China Automotive Magnesium Alloy Die Casting Industry Report, 2021

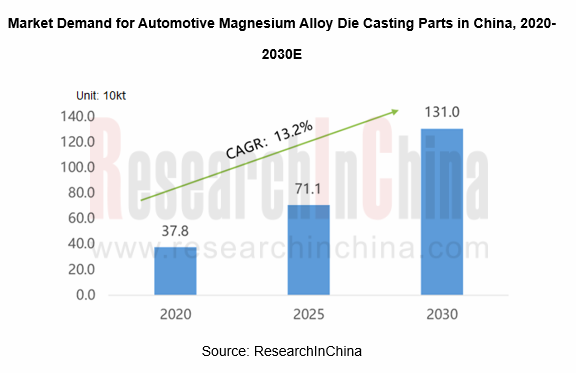

Under the general trend of automobile lightweight, the CAGR of magnesium alloy market demand reached 13.2%

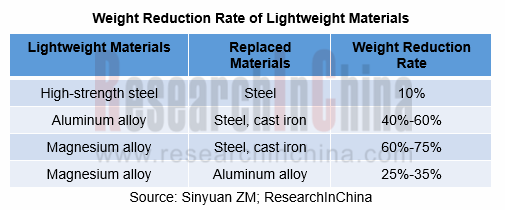

The vast majority of automotive magnesium alloy parts are die casting parts, which are mainly used in housings and brackets. Magnesium alloy is a good substitute for steel and aluminum alloy, and can reduce the product weight by 25%-75%. However, the current application ratio of magnesium alloy in automobiles is much lower than that of aluminum alloy.

Magnesium alloy facilitates lightweight vehicles

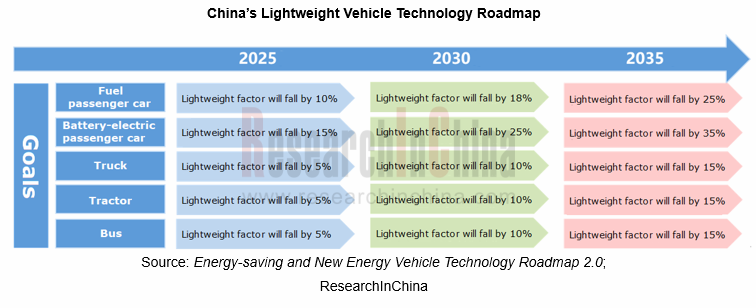

Given energy saving, environmental protection and performance, lightweight vehicles have become one of the important directions for the development of the global automotive industry. In 2020, China released Energy-saving and New Energy Vehicle Technology Roadmap 2.0, putting forward lightweight requirements for all types of vehicles. In addition, major automakers have proposed goals of promoting the development of lightweight vehicles.

At present, lightweight vehicle technology is mainly divided into three types: lightweight material technology, lightweight advanced process technology, and lightweight structure optimization technology. Lightweight materials are the key to lightweight vehicles.

Magnesium alloy features low density, high strength, good heat dissipation, strong vibration resistance, noise reduction, excellent die casting performance, and outstanding cutting performance, as an ideal lightweight material. Under the trend of lightweight vehicles, the market demand for magnesium alloy will grow rapidly.

In 2015, a single car in China only used about 1.5kg of magnesium, which was far lower than the level in Europe, America, Japan and other regions. However, with the rapid development of new energy vehicles and the acceleration of the lightweight vehicle process, the amount of magnesium used in a single vehicle in China has grown rapidly, and it is estimated to reach 15kg in 2020.

As per Energy-saving and New Energy Vehicle Technology Roadmap 2.0, a single car in China will use 45kg of magnesium alloy, which will account for 4% of the total vehicle weight by 2030 when the Chinese automobile market will demand 1.31 million tons of magnesium alloy die casting parts with a CAGR of 13.2% in 2020-2030.

