Research on Automotive LiDAR Industry: How five technology roadmaps develop amid the upcoming mass production of high-channel LiDAR?

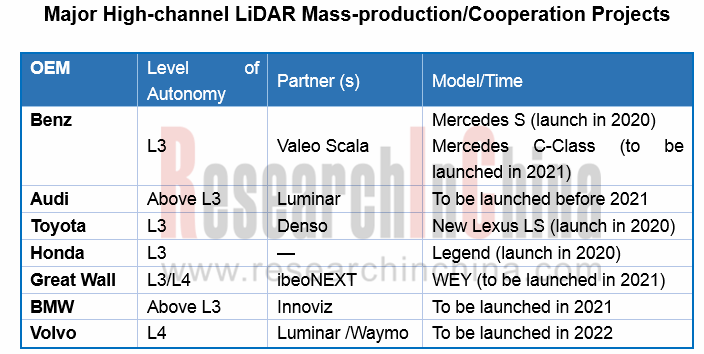

During 2020-2025, autonomous driving above L3 will be commercialized, for which LiDAR will become an important option. LiDAR vendors break through technical bottlenecks and work closely with OEMs to massively install high-channel LiDAR as soon as possible. Today, Audi has teamed up with Valeo/Luminar, BMW has cooperated with Innoviz, Volvo has collaborated with Luminar, Great Wall Motors has partnered with Ibeo, and Hyundai has joined forces with Velodyne. Even Mobileye, a proponent of visual ADAS, is developing its own LiDAR technology.

In early 2020, Bosch announced that it is making long-range LiDAR sensors production-ready-the first LiDAR (light detection and ranging) system that is suitable for automotive use. Continental delivers a 50-meter range 3D flash LiDAR sensor that's expected to find increasing application in commercial vehicles and off-highway machines in 2020. Valeo’s 16-channel SCALA 2, which can detect objects up to a distance of 150 meters, has won orders from some production vehicle models, and its SOP is expected in 2021. This shows that high-channel LiDAR is on the eve of mass production.

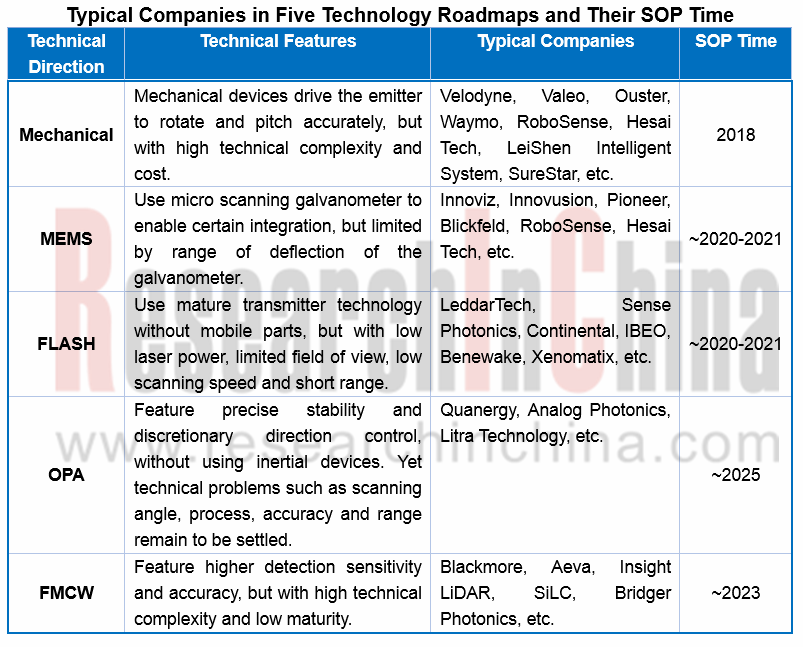

Still, the battle for technology roadmaps in the LiDAR field continues. There are now automotive LiDAR technology roadmaps encompassing mechanical, MEMS, FLASH, OPA and FMCW, among which FMCW is a coherent detection technology while the rest are pulsed ToF detection technologies.

