Global and China Automotive Operating System (OS) Industry Report, 2021

Automotive OS Research: Automotive OS Is Highly Competitive

Automotive OS has always been complicated and dazzling.

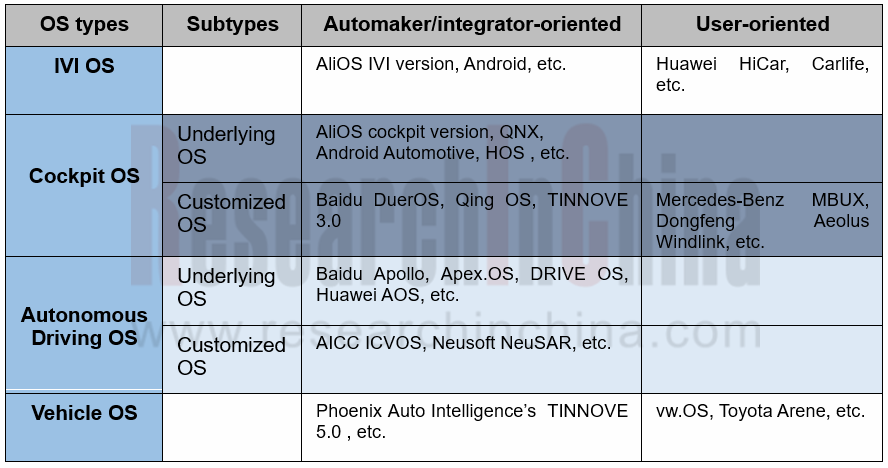

A year ago, ResearchInChina classified "Automotive OS" into four types:

1) Basic Auto OS: it refers to base auto OS such as AliOS, QNX, Linux, including all base components like system kernel, underlying driver and virtual machine.

2) Custom-made Auto OS: it is deeply developed and tailored on the basis of basic OS (together with OEMs and Tier 1 suppliers) to eventually bring cockpit system platform or automated driving system platform into a reality. Examples are Baidu in-car OS and VW.OS.

3) ROM Auto OS: Customized development is based on Android (or Linux), instead of changing system kernel. MIUI is the typical system applied in mobile phone. Benz, BMW, NIO, XPeng and CHJ Automotive often prefer to develop ROM auto OS.

4) Super Auto APP (also called phone mapping system) refers to a versatile APP integrating map, music, voice, sociality, etc. to meet car owners’ needs. Examples are Carlife and CarPlay.

However, profound changes have taken place in the Automotive OS field so far. In this report, we classified Automotive OS from another perspective.

Many Automotive OS vendors have started from IVI OS, with the technological evolution: IVI OS-->Cockpit OS -->Vehicle OS. They are expected to head toward Vehicle OS after 2024.

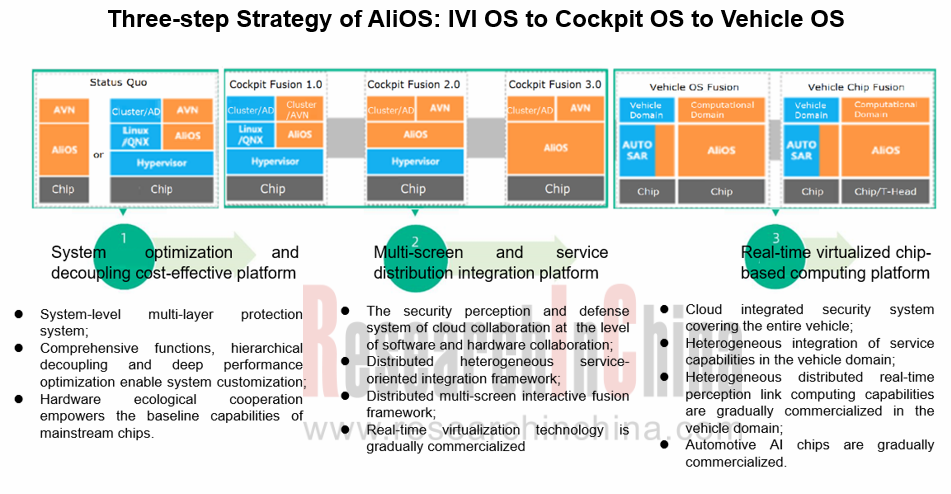

In 2020, Banma SmartDrive proposed the evolution route of AliOS, namely Smart IVI OS-->Smart Cockpit OS -->Smart Vehicle OS.