Magnesium alloy boosts lightweight new energy vehicles

For every 10% reduction in the weight of new energy vehicles, the average cruising range can increase by 5%-8%. Therefore, the demand for lightweight new energy vehicles is urgent. The density of magnesium alloy is 2/3 that of aluminum and 1/4 that of steel, so it is much lighter than the latter two, which means that magnesium alloy is the best choice for lightweight new energy vehicles.

New energy vehicle battery packs account for more than 20% of the vehicle weight, thus lightweight new energy vehicles partly hinge on lightweight battery packs.

Lightweight battery packs can make outer casings, bottom trays, and inner end/side panels lighter. For example, Tesla MODEL S mainly uses aluminum alloy for the battery pack shell which weighs up to 125 kg; if it uses magnesium alloy, the weight will be reduced by about 60 kg or nearly 50%.

At present, Wanfeng Meridian, Qianhe Magnesium, RSM Group, Eontec, Ka Shui Group, etc. have made layout in the field of magnesium alloy casting for battery pack shells of new energy vehicles.

As the world's leading supplier of new energy vehicle batteries, CATL has also deployed magnesium alloy die casting for battery packs. In November 2020, CATL, Sanxiang Advanced Materials, Vansun Group, and Zhuhai Hengqin Yinmei Technology jointly established Ningde Wenda Magnesium-Aluminum Technology Co., Ltd. to build a magnesium-aluminum alloy project with a total investment of RMB800 million. The products include die casting structural parts for battery casings.

Wanfeng Auto Wheel leads the market amid low market concentration

At present, the global automotive magnesium alloy die casting market is highly fragmented with low market concentration The relatively large-scale companies mainly include Georg Fisher, DGS, STIHL, Wanfeng Meridian, SUNDARAM CLAYTON, Gibbs, PACE, etc.

In the short history of China's automotive magnesium alloy die casting market, there are only a few companies of a certain size, mainly including Wanfeng Auto Wheel, RSM Group, Sinyuan ZM, Eontec, Ka Shui Group, etc.

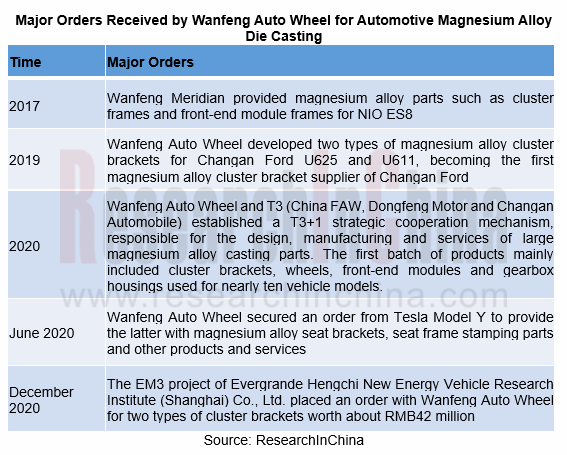

Wanfeng Auto Wheel has become a leader in the automotive magnesium alloy die casting market in China and even in the world through the acquisition of Wanfeng Meridian which was granted the Automotive Casting Excellence Award by The International Magnesium Association (IMA) for two consecutive years. Wanfeng Meridian serves not only Tesla, NIO and other new energy vehicle companies, but also traditional automakers such as Porsche, Audi, Mercedes-Benz, BMW and Volvo.

Enormous market potentials prompt companies to expand production

In view of enormous market potentials, domestic companies have invested in building or expanding automotive magnesium alloy die casting bases to meet the growing market demand. In the future, the competition in the industry will become more intense, and the automotive magnesium alloy die casting market will mature.

China Automotive Cybersecurity Software Research Report, 2022

Chinese in-vehicle terminal PKI market will be worth RMB1.89 billion in 2025.

The working principle of PKI (Public Key Infrastructure) is: the infrastructure that provides security services establish...

Global and China HD Map Industry Report, 2022

HD maps have been applied on a large scale, spreading from freeways to cities

According to ResearchInChina, more than 100,000 Chinese passenger cars were equipped with HD maps by OEMs in the first ha...

