Global and China Commercial Vehicle Telematics Industry Report, 2020

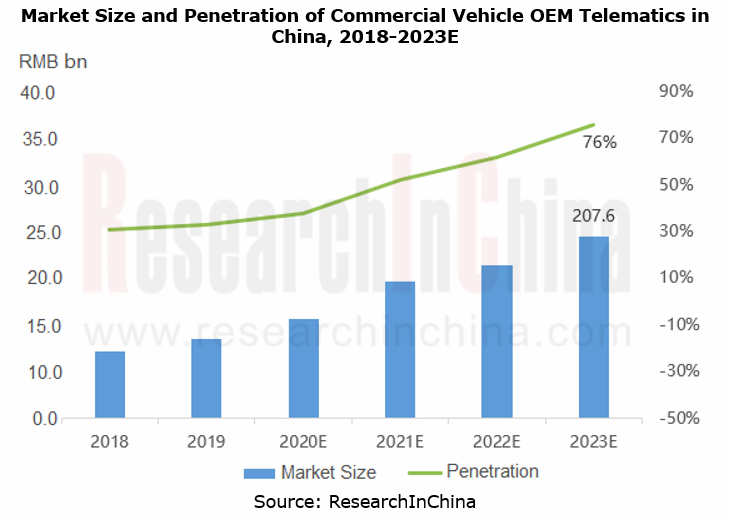

Commercial vehicle telematics research: before 2023, policies will drive the penetration up to 76% and the market will be worth more than RMB20.7 billion.

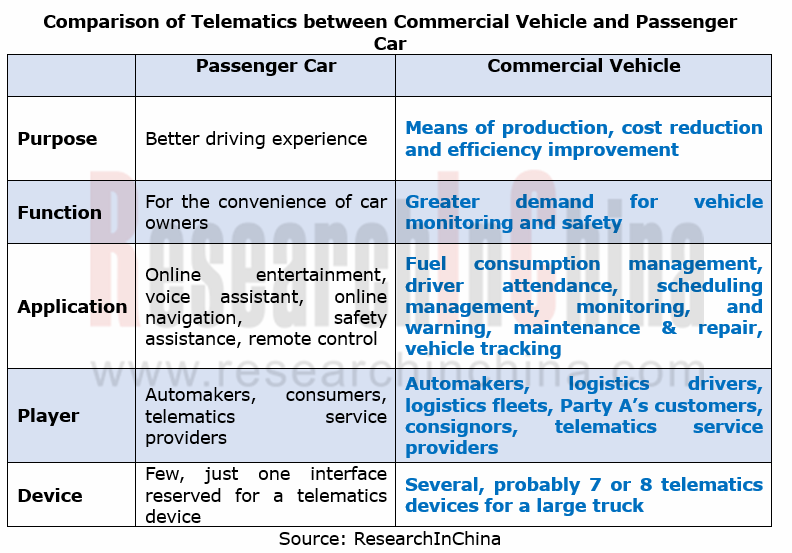

Differing from passenger car telematics mainly for better user experience, commercial vehicles that take first into account cost reduction, higher efficiency and safe operation because of their attribute of means of production, focusing more on telematics availability to improve vehicle efficiency and cost performance.

Policies and regulations serve as key drivers

Mandatory installation of driving record-enabled satellite positioning devices into “two buses, one special vehicle” (tourism chartered buses, Category III scheduled buses, and special vehicles for transporting hazardous chemicals, fireworks and firecrackers, and civil explosives), heavy trucks and tractors as policies required in 2013, ushered in an epoch-making era of commercial vehicle telematics.

Semi-trailer tractors and >12t trucks are required to pack driving record-enabled satellite positioning devices and intelligent video surveillance devices, and to be connected to standards-compliant monitoring platforms, according to the Regulation on Road Transport (Revised Draft for Comment) the Ministry of Transport of China drafted in November 2020, which invigorates China’s commercial vehicle telematics market further.

In the next three years, China’s Phase VI Emission Standard will be a key contributor to the market growth, according to which all sold and registered heavy vehicles should be subject to the Stage A requirements from July 1, 2020 onwards and all sold and registered light vehicles should be subject to the Stage B requirements starting from July 1, 2023. In the upcoming three years, the demand for telematics terminals that can monitor vehicles remotely online and detect exhaust will be blooming. On one estimate, the penetration of OEM telematics for commercial vehicles in China will hit 76% in 2023, with the market being valued over RMB20 billion.

OEMs’ deployments are being made inch by inch.

