Research on 800V high voltage platform: the mass production will commence in 2022

800V high voltage platform-based models are a key deployment of OEMs.

It is hard for a 400V platform to enable >200KW fast charge under current E/E architectures, while the upgrade to the 800V platform allows much smaller fast charging current at 200KW, making it more likely to achieve >350KW fast charge.

In the case of the same charging power, under the 800V fast charging architecture the high voltage wiring harness boasts smaller diameter and costs less, and the battery dissipates less heat, which makes thermal management easier and optimizes the overall cost of the battery.

Already, most OEMs have made aggressive inroads into the 800V high voltage platform since it serves as an efficient solution to the replenishment anxiety.

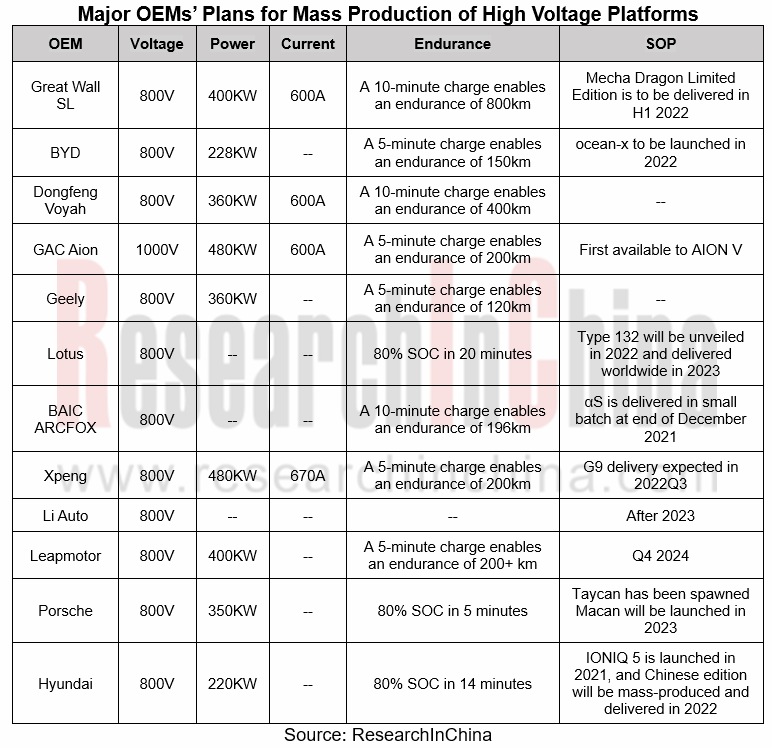

In 2021, BYD, Geely, Great Wall Motor, Xpeng Motors and Leapmotor among others have announced their 800V high voltage technology deployment plans; Li Auto, NIO and the likes are preparing for related technologies as well. Through the lens of start of production, major OEMs will roll out their new vehicles based on 800V solution beyond 2022.

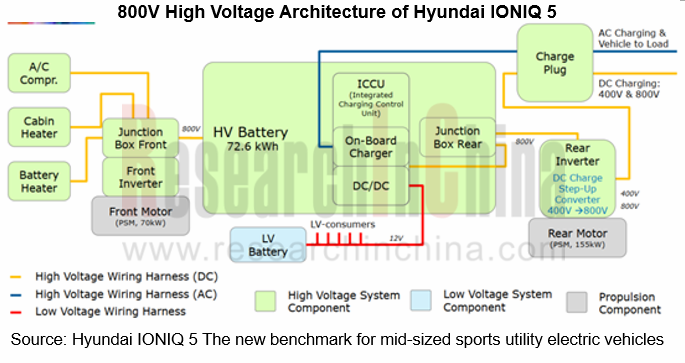

Hyundai: at the Auto Shanghai 2021, Hyundai introduced IONIQ5, the first IONIQ BEV model developed on the E-GMP. The Chinese edition will be spawned in 2022. IONIQ5 highlights the following:

- It takes just 18 minutes to rise state of charge (SOC) from 10% to 80%;

- 800V high voltage architecture

- The rear wheel drive integrates a HV booster that converts 400V to 800V.

