ADAS and Autonomous Driving Industry Chain Report 2018 (VI)- Commercial Vehicle Automated Driving

-

Aug.2018

- Hard Copy

- USD

$3,600

-

- Pages:195

- Single User License

(PDF Unprintable)

- USD

$3,400

-

- Code:

ZYW239

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$5,000

-

- Hard Copy + Single User License

- USD

$3,800

-

ADAS and Autonomous Driving Industry Chain Report 2018 - Commercial Vehicle Automated Driving, about 195 pages, covers the following:

Overview of autonomous commercial vehicle industry

Overview of autonomous commercial vehicle industry

Technologies, stages and costs of autonomous commercial vehicle

Technologies, stages and costs of autonomous commercial vehicle

Truck platooning autonomous driving

Truck platooning autonomous driving

Foreign commercial vehicle automated driving solution providers

Foreign commercial vehicle automated driving solution providers

Chinese commercial vehicle automated driving solution providers

Chinese commercial vehicle automated driving solution providers

Layout of foreign commercial vehicle makers in autonomous driving

Layout of foreign commercial vehicle makers in autonomous driving

Layout of Chinese commercial vehicle makers in autonomous driving

Layout of Chinese commercial vehicle makers in autonomous driving

With the enforcement of the new standard Safety Specifications for Commercial Bus, the commercial vehicle ADAS market in China springs up, and start-ups such as Roadefend, Maxieye, Minieye and INVO have earned the revenue of tens of millions or even hundreds of millions of yuan.

In terms of autonomous commercial vehicle, solution providers such as Westwell Lab, TrunkTech, PlusAI, TuSimple and FABU Technology have arisen. Most of them are committed to unmanned port trucks with autonomous container truck solutions. In China, there are more than 20,000 container trucks at ports, and each driver is paid about RMB300,000 per year, an opportunity for autonomous driving replacement.

There are many challenges for the access of autonomous driving to any particular scenario. For instance, driverless container trucks need to be in line with the production logic and dock management system of ports and interact with bridge cranes, tire cranes and other equipment. It sounds like autonomous driving along fixed routes. In fact, a new driving environment will be created in less than half a day after the containers stacked at ports are hoisted back and forth.

Autonomous commercial vehicles are first seen as port container trucks, which is quite similar to low-speed automated vehicle applied for driverless delivery. Closed areas, low-speed driving, the rising labor costs as well as the developed e-commerce and logistics in China are all driving factors.

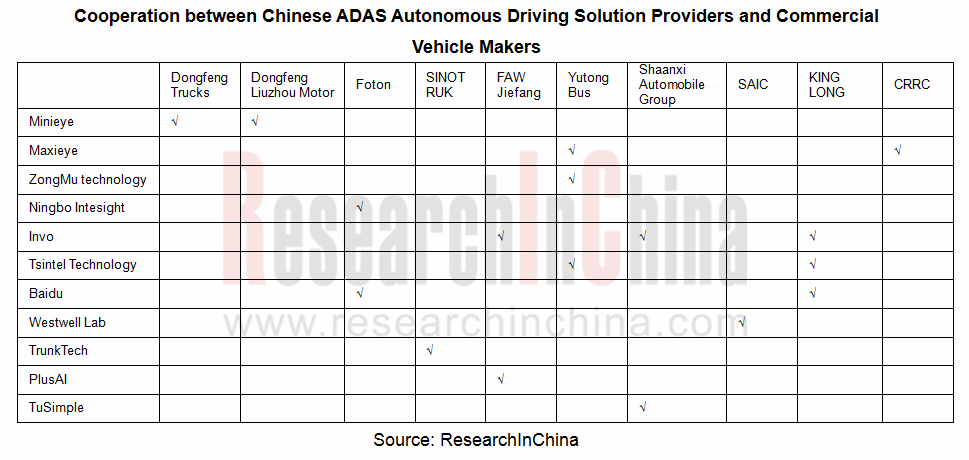

Commercial vehicle automated driving solution providers often partner with commercial vehicle manufacturers to enter a target market.

