Driven by market demand and policies, passenger cars equipped with L2 assisted driving functions have been mass-produced, which triggers enthusiastic market response and robust demand.

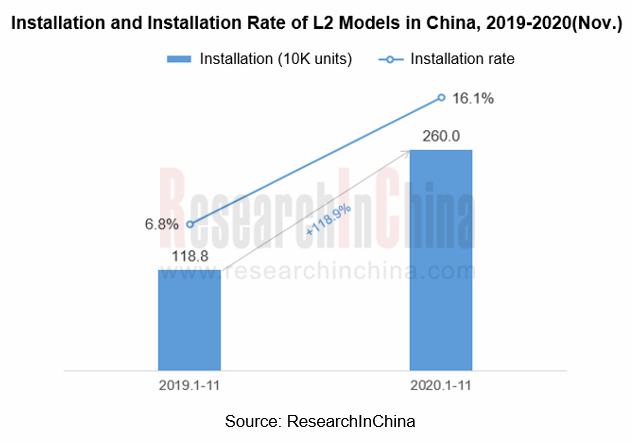

1. Installations of L2 autonomous driving functions increased by 118.9% year-on-year

In 2020, the automobile market was affected by the economic downturn and COVID-19. From January to November 2020, the number of passenger cars insured in China was 16.136 million, a year-on-year decrease of 7.5%. Among them, there were 2.60 million ones equipped with L2 autonomous driving functions, a year-on-year spike of 118.9%; the installation rate jumped 9.3 percentage points year-on-year to 16.1%. Plus multiple negative factors, installations of L2 autonomous driving functions bucked the trend to grow, with strong market demand.

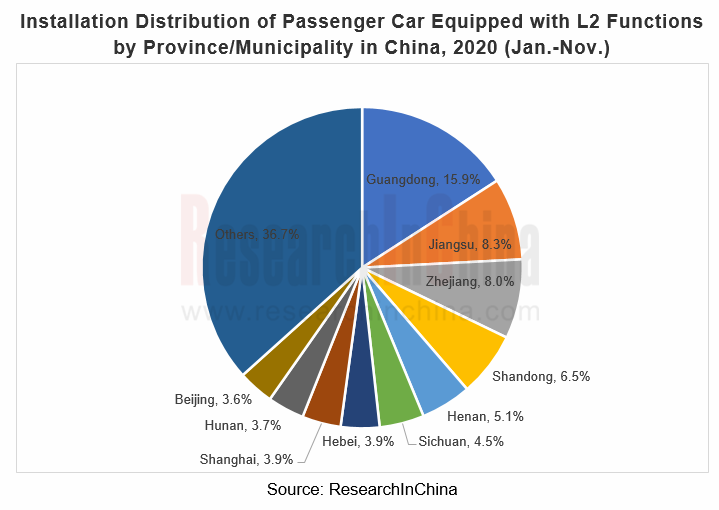

In terms of regions, models equipped with L2 autonomous driving functions are mainly sold to economically developed regions such as Guangdong, Jiangsu and Zhejiang. Among them, installations in Guangdong accounted for 15.9%, much higher than other provinces.