Mechanical LiDAR

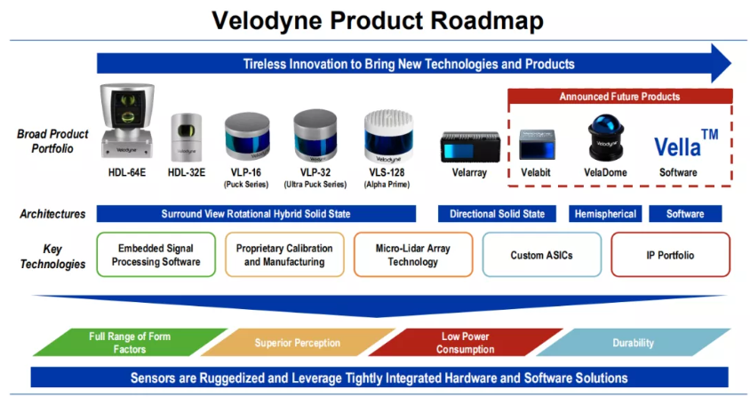

Mechanical LiDAR is the earliest developed and most mature product. Waymo's Honeycomb LiDAR is also based on mechanical technology. Although it has been criticized a lot, mechanical LiDAR is still the mainstream on the market. Representative companies of mechanical LiDAR include Velodyne, Valeo, Ouster, Waymo, RoboSense, Hesai Tech, SureStar, LeiShen Intelligent System, etc.

Most mechanical LiDAR vendors are pushing forward two strategies concurrently. On the one hand, they improve the mechanical LiDAR product line, try to reduce costs and enhance performance; on the other hand, they actively expand the solid-state LiDAR product portfolios (MEMS, FLASH, OPA, etc.).

For example, Velodyne has rolled out the all-solid-state Velarray LiDAR, and short-range VelaDome LiDAR perfect for automotive applications such as blind spot monitoring. Velodyne has acquired Mapper.ai, a HD map startup with a team of 25 talents, for quicker development of Vella software. In January 2020, Velodyne unveiled the cheap Velabit LiDAR priced only at $100.

Velodyne branches out to ADAS and other fields aggressively. Nowadays, the autonomous driving business only contributes a quarter of Velodyne's revenue, whereas the remaining earnings come from ADAS, robotics, surveying and mapping, smart cities, shuttles, and unmanned distribution, among which unmanned delivery, Robotaxi and ADAS will become main revenue contributors for Velodyne in the next four years. It is estimated that Velodyne will ship 8 million units by 2025.

MEMS LiDAR

Typical suppliers of MEMS LiDAR include Innoviz, Innovusion, Pioneer, Blickfeld, RoboSense, Hesai Tech, etc.. Using micro galvanometers, MEMS LiDAR is limited in size, vibration reliability and operating temperature range.

As concerns MEMS mirrors, foreign companies are at the forefront, such as Innoluce acquired by Infineon based in Germany, Mirrorcle and MicroVision in the United States, Hamamatsu in Japan, and STMicroelectronics in Switzerland. Their Chinese counterparts include Xi'an ZhiSensor, Taiwan Opus, Silicon Vision Microsystem, among others. A few LiDAR companies supply MEMS mirrors through alliances or independent development. For instance, RoboSense has invested in Silicon Vision Microsystem to deploy MEMS LiDAR; Hesai Tech PandarGT 3.0 uses self-developed MEMS mirrors.

MEMS LiDAR will be spawned by most vendors as early as 2020-2021.

Innoviz, which adopts the MEMS technology roadmap as a typical provider, has received more than USD210 million in financing within only four years since its inception. Innoviz is to date competent for mass production and has fetched orders from OEMs. BMW has selected Innoviz for series production of its autonomous vehicles, starting in 2021. Besides, Innoviz has allied with Tier1 suppliers Harman, HiRain Technologies and Aptiv. The latest Innoviz One has a detection range of 0.1-250 meters and will be produced on a large scale in 2021.

Zvision, a Chinese MEMS LiDAR company, secured RMB70 million in Series A+ round of financing in April 2020.

Flash LiDAR

Typical Flash LiDAR vendors are LeddarTech, Sense Photonics, Continental, IBEO, Benewake, Xenomatix and Ouster.

Sense Photonics as the first one to overcome technical challenges has introduced Osprey, its first modular FLASH LiDAR which was sold on the market in January 2020 at a price of $3,200. Continental’s Flash LiDAR, HFL110 featuring 1,064nm laser and hybrid InGaas/CMOS focal plane array, is expected to be spawned in 2020. IBEO’s NEXT LiDAR is about to be mounted on Great Wall VV7 in 2021.

Another company LeddarTech stands out for building Leddar Ecosystem. In July 2020, LeddarTech acquired VayaVision, a sensor fusion and perception software company. Their cooperative solution enables the fusion of camera, radar, and LiDAR for faster time-to-market, and allows for fusion of up to 15 different sensors for Level 2 to Level 4 autonomous driving applications. Two well-known sensor vendors First Sensor and Sunny Optical Technology also join LeddarTech Leddar Ecosystem.

OPA LiDAR

For OPA LiDAR, Quanergy previously released S3 but has yet to commercialize it. Some players like Analog Photonics and Shenzhen Litra Technology are in the phase of development and exploration. It will expectedly take them over 5 years to launch the technology.