From the 800V architecture diagram of IONIQ 5, it can be seen that almost all high voltage devices have been upgraded to 800V; the front wheel drive is a 75kW three-in-one drive, while the rear one is a 155kW five-in-one drive, with a 400V to 800V converter designed for wider scenarios of fast charge.

Great Wall: in November 2021, Great Wall SL unveiled Mecha Dragon, its first model that packs proprietary Dayu battery delivering capacity of 115kWh and CLTC range of 802km. Besides, Mecha Dragon uses 800V charging technology, enabling a 401km endurance by a 10-minute charge and 545km by a 15-minute charge, with peak current up to 600A.

Great Wall also endeavors to deploy 800V high voltage components, such as 800V dual-motor vector control module, 800V SiC controller, and 800V~1000V 250A ultrahigh voltage wiring harness systems.

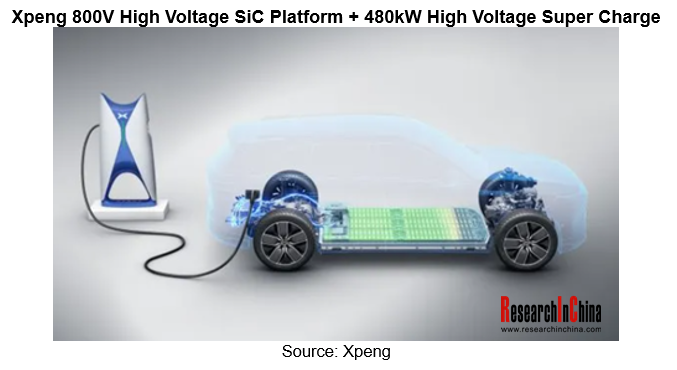

Xpeng: in November 2021, Xpeng released Xpeng G9, a production vehicle based on the 800V high voltage SiC platform. The new car can travel more than 200km by a 5-minute super charge. Its maximum charging current also exceeds 600A, electric drive efficiency is as high as 95%, and overall system efficiency is close to 90%.

All components on Xpeng G9 are 800V ones, meaning they support the high voltage of 800V. In addition, Xpeng G9 reduces the resistance of each high voltage linkage, and also offers safety protection in special circumstances. The maximum charging current of over 600A enables super charge in a real sense.

Leapmotor: in July 2021, Leapmotor announced its Future Strategy 2.0, specifying a clear-cut plan for 800V high voltage technology. The carmaker is scheduled to mass-produce the 800V ultrahigh voltage electrical platform in the fourth quarter of 2024, which allows 400KW ultrafast charge and brings a 200km endurance by a 5-minute charge. Moreover, Leapmotor also projects mass-production of a high-performance high-power silicon carbide (SiC) controller in late 2023 to replace the current IGBTs. This product in support of 800V fast charge can lift the power of motors to 300KW, with a 4% rise in efficiency.

