China Automotive Financial Leasing Industry Report, 2020-2026

-

May 2020

- Hard Copy

- USD

$3,200

-

- Pages:126

- Single User License

(PDF Unprintable)

- USD

$3,000

-

- Code:

ZJF150

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,500

-

- Hard Copy + Single User License

- USD

$3,400

-

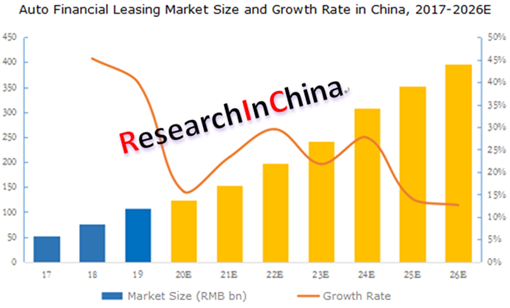

After ceaseless decline in 2018 and 2019, the Chinese automobile industry ushers in a period of recovery when the consumers are more prudent to buy cars and automobile consumer finance draws more attention, especially financial leasing as a key form of auto finance has a lower threshold for access than auto consumer credit and is advantaged and rooted in the third-line-below cities and rural markets, beneficial to both consumers and automakers. Following the galloping automobile industry in China over the past decade, auto financial leasing industry has sprung up with a market size in 2019 up to RMB107.3 billion, a figure projected to reach RMB396 billion amid the price cut of cars, the maturing industry and consumers’ growing acceptance of auto financial leasing.

Auto financial leasing started late in China, and the players in the industry are seeking for a suitable development route for own peculiarities. Not a leader has emerged in the industry that characterizes scattered development and mild competition and that desires to be concentrated. Nowadays, the most active internet-based auto financial leasing companies within the industry are expanding business presence most rapidly, while automakers and dealers are progressing slowly with limited input of resources in auto financial leasing since they still focus on traditional automobile credit business. Besides, professional leasing companies keep a low profile and have been making great strides in the industry thanks to its mature financial leasing business model.

Automaker-backed: such type of auto finance companies is advantageous in capital now that they can raise funds via stakeholders’ deposits, interbank borrowing, among others; additionally, it costs least for them to get cars but there are not so many car models;

Professional leasing companies: with mature business model and be competent enough for risk control;

Dealership companies: they are superior in the richness of car models and enjoy absolute advantage in customer acquisition for its full-fledged marketing channels;

Internet-based: such kind of financial leasing companies rapidly build own channels for customer acquisition by ways of mass advertising, ground promotion, the spread of outlets, etc.

Highlights in this report:

Automotive financial leasing (definition, classification, main models, development history, etc.);

Automotive financial leasing (definition, classification, main models, development history, etc.);

China’s automobile industry (production & sales, ownership, competitive landscape, used car trade);

China’s automobile industry (production & sales, ownership, competitive landscape, used car trade);

Automotive financing leasing development in China (policies, market size, competition pattern, financing channels, main products, development tendencies, etc.);

Automotive financing leasing development in China (policies, market size, competition pattern, financing channels, main products, development tendencies, etc.);

17 Chinese auto financial leasing companies including five automaker-backed financial leasing companies, five dealership companies, four internet-based companies and three professional leasing companies (operation, financial leasing business, financing channels, dynamics, etc.)

17 Chinese auto financial leasing companies including five automaker-backed financial leasing companies, five dealership companies, four internet-based companies and three professional leasing companies (operation, financial leasing business, financing channels, dynamics, etc.)