2. Emerging brands such as Tesla, NIO and Lixiang are more aggressive, with the L2 installation rate reaching 100%

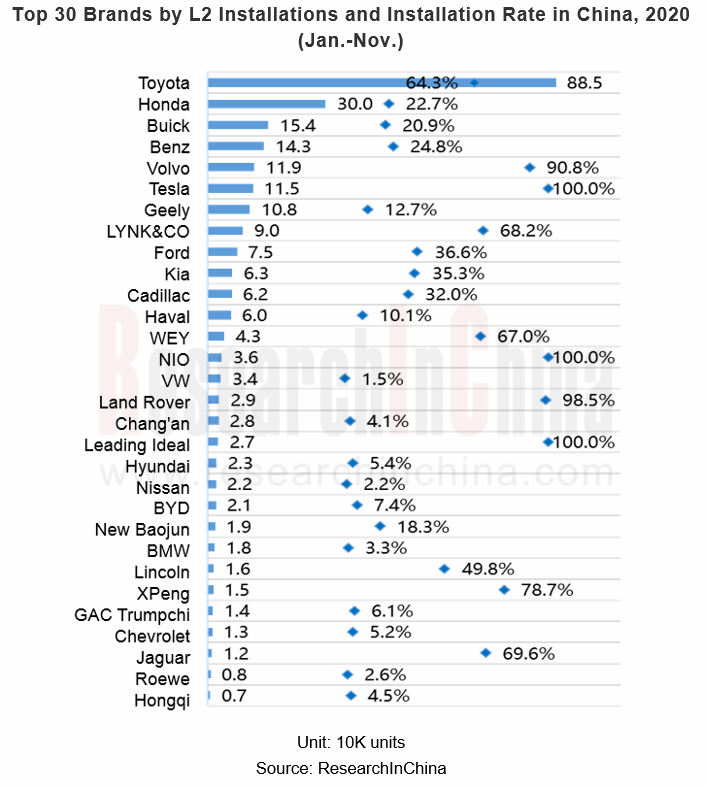

From January to November 2020, a total of 57 passenger car brands (including 32 independent brands and 25 joint venture brands) in China launched L2 autonomous driving functions. Among them, 28 brands (including 11 independent brands and 17 joint venture brands) installed the functions on more than 10,000 cars.

From the perspective of installations, Toyota tops among the industry with 885,000 cars equipped with L2 autonomous driving functions. Its Toyota Safety Sense system has been installed on popular models such as Corolla, Levin, RAV4, AVALON, etc. to feature lane tracking assist (LTA), which can follow the preceding vehicle, provide some necessary steering operations, and keep the vehicle in the center of the lane when the lane line is difficult to identify in traffic jams, or follow the trajectory of the preceding vehicle at low speed.

As for installation rate, emerging automakers represented by Tesla, NIO and Lixiang adopt advanced electronic and electrical architectures to enable vehicles to achieve L2 or L2+ assisted driving functions through OTA upgrades, and further develop toward intelligence.

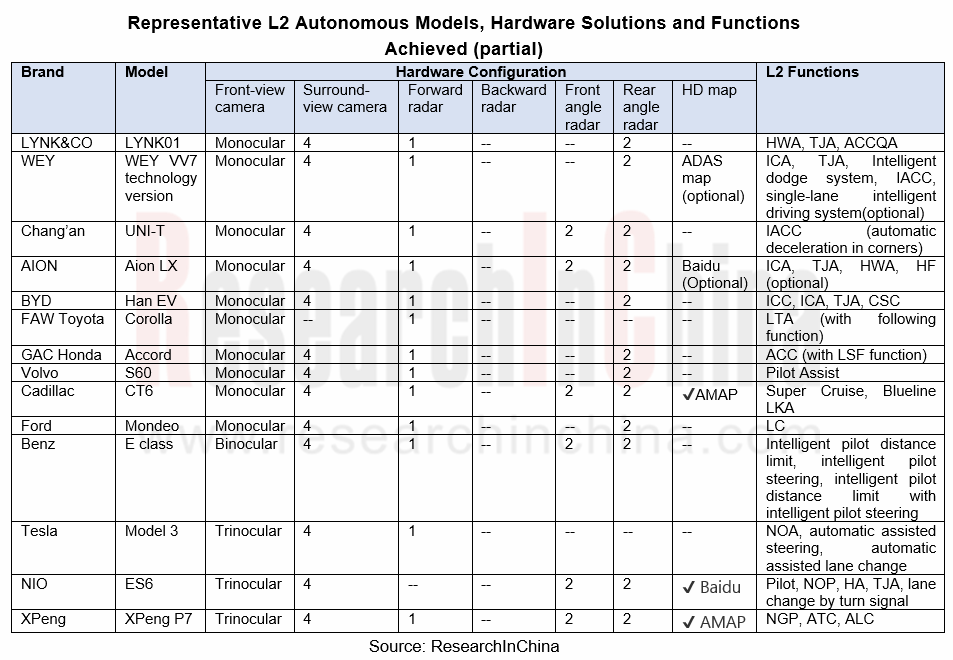

The current L2 autonomous driving functions are mainly divided into two categories: autonomous driving in a single lane, such as integrated adaptive cruise (ICA), traffic jam assist (TJA); autonomous driving that supports commanded lane changes, such as highway assist (HWA).

