Global and China Purpose Built Vehicle (PBV) and Robocar Report, 2022

PBV and Robocar research: new idea of building brick cars, a new car type for future mobility

Building brick cars moves the cheese of traditional OEMs.

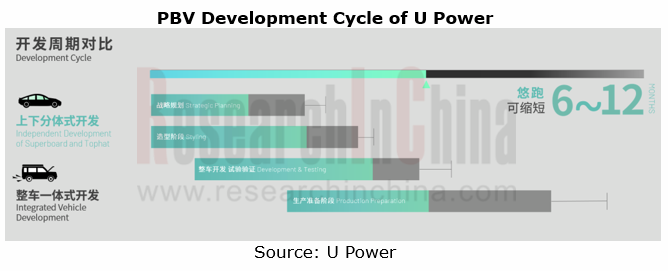

Purpose built vehicle (PBV) refers to special purpose vehicles based on small/medium-sized van or multi-box van. PBV suppliers adopt the approach of independent development of upper and lower vehicle bodies, and derive various vehicle types on the same chassis platform, meeting customization needs. Compared with conventional integrated vehicle development, such a development method has unique features below:

? Short development cycle and low cost

PBVs built on the same chassis don’t need repeated development, which shortens the start-of-production and time-to-market of new models. The standardized chassis components can also be reused, reducing manufacturing costs.

For example, the use of "UP Super Board" developed by Shanghai U Power Technology Co., Ltd. cuts down the orignal 2 or 3 years of vehicle R&D cycle to 12 months, and the R&D costs by up to 60%.

? Diversified PBV product forms

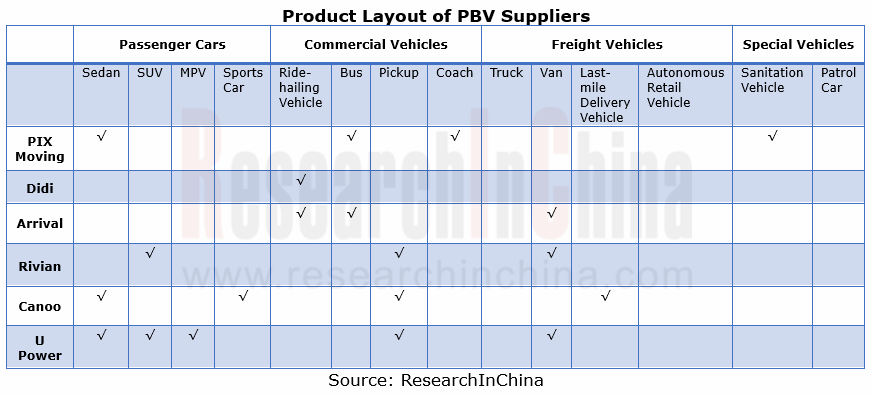

The flexible and changeable upper space of PBV allows a variety of product forms. For example, a PBV can be a logistics vehicle, a retail vehicle, a car, a bus, a sanitation vehicle, and so forth.

From the product layout of PBV suppliers, it can be seen that the product forms of PBV are led by three vehicle types: van, pickup and sedan. Wherein, PIX Moving enjoys the broadest range of product forms, involving four fields: passenger car, commercial vehicle, freight vehicle and special vehicle; U Power boasts the most abundant PBV product lineups and deploys five vehicle types, covering three fields: passenger car, commercial vehicle, and freight vehicle; with single PBV product form, Didi has only one product, D1, a customized car for the online ride-hailing mobility scenario. Didi plans to iterate a version every 18 months, to D3 in 2025 when 1 million units will be launched; and to remove the cockpit and realize autonomous driving in 2030.

? Diversified PBV profit models

Through the lens of business models, PBV suppliers often apply the To B model. Among them, PIX Moving, Arrival and Rivian employ both To B and To C models. For instance, PIX Moving starts with Robobus at the business end in a bid for quick commercialization, and will build a complete marketing system after launching consumer products.