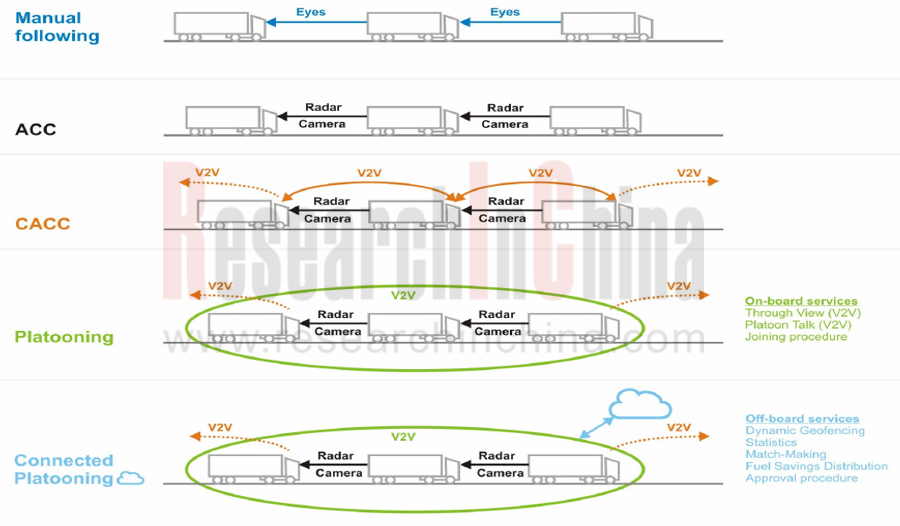

After the first-kilometers and last-kilometers unmanned freight market starts, the much larger freeway autonomous truck market will grow in a progressive way. Initially, autonomous trucks will be realized through platooning -- the first truck is manipulated by a driver while the following trucks are not.

Platooning will go through CACC, Platooning, Connected Platooning and other stages.

Europe is a leader in platooning. Individual carmakers conduct Platooning tests, and multiple automakers organize cross-brand trucks for driving tests and even hold European Truck Platooning Challenge. There is an urgent need for Chinese companies to catch up in this field.

The amazingly huge autonomous driving market is full of difficulties and challenges to ground, and the commercialization process is slower than expected. Fortunately, the Chinese market has witnessed the world's largest number of autonomous driving start-ups that work closely with traditional automakers to step into various segments and solve all technical problems around the clock. Like Chinese electric vehicle market which is the largest in the world, China's autonomous driving market is bound to be the biggest one around the globe.

