L4 autonomous driving research: the industry enters a new development phase, "dimension reduction + cost reduction".

L3/L4 autonomous driving enjoys much greater policy support.

The development of L3/L4 autonomous driving needs both policy and technology support. Since 2022, China has given far greater policy support to high-level autonomous driving.

The Development Plan for New Energy Vehicle Industry (2021-2035) issued by the State Council indicates that "by 2025, L4 vehicles will be commercialized in limited areas and specific scenarios, and by 2035, L4 vehicles will find massive application."

On March 1, 2022, the national recommended standard GB/T 40429-2021 Taxonomy of Driving Automation for Vehicles came into force. In November 2022, the Ministry of Industry and Information Technology together with the Ministry of Public Security organized the drafting of Notice on Piloting Entry and Road Travel of Intelligent Connected Vehicles (Draft for Comments), suggesting piloting the entry of production-ready intelligent connected vehicles with autonomous driving functions (L3 and L4 in the GB/T 40429-2021 standard).

As concerns local governments, the Administrative Rules of Beijing Municipality for Autonomous Shuttles in the Pilot Areas Carrying out Intelligent Connected Vehicle Policies (Road Test and Demonstration Application) released in November 2022, is China’s first policy to give the corresponding right of way in the form of coding to autonomous shuttles. In August 2022, the Regulation on the Administration of Intelligent Connected Vehicles in Shenzhen Special Economic Zone came into effect. It is China’s first L3 autonomous driving regulation that highlights the first clear identification of accident responsibilities.

As the knockout starts, L4 autonomous driving suppliers seek "cost reduction + dimension reduction", and the industry enters the phase of large-scale commercial application.

At present, the installation rate of autonomous driving functions in vehicles is on the rise, and L2/L2+ autonomous driving technology has been relatively mature. The competition in the market is white hot. To gain more competitive edges, OEMs and autonomous driving solution providers compete to enter the track of higher-level autonomous driving.

Yet high-level autonomous driving consumes more capital, and is unlikely to build a full commercial closed-loop in the short term. In October 2022, Argo AI, a star start-up specializing in L4 autonomous driving, declared bankruptcy due to the capital chain rupture, a result of the inability to attract further investments, as its backers Ford and Volkswagen decided to stop investing in it.

Despite ceasing to invest in Argo AI and turning the focus on L2+/L3 that is easier to implement, Ford is still optimistic about L4 autonomous driving, but chooses not to develop on its own. It would team up with L4 autonomous driving solution providers in the future.

The case of Argo AI shows the challenges faced by L4 autonomous driving suppliers in current stage. If they do not try to develop real commercial solutions, they may eventually be weeded out by the market under capital pressure. To run farther on L4 autonomous driving track, all major suppliers aim at the mass production OEM market of passenger cars and embark on “dimension reduction” application, while working hard on L4 technology.

(1) “Dimension reduction” application

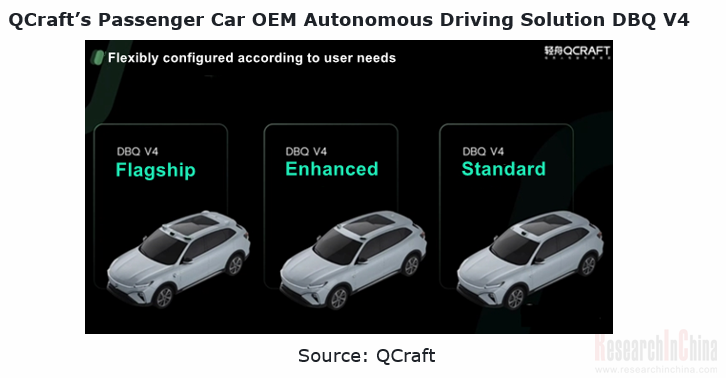

QCraft: propose the dual engine strategy. On one hand, based on public road L4 autonomous driving software and hardware solutions, it makes continuous efforts to improve its technical competence; on the other hand, based on the mass production and large-scale application of autonomous driving for OEM market, it keeps expanding application scenarios.