Automotive Software Providers and Business Models Research Report, 2022

Research on software business models: four business forms and charging models of automotive software providers.

In an age of software-defined vehicles, automotive software booms, and providers step u...

China Automotive Integrated Die Casting Industry Research Report, 2022

Integrated Die Casting Research: Upstream, midstream and downstream companies are making plans and layouts in this booming field

Automotive integrated die casting is an automotive manufacturing proce...

Emerging Automakers Strategy Research Report, 2022--Xpeng Motors

XPeng Motors Strategy Research: Landing Urban NGP and Expanding Three Branch BusinessesXPeng P7 drives overall sales growth, and three new models will be launched from 2022 to 2023 to drive new growth...

Global Passenger Car Vision Industry Report, 2022

Foreign automotive vision research: leading Tier 1 suppliers vigorously deploy DMS/OMS, and vital sign detection becomes a standard configuration for OMS.

1. The revenues of major Tier 1 suppliers in...

China Automotive Vision Industry Report, 2022

China automotive vision research: DMS is booming, with the installations soaring 141.8% year-on-year

1. China will install 75.4 million cameras in 2025

According to ResearchInChina, China installed ...

C-V2X (Cellular Vehicle to Everything) and CVIS (Cooperative Vehicle Infrastructure System) Industry Report, 2022

C-V2X industry research: C-V2X was pre-installed in more than 20 production passenger car models, with a penetration rate of over 0.5%.

More than 20 production passenger car models were equipped wit...

New Energy Vehicle Thermal Management System Market Research Report,2022

Thermal Management Research: Technological Innovation and Iteration Have Spawned Emerging Markets

The rapid development of Chinese new energy vehicles has brought more opportunities for parts and com...

CTP, CTC and CTB Integrated Battery Industry Research Report, 2022

Integrated battery research: three trends of CTP, CTC and CTB

Basic concept of CTP, CTC and CTB

The traditional integration method of new energy vehicle power system is CTM, that is, "Cell to Module...

China Driving Recorder Market Research Report, 2022

Driving recorder research: sales volume of passenger cars equipped with OEM DVRs increased by 52.5% year-on-year in 2022 H1

In April 2021, the Ministry of Industry and Information Technology s...

Autonomous Delivery Vehicle Industry Report, 2022

Research on autonomous delivery: the cost declines, and the pace of penetration and deployment in scenarios accelerate.

Autonomous delivery contains outdoor autonomous delivery (including ground-base...

China Autonomous Heavy Truck Industry Report, 2022

Autonomous heavy truck research: entering operation and pre-installed mass production stage, dimension reduction and cost decrease are the industry solution

ResearchInChina released "China Autonomous...

China Smart Parking Industry Report, 2022

Smart parking research: there are 4,000 players, and city-level parking platforms have been established.

Smart parking market shows great potentials, and Baidu, Alibaba, Tencent and Huawei (BATH) hav...

Automotive Head-up Display (HUD) Industry Report, 2022

Automotive HUD research: AR HUD is being largely mounted on vehicles, and local suppliers lead the way. 1. AR HUD is being used widely, with 35,000 vehicles equipped in the first half of 2022.

S...

Intelligent Vehicle E/E Architecture Research Report, 2022

E/E architecture research: 14 key technologies, and innovative layout of 24 OEMsKey technologies of next-generation electronic and electrical architectures (EEA)

The definition of next-generation E/E...

China Automotive Lighting Market Research Report, 2022

Automotive lighting research: the penetration of ambient lights has reached 31%, and intelligent lighting is reshaping the third living space.

Favorable policies and consumption upgrade help automake...

Global and China Automotive IGBT and SiC Research Report, 2022

1. In 2025, China's automotive SiC market will be valued at RMB12.99 billion, sustaining AAGRs of 97.2%.

Silicon carbide (SiC) devices that feature the resistance to high voltage and high frequency ...