1 Overview of Commercial Vehicle Automated Driving Industry

1.1 Active Safety and ADAS Become Mandatory Requirements

1.2 Safety Specifications for Commercial Vehicle for Cargo Transportation (2018)

1.3 Domestic Laws on Active Safety and ADAS

1.4 Reference Architecture of Commercial Vehicle Automated Driving

1.5 Evolution of Commercial Vehicle Automated Driving

1.6 Typical Application Scenarios of Commercial Vehicle Automated Driving

1.7 Technical Solutions for Typical Application Scenarios of Commercial Vehicle Automated Driving

1.8 Roadmap of Commercial Truck Automated Driving

1.9 Key Challenges of Commercial Vehicle Automated Driving

1.10 Most Problems in Truck Industry Can Be Solved via Automated Driving

1.11 Port Driverless Truck

2 Technology, Stages and Costs of Commercial Vehicle Automated Driving

2.1 Technology and Development Stages of Commercial Vehicle Automated Driving

2.1.1 Commercial Vehicle Automated Driving Technology: Perception, Decision-making and Control

2.1.2 Key Technologies of Autonomous Truck

2.1.3 Expected Development Paths of Automated Commercial Vehicle

2.1.4 Truck Automated Driving by Stage

2.1.5 Functions in L0-L5

2.2 ADAS Functions Required by Commercial Vehicle

2.2.1 The Most Fundamental ADAS Functions on Truck

2.2.2 ADAS on Volvo Commercial Vehicles

2.3 Costs of Truck Automated Driving

2.3.1 Impact of Truck Automated Driving on Operating Costs

2.3.2 Three Application Cases of Truck Automated Driving

2.3.3 Calculation of Payback Period of Automated Driving in Application Cases

2.3.4 Impact of Vehicle Platooning on Payback Period

2.4 Challenges and Influence of Automated Truck

2.4.1 Impact on Stakeholders in Truck Industry

2.4.2 Technology Push of Different Stakeholders

3 Commercial Vehicle Platooning Autonomous Driving

3.1 Overview of Truck Platooning

3.1.1 Key Components for Autonomous Truck Platooning

3.1.2 Truck Platooning Technology: Truck Connection

3.1.3 Truck Platooning Technology: CACC (Cooperative Adaptive Cruise Control)

3.1.4 Vehicle Platooning Technology: from ACC, CACC to Connected Platooning

3.1.5 Design Structure of Truck CACC System

3.1.6 Cooperative Truck Platooning Aerodynamics

3.2 Participants in Truck Platooning

3.2.1 Competitive Edges of Large Fleet Operators in Platooning

3.2.2 List of Participants in Platooning Field

3.3 Business and Social Value of Truck Platooning

3.4 Procedures of Truck Platooning

3.5 Development of Truck Platooning in Europe

3.5.1 Roadmap of Truck Platooning Automated Driving in Europe

3.5.2 European Truck Platooning Challenge (ETPC)

3.5.3 Multi-brand Truck Platooning Programs in Europe

3.5.4 Truck Platooning Program in Europe: Sweden4Platooning

3.5.5 Truck Platooning Program in Europe: ENSEMBLE

3.5.6 Finland-Norway Truck Platooning Test

3.6 Truck Platooning Programs in the United States

3.6.1 FHWA-FMCSA Truck Platooning Program

3.6.2 Nine States Allow Tests and Over 20 States Are Interested in It

4 Foreign Providers of Commercial Vehicle Automated Driving Solutions

4.1 Starsky Robotics

4.1.1 Technology Solutions

4.2 Embark

4.2.1 Embark AI System

4.3 Peloton Technology

4.3.1 Peloton Team

4.3.2 Peloton Truck Platooning System

4.3.3 Peloton PlatoonPRO

4.3.4 Peloton + Omnitracs Strengthen Fleet Management and Platooning

4.3.5 Industry Leaders’ Investment into Peloton Technology

4.3.6 FCAM Reduces Rear-end Collisions by 71%

4.4 BestMile

4.4.1 Core Engine of BestMile Mobility Platform

4.4.2 System Architecture of BestMile Mobility Platform

4.4.3 APP of BestMile Mobility Platform

4.4.4 BestMile’s Solutions for Autonomous Fleet Management

4.4.5 Application of BestMile’s Products to Autonomous Bus

4.4.6 BestMile’s Specific Solutions: Ride-hailing and Micro-transit

4.4.7 Integration under Multi-mode Environment

4.4.8 Value Chain, Customers and Partners of BestMile

4.4.9 Cooperative Projects of BestMile

4.5 Oxbotica