In May 2022, QCraft introduced DBQ V4, an autonomous driving solution for passenger car OEM market. Supporting 1 to 5 LiDARs, 0 to 4 blind spot radars, 6 radars and 12 perception cameras, it enables 360-degree perception without missing blind spots and dead corners, and allows mutual redundancy between left and right. It also packs a customized traffic light recognition camera. The solution is expected to be mass produced and mounted on vehicles during 2023-2024.

DBQ V4 offers standard and high configuration versions. The high configuration version has all L4 autonomous driving functions. Compared with high configuration version, the standard version features a slightly lower configuration, but it can still enable 99% L4 autonomous driving capabilities. The DBQ V4 autonomous driving solution integrates full-stack autonomous driving software and hardware technologies independently developed by QCraft. The standard version with a reduced LiDAR configuration carries a computing platform with lower computing power, cutting down the mass production cost to about RMB10,000. The mass-produced solution for the OEM market also enables driving and parking integrated functions.

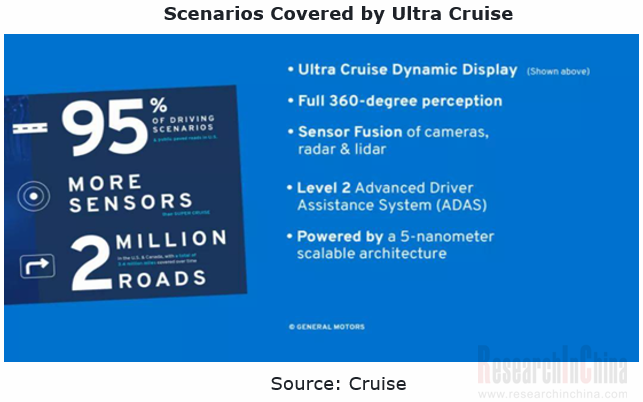

Cruise: since 2021, it has worked to build Ultra Cruise intelligent driving system for GM. This solution is mainly mounted on the high-end vehicle models of GM and complements the Super Cruise system, helping GM to apply driving assistance technologies to all of its models.

Compared with Super Cruise, Ultra Cruise has added some new autonomous driving functions:

?Follow the internal navigation route and keep moving forward;

?Observe the speed limit

?Support automatic and on-demand lane change

?Support automatic left and right turns

?Support close object avoidance

“Cost reduction” application

In addition, the high cost is also a major obstacle to the implementation of L4 autonomous driving products. In particular, for cost-sensitive passenger cars, it is obvious that L4 autonomous driving that generally costs hundreds of thousands of yuan doesn’t justify it. All suppliers therefore have begun to vigorously "cut down cost".

Deeproute.ai: in June 2022, Deeproute.ai launched DeepRoute-Driver 2.0, a low-cost L4 autonomous driving system worth USD10,000 (about RMB64,000). This solution carries 2 to 5 solid-state LiDARs and 8 cameras, Nvidia Orin high computing power automotive chip, integrated navigation and HD map, enabling high-level autonomous driving.

Deeproute.ai says that in the future the cost of L4 autonomous driving could be lowered to less than RMB20,000 by cooperating with conventional OEMs for mass production and purchasing hardware equipment uniformly.

Haomo.ai: in April 2022, Haomo.ai launched Little Magic Camel 2.0, a product priced RMB128,800 for a single vehicle. Haomo.ai can build RMB100,000 autonomous distribution vehicles, mainly because its autonomous distribution vehicles reuse its passenger car autonomous driving technologies, and cost less by virtue of passenger car supply chain advantages. In terms of hardware, Little Magic Camel 2.0 that bears an automotive perception kit and ICU 3.0, a computing platform with high computing power can cover all medium- and low-speed road scenarios and all road conditions on urban public roads.

