TSP research: the coverage of TSPs has spread from IVI, cockpits to vehicles.

With the emergence of Internet of Vehicles, telematics service providers (TSPs) take on the roles of operation platforms, service platforms, cloud platforms and data platforms, and provide services such as call centers, navigation and positioning, audio-visual entertainment, vehicle monitoring, remote upgrade and information security. Influenced by the concept of intelligent cockpits, automotive functions are being redefined. TSP have been constantly enriching their services, and expanding the coverage.

1. From the perspective of service scope, TSPs gradually expand their coverage along the path of "IVI → cockpits → vehicles"

Advances in technologies such as cockpit-driving integration and central computing platforms have made the demand for ecological expansion in the vehicle rigid. TSPs' business scope is spreading from automotive OS to cockpit OS and vehicle OS.

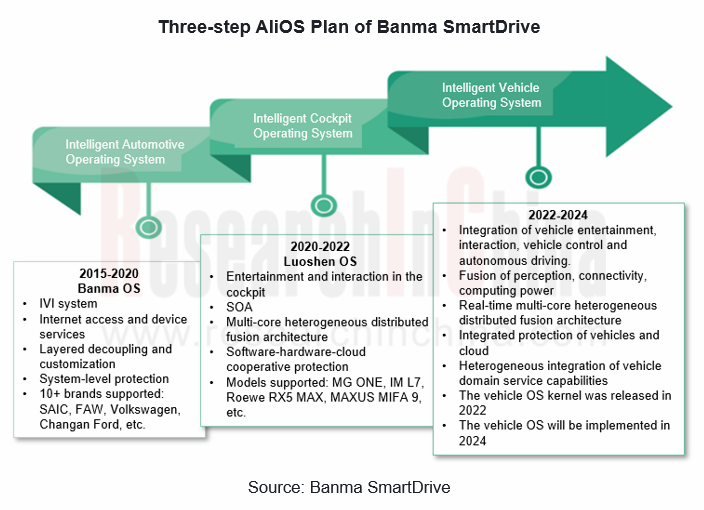

For example, Banma SmartDrive has made a definite three-step plan for its AliOS. From 2015 to 2020, it should realize customization based on layered decoupling and develop intelligent automotive OS. From 2020 to 2022, it should build intelligent cockpit OS based on the heterogeneous distributed fusion architecture. From 2022 to 2024, it should accomplish intelligent vehicle OS based on the time-sharing multi-core heterogeneous distributed fusion architecture.

2. From the perspective of business model, TSPs led by OEMs are seeking business independence.

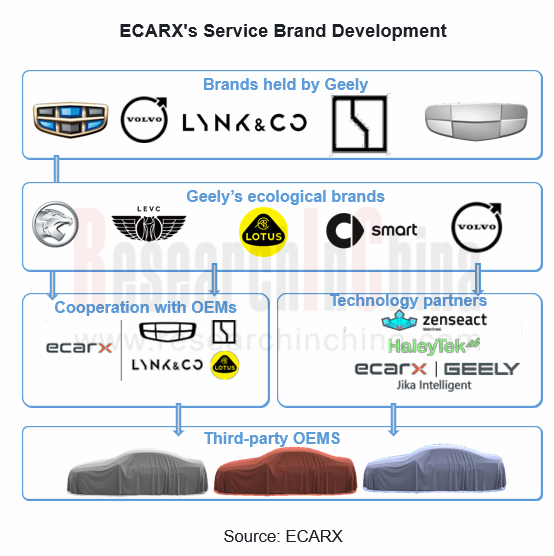

ECARX, a TSP invested by Geely, has contributed significantly to the construction and operation of Geely's IVI system. It has not only helped Geely upgrade G-NetLink to GKUI, but also achieved interoperability with popular ecosystems such as Tencent, Baidu and Alipay by building a unified account system. It has developed Galaxy OS and Galaxy OS Air, the next-generation intelligent cockpit systems, with Visteon and Qualcomm, enabling multi-screen interaction (clusters, center consoles, co-driver screens, AR-HUD), multi-domain integration (power domain, chassis domain and body domain) as well as more natural human-computer interaction.

