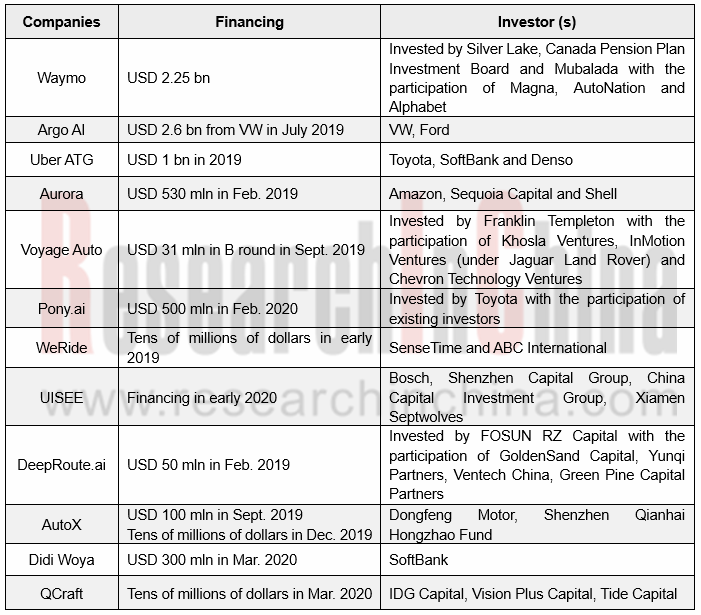

Giants gain high finance.

Progress of L4 autonomous driving is greatly hampered over the recent two years, causing OEMs’ and Tier 1 suppliers’ delay in L4 launches. Yet, the top L4 companies still raised huge funds in the past year.

In 2019, Baidu, Pony.ai and WeRide succeeded in commercial pilot of Robotaxi on complex urban roads in limited areas, a crucial step for L4 autonomous driving in China.

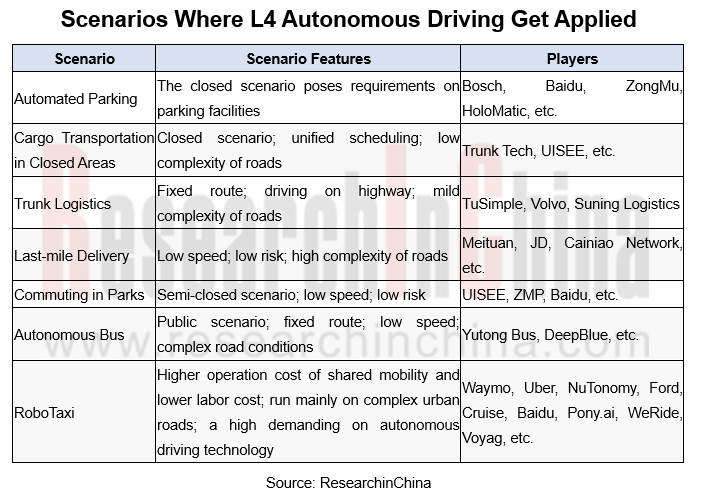

L4 autonomous driving technologies starts to find real application but gets deployed by most players first in one scenario or two as the current L4 cannot be perfectly suited to all driving scenarios.

It is shown from the planning of the OEMs and the providers of technical solutions for autonomous driving that L4 autonomous driving will be commercialized in limited scenarios ahead of open scenarios in the following three to five years.

Baidu, UISEE, DeepBlue and Trunk Tech all have conducted L4 trials in limited scenarios such as parks, ports, and airports. Besides, Baidu, Momenta, Bosch, ZongMu and UISEE are vigorously deploying in the parking lot scenario.

Deployments in open scenarios cover Robotaxi on urban roads and autonomous trucks on the expressways. In the Robotaxi field, Waymo, Baidu, Pony.ai, and WeRide have carried out pilot projects in both China and the U.S. in specific areas of a city, manned by safety officers, and WeRide is already fully open to the public in Nov.2019. Software & hardware technology iteration and larger-scale tests are essential for open Robotaxi in wider areas.

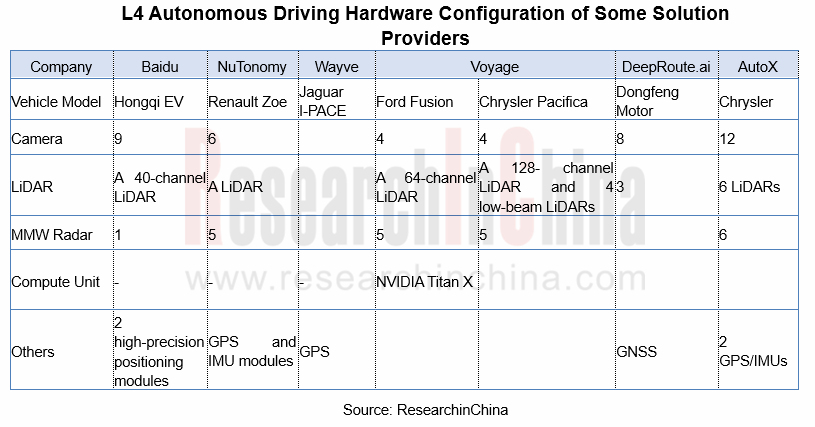

Technically, the current L4 autonomous vehicles for tests (or trial operation) are largely provided with the single-car intelligence solution. For safer autonomous driving, solution providers make vehicle’s environment perception capability optimized ever. For instance, Voyage’s G2 autonomous vehicle carries Velodyne's VLS-128 LiDAR system with a detection range up to 300 meters, tripling the capability of the 64-channel LiDAR installed on the 1st-Gen autonomous vehicle. Boasting 29 cameras, Waymo’s next-generation autonomous driving system enables a detection range of 500 meters whist improving LiDARs’ performance significantly.

Also, it is of vital importance to enhance vehicle’s motion perception competence. High-precision positioning can be realized by integrating high-precision positioning modules (composed of 5G modules, IMU and HD maps).

In the short term, either single-car intelligence solution or strong field terminal solution fulfills L4 autonomous driving in the confined areas, but in the long run, collaborative vehicle infrastructure system (CVIS) is the mainstream technology roadmap for L4 autonomous driving. Through CVIS, the vehicle is fully connected to the “X” as spatiotemporal dynamic traffic information are collected and integrated whilst the active safety control of vehicle and the collaborative management on roads are done for safer running of autonomous vehicle.

By analyzing the test data, Baidu concludes that CVIS can solve 54% of the problems encountered in road tests and 62% of the takeovers incurred by single-car intelligence, adding redundancy for autonomous driving safety.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...