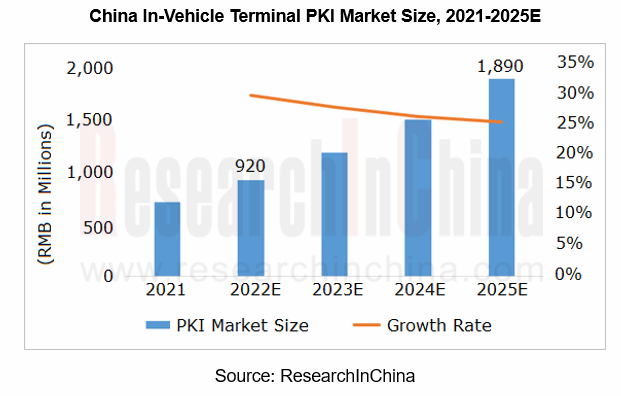

Chinese in-vehicle terminal PKI market will be worth RMB1.89 billion in 2025.

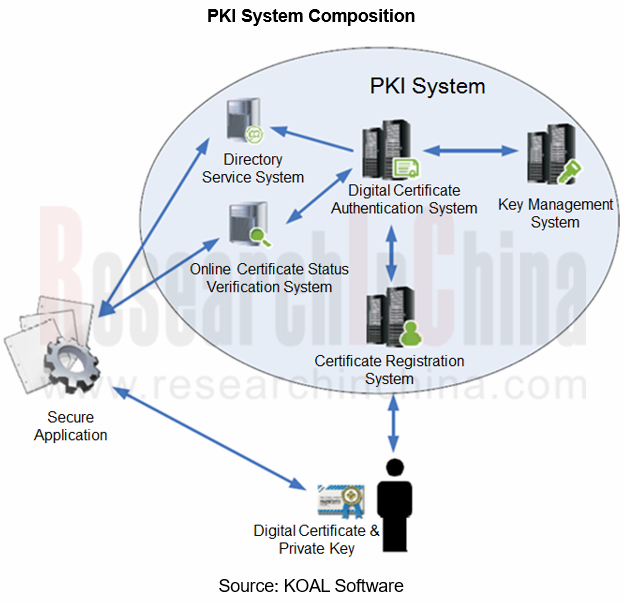

The working principle of PKI (Public Key Infrastructure) is: the infrastructure that provides security services established by leveraging public key cryptography technology, and provides users with certificate management and key management, etc., in a bid for identity authenticity, information confidentiality and other goals.

China's automobile cybersecurity is protected mainly by the PKI system by far. The asymmetric encryption technology based on PKI is applied to various links such as onboard devices, Internet of Vehicles operation, and network communication, and plays a core role in the security protection at all levels of cloud, communication, and terminals. As for in-vehicle terminals, various terminal devices need to be embedded with security chips to manage keys and encryption operations; all communications with the outside world also require to be encrypted, driving the robust demand for PKI.

Facilitated by the factors like the expanding demand for automotive cybersecurity protection and the rapid rise in the penetration rate of Internet of Vehicles, Chinese PKI market size of in-vehicle terminals will expectedly reach RMB920 million to RMB1,890 million from 2022 to 2025, with an average annual growth rate of 27%.