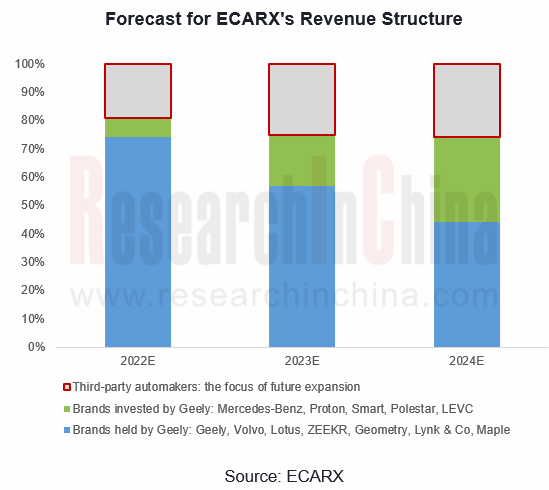

As of the first half of 2022, ECARX’s TSP solution had landed in 3.2 million vehicles, mainly in Geely's 12 brands. In May 2022, ECARX hoped to upgrade the enterprise image and expand the market through the listing on NASDAQ. The focus of market expansion transfers from Geely to third-party suppliers. According to the plan, third-party automakers will contribute about 24% to the revenue of ECARX in 2024.

3. From the perspective of ecological content, cross-terminal information flow will infinitely broaden the service boundary.

ICT suppliers represented by Huawei are committed to transplanting the mobile phone ecology into vehicles in the field of TSP, with the "flow" of information as the highlight.

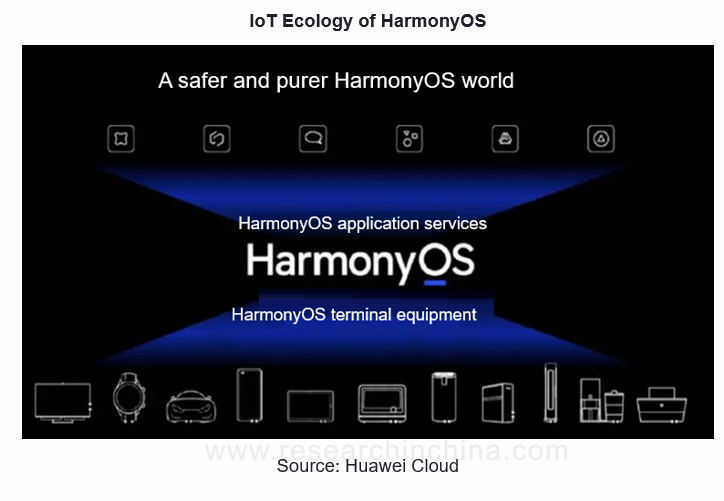

Huawei HarmonyOS is a future-oriented distributed intelligent operating system for all scenarios. In the form of building the underlying operating system, it organically links people, equipment and scenarios through a super virtual terminal, connects with applications via communication, and extends the advantages of mobile phones to IVI and other peripheral devices.

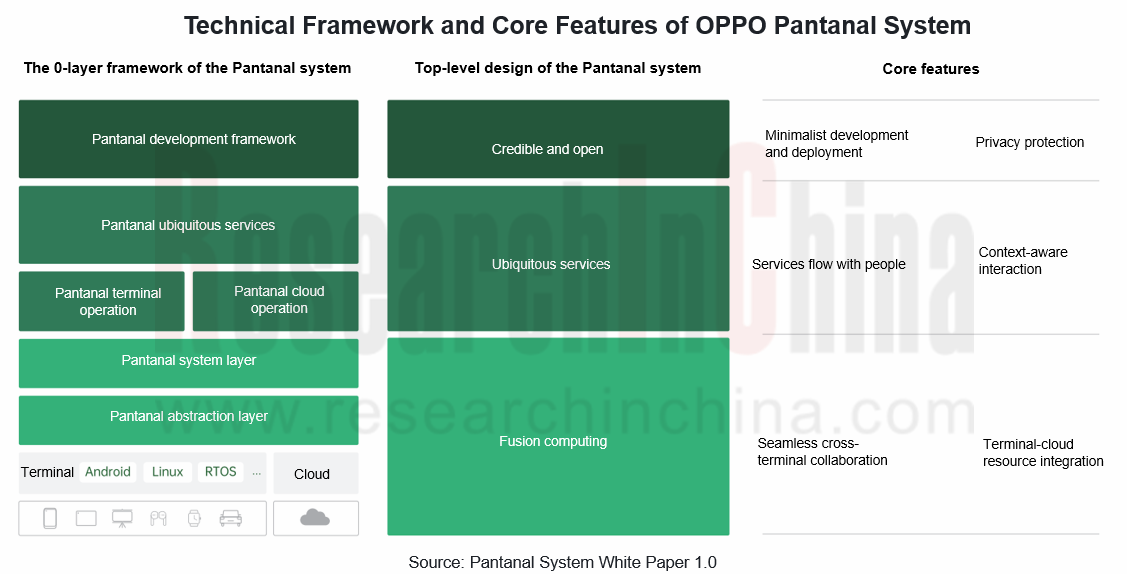

The Pantanal system released by OPPO is grafted to different operating systems in the form of middleware to enable seamless service flow across brands, systems and devices.