Technology reuse helps to expand multiple application scenarios for L4 autonomous driving systems.

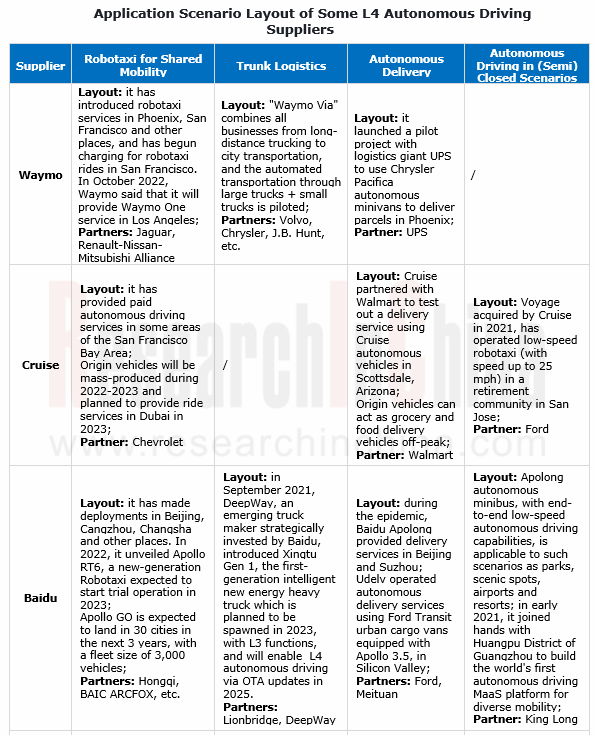

Affected by technology maturity and regulatory restrictions, L4 autonomous driving is available to relatively limited application scenarios in the short run. The main application scenarios include Robotaxi, autonomous delivery, autonomous shuttle, and autonomous logistics in (semi) closed scenarios.

For L4 autonomous driving is being piloted in application fields, the deployment scale is not large, and just with tweaks, L4 autonomous driving technology can be reused in different types of vehicles, so L4 suppliers rarely follow a single business line, and generally make multi-scenario deployments.

Global and China L4 Autonomous Driving and Start-ups Report, 2022 highlights the following:

L4 autonomous driving (policies, standards, regulations, etc.);

L4 autonomous driving (policies, standards, regulations, etc.);

L4 autonomous driving market (size, competitive landscape, etc.);

L4 autonomous driving market (size, competitive landscape, etc.);

Key technologies (algorithm, HD map and positioning, data closed-loop, vehicle-road-cloud cooperation, redundancy, etc.) of L4 autonomous driving (major suppliers, technical solutions, etc.);

Key technologies (algorithm, HD map and positioning, data closed-loop, vehicle-road-cloud cooperation, redundancy, etc.) of L4 autonomous driving (major suppliers, technical solutions, etc.);

Application scenarios (Robotaxi, autonomous shuttle, autonomous delivery, autonomous truck, etc.) of L4 autonomous driving (major suppliers, technical solutions, operation, etc.);

Application scenarios (Robotaxi, autonomous shuttle, autonomous delivery, autonomous truck, etc.) of L4 autonomous driving (major suppliers, technical solutions, operation, etc.);

OEMs’ layout and planning of L4 autonomous driving solutions;

OEMs’ layout and planning of L4 autonomous driving solutions;

Major L4 technology suppliers (technical solution iterations, application and layout of L4 products, etc.).

Major L4 technology suppliers (technical solution iterations, application and layout of L4 products, etc.).

Commercial Vehicle Intelligent Chassis Industry Report, 2023

Commercial Vehicle Intelligent Chassis Industry Report, 2023, released by ResearchInChina, combs through and researches status quo and related product layout of OEMs and suppliers, and predicts future...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2023

1. Wide adoption of NOA begins, and local brands grab market share.

According to ResearchInChina, from January to August 2023, joint venture brands accounted for 3.0% of installations of L2.5 and hi...

