Global and China Automotive Millimeter-wave (MMW) Radar Industry Report, 2019-2020

Millimeter wave radar installations soared by 44.37% year-on-year in 2019 and were available in more scenarios, encroaching on Lidar and ultrasonic.

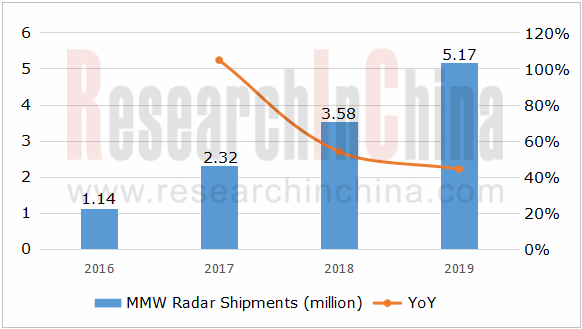

Automotive radar wins popularity and gets increasingly installed. In 2019, 5.17 million mm-wave radars were installed in passenger cars in the Chinese market with an annualized spurt of 44.37%, particularly 77GHz radar installations with an upsurge of 69.3% from a year earlier.

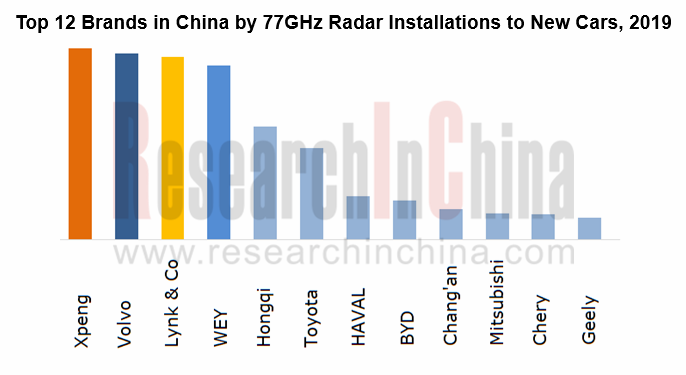

Chinese carmakers have more radar installations than joint venture brands. For the newly launched models, Geely Geometry, WM Motor, BAIC ARCFOX, Chang’an, SAIC Roewe / MAXUS, FAW Hongqi, Xpeng and other homegrown brands all emphasize L2 / L2.5 / L3 autonomous driving technology and install more sensors including mm-wave radar.

Well-known radar suppliers are promoting 77GHz radar vigorously, like the latest generation of medium- and long-range 77GHz radar launched by Bosch and Continental, and at the same time famous radar chip makers are mostly rolling out the 77GHz-centric chip generally in favor of the high modulation bandwidth 2GHz and with 3 transmitters and 4 receivers to detect farther.

The upcoming RXS816xPL is a highly integrated device that addresses the needs of 77-79 GHz radar for all safety-critical applications from automatic emergency-braking (AEB) to high-resolution radar in automated driving and that performs all functions of a radar front-end in a single device – from FMCW signal conditioning to generation of digital receive data output. It resorts to high modulation bandwidth 2 GHz to realize precise distance measurement and simultaneous transmitter operation for MIMO, capable of detecting and identifying objects within 300 meters.

Texas Instruments plans to launch the 77GHz AWR2243, an integrated single-chip FMCW transceiver working in the 76- to 81-GHz band. The device has a tiny footprint and unprecedented integration and supports 5G bandwidth. Simple programming model changes enable a wide variety of sensor implementation (short, medium, long range). Additionally, the device is provided as a complete platform solution to reduce development costs.

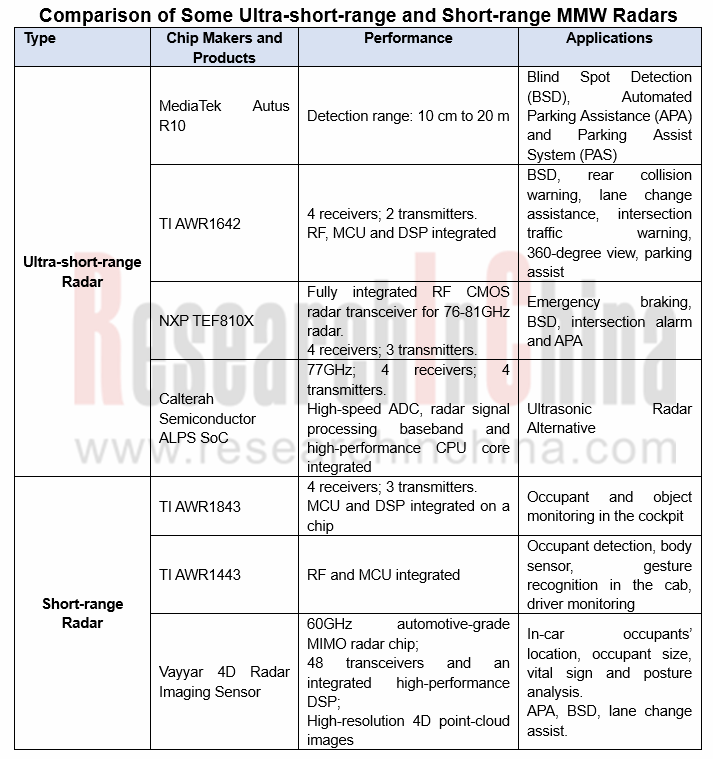

MMW radar chip vendors have released suitable chips for more applications, especially in ultra-short range and short range.

Radar finds wider applications in scenarios like cockpit and occupant monitoring, automated parking, collaborative vehicle infrastructure system (CVIS) and intelligent transportation with the help of radar chips.