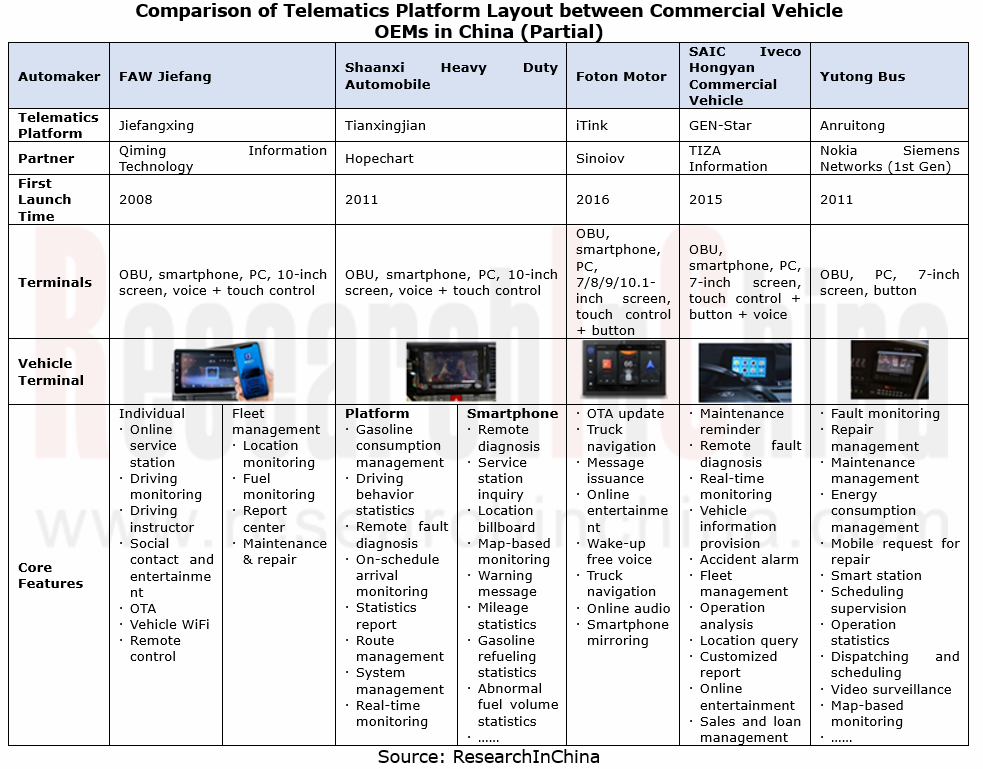

Stimulated by policy requirements and robust demand, major heavy truck manufacturers like FAW Jiefang, Shaanxi Automobile and Dongfeng Trucks have taken the lead in deploying and raced to make plans of using telematics as a standard configuration.

“Jiefang Pilot” and “Jiefangxing”, respective telematics platform of FAW Jiefang Changchun Base and Jiefang Qingdao Base, was reshuffled into one in March 2020. The full family of FAW Jiefang models have been equipped with telematics system as a standard configuration since 2019, with more than 700,000 units connected since then.

Shaanxi Automobile Group Commercial Vehicle Co., Ltd. has started deploying telematics since 2010. Its “Tianxingjian” telematics system launched together with Hopechart in 2019 has been a standard configuration of its full range of trucks, with 600,000 units installed.

Foton Motor has set about deploying telematics since 2011, and established Foton iTink Information Technology Service Company for telematics development in 2012. Since its launch in 2016, Foton iTink Telematics System has boasted more than 1 million installs.

Telematics platform will deepen data application.