Passenger Car Radar Industry, 2022-2023

Passenger Car Radar Industry Research in 2023:?In 2023, over 20 million radars were installed, a year-on-year jump of 35%;?Driven by multiple factors such as driving-parking integration, NOA and L3, 5...

Automotive Audio System Industry Report, 2023

Technology development: personalized sound field technology iteration accelerates

From automotive radio to “host + amplifier + speaker + AVAS” mode, automotive audio system has passed through several...

China Intelligent Door Market Research Report, 2023

China Intelligent Door Market Research Report, 2023 released by ResearchInChina analyzes and studies the features, market status, OEMs’ layout, suppliers’ layout, and development trends of intelligent...

Automotive Infrared Night Vision System Research Report, 2023

According to the data from ResearchInChina, during 2022-2023, the installations of NVS (night vision system) in new passenger cars in China went up at first and then down. From January to July 2022, t...

New Energy Vehicle Electric Drive and Power Domain Industry Report, 2023

Electric drive and power domain research: electric drive assembly evolves to integration and domain control

To follow the development trend for electrified and lightweight vehicles, new energy vehic...

Automotive Software Business Models and Suppliers’ Layout Research Report, 2023

From the layout of automotive software products and solutions, it can be seen that intelligent vehicle software business models include IP, solutions and technical services, which are mainly charged i...

Automotive LiDAR Industry Report, 2023

In August 2021, Waymo discontinued its commercial LiDAR business.

In October 2022, Ibeo declared bankruptcy; in November, two listed companies, Velodyne and Ouster, confirmed their merger; and in Dec...

Automotive Power Supply (OBC+DC/DC+PDU) and Integrated Circuits (IC) Industry Report, 2023

Automotive power supply and IC: Chinese chips are promising in the evolution from physical integration to system integration

As the core component of a new energy vehicle, automotive power supply is ...

OEMs’ Model Planning Research Report, 2023-2025

OEMs’ Model Planning Research Report, 2023-2025, released by ResearchInChina, combs through model planning and features of Chinese independent brands, emerging carmakers, and joint venture brands in t...

Leading Foreign OEMs’ADAS and Autonomous Driving Report, 2023

Global automakers evolve to software-defined vehicles by upgrading EEAs.

Centralized electronic/electrical architectures (EEA) act as the hardware foundation to realize software-defined vehicles. At ...

Automotive AI Algorithm and Foundation Model Application Research Report, 2023

Large AI model research: NOA and foundation model facilitate a disruption in the ADAS industry.

Recently some events upset OEMs and small- and medium-sized ADAS companies, as the autonomous driving i...

Intelligent Cockpit Domain Controller and SoC Market Analysis Report, 2023Q2

Cockpit domain controller and chip in 2023Q2: by intelligent cockpit level, L1 surged by 105% on a like-on-like basis, and L2 soared by 171%.On May 17, 2023, the “White Paper on Automotive Intelligent...

Intelligent Vehicle E/E Architecture Research Report, 2023

E/E Architecture Research: How will the zonal EEA evolve and materialize from the perspective of supply chain deployment?Through the lens of development trends, automotive EEA (Electronic/electrical A...

China Passenger Car Brake-by-wire Industry Report, 2023

Passenger car brake-by-wire research: One-box solution takes an over 50% share.

China Passenger Car Brake-by-wire Industry Report, 2023 released by ResearchInChina combs through and summarizes passe...

Smart Car OTA Industry Report, 2023

Vehicle OTA Research: OTA functions tend to cover a full life cycle and feature SOA and central supercomputing.In the trend for software-defined vehicles, OTA installations are surging, and software i...

Intelligent Vehicle Multi-Domain Computing Industry Report, 2023

Multi-domain computing research: in the coming first year of cross-domain fusion, major suppliers will quicken their pace of launching new solutions.

As vehicle intelligence develops, electrical/ele...