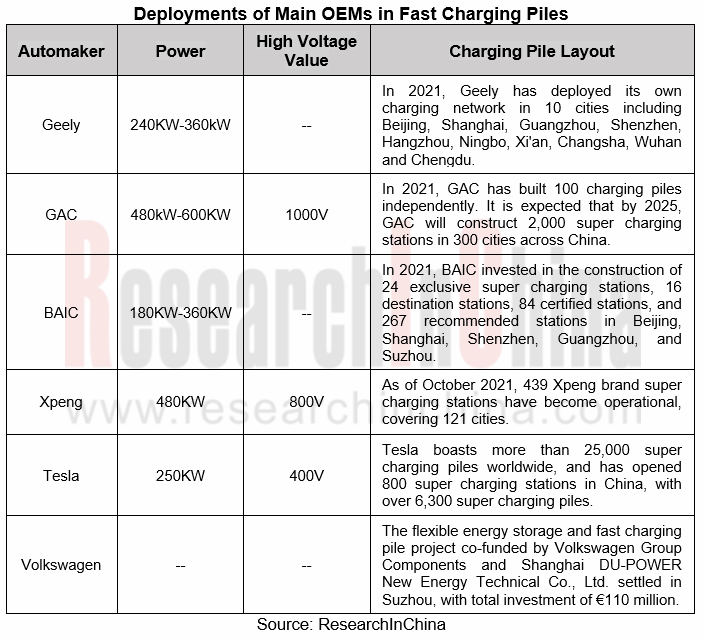

OEMs step up efforts to deploy the self-operated ultrafast charging networks for their high voltage platform-based models.

Vehicles equipped with 800V high voltage platforms charge on existing common charging piles that allow just lower-than-expected charging speed and fall short of ultrafast charging in real terms. The onboard 800V high voltage platform therefore cannot exert itself fully without super charging piles. It grows a trend for 800V vehicle high voltage platform and super charging pile to be combined.

At present, models based on 800V platforms is in readiness for production, and the deployment of super charging piles is also progressing steadily. As well as cooperating with operators to deploy charging networks, OEMs also work to build their own. The high voltage technology is an important development trend regardless of self-built or cooperative charging networks.

GAC: in August 2021, GAC AION launched an A480 super charging pile, which is compatible with 800V high voltage platform-based models. This pile enables 6C high-rate charge, that is, 0% to 80% charge in 8 minutes, and 30% to 80% charge in 5 minutes.

GAC AION has built its first super charging station at Guangzhou Donghong International Plaza and has brought it into operation, with a plan to build 2,000 super charging stations in 300 cities by 2025.

Xpeng: Xpeng’s super energy replenishment system is implemented at vehicle, charging pile and station simultaneously. At the vehicle end, the production models with 800V high voltage SiC platforms will be deployed. As concerns the charging pile, the 480kW high voltage supercharging piles will be first built. In the charging station, the self-developed energy storage and charging technologies will be applied, with energy storage at a time meeting the needs of 30 vehicles for uninterrupted high power super charge. As of October 2021, there have been 439 Xpeng brand supercharging stations in 121 cities.

Automotive SiC ushers in a boom, and suppliers expedite their layout.

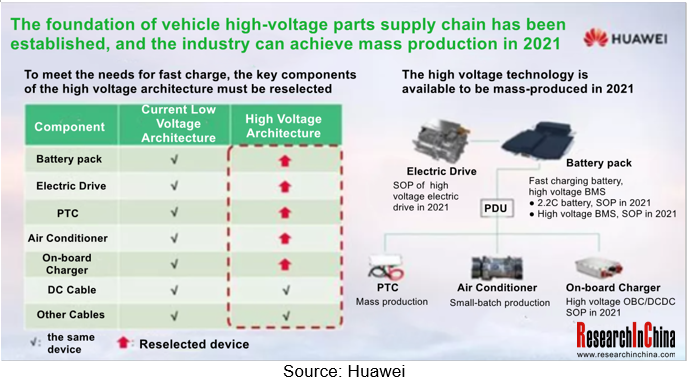

On the 800V high voltage platform, the withstand voltage of system components also needs to be leveled up to 800V, so do the corresponding components and materials. And under the high voltage architecture, battery pack, electric drive, PTC, air conditioner, on-board charger, etc. all require being re-selected as well.

As for the vehicle, high voltage technologies such as electric drive, fast charging battery, PTC, and DCDC have been production-ready. In fast charging battery’s case, in April 2021, Honeycomb Energy Technology under Great Wall Motor launched an all-new fast charging battery and corresponding battery cells. The 1st-Gen 2.2C fast-charging battery features cell capacity of 158Ah and energy density of 250Wh/kg, and enables 20%-80% SOC in 16 minutes. It is to be mass-produced in the fourth quarter of 2021. The 2nd-Gen 4C fast-charging battery boasts typical charging capacity of 165Ah and energy density of >260Wh/kg, and enables 20%-80% SOC in 10 minutes. Its mass production is arranged in Q2 2023.