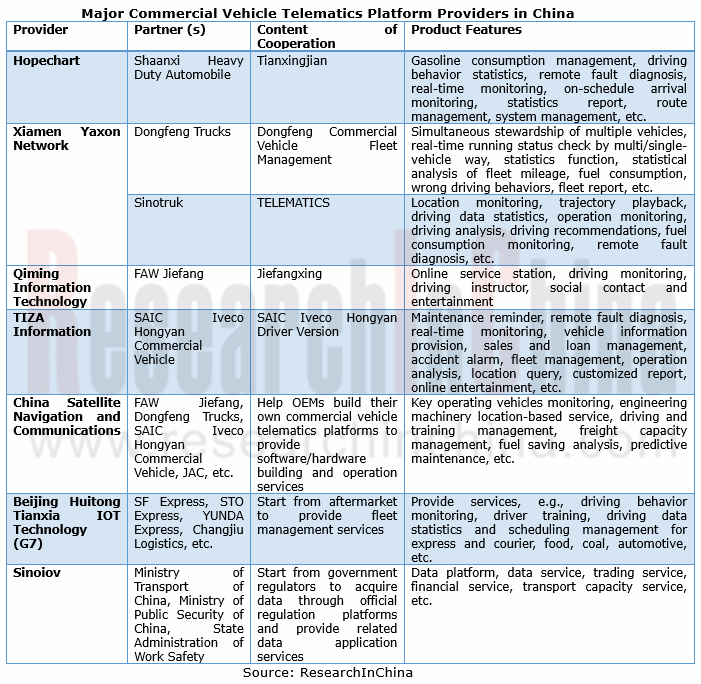

Operating platform remains the epicenter of telematics. OEMs and platform providers forge close partnerships now. Examples include Shaanxi Heavy Duty Automobile developing Tianxingjian with Hopechart, and Dongfeng Trucks in harness with Xiamen Yaxon Network to develop “Dongfeng Commercial Vehicle Fleet Management”, with telematics capabilities available during the lifespan of vehicles. Deeper application of telematics data will be the next development priority of platforms.

FAW Jiefang: underline telematics data + scenario enabler.

In May 2020, FAW Jiefang and China Satellite Navigation and Communications set up Smartlink Intelligent Technology (Nanjing) Co., Ltd.. Based on the new-generation “Jiefangxing” telematics platform, the joint venture provides partners with telematics data enabling ‘vehicle data plus scenario data’, combining FAW Jiefang’s three key products, Jiefangxing Individual APP, Fleet Management System (FMS) and Transportation Management System (TMS).

Shaanxi Heavy Duty Automobile: commercialize telematics data + insurance applications.

In October 2020, Shaanxi Tianxingjian Telematics Information Technology Co., Ltd., Maxim Insurance Brokers (Shanghai) Co., Ltd. and China Pacific Property Insurance Co., Ltd. (CPIC Property) negotiated about collaboration on commercial vehicle UBI. This move will broaden Tianxingjian Telematics’ big data use in the aftermarket.

Intelligent vehicle terminals will be a future hit.

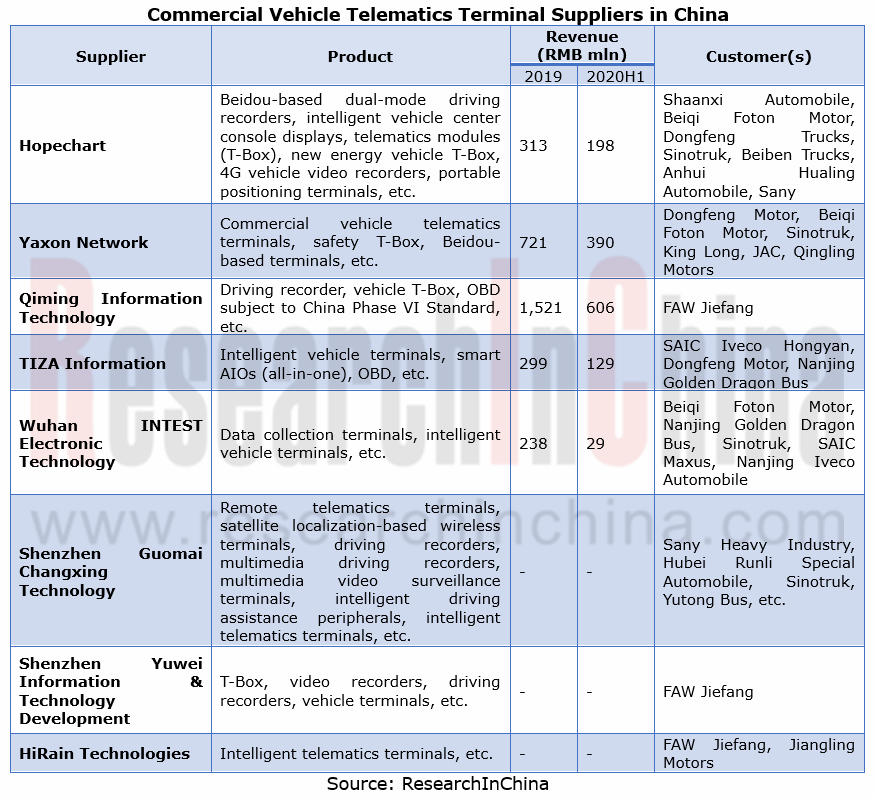

In China, typical commercial vehicle telematics terminal suppliers like Hopechart and Yaxon Network have sharp edges in both OEM market and aftermarket on strength of their large customer bases. The implementation of China Phase VI Emission Standard, the Regulation on Road Transport and other polices will bring in more revenues to them.