China Intelligent Door Market Research Report, 2023

China Intelligent Door Market Research Report, 2023 released by ResearchInChina analyzes and studies the features, market status, OEMs’ layout, suppliers’ layout, and development trends of intelligent...

Automotive Infrared Night Vision System Research Report, 2023

According to the data from ResearchInChina, during 2022-2023, the installations of NVS (night vision system) in new passenger cars in China went up at first and then down. From January to July 2022, t...

New Energy Vehicle Electric Drive and Power Domain Industry Report, 2023

Electric drive and power domain research: electric drive assembly evolves to integration and domain control

To follow the development trend for electrified and lightweight vehicles, new energy vehic...

Automotive Software Business Models and Suppliers’ Layout Research Report, 2023

From the layout of automotive software products and solutions, it can be seen that intelligent vehicle software business models include IP, solutions and technical services, which are mainly charged i...

Automotive LiDAR Industry Report, 2023

In August 2021, Waymo discontinued its commercial LiDAR business.

In October 2022, Ibeo declared bankruptcy; in November, two listed companies, Velodyne and Ouster, confirmed their merger; and in Dec...

Automotive Power Supply (OBC+DC/DC+PDU) and Integrated Circuits (IC) Industry Report, 2023

Automotive power supply and IC: Chinese chips are promising in the evolution from physical integration to system integration

As the core component of a new energy vehicle, automotive power supply is ...

OEMs’ Model Planning Research Report, 2023-2025

OEMs’ Model Planning Research Report, 2023-2025, released by ResearchInChina, combs through model planning and features of Chinese independent brands, emerging carmakers, and joint venture brands in t...

Leading Foreign OEMs’ADAS and Autonomous Driving Report, 2023

Global automakers evolve to software-defined vehicles by upgrading EEAs.

Centralized electronic/electrical architectures (EEA) act as the hardware foundation to realize software-defined vehicles. At ...

Automotive AI Algorithm and Foundation Model Application Research Report, 2023

Large AI model research: NOA and foundation model facilitate a disruption in the ADAS industry.

Recently some events upset OEMs and small- and medium-sized ADAS companies, as the autonomous driving i...

Intelligent Cockpit Domain Controller and SoC Market Analysis Report, 2023Q2

Cockpit domain controller and chip in 2023Q2: by intelligent cockpit level, L1 surged by 105% on a like-on-like basis, and L2 soared by 171%.On May 17, 2023, the “White Paper on Automotive Intelligent...

Intelligent Vehicle E/E Architecture Research Report, 2023

E/E Architecture Research: How will the zonal EEA evolve and materialize from the perspective of supply chain deployment?Through the lens of development trends, automotive EEA (Electronic/electrical A...

China Passenger Car Brake-by-wire Industry Report, 2023

Passenger car brake-by-wire research: One-box solution takes an over 50% share.

China Passenger Car Brake-by-wire Industry Report, 2023 released by ResearchInChina combs through and summarizes passe...

Smart Car OTA Industry Report, 2023

Vehicle OTA Research: OTA functions tend to cover a full life cycle and feature SOA and central supercomputing.In the trend for software-defined vehicles, OTA installations are surging, and software i...

Intelligent Vehicle Multi-Domain Computing Industry Report, 2023

Multi-domain computing research: in the coming first year of cross-domain fusion, major suppliers will quicken their pace of launching new solutions.

As vehicle intelligence develops, electrical/ele...

Automotive Head-up Display (HUD) Industry Report, 2023

Automotive HUD research: in the "technology battle" in AR-HUD, who will be the champion of mass production?

Automotive head-up display (HUD) works on the optical principle for real-time display of s...

Automotive Cloud Service Platform Industry Report, 2023

Research on Automotive Cloud Services: As Dedicated Automotive Cloud Platforms Are Launched, the Market Enters A Phase of Differentiated Competition

1. The exponentially increasing amount of v...

Global and China Automotive Gateway Industry Report, 2023

Automotive gateway research: integrated gateways have become an important trend in zonal architecture.

Automotive gateway is a core component in the automotive electronic/electrical architecture. As ...

In-vehicle Communication and Network Interface Chip Industry Report, 2023

In-vehicle communication chip research: automotive Ethernet is evolving towards high bandwidth and multiple ports, and the related chip market is growing rapidly.

By communication connection form, au...