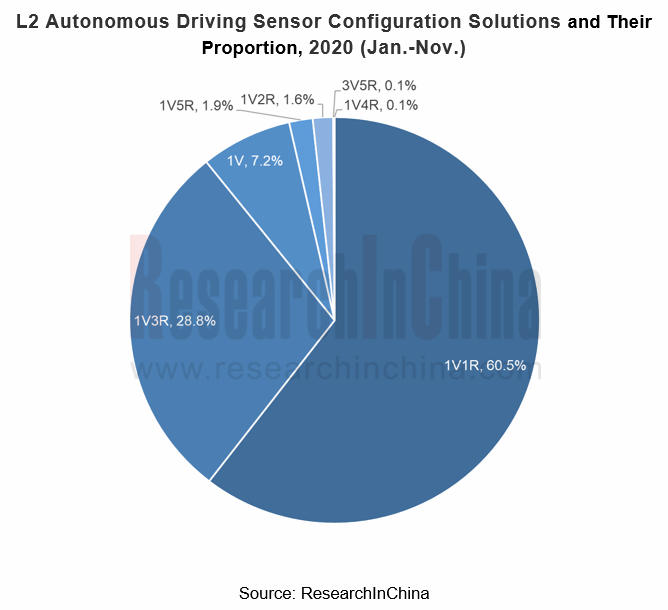

3. 1V1R is the mainstream sensor configuration solution

At present, the mainstream solutions of L2 autonomous driving include 1V1R (a camera + a forward radar) and 1V3R (a camera + a forward radar + 2 rear angle radar), which seize the combined market share of 89.3%; however, 1V1R enjoys the lion’ s share of 60.5%.

Given roadmaps or cost control, some automakers realize L2 autonomous driving through a single vision solution (1V). Some other manufacturers use 1V5R, 1V2R, 1V4R, 3V4R and the like to explore solutions and functions.

For example, NIO ES6 adopts the 3V4R solution

The 2020 NIO ES6 adopts a trinocular camera, 2 front-angle radars, 2 rear-angle radars, and a Mobileye chip to achieve Navigation on Pilot (NOP), Highway Pilot, and Traffic Jam Pilot (TJP), Auto-Lange Change (ALC) and many other L2 autonomous driving functions, and upgrade functions through OTA.

The trinocular camera used by NIO ES6 has wider field of view and higher accuracy than a monocular camera. The 52-degree camera detects general road conditions, the 28-degree camera detects long-distance targets and traffic lights, and the 150-degree camera detects the sides of the car body and cutting-in vehicles in short distance, with better front recognition performance.

In addition, ES6's NOP is based on the basic pilot functions, so that it can automatically switch high-speed lanes, enter or exit ramps according to navigation, and can intelligently adjust the cruising speed on the current road. Based on the realization of pilot lane keeping, ALC enables the automatic lane change of the vehicle by turning the turn signal lever.

4. L2 autonomous driving based on HD map is expected to prevail

With centimeter-level accuracy and rich road information, HD map has become an indispensable element of L3-L5 autonomous driving. But with the deepening of L2 autonomous driving, HD map is expected to find a new scenario.

Some top automakers have tried to apply HD map to L2 autonomous driving:

Tesla, NIO, Xpeng and other emerging automakers have launched L2+ highway cruise based on navigation/HD map, and enabled autonomous driving on highways through navigation path planning.

In July 2020, SAIC-GM Cadillac CT6 equipped with the Super Cruise driver-assistance feature officially debuted. With HD map, Super Cruise can control vehicles on highways and keep them within lanes.

Map suppliers have also introduced corresponding solutions.

Baidu released ANP, a high-level intelligent driving solution based on HD map

In December 2020, Baidu released ANP (Apollo Navigation Pilot), a high-level intelligent driving solution based on HD map.

ANP is a low-level Apollo Lite which is Baidu’s L4 autonomous driving solution. Equipped with the HD map tailored by Baidu for autonomous vehicles, ANP not only supports highways and city loops, but also fits for urban roads. Through CVIS, the driving experience is close to the L4 Robotaxi.

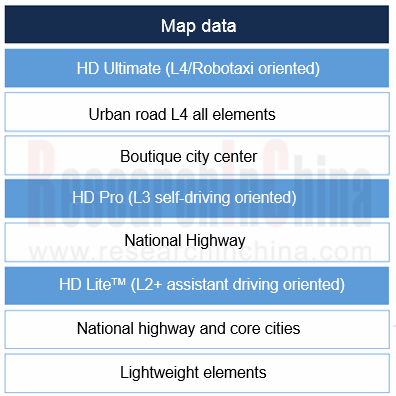

NavInfo launched LitePilot, an HD map product for L2+ autonomous driving

NavInfo has launched HD map for L2+, L3, and L4-5 respectively. LitePilot, an HD map product for L2+ autonomous driving scenarios, can help vehicles drive through ramps, roundabouts and intersections, as well as prepare to turn right.

NavInfo HD map products for different scenarios:

Focusing on L2+ autonomous driving, HD Lite is currently the main product of NavInfo. Compared with HD Pro, HD Lite has fewer map elements, but it can provide autonomous driving map services with lower cost, wider area coverage and higher update frequency, enable highway and city map services, and accelerate the implementation of L2+ autonomous driving technology.

Under the background that L3 autonomous driving features have not been mass-produced, OEMs, integrators, map vendors and other industry chain companies will strive to maximize the capability of L2 autonomous driving and move closer to L3. HD map is expected to find new market space herein.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...