination with telematics; (2) to study the licensing of special spectrums for automotive wireless communications, to hasten construction of wireless communication network for automotive use; (3) to accelerate construction of a unified national high-accuracy spatial temporal datum service capabilities by giving full play to the existing Beidou satellite positioning reference station network; (4) to develop the intelligent vehicle maps with unified standards, to build a perfect geographic information system containing road network information, to offer real-time kinematic (RTK) data services; (5) the existing facilities and data resources will be leveraged to build a national intelligent vehicle big data cloud-enabled platform.

5G+V2X, as a crucial infrastructure to autonomous driving, is booming with policy support. V2X started from 2019 to be piloted successively and will be more popular with 5G deployments in 2022. Meanwhile, 5G NR V2X is being tested and certified, setting the stage for large-scale application of intelligent vehicles with higher autonomy in 2025.

The traditional automotive terminals like T-Box are on the brink of a revolution. The automotive TCU (Telematics Control Unit) integrates 4G/5G module, C-V2X module, onboard navigation module and so forth, which means the opportunities and challenges to the providers of both cockpit electronics and conventional telematics.

Huawei Technologies rolled out the C-V2X T-Box compatible with both 4.5G and 5G; PATEO launched 4.5G C-V2X T-box; Neusoft released T-Box 3.0 combining C-V2X, 5G, Ethernet and other technologies; Samsung Harman announced the availability of TCU in-built with cellular NAD and Autotalks’ 2nd-Gen chipset, offering C-V2X capabilities.

Telematics evolves from initially TSP platform to intelligent connectivity platform and then to autonomous driving cloud-enabled platform (cooperative vehicle infrastructure system). 5G T-Box, a portal for big data of intelligent vehicles in future, will be the core product for smart hardware producers. Automakers also have collaborations with Tier 1 suppliers and plan to have the to-be-launched models configured with 5G+V2X successively.

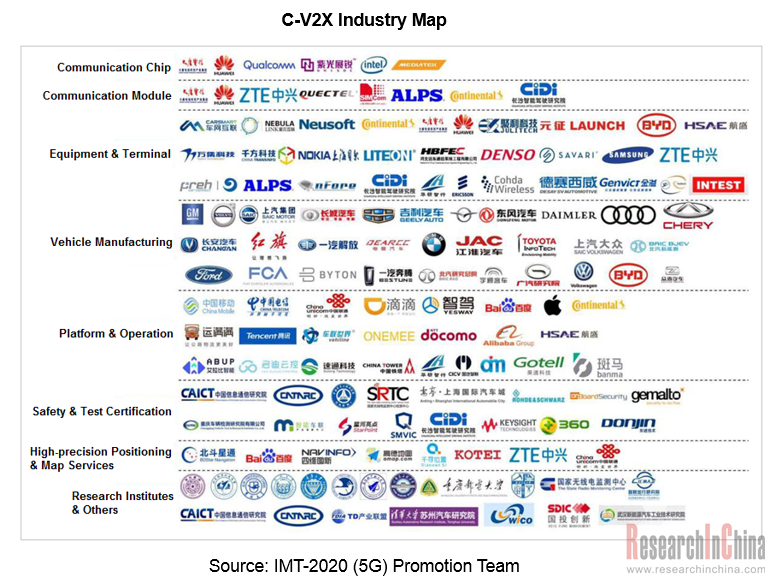

Perfection of C-V2X industry chain in China

C-V2X industry chain involves communication chip, communication module, terminals & equipment, vehicle manufacturing, test & certification, operation services, etc., where there are many players such as chip vendors, equipment manufacturers, OEMs, solution providers and telecom carriers. In October 2019, C-V2X ‘Four Crosses’ (cross-chip module, cross-terminal, cross-vehicle, cross- safety platform) connectivity demonstrations were successfully held, a full interpretation of C-V2X complete chain technology competences and facilitating further C-V2X deployments at home.

Huawei make great strides in C-V2X and has unveiled C-V2X chip, gateway, T-Box, RSU (Road Side Unit) to end-to-end solutions. In 2019, Huawei launched 5G in-car module MH5000 which is highly integrated with 5G and C-V2X technologies and is packed with 5G baseband chip Balong 5000 with such features as one-core multi-mode, high rates, downlink-uplink decoupling, support of SA (5G standalone) and NSA (5G non-standalone) dual-mode network, support of C-V2X, to name a few.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...