Launch of Autonomous Driving Remains to Use Mature Chassis-by-wire Technology

Chassis-by-wire makes it feasible to remove accelerator pedal, brake pedal and steering wheel, whose maturity has a bearing on autonomous driving implementations.

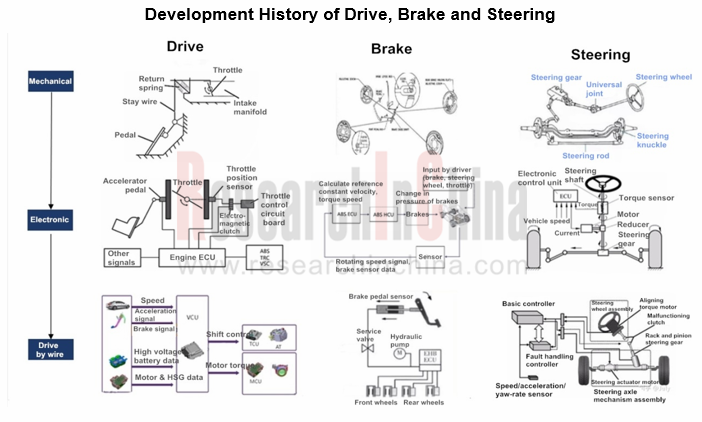

Critical elements of chassis by wire include: throttle by wire, gear shift by wire, suspension by wire, steering by wire and brake by wire. Wherein, drive, brake and steering are deemed as the crucial factors to vehicle travel.

Throttle by wire has been the first option for passenger cars, especially ACC/TCS-enabled vehicles for which such throttle has been a standard configuration. Promotion of drive by wire and steering by wire has suffered a setback due to a combination of factors such as poor user experience than conventional mechanical system for early immature technology, and difficulty in sorting out who is responsible, a result that drive by wire technology refers to regulation and control on the actuator by ECU. In recent years, boom of intelligent connected vehicles has invigorated drive-by-wire technology.

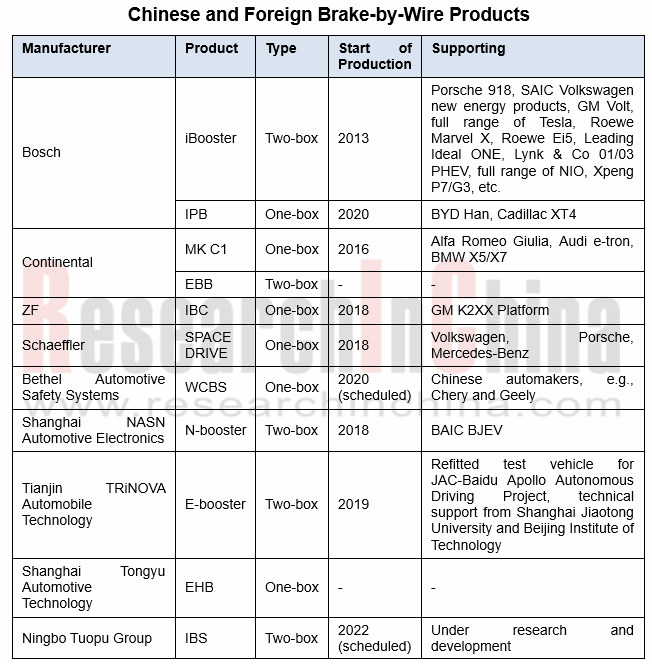

Brake by wire: Bosch, Continental and ZF leads the pack, while Chinese companies like Bethel Automotive Safety Systems Co., Ltd., Shanghai NASN Automotive Electronics Co., Ltd. and Ningbo Tuopu Group are chasing hard.

