Global and China Automotive Operating System (OS) Industry Report, 2019-2020

With advances in smart cockpit and intelligent driving, and enormous strides of Tesla, OEMs care more about automotive operating system (OS). Yet, it is by no means easy for both new carmakers and traditional OEMs to develop base software for intelligent cars. It is in the report that world’s vehicle OS vendors are compared and analyzed.

Auto OS is generally classified into four types:

1) Basic auto OS: it refers to base auto OS such as AliOS, QNX, Linux, including all base components like system kernel, underlying driver and virtual machine.

2) Custom-made auto OS: it is deeply developed and tailored on the basis of basic OS (together with OEMs and Tier 1 suppliers) to eventually bring cockpit system platform or automated driving system platform into a reality. Examples are Baidu in-car OS and VW.OS.

3) ROM auto OS: Customized development is based on Android (or Linux), instead of changing system kernel. MIUI is the typical system applied in mobile phone. Benz, BMW, NIO, XPeng and CHJ Automotive often prefer to develop ROM auto OS.

4) Super auto APP (also called phone mapping system) refers to a versatile APP integrating map, music, voice, sociality, etc. to meet car owners’ needs. Examples are Carlife and CarPlay.

OEMs are not only striving to gain control of vehicle base software and hardware and apt to use neutral OS, but exerting itself to reduce the development cycle and costs by more collaborations and leveraging open source software organizations.

Preference to Neutral and Free OS

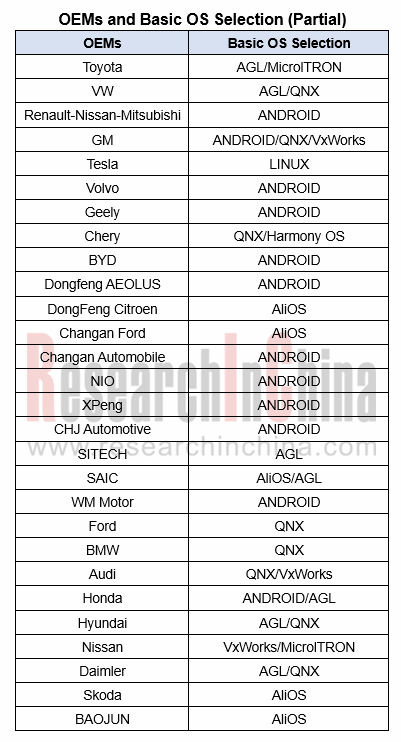

It can be seen in the table below that most Chinese automakers select Android, while foreign peers choose AGL. Both Android and and AGL are neutral and free operating systems.

AGL now has the support of 11 OEMs including Toyota, VW, Daimler, Hyundai, Mazda, Honda, Mitsubishi, Subaru, Nissan, SAIC , etc.

AGL addresses 70% of OS development work, while the remaining 30% can be developed by OEMs. This facilitates development progress and cuts costs significantly.

More than 140 AGL members work together to develop a common platform for infotainment, which will be further available to ADAS, OTA, gateway, V2X and automated driving in the future.

ANDROID ecosystem, compared with AGL, is more mature and widely used by Chinese OEMs. However, OEMs felt risky to apply ANDROID as Google banned Huawei from using the Google Mobile Services (GMS) on Huawei phones in 2019, giving vitality to other operating systems. For instance, AliOS has already been seen in at least nine auto brands.

Reduce Development Cycle and Costs with the Help of Open Source Software Organizations

The GENIVI Alliance was jointly founded by giants like BMW, GM and Intel in 2009, aiming to offer applicable standards and open source codes for in-vehicle infotainment (IVI) platform. The alliance associates with the users of Android, AUTOSAR, Linux, and other in-car software and the solution suppliers to form a productive and collaborative community of 100+ members worldwide encompassing leading automakers, Tier 1 suppliers, semiconductor suppliers, software developers and service providers. GENIVI alliance always leads in field of open source cockpit software development.

The successful operation of GENIVI Alliance shows the industry’s urgent need to reduce development costs and avoid the duplication of development via open source software organizations.

The Autoware Foundation is a non-profit organization founded in Dec. 2018, aiming to develop open source software for autonomous vehicle. With nearly 40 members globally, Autoware is adopted by over 200 organizations in the world.

IT firms Marry Cars and Various Smart Hardware via OS

LG acquired webOS (developed by Palm) from HP in 2013, and then extended webOS as a mobile phone OS to the suitable one for TVs, smart refrigerators, smart watches and smart cars. At present, LG has sold millions of its webOS-enabled Smart TVs. In the early 2020, LG’s webOS is increasingly seen in automotive sector.

Samsung has ambitious plans for Tizen, an open operating system, which has already been found in Samsung’s wearables and smart fridges, and will be applied to floor mopping robots, washing machines, air conditioners and even cars in future.

Huawei does alike in Harmony OS, a microkernel-based, distributed OS designed to deliver a 'smooth experience' across all devices in all scenarios. It enables seamless cross-terminal synergy across multiple devices and platforms including smart phone, TV, Tablet PC and automotive infotainment.

IT companies are attempting to realize intelligence of all scenarios from mobility, home to office by centering on OS. It remains to be seen whether OEMs will adopt the plan and when the plan will be actually carried out.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...