As one of the most widely used passive components, MLCC commands approximately 40% of the capacitor market. MLCC finds broad application in fields like communication, consumer electronics, automobile and military, where the robust demand conduces to the expanding MLCC market.

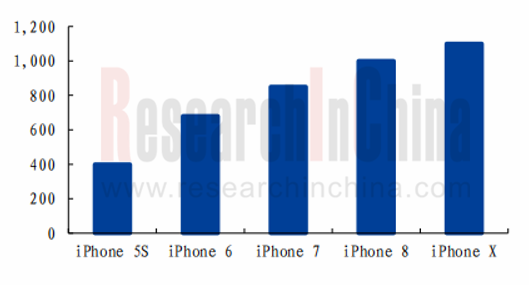

A staggering 64% or so of MLCCs are consumed by consumer electronics, especially smartphones which occupy 39% of total consumption. In iPhone’s case, smartphones with higher configuration use more MLCCs, e.g., an iPhone X needs as many as 1,100 MLCCs compared with an iPhone 5S using 400 pieces. Besides, the portable and intelligent wearables such as TWS headphones and smart watches have drawn much attention from the market over recent years, producing significant demand for MLCCs.

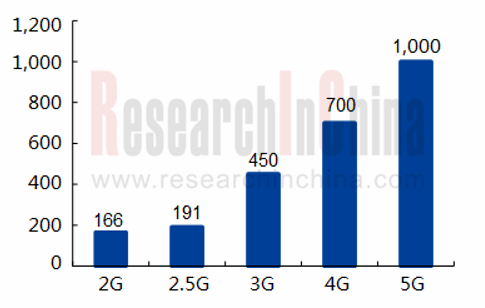

As commercial use of 5G is at a gallop, 5G-enabled smartphones will pack more MLCCs than 4G ones. Examples include a Sub-6Ghz 5G smartphone that uses 10%-15% more MLCCs and an mmWave 5G phone adding 20%-30%. Meanwhile, 5G smartphones’ higher power consumption further drives up demand for high-end, micro/ultra-micro (0201, 01005, etc.) MLCCs with large capacity and low power consumption.

During the faster construction of 5G in 2020, a larger number of 5G base stations to be built and more MLCCs per such a station compared with 4G ones are two factors behind the rising demand for MLCCs. By 2023, global communication base stations’ demand for MLCCs will be 2.1-fold of that in 2019, estimated by Taiyo Yuden. In the meantime, internet of things (IoT) that requires far more stable connectivity will be a beneficiary of low-latency 5G network. A study of VENKEL shows that a terminal needs over 75 MLCCs on average, from which it can be foreseen that more and more connected IOT devices will, beyond doubt, spur the MLCC market to grow.

The development of new energy vehicle and ADAS drives MLCC into a new blue ocean. A common car needs around 3,000 or 4,000 MLCCs while a hybrid/plug-in hybrid vehicle bears around 12,000 pieces and a battery electric vehicle carries virtually 18,000 pieces.

Among vehicle electronic systems, ADAS which applies more MLCCs could collect, detect, recognize and track changed data inside and outside of the vehicle in the shortest time via sensors on the vehicle and helps the driver beware of potential dangers to operate correctly and safely by combining navigation map data to calculate and analyze. Wider coverage of 5G network will be another solution to latency problem. As more and more vehicles carry ADAS that tends to be more intelligent, the demand for MLCCs will multiply.

New energy vehicle with a larger number of control modules like ECU need more passive components to support electronic systems, with a new energy vehicle in want of at least 10,000 MLCCs. With the roll-out of timetables for elimination of ICE vehicles across the world in recent years, new energy vehicles have boasted higher penetration, coupled with more use of MLCCs by a single vehicle, together stimulating the demand for automotive MLCCs.

Of a wide range of automotive MLCC models, those with size ranging from 0402 to 2220 are in use while 0603, 0805 and 1206 get most utilized. Despite unconcern about size of MLCCs, automotive market has a high demanding on them in safety parameters (reliability, service life and failure rate) as well as working temperature, humidity, climate and vibration resistance. Automotive market poses a high entry barrier to MLCC which must be subject to a set of automotive standards (AEC-Q200) and pass quality certification.

It is in the MLCC market that leading players include Murata, Samsung Electro-Mechanics, Yageo, Walsin Technology, Taiyo Yuden, TDK, Kyocera and Chinese Mainland companies like Fenghua Advanced Technology and Chaozhou Three-circle. Since 2016, few MLCC vendors like Murata and TDK have shifted to focus on automotive MLCC, a promising and lucrative high-tech market. This move disrupts the global passive components supply chain and makes low- and mid-end customers turn to companies like Yageo, Fenghua Advanced Technology and Chaozhou Three-circle.