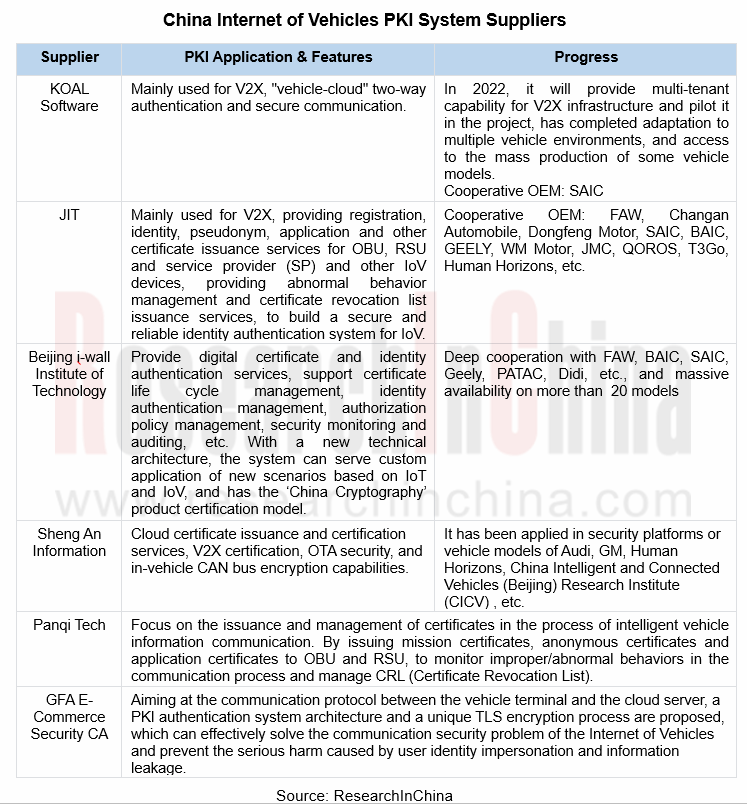

Of the PKI application scenarios, V2X is the focus of major suppliers. The use of PKI system to on-board unit (OBU), roadside unit (RSU), service provider (SP), and secure communication and identity authentication between cloud platforms will be the mainspring of future development.

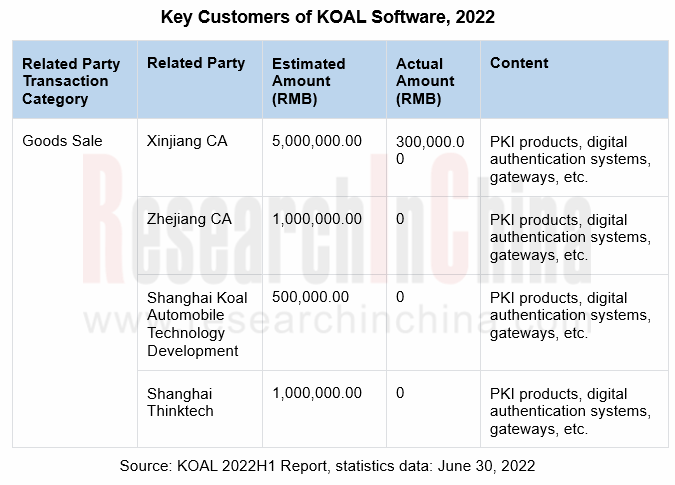

KOAL Software is one of the early developers of PKI products in China, and has formed three major product systems: PKI infrastructure products, PKI security application products, and general security products.

KOAL's PKI solution for intelligent vehicle connectivity is centered round the V2X-PKI security service system, integrates IEEE1609.2 international standards and GB/T 37374 national standards, meets ITS standards and Ministry of Transport standards, and also supports GM (China Cryptography) algorithms.

In the automotive sector, KOAL Software has SAIC as its main customer and has built a security certificate management system for the wireless communication technology of the Internet of Vehicles for SAIC Prospective Technology Research Department, including V2X and V2N security certificate systems. In addition, it also built a comprehensive certificate management system, digital certificate authentication system, and signature verification system for SAIC Cloud Data Center mobile office project, and built a cloud PKI system for SAIC Motor Overseas Intelligent Mobility Technology Co., Ltd.

In 2022, KOAL Software's products in automotive field expand from identity authentication system to data security system of the Internet of Vehicles. The "Guidelines for the Application of Internet of Vehicles Transmission Security Protection Based on Domestic Cryptography" has been successfully approved, becoming the first group standard to pass the expert review of Shanghai Business Cryptography Association.

Changchun Jilin University Zhengyuan Information Technologies Co., Ltd. (hereinafter referred to as JIT) is the main member and sub project convener of WG3 (cryptography Working Group), WG4 (Authentication and Authorization Working Group), WG5 (Cybersecurity Assessment Working Group), WG7 (Cybersecurity Management Working Group) and SWG-BDS (Special Working Group on Big Data Security Standards) of National Cybersecurity Standardization Technical Committee. JIT is also one of the main constitutors of standards about PKI electronic certification products in China.

JIT has developed product lines such as password security, identity and access security, data security and security applications, and formed six star products: PKI, V2X PKI, identity and access management (IAM), password comprehensive service management platform, secure blockchain platform and data security solutions.

In respect of V2X PKI, based on the digital certificate format specification of GM/T 0015 SM2 cryptographic algorithm, JIT combines various application scenarios of transportation information systems, and focuses on the requirements of ITS (Intelligent Transportation System) application on the length, computing efficiency, etc. of digital certificates. The format of the ITS equipment certificate has been redefined, and JIT developed the ITS digital certificate product independently to provide technical and product support for intelligent transportation.

China Automotive Cybersecurity Software Research Report, 2022 highlights the following:

Automotive cybersecurity system architecture and key software product range;

Automotive cybersecurity system architecture and key software product range;

The application of cryptographic technology and PKI system in the Internet of Vehicles system, main enterprises and products;

The application of cryptographic technology and PKI system in the Internet of Vehicles system, main enterprises and products;

The application of IDPS in automotive cybersecurity defense system, main enterprises and solutions;

The application of IDPS in automotive cybersecurity defense system, main enterprises and solutions;

Status quo of China's automotive cybersecurity testing, major companies and testing platforms;

Status quo of China's automotive cybersecurity testing, major companies and testing platforms;

Development trends and suggestions for automotive cybersecurity.