SiC features good voltage withstand, high stability, better frequency than silicon-based IGBTs, and small size, in the process of upgrading 800V high voltage platform components. It has drawn widespread attention in the industry.

In new energy vehicles, SiC is largely used in vehicle power supplies and motor controllers. Though still priced high in a relative sense and the inevitable higher cost by massive adoption in a single vehicle, the use of SiC devices can deliver a longer mileage range and slash the battery cost. The cost of a single vehicle is actually lower after offsetting the cost rise caused by SiC devices.

In the long run, the price of SiC devices will edge down. In China, silicon-based IGBTs are monopolized by foreign vendors, while in the SiC field Chinese suppliers like Huawei, Shinry Technologies and Zhuhai Enpower Electric have made successful deployments. Chinese players may outrun and replace their foreign peers in the race. The cost of SiC devices will drop further if localized.

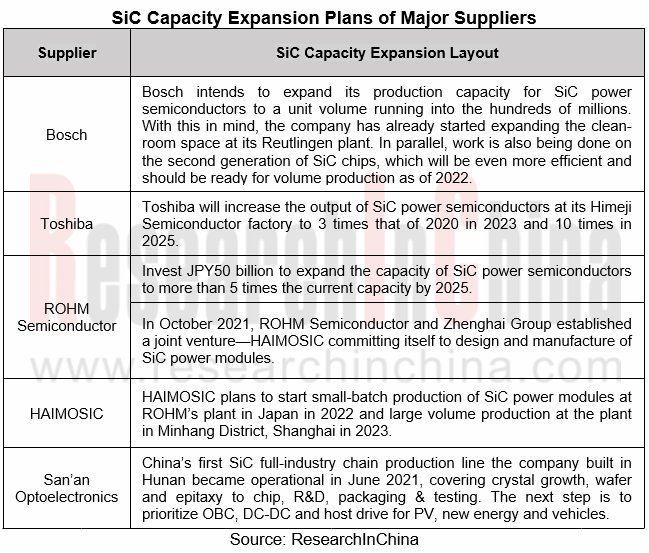

The mass production of 800V high voltage platforms breathes new life into the development of SiC. Influential suppliers compete to expand SiC production capacity to satisfy the growing demand.

The 800V High Voltage Platform Research Report, 2022 highlights the following:

Introduction to 800V high voltage platform and its advantages, vehicle high voltage platform standards, charging pile high voltage platform standards, high voltage platform market size and competitive landscape, etc.;

Introduction to 800V high voltage platform and its advantages, vehicle high voltage platform standards, charging pile high voltage platform standards, high voltage platform market size and competitive landscape, etc.;

800V high voltage platform's impacts on the upstream industry chain (battery, electric drive, thermal management, etc.), electrical architecture design of the 800V high voltage platform, status quo of the downstream new energy vehicle sector, etc.;

800V high voltage platform's impacts on the upstream industry chain (battery, electric drive, thermal management, etc.), electrical architecture design of the 800V high voltage platform, status quo of the downstream new energy vehicle sector, etc.;

Development stages of 800V high voltage platform, its availability on vehicles, and its use in charging piles, etc.;

Development stages of 800V high voltage platform, its availability on vehicles, and its use in charging piles, etc.;

Merits of SiC applied in 800V high voltage platform, its application at the vehicle end, its application in charging piles, status quo of SiC industry, etc.;

Merits of SiC applied in 800V high voltage platform, its application at the vehicle end, its application in charging piles, status quo of SiC industry, etc.;

Deployments of OEMs and suppliers in 800V high voltage technology.

Deployments of OEMs and suppliers in 800V high voltage technology.

NIO ET5/ET7 Intelligent Function Deconstructive Analysis Report, 2022

NIO ET5/ET7 Intelligent Function Deconstruction: R&D will change the market pattern in 2025Chinese automakers have triumphed remarkably in the field of high-end intelligent electric vehicles. Afte...