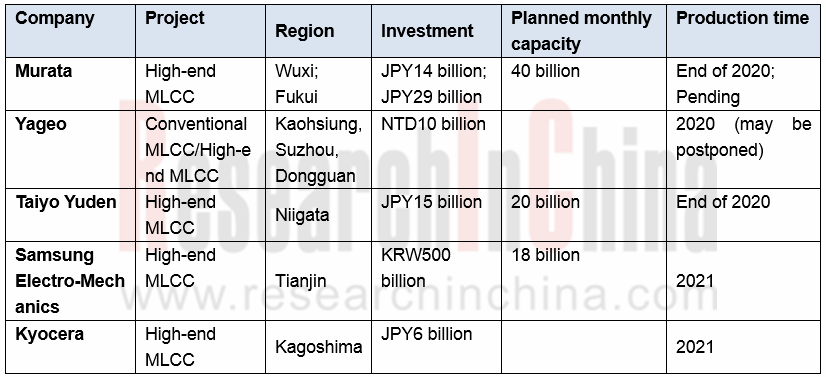

Some vendors have pivoted to the automotive MLCC market.

Murata is the MLCC vendor with the highest market share in the world (approximately 56% of the automotive MLCC market), boasting annual capacity up to 1,100 billion MLCCs or so. In recent years, the company has slashed the capacity of low-end MLCCs while ramping up production of automotive and other high-end products. Murata quickens the R&D and mass production of MLCCs for high-end consumer electronics whilst expediting to launch automotive products. In 2019, Murata began to spawn 008004, which will be used in 5G flagship phones of Apple and Huawei. In April 2020, Murata started mass-production of two new multilayer ceramic capacitors for automotive use -- the NFM15HC105D0G3, which is the world's smallest 0402 size (1.0×0.5mm) three-terminal low-ESL multilayer ceramic capacitor, and the NFM18HC106D0G3, which is the three-terminal low-ESL multilayer ceramic capacitor with the world's highest capacitance of 10μF in 0603 size (1.6×0.8mm), suitable for ADAS and autonomous driving.

The second-ranked Samsung Electro-Mechanics by MLCC market share in the world (ranking fourth in the automotive MLCC market with about 6% share) has followed suit over the recent years, like squeezing out low-end capacity and stepping up the deployment of high-end products. In July 2020, the company developed five new types of MLCCs, including three types for power systems and two types for anti-lock braking systems, which will be available to global automakers in future. Besides building a dedicated automotive production line at the Busan plant, Samsung Electro-Mechanics is pressing ahead with construction of a new plant in Tianjin, China.

Given its inferiority in MLCCs for consumer electronics, TDK cancelled orders for 700 million MLCCs covering about 360 models, and committed itself to mid-to-high-end products in 2017 as the first one aggressively exploring the automotive MLCC market, where TDK now seizes about 25% shares.

MLCC vendors in Mainland China have been developing by leaps and bounds in recent years, especially Fenghua Advanced Technology is one of few Chinese MLCC vendors offering a full range of MLCCs covering 01005-2220 and above sizes with advantages in production scale and technical processes; but it still targets consumer electronics. In 2018, the company launched products in line with the AEC-Q200 standard, but still posing no threat to Japanese and Korean peers due to its weak foundation.

Since 2018, traditional automakers worldwide have begun to deploy electric vehicle manufacturing on a large scale, and the governments have introduced timetables for elimination of ICE vehicle. As the number of MLCCs used in an electric vehicle is 6 times that in an ordinary car, MLCCs are bound to be much sought after. Hundreds of carmakers require automotive MLCCs which are only offered by a few automotive MLCC vendors, inevitably leading to the tight supply of automotive MLCCs in the next two years or three, and a big challenge to any automaker who is in readiness for capacity expansion of electric vehicles and even a mission impossible for emerging automakers because leading MLCC suppliers will give priority to key automakers. The MLCCs from tier-II suppliers as a last resort may cause quality issues and enormous maintenance costs.

Global and China Multi-layer Ceramic Capacitor (MLCC) Industry Report, 2020-2026 highlights the following:

MLCC industry (definition, classification, industry chain, technology trend, etc.);

MLCC industry (definition, classification, industry chain, technology trend, etc.);

Global and Chinese MLCC markets (size and forecast, competitive landscape, market segments, etc.);

Global and Chinese MLCC markets (size and forecast, competitive landscape, market segments, etc.);

Automotive MLCC market (size and forecast, competition pattern, etc.);

Automotive MLCC market (size and forecast, competition pattern, etc.);

Leading automotive MLCC vendors in China and beyond (profile, operation, business, new products, etc.);

Leading automotive MLCC vendors in China and beyond (profile, operation, business, new products, etc.);

Upstream MLCC formula vendors (profile, operation, business, new products, etc.)

Upstream MLCC formula vendors (profile, operation, business, new products, etc.)

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...