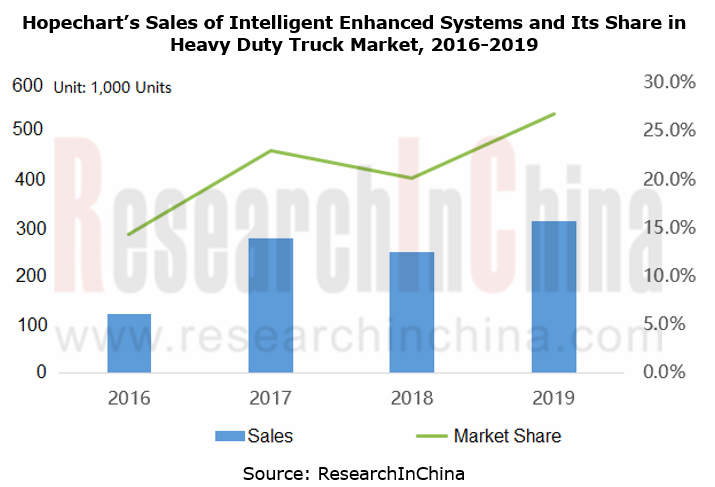

Hopechart, China’s biggest supplier of commercial vehicle telematics terminals, sold 313,000 sets of “intelligent enhanced driving terminals” (including hardware devices (T-BOX, driving recorder, etc.), intelligent enhanced driving modules and big data cloud platform) in 2019, commanding over 20% of the heavy duty truck market. In 2020, Hopechart becomes a qualified supplier of Sinotruk, which will further push up its share in the market.

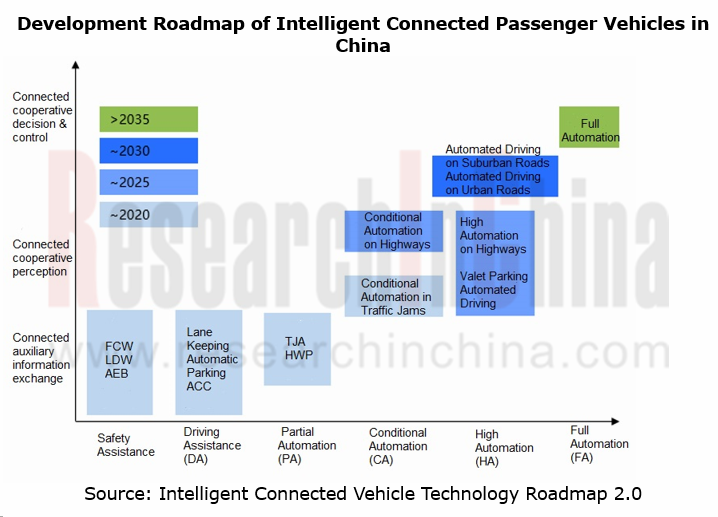

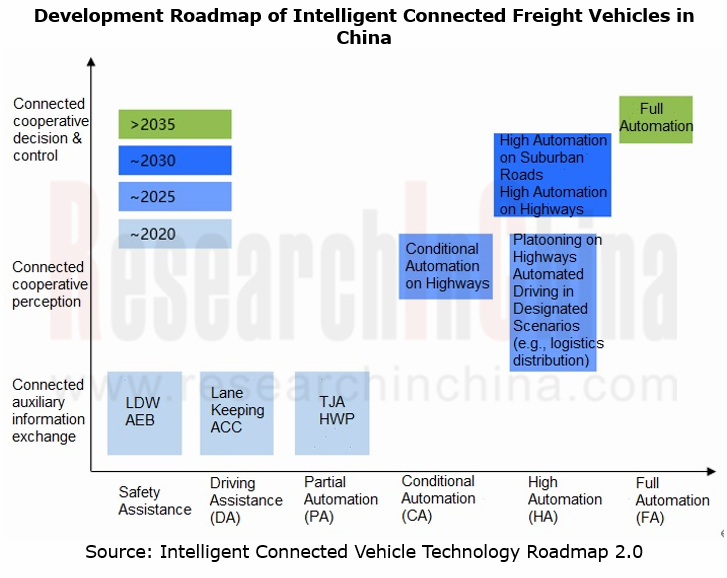

Commercial vehicle telematics will fuse with automated driving features.

In an age of intelligence, telematics and automated driving lean toward a fusion with the support of V2X and 5G, and capabilities like platooning and predictive cruise are expected to become available first.

Platooning: commercial vehicle platooning is hopefully the first application where automated driving is implemented, an effective solution to control on the distance between vehicles and feet driving status for a big cut in fuel consumption (by 10%-15% in truck platooning according to TNO, the Netherlands Organization for Applied Scientific Research), labor cost reduction, lower driver working intensity, and less cost of operating commercial vehicles. At present, quite a few OEMs have set foot in the field.

Predictive cruise: data like slope, curvature, heading and speed limit are extracted from telematics-based map data to make driving decisions and reduce fuel consumption, coupled with improving fuel saving algorithms.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...