Automotive Smart Cockpit Design Trend Report, 2022

Research on design trends of intelligent cockpits: explore 3D, integrated interaction. ...

Commercial Vehicle Telematics Report, 2022

Commercial vehicle telematics research: three parties make efforts to facilitate the industrial upgrade of commercial vehicle telematics.

In 2022, China's commercial vehicle telematics industry cont...

Passenger Car Intelligent Steering Industry Research Report, 2022

Research on intelligent steering of passenger cars: The development of intelligent steering is accelerating, and it will be put on vehicles in batches in 2023

In September 2022, Geely and Hella joi...

China Charging / Battery Swapping Infrastructure Market Research Report, 2022

Research of charging / battery swapping: More than 20 OEMs layout charging business, new charging station construction accelerated

From January to September 2022, the sales volume of new energy vehic...

China L2 and L2+ Autonomous Passenger Car Research Report, 2022

L2 and L2+ research: The installation rate of L2 and L2+ is expected to exceed 50% in 2025.So far, L2 ADAS has achieved mass production, and L2+ ADAS has seen development opportunities as the layout f...

Global and China L4 Autonomous Driving and Start-ups Report, 2022

L4 autonomous driving research: the industry enters a new development phase, "dimension reduction + cost reduction".

L3/L4 autonomous driving enjoys much greater policy support.

...

Software-defined vehicle Research Report 2022- Architecture Trends and Industry Panorama

Software-defined vehicle research: 40 arenas, hundreds of suppliers, and rapidly-improved software autonomyThe overall architecture of software-defined vehicles can be divided into four layers: (1) Th...

Emerging Automaker Strategy Research Report, 2022 - Li Auto

Research on Emerging Automaker Strategy: the strategic layout of Li Auto in electric vehicles, cockpits and autonomous driving

Li Auto will shift from the single extended-range route to the “extended...

Commercial Vehicle Intelligent Chassis Industry Report, 2022

Commercial vehicle industry is characterized by large output value, long industry chain, high relevance, high technical requirements, wide employment and large consumer pull, and is a barometer of nat...

China TSP and Ecological Construction Research Report, 2022

TSP research: the coverage of TSPs has spread from IVI, cockpits to vehicles.

With the emergence of Internet of Vehicles, telematics service providers (TSPs) take on the roles of operation platforms,...

Global and China Automotive Seating Industry Report, 2022

Automotive seating research: automotive seating enjoys an amazing boom in the context of autonomous driving.

As autonomous driving develops, vehicles, a simple mobility tool, are tending to be positi...

Automotive Smart Surface Industry Research Report, 2022

Smart Surface Research: As an important medium for multimodal interaction, smart surfaces lead the trend of smart cockpits.Smart surfaces represent the development trend of automotive interiors and ex...

China Passenger Car Cockpit Multi and Dual Display Research Report, 2022

Cockpit multi and dual display research: 51.5% year-on-year growth in center console multi and dual display installation from January to July 2022

ResearchInChina released "China Passenger Car Cockpi...

China Automotive Cybersecurity Hardware Research Report, 2022

Cybersecurity hardware research: security chip and HSM that meet the national encryption standards will build the automotive cybersecurity hardware foundation for China.

1. OEMs generally adopt the s...

China Automotive Cybersecurity Software Research Report, 2022

Chinese in-vehicle terminal PKI market will be worth RMB1.89 billion in 2025.

The working principle of PKI (Public Key Infrastructure) is: the infrastructure that provides security services establish...

Global and China HD Map Industry Report, 2022

HD maps have been applied on a large scale, spreading from freeways to cities

According to ResearchInChina, more than 100,000 Chinese passenger cars were equipped with HD maps by OEMs in the first ha...

Automotive Software Providers and Business Models Research Report, 2022

Research on software business models: four business forms and charging models of automotive software providers.

In an age of software-defined vehicles, automotive software booms, and providers step u...