4.5.1 Oxbotica’s Products

4.5.2 Oxbotica’s Automated Driving Programs

4.6 Einride

4.6.1 T-Pod and T-Log

4.7 KeepTruckin

4.7.1 KeepTruckin’s Products

4.8 INRIX

4.8.1 INRIX AV Road Rules Platform

4.9 WABCO

4.9.1 Development Course

4.9.2 Layout in Automated Driving Products

4.9.3 OnGuardACTIVE

4.9.4 ADAS System

4.9.5 Industry Leader

4.10 Kodiak

5 Chinese Commercial Vehicle Automated Driving Solution Providers

5.1 Tianjin Tsintel Technology Co., Ltd.

5.1.1 Tsintel’s Commercial Vehicle AEB

5.1.2 Architecture and Application Cases of Tsintel’s Commercial Vehicle AEB Systems

5.1.3 Tsintel’s Automated Driving Solutions for Specific Scenarios

5.2 Beijing TuSimple Future Technology Co., Ltd.

5.2.1 Core Technologies and Position

5.2.2 TuSimple Makes Inroad into the Field of Port Container Truck Autonomous Transportation

5.3 Shanghai Westwell Information Technology Co., Ltd.

5.3.1 Core Technologies

5.3.2 Products and Applications

5.4 Hangzhou Zhuying Technology Co., Ltd./Fabu Technology Limited

5.4.1 Core Technologies

5.4.2 Products and Development Strategy

5.5 PlusAI Inc.

5.5.1 Core Technologies and Application Scenarios

5.5.2 Application Cases

5.6 TrunkTech

5.6.1 TrunkTech’s Autonomous Electric Trucks

5.7 Changsha Intelligent Driving Research Institute – A Supplier of Intelligent Logistics Vehicles and Systems

5.7.1 Heavy Truck Automated Driving Solutions

5.8 Henan Huhang Industry Co., Ltd.

5.8.1 Coach Application Solution

5.8.2 Bus Application Solution

5.8.3 Hazardous Chemicals Transport Vehicle Application Solution

5.8.4 Truck Application Solution

5.8.5 Learner-driven Vehicle Application Solution

5.9 G7

6 Automated Driving Layout of Foreign Commercial Vehicle Companies

6.1 Volkswagen (VW)

6.1.1 VW’s Automated Driving Projects

6.1.2 AdaptIVe Project

6.1.3 L3PILOT Project

6.1.4 Roadmap of Mobility Services and Products

6.1.5 MaaS Commercial Vehicles

6.1.6 Autonomous Truck Layout

6.1.7 MAN SE’s Autonomous Trucks for Highway Construction

6.2 PACCAR

6.2.1 Share in Heavy Truck Market and Industry Ranking

6.2.2 Financial Data

6.2.3 New Products and Technologies

6.2.4 Automated Driving Technologies and Truck Platooning

6.3 Volvo

6.3.1 Financial Status by Division

6.3.2 Mass-produced Active Safety Systems

6.3.3 Future Trucks

6.3.4 Layout of Commercial Vehicle Automated Driving

6.4 Daimler

6.4.1 Layout of Commercial Vehicle Automated Driving

6.4.2 SuperTruck 1 Project – Development Roadmap

6.4.3 SuperTruck 1 Project – Overview

6.4.4 SuperTruck 2 Project – Challenges

6.4.5 SuperTruck 2 Project – Development Steps

6.4.6 SuperTruck 2 Project – Stages

6.4.7 Autonomous Truck Layout and Partners

6.4.8 Autonomous Truck ADAS Roadmap

6.5 SCANIA

6.5.1 Financial Status, 2013-2017

6.5.2 Operating Business and Market Status

6.5.3 Automated Driving Solutions

6.5.4 Autonomous Trucks and Bus Solutions

6.5.5 Autonomous Tramcar, Truck and Bus

6.5.6 Automated Driving Test

6.5.7 Autonomous Truck Platooning

7 Automated Driving Layout of Chinese Commercial Vehicle Companies

7.1 Beiqi Foton Motor Co., Ltd.

7.1.1 Strategic Clients and Global Partners

7.1.2 Foton and Baidu Cooperated to Launch Autonomous Trucks

7.1.3 Foton Acquired China’s First Commercial Vehicle Automated Driving Test License

7.1.4 Foton’s Intelligent Driving Layout

7.1.5 Foton’s Commercial Vehicle Ecosystem

7.2 Dongfeng Motor Corporation

7.2.1 Dongfeng’s Commercial Vehicle Application Scenario Planning

7.2.2 Intelligent Vehicle Planning of Dongfeng Liuzhou Motor Co., Ltd.

7.3 China National Heavy Duty Truck Group Co., Ltd. (SINOTRUCK)

7.4 FAW Jiefang Automotive Co., Ltd.

7.5 Shaanxi Automobile Holdings Limited

7.6 SAIC-IVECO Hongyan Commercial Vehicle Co., Ltd.

7.7 Zhengzhou Yutong Bus Co., Ltd.

7.8 Xiamen King Long United Automotive Industry Co., Ltd.

7.9 CRRC Corporation Limited

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...