As for manufacturing, all suppliers except for Didi have their own production bases. Didi partners with BYD to produce D1 at BYD’s base in Changsha city. In June 2021, Canoo started building a production line in Oklahoma, the US, and ceased the outsourcing contract with VDL Nedcar, opting to build cars by itself.

There are mainly three profit models: vehicle sales, rental, and software subscription & other value-added services. Didi and Arrival apply the rental model, but their rental schemes are different. Didi offers two rental schemes that target Didi drivers: half-year rental, with a monthly rent of RMB4,399; one-year rental, RMB4,299 per month. Arrival, however, aims at third-party lessors such as LeasePlan (in 2021, Arrival and LeasePlan signed a sales cooperation agreement for 3,000 vans). For profits, the supplier Canoo has begun to take into account both the subscription and vehicle sales models.

Is Robocar the ultimate form of PBV products?

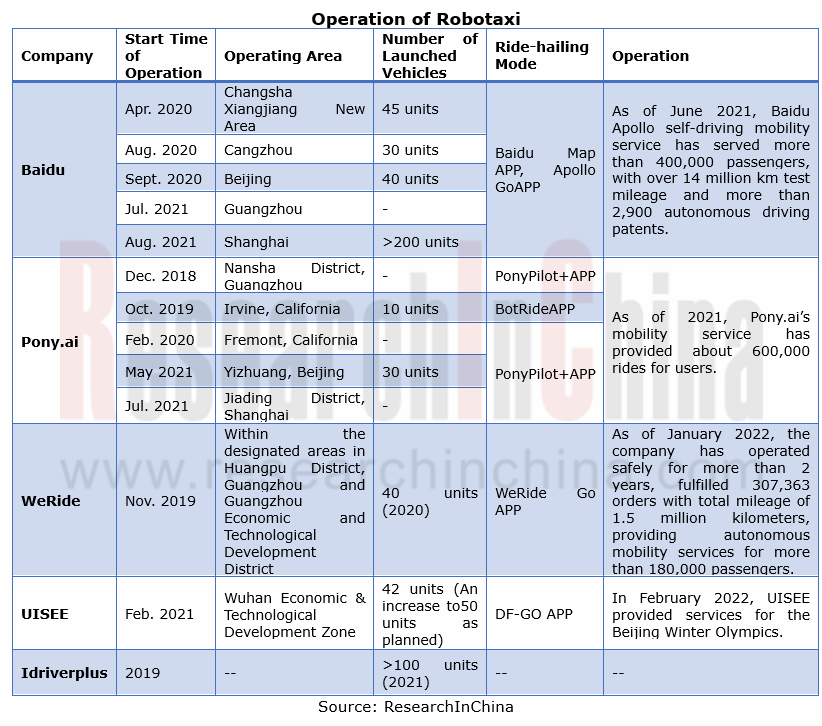

The new idea of building brick cars gives birth to diversified vehicle forms, including Robocar, a robot that looks like a vehicle, can move freely and is capable of L4 autonomous driving. The product forms of Robocars are led by Robotaxi and Robobus. At present, Robotaxies built by Baidu, Pony.ai, QCRAFT and the like have begun to run. In the future, Robocars will also be upgraded to L5 autonomy, competent enough to self-learn, make decisions independently, and adapt to a variety of complex scenarios and inclement weather like rain and fog, and they will completely replace humans by then.

Global and China Automotive Wireless Communication Module Industry Report,2023

Vehicle communication module research: 5G R16+C-V2X module, smart SiP module and other new products spring up.

In 2022, 4G modules swept 84.3% of the vehicle communication module market....

Intelligent Vehicle Cockpit-Driving Integration Research Report, 2023

Cockpit-Driving Integration Research: many companies are making layout and may implement it during 2024-2025.

1. What is the real cockpit-driving integration?

At present, automotive electroni...

