Chinese ADAS and Autonomous Driving Tier 1 Suppliers Report, 2021-2022

Autonomous Driving Tier 1 Suppliers Research: the installation rate of L2 and above autonomous driving functions in passenger cars hit over 30% in 2022Q1.

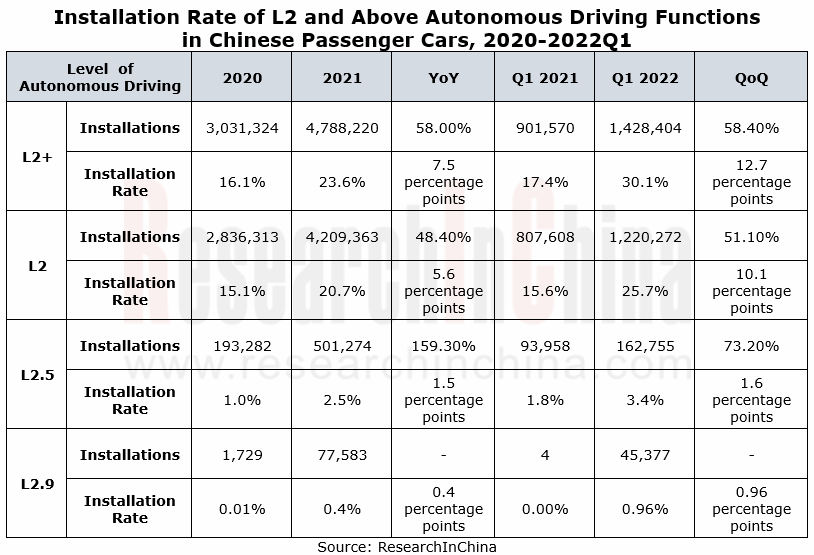

In 2022Q1, the installation rate of L2 and above autonomous driving functions in Chinese passenger cars reached 30.1%, a year-on-year increase of 12.7 percentage points. Specifically, the L2 installation rate went up by 10 percentage points to 25.7%; the L2.5 installation rate rose by 1.6 percentage points to 3.43%; the L2.9 installation rate edged up by 0.95 percentage points to 0.96%.

The boom of ADAS favored a surge in Tier 1 suppliers’ revenue from autonomous driving products.

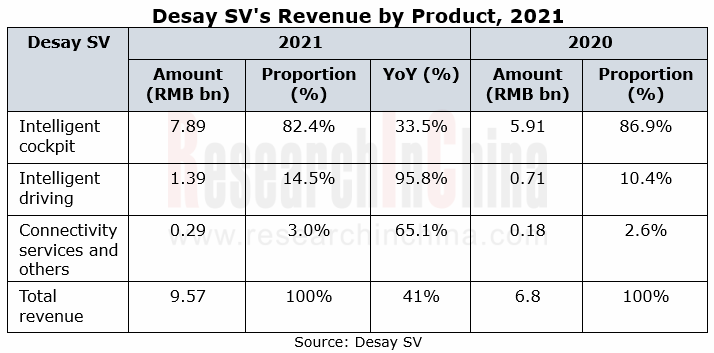

In 2021, Desay SV's revenue from intelligent driving products hit RMB1.39 billion, a year-on-year spike of 95.8%. Desay SV entering the field of autonomous driving in 2016 primarily produces cameras, radars and domain controllers. In the future, it will still focus on perception fusion algorithms and control strategy, and will make further deployments in L3 and L4 autonomous driving solutions. Its domain controller IPU03 was mass-produced for Xpeng P7 in April 2020; the domain controller IPU04 launched in September 2021 is scheduled to be used by Li Auto in 2022; the intelligent computing platform (ICP) "Aurora" became available on market in April 2022.

Neusoft Reach started deploying autonomous driving in 2004. The company works on R&D and commercialization of autonomous driving core technologies, covering autonomous driving systems such as visual perception, embedded high-performance computing, sensor fusion, decision and planning, and vehicle control.

Neusoft Reach provides technologies and solutions for passenger car/commercial vehicle products. Its autonomous driving products include front view smart cameras, driver monitoring systems, domain controllers, and central computing platforms. Its self-developed automotive basic software platform NeuSAR enables effective decoupling of software and hardware. The encapsulation of end-cloud cooperation middleware services helps to connect vehicle-cloud cooperation value data communication links and mobilize cloud platform services to enable the continuous intelligent driving iterations and updates at the vehicle end.