Development trends and suggestions for automotive cybersecurity.

Automotive Power Supply (OBC+DC/DC+PDU) and Integrated Circuits (IC) Industry Report, 2023

Automotive power supply and IC: Chinese chips are promising in the evolution from physical integration to system integration

As the core component of a new energy vehicle, automotive power supply is ...

OEMs’ Model Planning Research Report, 2023-2025

OEMs’ Model Planning Research Report, 2023-2025, released by ResearchInChina, combs through model planning and features of Chinese independent brands, emerging carmakers, and joint venture brands in t...

Leading Foreign OEMs’ADAS and Autonomous Driving Report, 2023

Global automakers evolve to software-defined vehicles by upgrading EEAs.

Centralized electronic/electrical architectures (EEA) act as the hardware foundation to realize software-defined vehicles. At ...

Automotive AI Algorithm and Foundation Model Application Research Report, 2023

Large AI model research: NOA and foundation model facilitate a disruption in the ADAS industry.

Recently some events upset OEMs and small- and medium-sized ADAS companies, as the autonomous driving i...

Intelligent Cockpit Domain Controller and SoC Market Analysis Report, 2023Q2

Cockpit domain controller and chip in 2023Q2: by intelligent cockpit level, L1 surged by 105% on a like-on-like basis, and L2 soared by 171%.On May 17, 2023, the “White Paper on Automotive Intelligent...

Intelligent Vehicle E/E Architecture Research Report, 2023

E/E Architecture Research: How will the zonal EEA evolve and materialize from the perspective of supply chain deployment?Through the lens of development trends, automotive EEA (Electronic/electrical A...

China Passenger Car Brake-by-wire Industry Report, 2023

Passenger car brake-by-wire research: One-box solution takes an over 50% share.

China Passenger Car Brake-by-wire Industry Report, 2023 released by ResearchInChina combs through and summarizes passe...

Smart Car OTA Industry Report, 2023

Vehicle OTA Research: OTA functions tend to cover a full life cycle and feature SOA and central supercomputing.In the trend for software-defined vehicles, OTA installations are surging, and software i...

Intelligent Vehicle Multi-Domain Computing Industry Report, 2023

Multi-domain computing research: in the coming first year of cross-domain fusion, major suppliers will quicken their pace of launching new solutions.

As vehicle intelligence develops, electrical/ele...

Automotive Head-up Display (HUD) Industry Report, 2023

Automotive HUD research: in the "technology battle" in AR-HUD, who will be the champion of mass production?

Automotive head-up display (HUD) works on the optical principle for real-time display of s...

Automotive Cloud Service Platform Industry Report, 2023

Research on Automotive Cloud Services: As Dedicated Automotive Cloud Platforms Are Launched, the Market Enters A Phase of Differentiated Competition

1. The exponentially increasing amount of v...

Global and China Automotive Gateway Industry Report, 2023

Automotive gateway research: integrated gateways have become an important trend in zonal architecture.

Automotive gateway is a core component in the automotive electronic/electrical architecture. As ...

In-vehicle Communication and Network Interface Chip Industry Report, 2023

In-vehicle communication chip research: automotive Ethernet is evolving towards high bandwidth and multiple ports, and the related chip market is growing rapidly.

By communication connection form, au...

China Autonomous Driving Data Closed Loop Research Report, 2023

Data closed loop research: in the stage of Autonomous Driving 3.0, work hard on end-to-end development to control data.

At present, autonomous driving has entered the stage 3.0. Differing from the s...

ADAS and Autonomous Driving Tier 1 Research Report, 2023 - Foreign Companies

Research on foreign ADAS Tier 1 suppliers: 4D radar starts volume production, and CMS becomes a new battlefield.

1. Global Tier 1 suppliers boast complete ADAS/AD product matrix, and make continuous...

China Passenger Car Driving-parking Integrated Solution Industry Report, 2023

Research on driving-parking integration: with the declining share of the self-development model, suppliers' solutions blossom.

Local suppliers lead the driving-parking integration market.

The statis...

Passenger Car Cockpit Entertainment Research Report, 2023

Cockpit entertainment research: vehicle games will be the next hotspot.

The Passenger Car Cockpit Entertainment Research Report, 2023 released by ResearchInChina combs through the cockpit entertainme...

Smart Road - Roadside Perception Industry Report, 2023

Roadside perception research: evolution to integration, high performance and cost control.In June 2023, at a regular policy briefing of the State Council the Ministry of Industry and Information Techn...