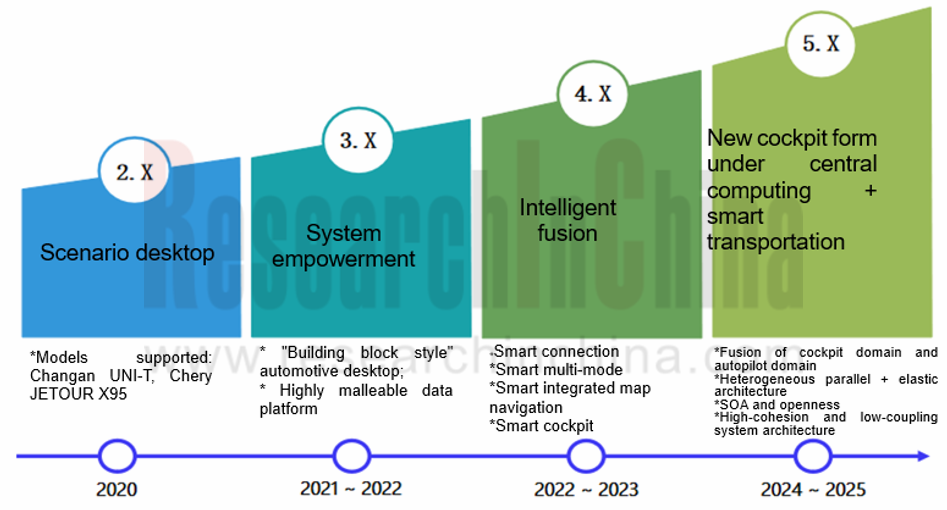

Based on Tencent's ecology, TINNOVE OS follows the technology roadmap from Cockpit OS to Vehicle OS that integrates the cockpit domain and the autonomous driving domain.

Through the "open" and "ecological" approach, TINNOVE OS transfers Tencent’s ecosystem to the system and OEMs. At present, it has cooperated with Changan Automobile, Audi, Chery JETOUR, Ford and other brands. TINNOVE OS has been installed in more than a dozen models like Changan CS75Plus, UNI-T, CS35Plus and CS85 COUPE. Phoenix Auto Intelligence has recently reached in-depth cooperation with Qualcomm, and SemiDrive, etc.

Autonomous Driving OS and Domain Controllers Are Integrated to Be Autonomous Driving Computing Platform

With the popularity of software-defined vehicles and domain controllers, automakers, Tier1 suppliers and core chip vendors have been all making layout from the perspective of platforms and ecology.

Autonomous driving computing platform providers not only lay out Autonomous Driving OS, but also launch domain controllers, and build ecosystems based on computing platforms consisting of Autonomous Driving OS and domain controllers. With these autonomous driving platforms, OEMs and autonomous driving integrators no longer have to deal directly with the underlying operating system and chips, which can greatly simplify the development process and shorten the product cycle.

Neusoft Reach and AICC are typical autonomous driving computing platform providers.

Neusoft Reach’s next-generation autonomous driving computing platform includes the software platform NeuSAR3.0, the all-in-one X-Cube3.0 for ADAS, and the autonomous driving domain controller X-Box 3.0. In October 2021, Neusoft Reach was invested by SDIC and Virtue Capital with a total of RMB650 million.

In February 2021, AICC released the intelligent driving computing platform "Intelligent Vehicle Basic Brain" (iVBB) 1.0, including intelligent connected vehicle operation system (ICVOS), intelligent vehicle domain hardware (ICVHW), and intelligent connected vehicle-edge-cloud basic software (ICVEC). It features rapid application development, platformization, connectivity, scalability and compliance with automotive regulations.

Automotive OS investment soars, and market competition becomes fierce

In March 2021, Evergrande New Energy Vehicle and Phoenix Auto Intelligence signed an agreement to invest 60% and 40% respectively in establishing an operating system joint venture.

In July 2021, the veteran shareholders Alibaba Group, SAIC Group, SDIC, and Yunfeng Capital jointly injected RMB3 billion into Banma SmartDrive for further R&D and promotion of intelligent vehicle OS.

In June 2021, AICC the completed the angel financing of nearly RMB100 million. In October 2021, AICC raised hundreds of millions of yuan in the pre-A round of financing.

The background of the above three companies: Phoenix Auto Intelligence is backed up by Tencent, Alibaba is behind Banma SmartDrive, and AICC is supported by CICV (invested by more than a dozen traditional OEMs and Tier1 suppliers). Plus Baidu and Huawei, which are aggressive in the Automotive OS market, all players are powerful.