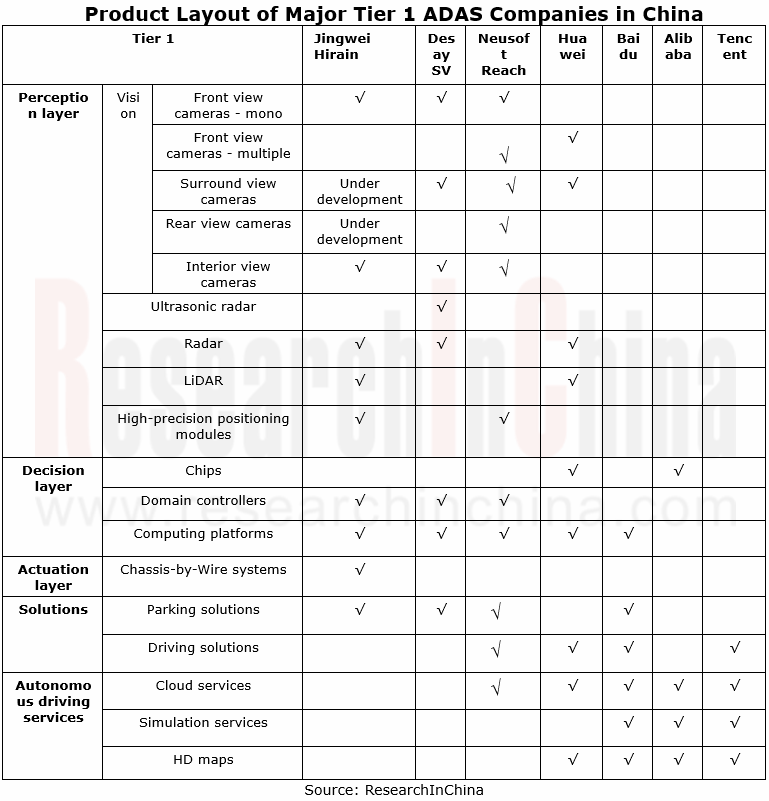

Jingwei Hirain’s revenue from intelligent driving electronics sustained AAGRs of over 100% in recent three years. Jingwei Hirain has begun to deploy autonomous driving in 2015, and established its intelligent driving division in 2017. Its products are led by cameras, radars, domain controllers, computing platforms and chassis-by-wire. The company is working hard to develop system software technology.

Both conventional Tier 1 suppliers and emerging Tier 1 Internet firms are deploying decision layer products

Decision layer products are the bridge between the perception layer and the execution layer. As the core products of high-level autonomous driving, they are responsible for computing, judgment, and decision. At present, Jingwei Hirain, Desay SV, Neusoft Reach, Huawei, and Baidu all have launched their own domain controllers and computing platforms.

Huawei set up the "Internet of Vehicles Division" in 2013. It dabbles in the field of smart cars by starting with the automotive communication module ME909T. Huawei has started developing autonomous driving communication architecture since 2015, and has rolled out the autonomous driving AI chip "Ascend", the Ascend-based intelligent driving computing platform MDC, the intelligent driving cloud service “Octopus”, the intelligent driving operating system AOS, LiDAR, 4D imaging radar, etc.

Huawei keeps enriching its computing platform offerings. In October 2018, Huawei first introduced its intelligent driving computing platforms, MDC600 for L3 autonomous driving and MDC300 for L4. In September 2020, it unveiled MDC210 for L2+ and MDC610 for L3-L4. The vehicle models in which Huawei is negotiating on use of MDC610 include GAC AION LX, Great Wall Salon Mecha Dragon, and GAC Trumpchi. In April 2021 Huawei announced MDC810 an intelligent driving computing platform that supports L4-L5 and will be first seen in BAIC ARCFOX αS Huawei Inside (HI) Edition. The installation of the chip in 2022 Neta TA and GAC Aion is under negotiation. Huawei also plans to launch MDC100 in 2022.

The Institute of Deep Learning Baidu founded in July 2013 has launched an autonomous vehicle project and developed the Apollo autonomous driving open platform. It has introduced autonomous driving service products such as autonomous driving cloud service, simulation service, HD map. In 2021, its products were extended to autonomous driving solutions and decision products. In April 2021, its AVP solution and the corresponding computing platform were first mounted on Weltmeister W6.

Emerging Tier 1 companies are eagerly converting their role in the industry chain.

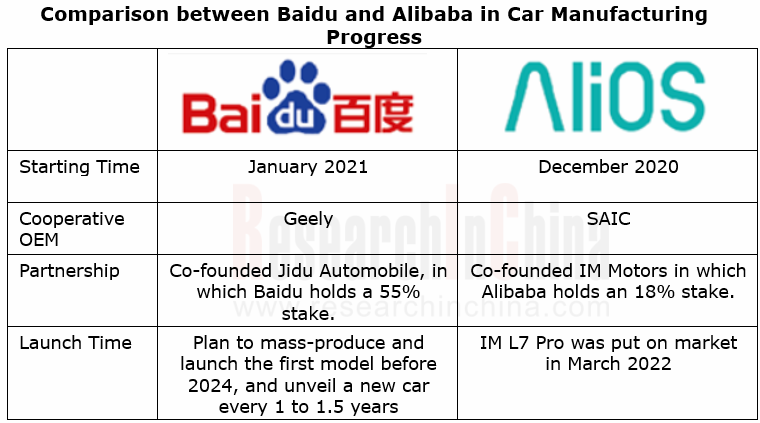

Emerging Tier 1 companies (Baidu, Alibaba, etc.) have made a foray into the automotive field with their superior software technology and data platforms. They are accelerating the development of software-defined vehicles and shortening the development cycle of new automotive products. Meanwhile, they have realized that the Tier 1 market is limited and they need to vigorously change their role in the industry chain into a partner of conventional OEMs to jointly build cars. For example, Alibaba and SAIC together established IM Motors in 2020; Baidu and Geely co-funded Jidu Automobile in 2021.

