Autonomous mining vehicle and autonomous sanitation vehicle markets take off.

This report highlights progress of autonomous working vehicles in four fields: sanitation, airport, agriculture and mining.

Autonomous working vehicles that run on relatively closed roads and fixed routes, are often free of public road traffic rules, making for popularization of highly automated driving technology. Although the COVID-19 pandemic hinders the development of autonomous driving at airports for the time being, autonomous driving technology for sanitation, agriculture and mining is developing by leaps and bounds.

Autonomous sanitation vehicle

Urban autonomous sanitation street sweepers shall travel at speeds lower than 12km/h according to China’s national standards. The use of autonomous driving technology in sanitation field enables all-weather and more efficient operation subject to strict specifications. In China, autonomous sweepers are being piloted in dozens of places nationwide, mainly for enclosed scenarios such as parks and scenic spots. As China spends RMB200 billion to RMB300 billion on sanitation and more than 100,000 sanitation vehicles are sold each year, autonomous sanitation vehicle sales and service market will be worth a staggering tens of billions of yuan considering sanitation vehicles are being replaced by self-driving ones.

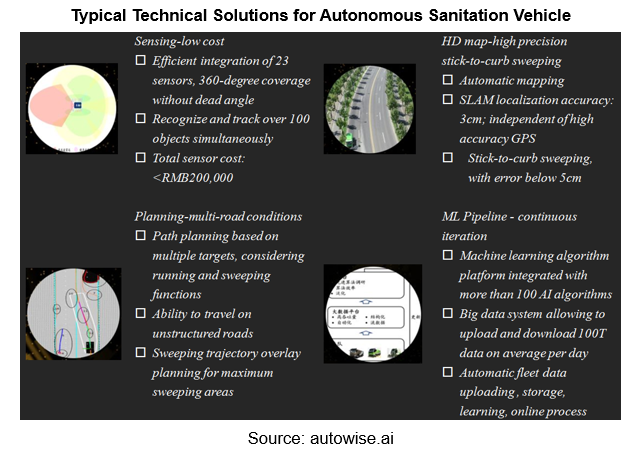

In China, vision + radar solution currently prevails among technology roadmaps of autonomous sanitation vehicle manufacturers who differ greatly in underlying algorithms and sensor cost control. As pilot run and operation of autonomous sanitation vehicles are under way in some places of China, solution providers face challenges of cost control posed by mass production, so most of them turn to homemade sensors and low-cost computing platforms like ARM from NVIDIA.

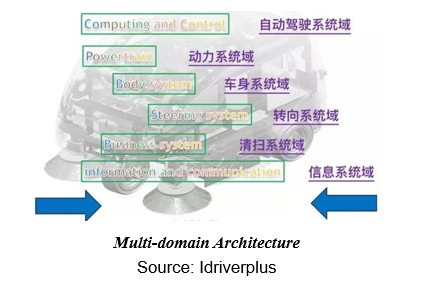

Most start-ups build autonomous sweepers based on existing sweeping vehicles, while body frame and modules of Idriverplus VIGGO are developed specially for autonomous vehicle. VIGGO’s electronic/electrical architecture consists of the following domains: Computing and Control, Powertrain, Body System, Steering System, Business System, and Information and Communication.

The new design that dispenses with driver’s seat saves seat space for water tank or battery to increase effective operating radius.

By virtue of down-to-earth R&D and reliable products, Idriverplus acquired orders for 1,000 units of its 5G autonomous vehicles from China Mobile in July 2019. Hundreds of VIGGO sweepers have been sold.

In February 2020, Idriverplus also rolled out a spraying sterilizer vehicle for curbing coronavirus disease.

Apart from VIGGO, cockpitless design is also found in AXL, a fully autonomous concept mining truck introduced by Scania. The vehicle represents a future trend for mining vehicle.

Autonomous mining vehicle

Autonomous mining vehicles already find broad application in foreign countries. Autonomous mining vehicles of Fortescue Metals Group Ltd (FMG), an iron ore tycoon, have run a total of 33.5 million km and transported more than 1 billion tons of ores and materials, with production efficiency 30% higher than conventional manual transport. FMG has operated 137 self-driving mining vehicles.

In China, mining companies need to pay out tens of billions of yuan for workers to transport ores and materials each year, who cannot still ensure transport safety and efficiency. In major mining areas of China, road dump trucks featuring non-widebody and small tonnage are largely used with ownership of roughly 200,000 units, while around 5,000 units of off-road wide body dump trucks for mining are produced and sold annually, with ownership of just over 10,000 units. The refitted autonomous mining vehicle market (OEM and aftermarket) in China is valued at least RMB500 billion.

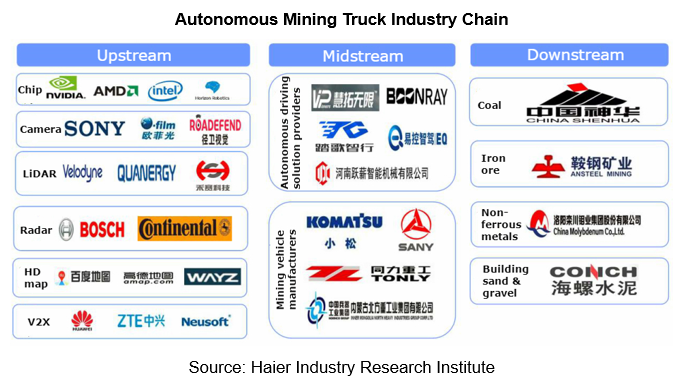

As concerns technology roadmap, mining trucks usually utilize the LiDAR + vision + radar solution for their common price of RMB800,000 at least makes manufacturers seldom weigh the cost of LiDAR. The three sensor fusion solution allows all-day, all-weather perception by sensing system in bad conditions at mines. That mining vehicles travel at low speeds and in simple environment means that LiDAR is optional so some companies also use vision + radar solution for a sharp cut in refit cost.