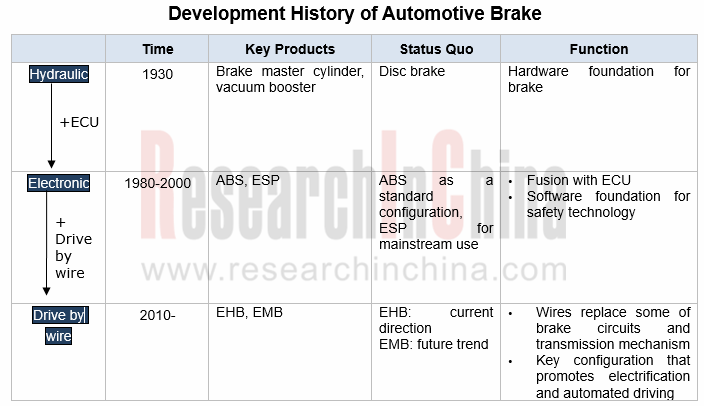

Over a century, automotive brake system has evolved from the mechanical to the hydraulic and then to the electronic (ABS/ESC). For L3 autonomy and above, responsive time of brake system is of paramount importance. Faster response of brake by wire ensures safe autonomous driving.

Brake-by-wire system is bifurcated into two types: Electro Hydraulic Brake (EHB) and Electro Mechanical Brake (EMB). EHB is split into One-Box and Two-Box solutions based on whether it is integrated with ABS/ESP or not.

One-box solution already prevails:

- One-box solution with fusion of ESP into EHB is based on mass production of mature ESP. Considering performance and cost, Bosch, Continental and ZF are doubling down on One-box products.

- Chinese suppliers with first-mover advantage are expected to replace foreign brands. Bethel Automotive Safety Systems Co., Ltd., the first to have developed One-box products in China, plans to spawn WCBS products in 2020, close to the SOP time of its foreign peers like Bosch. Its WCBS integrated with dual control EPB is more cost-effective.

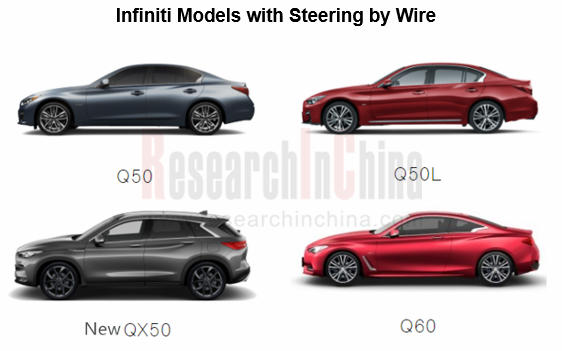

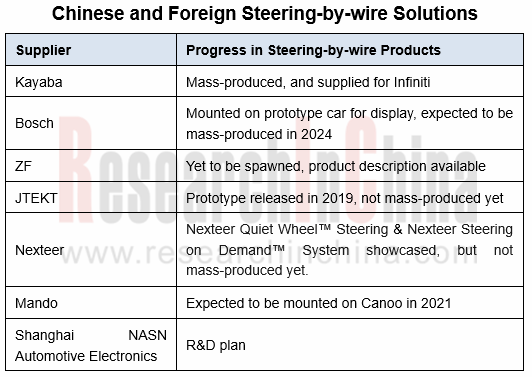

Steering by wire: intelligence spurs the industry but commercialization is hindered

So far only Infiniti has had steering-by-wire solution for mass production since its advent. In 2014, Infiniti Q50 packing steering-by-wire solution offered by KYB made a debut. Yet, in July 2016, Dongfeng Motor and Nissan recalled 6,840 units of Infiniti Q50 and China-made Infiniti Q50L in all because of potential safety risks posed by steering by wire. In current stage, Infiniti has four models carrying Direct Adaptive Steering? (DAS) solutions all from KYB.

On a global view, international tycoons like Bosch, ZF, JTEKT, NSK and Nexteer boast mature steering by wire technologies and products but they still hit a bottleneck in commercialization.

In 2020, the mass production of L3 autonomous vehicles is to quicken commercial use of drive-by-wire systems. Foreign companies with an early layout in China will have first-mover advantage. Throughout the Chinese market, very few local players have made a difference in drive by wire technology, with small business scale, but the importance of drive-by-wire chassis makes them an enticement to capital and giants. In 2019, Shanghai NASN Automotive Electronics Co., Ltd. raised funds of RMB400 million. It is alleged that Huawei will set foot in drive by wire field.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...