OPA LiDAR enables precise stability and discretionary direction control, without using inertial devices. Yet technical problems such as scanning angle, process, accuracy and range remain to be settled. Current integrated OPA technology fails to offer large aperture needed by mid- and long-range LiDAR, due to complexity, high power consumption or low optical efficiency. In August 2020, researchers at University of Colorado Boulder developed a serpentine optical phased array (SOPA) chip which can enlarge optical aperture for LiDAR.

FMCW LiDAR

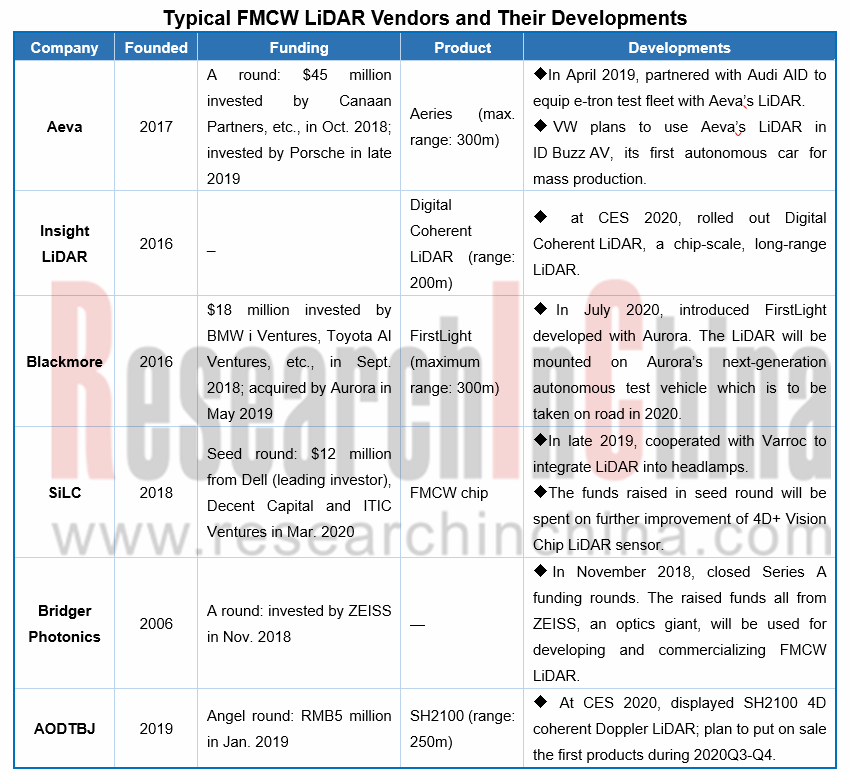

Coherent LiDAR is still in its infancy compared with pulsed ones. The leading technology for the LiDAR is frequency modulated continuous wave (FMCW), into which about 10 players worldwide get involved, including Aeva (invested by Porsche), Blackmore (acquired by Aurora in 2019), Strobe (acquired by Cruise in 2017), SiLC Technologies (invested by Dell), Bridger Photonics (invested by Carl Zeiss) and AODTBJ.

The reason why BMW, Toyota, Porsche, GM and Aurora select FMCW LiDAR lies in FMCW’s edges over pulsed ToF, on ability to directly detect speed (4D information) and high resolution range and permission to use cheap photoelectric detectors (e.g., PIN). The biggest challenge before FMCW technology is the need for being integrated with a plurality of optical components, e.g., laser, amplifier, phase and amplitude controlled low-noise photodiode, mode converter and optical waveguide, all of which should be further integrated into a commercial-scale compact FMCW LiDAR.

From the latest progress, it can be seen that Aeva’s Aeries FMCW system irons out the dependency between maximum detection range and point cloud density, and integrates multiple beams on a chip, achieving full range performance of over 300 meters for objects in addition to the ability to measure instant velocity for every point with a 120-degree field-of-view. The product is projected to be available for use in 2020, costing less than $500 once mass produced.

Furthermore, FirstLight, a LiDAR co-developed by Blackmore and Aurora, allows the Aurora Driver to see well beyond 300 meters even on targets that don't reflect much light, such as a pedestrian wearing dark clothing at night. Aurora has installed its Aurora Driver in six different vehicles, ranging from sedans and Chrysler Pacifica minivans to self-driving trucks. Aurora plans to use its FirstLight LiDAR in its fleet of self-driving development vehicles in 2020.

Actually, OEMs tend to choose more than one technologies. For example, Audi investing Blackmore, a typical FMCW firm, installed Valeo's 4-channel mechanical LiDAR into Audi A8 in 2018 and also has a plan to pack the to-be-produced cars in 2021 with Luminar’s solid state LiDAR.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...