Chinese Joint Venture OEMs' Telematics System and Entertainment Ecosystem Research Report, 2022

Telematics System Research 2: Baidu Family Bucket, Huawei and Tencent Become the Mainstream Ecosystems

ResearchInChina released Chinese Joint Venture OEMs' Telematics System and Entertainment Ecosyst...

China Automotive Digital Key Research Report, 2023

Automotive Digital Key Research: the pace of mobile phones replacing physical keys quickens amid the booming market

"China Automotive Digital Key Research Report, 2023" released by ResearchInChina co...

Automotive Camera Tier2 Suppliers Research Report, 2022-2023

1. The automotive camera market maintains a pattern of "one superpower and several great powers".

Automotive cameras are used to focus the light reflected from the target onto the CIS after refractio...

Emerging Carmaker Strategy Research Report, 2023 - NIO

Emerging carmaker strategy research: NIO is deploying battery swap and sub-brands for the knockout match in 2023.In 2022, the sales surged by 32.3% year on year, being concentrated in first-tier citie...

Nissan CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022-2023

Nissan CASE research: two leverages for Dongfeng Nissan to turn the tables. Introduction: since 2020, the declining sales of Dongfeng Nissan have exposed its problems in brand influence and product co...

China Automotive Gesture Interaction Development Research Report,2022-2023

Vehicle gesture interaction research: in 2022, the installations rocketed by 315.6% year on year.China Automotive Gesture Interaction Development Research Report, 2022-2023 released by ResearchInChina...

Automotive Power Management Integrated Circuits (PMIC) Industry Report, 2023

Automotive PMIC research: the process of domestic automotive PMICs replacing foreign ones in China in the “crisis of chip shortage”.

Automotive power management integrated circuits (PMIC) find broad ...

Automotive Cockpit SoC Research Report, 2023

Cockpit SoC research in 2023: Can X86 solutions returning to cockpit SoC challenge the “ARM+Google” mobile solution?

This report highlights the research on the products and plans of 9 overseas and 8 ...

AI Foundation Model and Autonomous Driving Intelligent Computing Center Research Report, 2023

New infrastructures for autonomous driving: AI foundation models and intelligent computing centers are emerging.

In recent years, the boom of artificial intelligence has actuated autonomous driving, ...

Automotive Microcontroller Unit (MCU) Industry Report, 2023

MCU Industry Research: Automotive high-end MCU will be still in short supply, and how OEMs can break the situation.

ResearchInChina has released "Automotive Microcontroller Unit (MCU) Industry Repor...

Global and China Fuel Cell Market and Trend Research Report, 2023

Fuel Cell Industry Research: Hydrogen energy has been put on the national agenda with scenario application being rolled out.The hydrogen energy industry has been included into the national energy stra...

Global and China Automotive Smart Antenna Research Report, 2022-2023

Smart antenna research: the integration of automotive antennas and intelligent connected terminals tends to accelerate.

The development trend of automotive antennas: tend to be intelligent, diversif...

Chinese Independent OEMs’ Telematics System and Entertainment Ecosystem Research Report, 2022

Vehicle telematics system research 1: the control scope is expected to expand to the entire vehicle.From January to December 2022, Chinese independent OEMs installed telematics systems in 6.42 million...

China Autonomous Shuttle Market Report, 2022-2023

Autonomous Shuttle Research: application scenarios further extend amidst policy promotion and continuous exploration

Autonomous shuttles are roughly categorized into minibuses and robobuses. Minibuse...

Intelligent Cockpit Domain Control Unit (DCU) and Head Unit Dismantling Report, 2023 (1)

Dismantling of Head Unit and Cockpit Domain Control Unit (DCU) of NIO, Toyota and Great Wall Motor The report highlights the dismantling of Toyota’s MT2712-based head unit, Fisker’s Intel A2960-based ...

Automotive Vision Algorithm Industry Research Report, 2023

Research on automotive vision algorithms: focusing on urban scenarios, BEV evolves into three technology routes.1. What is BEV?

BEV (Bird's Eye View), also known as God's Eye View, is an end-to-end t...