1. Overview

1.1 Definition & Classification

1.2 Main Modes

1.3 Development History

2. Chinese Automotive Industry

2.1 Market Size

2.2 Pattern

2.3 Car Ownership

2.4 Used Car Trade

3. Auto Financial Leasing Industry

3.1 Policy Environment

3.2 Automotive Finance Industry

3.3 Market Size

3.4 Main Products and Prices

3.5 Financing and Cost

3.6 Competitive Landscape

3.7 Development Trends

4. Auto Financial Leasing Companies

4.1 SAIC-GMF

4.1.1 Profile

4.1.2 Main Products

4.1.3 Developments

4.2 Ford Automotive Financial Leasing (Shanghai) Limited

4.2.1 Profile

4.2.2 Main Products

4.3 Herald International Financial Leasing

4.3.1 Profile

4.3.2 Auto Finance Business

4.4 Toyota Leasing

4.4.1 Profile

4.4.2 Main Business

4.5 BYD International Leasing

4.5.1 Profile

4.5.2 Main Products

4.6 Pang Da Orix

4.6.1 Profile

4.6.2 Main Business

4.7 Lei Shing Hong Leasing

4.7.1 Profile

4.7.2 Main Business

4.8 Great China Finance Leasing Co., Ltd.

4.8.1 Profile

4.8.2 Auto Finance Business

4.9 Yongda Finance

4.9.1 Profile

4.9.2 Main Business

4.10 All Trust Leasing

4.10.1 Profile

4.10.2 Main Business

4.11 eCapital

4.11.1 Profile

4.11.2 Auto Finance Business

4.12 Huasheng Haoche

4.12.1 Profile

4.12.2 Main Business

4.12.3 Development

4.13 Souche

4.13.1 Profile

4.13.2 Financing

4.13.3 Auto Financial Leasing

4.13.4 Development

4.14 Dafang Car Rental

4.14.1 Profile

4.14.2 Auto Finance Business

4.15 Billions Leasing

4.15.1 Profile

4.15.2 Auto Financial Leasing

4.16 Oranger

4.16.1 Profile

4.16.2 Main Products

4.17 Jiayin Financial Leasing

4.17.1 Profile

4.17.2 Auto Finance Business

Classification of Auto Financial Leasing

Role of Auto Financial Leasing

Comparison between Auto Financial Leasing and Bank Car Loan

Auto Financial Leasing Model – Direct Leasing

Auto Financial Leasing Model – Sale-leaseback

Development Course of Automotive Finance

Development History of Auto Financial Leasing Industry

Automobile Output in China, 2010-2026E

Automobile Sales Volume and Growth in China, 2012-2026E

Passenger Car Production and Sales by Type in China, 2018-2019

Passenger Car Sales Volume in China, 2010-2019

Commercial Vehicle Sales Volume in China, 2010-2019

Top10 Passenger Car Manufacturers by Sales Volume in China, 2019

Top10 Passenger Car Brands by Sales Volume in China, 2019

Sales Volume Structure of Passenger Car by Country in China, 2019

Automobile Ownership in China, 2014-2026E

Passenger Car (Origin of Country) Ownership Rankings in China, 2018-2019

New Energy Vehicle and Battery Electric Vehicle Ownership in China, 2015-2019

Used Car Trade Volume and Value in China, 2015-2019

Used Car Trade Volume Structure by Model, 2019

Top 10 Provinces/Municipalities by Used Car Trade (by Model), 2019

Chinese Policies and Laws & Regulations on Auto Financial Leasing Industry

Transfer of Regulatory Responsibility for Chinese Financial Leasing Industry

Implications of Regulatory Responsibility Transfer for Auto Financial Leasing Companies

Penetration of Auto Finance in China, 2015-2026E

Auto Finance Market Size in China, 2017-2026E

Penetration of Auto Financial Leasing in Major Countries

Market Size and Penetration of Auto Financial Leasing in China, 2017-2026E

Key Elements for Auto Financial Leasing Product Design

Some Reference Models for Auto Financial Leasing Product Design

General Types of Major Auto Financial Leasing Products on the Market

Causes for Quite High Rates of Auto Financial Leasing in China

External Financing Means of Chinese Auto Financial Leasing Companies

Chinese Auto Financial Leasing Companies’ Capital Use in Order of Priority

Ways of Debt Cooperation between Auto Financial Leasing Companies and Banks

Merits of Auto Financial Leasing Companies’ Asset-backed Securities (ABS) Financing

Auto Financial Leasing ABS Issuance Scale in China, 2015-2019

Classification of Participants in Auto Financial Leasing Industry

Competitive Edges of Different Types of Auto Financial Leasing Companies

Customer Acquisition Channels of Different Auto Financial Leasing Companies

Life Cycle of Chinese Auto Financial Leasing Industry

Used Car Trade Volume and Value in China, 2018-2026E

Equity Structure of SAIC-GMF

Leasing Schemes of SAIC-GMF

SAIC-GMF’s Financial Leasing Procedure for Car Purchase

Comparison of Ford Auto Financial Leasing Schemes

Brands Supported by Herald International Financial Leasing

Main Auto Finance Products of Herald International Financial Leasing

Auto Financial Leasing Products of Toyota Leasing

Business Handling Flow of Toyota Leasing

Main Types of Lease and Products of Toyota Leasing

Direct Financing Lease Schemes of BYD International Leasing

Sale-leaseback Schemes of BYD International Leasing

Work Flow of BYD International Leasing

Operating Leasing and Financial Leasing of Pang Da ORIX Auto Leasing

Auto Financial Leasing Procedures of Pang Da ORIX Auto Leasing

Sale-leaseback Business Process of Pang Da ORIX Auto Leasing

Regional Presence of Pang Da ORIX Auto Leasing

Business Diagram of Lei Shing Hong Leasing

Major Partners of Great China Finance Leasing

Development Course of Great China Finance Leasing

Main Products of Great China Finance Leasing

Features of Great China Finance Leasing

Online Car Purchase Application Procedures of Great China Finance Leasing

Financial Businesses of Yongda Automobiles

Six Advantages of Financial Leasing of Yongda Automobiles

Regional Presence of Yongda Finance

Major Financial Leasing Schemes of All Trust Leasing

Financial Leasing Procedures of All Trust Leasing

Major Partners of eCapital

Development Course of eCapital

Financial Leasing Schemes of eCapital

Features of Huasheng Haoche’s Financial Leasing Schemes

Financial Leasing Business Process of Huasheng Haoche

Presence of Huasheng Haoche’s Direct-sale Stores in China

Cooperative Brands of Souche

Financing of Souche

Main Features of Tangeche

Total Expense Structure of Tangeche

Main Advantages of TANGECHE

Dafang Car Rental’s Platform (usedcar.dafang24.com) -- Six Advantages

Dafang Car Rental’s Platform (usedcar.dafang24.com) -- Procedures

Major Auto Finance Products of Billions Leasing

Main Operations of Oranger

Direct Financing Lease Model of Oranger

Sale-leaseback Model of Oranger

Presence of Oranger’s Outlets in China

Equity Structure of Jiayin Financial Leasing

New Car Financing Schemes of Jiayin Financial Leasing

Used Car Financing Schemes of Jiayin Financial Leasing

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...