Major autonomous mining truck solution providers in China have actual projects carried out but all on small scale. Most of autonomous mining truck start-ups have closed one or two funding rounds, marking that capital has turned attention to the segment. At present, they are close to each other in technology roadmap but still need to improve their technology, with orders they announced often worth RMB100 million or so and few vehicles operated (generally dozens of units), which means no one plays a leading role.

Following a contract for two new autonomous vehicles signed on July 4, 2019, Beijing Tage Idriver Technology Co., Ltd. and Inner Mongolia North Hauler Joint Stock Co., Ltd., China’s largest mining truck manufacturer sweeping 80% of the domestic market, signed on April 8, 2020 a supply order for 10 sets of “autonomous driving control systems”, which will be mounted on 10 units of new NTE200AT vehicles.

Autonomous agricultural vehicle

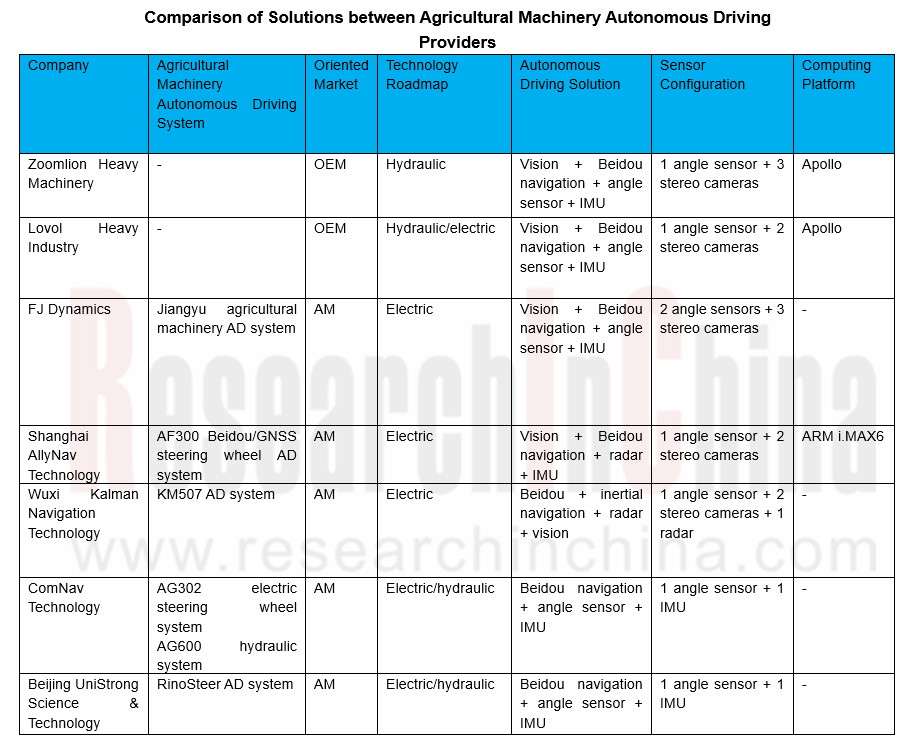

Autonomous driving for agricultural machinery, the simplest one among all autonomous driving technologies for special vehicles, depends more on high-precision positioning systems and software algorithms. Mainstream hardware configuration is Beidou system + angle sensor + IMU, and vision is optional and available to users who need. In terms of technology roadmap, OEMs often use a hydraulic solution where electro-hydraulic proportional valves are used to drive steering wheel. In aftermarket, the electric steering wheel solution in which motors are used to simulate manual driving is largely used due to being easy to refit and low cost.

Globally, big agricultural machinery manufacturers all have a range of models pre-installed autonomous driving technology (GPS Ready). Examples include John Deere 8R Series, Case New Holland Magnum Series, and AGCO Auto Guide 3000 with standard configuration of Danfoss hydraulic valves. In the Chinese OEM market, hydraulic solutions rule the roost.

In aftermarket, hydraulic and steering wheel autonomous driving solutions take up a considerable proportion of installation and sales. In the Chinese market, flagship products of most system providers are steering wheel solution. Beijing UniStrong Science & Technology Co., Ltd. provides both hydraulic and steering wheel solutions but the hydraulic dominate; Shanghai AllyNav Technology Co., Ltd. has offerings of both, of which the hydraulic led previously and the steering wheel got vigorously promoted in 2019. Of the shipments of autonomous driving systems for agricultural machinery in China, electric steering wheel solutions shared roughly 20% and the hydraulic solutions swept 80% from 2018 to 2019.

In view of application, agricultural machinery self-driving systems are still expensive (RMB70,000-RMB80,000/set), and massively used in areas with large farmlands, like Xinjiang and Northeastern China. Agricultural machinery autonomous driving system market in China will be valued at RMB4 billion to RMB5 billion given that virtually 200,000 units of mid- and high-end tractors are sold a year and penetration of such systems is 50%. In future, autonomous driving and variable operations will bring a larger market.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...