Cockpit and Occupant Monitoring

Vayyar Imaging, an Israeli provider of radar imaging sensor technology, said in November 2019 it raised $109 million in a Series D funding led by Koch Disruptive Technologies, bringing its total raised to-date to $188 million. In the automotive domain, Vayyar claims its chip enables in-cabin passenger location and classification, occupant size, vital sign and posture analysis, as well as 360° exterior mapping, including monitoring cars, objects and pedestrians around a vehicle, in all lighting and weather conditions, and in real time. At the 2018 Paris Motor Show, Valeo indeed announced it was integrating Vayyar’s radar sensors with its products to monitor infants’ breathing and trigger an alert in case of emergency. Brose and Vayyar collaborate on sensor technology for new door and interior functions. Sensors recognize occupancy in the interior at all times to ensure the necessary level of safety in the interaction of mechanical and electronic systems. These sensors will also make it possible for side doors to open and close automatically and if other vehicles or obstacles are in the way, the movement ends before the door comes into contact with any object.

For L2, L3 and L4 autonomous driving, occupant monitoring is of growing importance. Autonomous vehicle interiors are fairly flexible, like sliding seats, screens and consoles, suitable for work and relaxation. The short-range radar and visual sensors work together to identify the situation in the car in real time, and the mechanical and electronic systems interact to ensure the safety.

Automated Parking

In December 2019, ZongMu Technology released in Xiamen city the second-generation autonomous parking product -- AVP Gen.2 that has main sensors including four fisheye cameras, 12 ultrasonic sensors, and four 4D MMW radars.

When all of four surround-view cameras are blocked and only mm-wave radar is available, AVP Gen. 2 can still fully implement AVP because the radar can deliver the dense point cloud information comparable to that of Lidar and clearly outline the surrounding buildings to achieve high-precision localization based on radar point clouds.

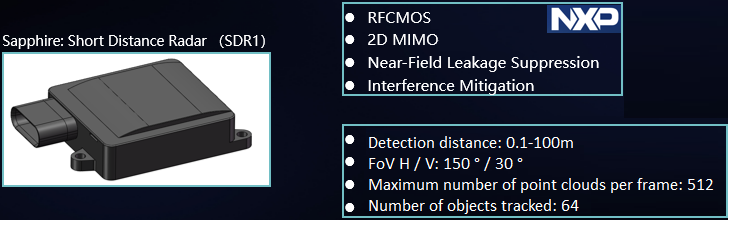

The radar used by AVP Gen.2 is called SDR1, which gets specially optimized in the typical parking scenarios (underground / ground parking lots, parks, etc.) on the basis of traditional angle radar ADAS functions to perfectly meet all parking needs. SDR1 takes into account both of low-speed parking scenarios and high-speed ADAS, and can work under extreme conditions such as wind, heavy snow, night, etc. The product will be spawned in the fourth quarter of 2020.

CVIS and Intelligent Transportation

In April 2020, Muniu Tech rolled out three WAYV-branded radars: WAYV Air, WAYV and WAYV Pro. WAYV includes T300 and S300, which are used in intelligent transportation and intelligent security respectively. WAYV Pro breaks the detection distance limit of video and infrared sensors to reach 1,000 meters, ideal for highway accident monitoring and large-area security.

With a detection range of 300 meters, Wayv T300 covers 8 lanes, detects and tracks 128 objects simultaneously, mainly serving urban traffic data perception and planning. Wayv T1000 works at a maximum distance of 1,000 meters, suitable for long-distance and highway deployment. It can detect and track 256 objects on 10 lanes simultaneously.

Market Shares of Lidar and Ultrasonic Radar Are Squeezed

Millimeter-wave radar is developing radically, with the imaging radar as an alternative to Lidar and the ultra-short-range radar as a substitute for ultrasonic.

The thriving angle radar has lured mm-wave radar vendors to develop ultra-short-range solutions for parking, AEB and short-range blind spot detection as the alternative of traditional ultrasonic sensors.

With far better performance than ultrasonic sensors on the market, the Autus R10 chip of MediaTek offers a wider detection range. Other than distance information, it can also provide speed information while ultrasonic does not. The Autus R10 chip can be used for multiple applications including blind spot detection (BSD), parking assist system (PAS), automatic parking assistance (APA), rear automatic emergency braking, cross-traffic alerts, door opening alerts and ultra-short-range BSD.

The most cost-effective ultrasonic sensor has a slow response to object detection, and it cannot classify objects into human and non-human, while mm-wave radar can perform object classification and biometric monitoring.

Many chip vendors, including traditional radar chip giants such as NXP, TI and Infineon, have launched solutions that shore up high-resolution radar. High-resolution imaging radar will outperform Lidar in terms of cost and performance. In some cases, imaging radar may identify objects such as bicycles, pedestrians, or small obstacles on the road and it also can deal with severe weather conditions.

Lidar will be replaced by Camera + imaging MMW Radar + V2X, said by Lars Reger, CTO of the NXP Semiconductors Automotive Division. The focus of the collaboration between NXP and HawkEye Technology is to create high-resolution imaging radar.

MMW Radar Boosts the Plasticization of Automotive Exterior Parts

Radars are generally fixed behind the car logo or the grille, and integrated into the lights, roof, etc. Millimeter wave radar detects the object, distance, speed and position by emitting electromagnetic waves, which are extremely sensitive to metals, and detecting echoes. In the traditional design, car head and door panels mostly made of metal cannot hide the radar.

Radars must come with plastic peripheral parts whose electrolyte conductivity should be low, especially the materials cannot contain carbon fiber or metals with electronic shielding effect. Covestro, BASF, Lotte, Orinko, Sumitomo, Mitsubishi and the like have developed wave-transparent materials PC, PP, ABS and so on for automotive exterior parts.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...