Automotive Ultrasonic Radar and OEM Parking Roadmap Development Research Report, 2023

Automotive Ultrasonic Radar Research: as a single vehicle is expected to carry 7 units in 2025, ultrasonic radars will evolve to the second generation.

As a single vehicle is expec...

Autonomous Driving SoC Research Report, 2023

Research on autonomous driving SoC: driving-parking integration boosts the industry, and computing in memory (CIM) and chiplet bring technological disruption.

“Autonomous Driving SoC Research ...

China ADAS Redundant System Strategy Research Report, 2023

Redundant System Research: The Last Line of Safety for Intelligent VehiclesRedundant design refers to a technology adding more than one set of functional channels, components or parts that enable the ...

Intelligent Steering Key Components Report, 2023

Research on intelligent steering key components: four development trends of intelligent steering

The automotive chassis consists of four major systems: transmission system, steering system, driving ...

Automotive Digital Instrument Cluster Operating System Report, 2023

Digital Instrument Cluster Operating System Report: QNX commanded 71% of the Chinese intelligent vehicle cluster operating system market.

Amid the trend for the integration of digital cluster and cen...

800V High Voltage Platform Research Report, 2023

How to realize the commercialization of 800V will play a crucial part in the strategy of OEMs.

As new energy vehicles and battery technology boom, charging and battery swapping in the new energy vehi...

Automotive Intelligent Cockpit Platform Research Report, 2023

Intelligent cockpit platform research: the boundaries between vehicles and PCs are blurring, and there are several feasible paths for cockpit platforms.

Automotive Intelligent Cockpit Platform Resea...

Global and China Automotive Wireless Communication Module Industry Report,2023

Vehicle communication module research: 5G R16+C-V2X module, smart SiP module and other new products spring up.

In 2022, 4G modules swept 84.3% of the vehicle communication module market....

Intelligent Vehicle Cockpit-Driving Integration Research Report, 2023

Cockpit-Driving Integration Research: many companies are making layout and may implement it during 2024-2025.

1. What is the real cockpit-driving integration?

At present, automotive electroni...

Chinese Joint Venture OEMs' Telematics System and Entertainment Ecosystem Research Report, 2022

Telematics System Research 2: Baidu Family Bucket, Huawei and Tencent Become the Mainstream Ecosystems

ResearchInChina released Chinese Joint Venture OEMs' Telematics System and Entertainment Ecosyst...

China Automotive Digital Key Research Report, 2023

Automotive Digital Key Research: the pace of mobile phones replacing physical keys quickens amid the booming market

"China Automotive Digital Key Research Report, 2023" released by ResearchInChina co...

Automotive Camera Tier2 Suppliers Research Report, 2022-2023

1. The automotive camera market maintains a pattern of "one superpower and several great powers".

Automotive cameras are used to focus the light reflected from the target onto the CIS after refractio...

Emerging Carmaker Strategy Research Report, 2023 - NIO

Emerging carmaker strategy research: NIO is deploying battery swap and sub-brands for the knockout match in 2023.In 2022, the sales surged by 32.3% year on year, being concentrated in first-tier citie...

Nissan CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022-2023

Nissan CASE research: two leverages for Dongfeng Nissan to turn the tables. Introduction: since 2020, the declining sales of Dongfeng Nissan have exposed its problems in brand influence and product co...

China Automotive Gesture Interaction Development Research Report,2022-2023

Vehicle gesture interaction research: in 2022, the installations rocketed by 315.6% year on year.China Automotive Gesture Interaction Development Research Report, 2022-2023 released by ResearchInChina...

Automotive Power Management Integrated Circuits (PMIC) Industry Report, 2023

Automotive PMIC research: the process of domestic automotive PMICs replacing foreign ones in China in the “crisis of chip shortage”.

Automotive power management integrated circuits (PMIC) find broad ...

Automotive Cockpit SoC Research Report, 2023

Cockpit SoC research in 2023: Can X86 solutions returning to cockpit SoC challenge the “ARM+Google” mobile solution?

This report highlights the research on the products and plans of 9 overseas and 8 ...

AI Foundation Model and Autonomous Driving Intelligent Computing Center Research Report, 2023

New infrastructures for autonomous driving: AI foundation models and intelligent computing centers are emerging.

In recent years, the boom of artificial intelligence has actuated autonomous driving, ...