The competition in automotive computing platforms, including operating systems, is essentially ecological competition. Who can win the support of more software developers, component companies, service operators, etc. will dominate the future autonomous driving.

China Passenger Car Cockpit Multi and Dual Display Research Report, 2022

Cockpit multi and dual display research: 51.5% year-on-year growth in center console multi and dual display installation from January to July 2022

ResearchInChina released "China Passenger Car Cockpi...

China Automotive Cybersecurity Hardware Research Report, 2022

Cybersecurity hardware research: security chip and HSM that meet the national encryption standards will build the automotive cybersecurity hardware foundation for China.

1. OEMs generally adopt the s...

China Automotive Cybersecurity Software Research Report, 2022

Chinese in-vehicle terminal PKI market will be worth RMB1.89 billion in 2025.

The working principle of PKI (Public Key Infrastructure) is: the infrastructure that provides security services establish...

Global and China HD Map Industry Report, 2022

HD maps have been applied on a large scale, spreading from freeways to cities

According to ResearchInChina, more than 100,000 Chinese passenger cars were equipped with HD maps by OEMs in the first ha...

Automotive Software Providers and Business Models Research Report, 2022

Research on software business models: four business forms and charging models of automotive software providers.

In an age of software-defined vehicles, automotive software booms, and providers step u...

China Automotive Integrated Die Casting Industry Research Report, 2022

Integrated Die Casting Research: Upstream, midstream and downstream companies are making plans and layouts in this booming field

Automotive integrated die casting is an automotive manufacturing proce...

Emerging Automakers Strategy Research Report, 2022--Xpeng Motors

XPeng Motors Strategy Research: Landing Urban NGP and Expanding Three Branch BusinessesXPeng P7 drives overall sales growth, and three new models will be launched from 2022 to 2023 to drive new growth...

Global Passenger Car Vision Industry Report, 2022

Foreign automotive vision research: leading Tier 1 suppliers vigorously deploy DMS/OMS, and vital sign detection becomes a standard configuration for OMS.

1. The revenues of major Tier 1 suppliers in...

China Automotive Vision Industry Report, 2022

China automotive vision research: DMS is booming, with the installations soaring 141.8% year-on-year

1. China will install 75.4 million cameras in 2025

According to ResearchInChina, China installed ...

C-V2X (Cellular Vehicle to Everything) and CVIS (Cooperative Vehicle Infrastructure System) Industry Report, 2022

C-V2X industry research: C-V2X was pre-installed in more than 20 production passenger car models, with a penetration rate of over 0.5%.

More than 20 production passenger car models were equipped wit...

New Energy Vehicle Thermal Management System Market Research Report,2022

Thermal Management Research: Technological Innovation and Iteration Have Spawned Emerging Markets

The rapid development of Chinese new energy vehicles has brought more opportunities for parts and com...

CTP, CTC and CTB Integrated Battery Industry Research Report, 2022

Integrated battery research: three trends of CTP, CTC and CTB

Basic concept of CTP, CTC and CTB

The traditional integration method of new energy vehicle power system is CTM, that is, "Cell to Module...

China Driving Recorder Market Research Report, 2022

Driving recorder research: sales volume of passenger cars equipped with OEM DVRs increased by 52.5% year-on-year in 2022 H1

In April 2021, the Ministry of Industry and Information Technology s...

Autonomous Delivery Vehicle Industry Report, 2022

Research on autonomous delivery: the cost declines, and the pace of penetration and deployment in scenarios accelerate.

Autonomous delivery contains outdoor autonomous delivery (including ground-base...

China Autonomous Heavy Truck Industry Report, 2022

Autonomous heavy truck research: entering operation and pre-installed mass production stage, dimension reduction and cost decrease are the industry solution

ResearchInChina released "China Autonomous...

China Smart Parking Industry Report, 2022

Smart parking research: there are 4,000 players, and city-level parking platforms have been established.

Smart parking market shows great potentials, and Baidu, Alibaba, Tencent and Huawei (BATH) hav...

Automotive Head-up Display (HUD) Industry Report, 2022

Automotive HUD research: AR HUD is being largely mounted on vehicles, and local suppliers lead the way. 1. AR HUD is being used widely, with 35,000 vehicles equipped in the first half of 2022.

S...

Intelligent Vehicle E/E Architecture Research Report, 2022

E/E architecture research: 14 key technologies, and innovative layout of 24 OEMsKey technologies of next-generation electronic and electrical architectures (EEA)

The definition of next-generation E/E...