China Passenger Car Camera Market Report, 2019Q1

-

May 2019

- Hard Copy

- USD

$1,700

-

- Pages:73

- Single User License

(PDF Unprintable)

- USD

$1,500

-

- Code:

LY007

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$2,300

-

- Hard Copy + Single User License

- USD

$1,900

-

Passenger Car Camera Market: Front-view Monocular Camera Installation Soared by 71.7% in 2019Q1 from the Same Period Last Year.

In China, front view monocular camera is the one largely demanded in passenger car market, with its installations in 2019Q1 surging by 71.7% from the same period of 2018, according to our recent report -- China Passenger Car Camera Market Report, 2019Q1.

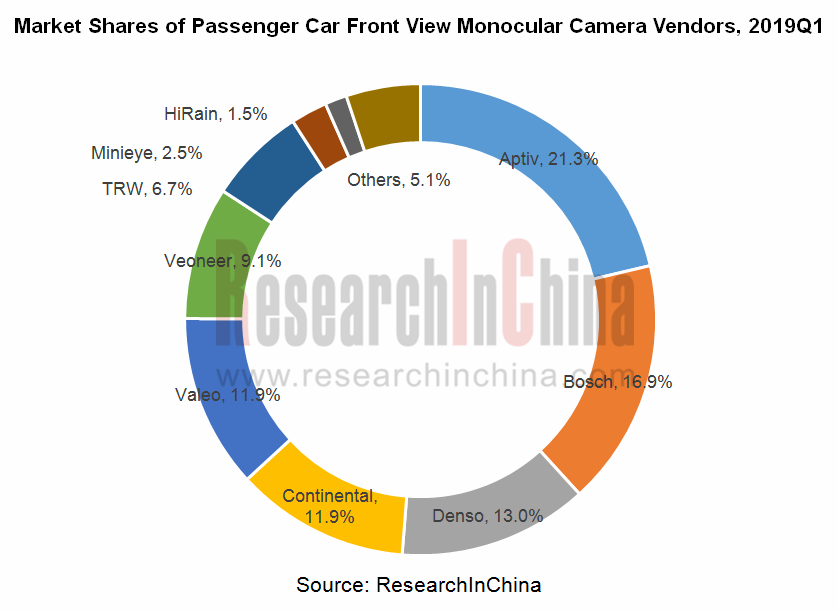

The top three players Aptiv, Bosch and Denso commanded 21.3%, 16.9% and 13.0% of the market, respectively.

Chinese vendors have made headway in ADAS camera field, among which Minieye and HiRain Technologies have entered the top ten monocular camera vendor list where the four radar monopolists, Aptiv, Bosch, Continental and Denso are also ranked, with respective market share of 2.5% and 1.5%.

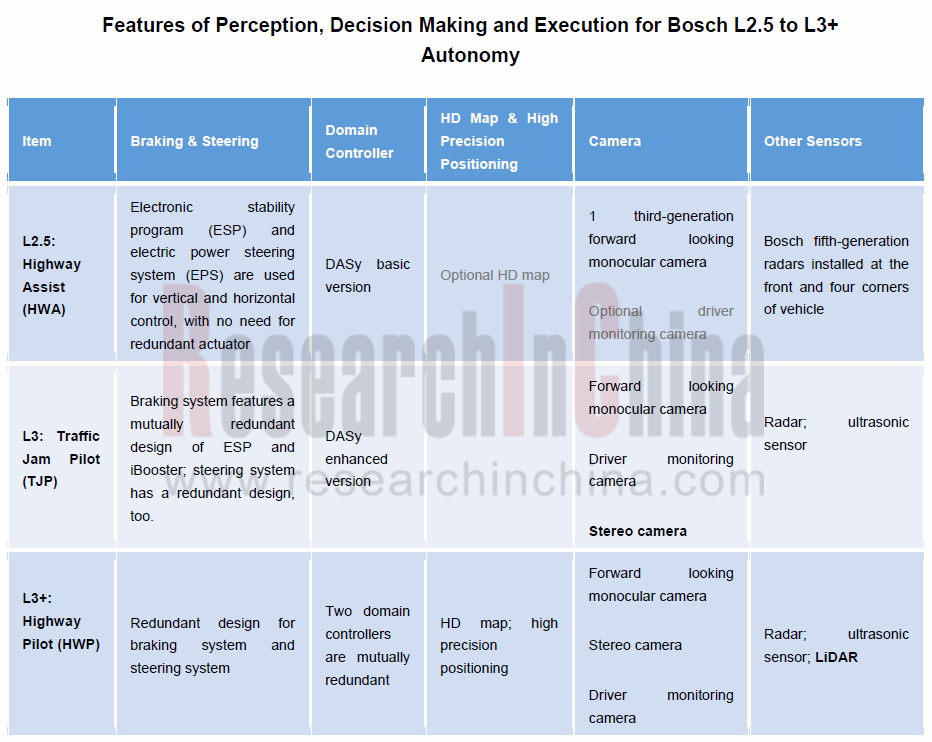

Bosch vision-based ADAS products grow fast in the Chinese market. In 2019Q1, the market share of its forward looking monocular cameras jumped to 16.9% compared with less than 10% in 2018. The mass-produced Chinese vehicle models packing Bosch L2 autonomy technology include: Geely Borui GE, Changan CS55, Great Wall VV6, Geely Binrui, SAIC Marvel X and SGMW New Baojun RS-5. Bosch expects more than 40 models with its L2 capability will be available on market in 2019.

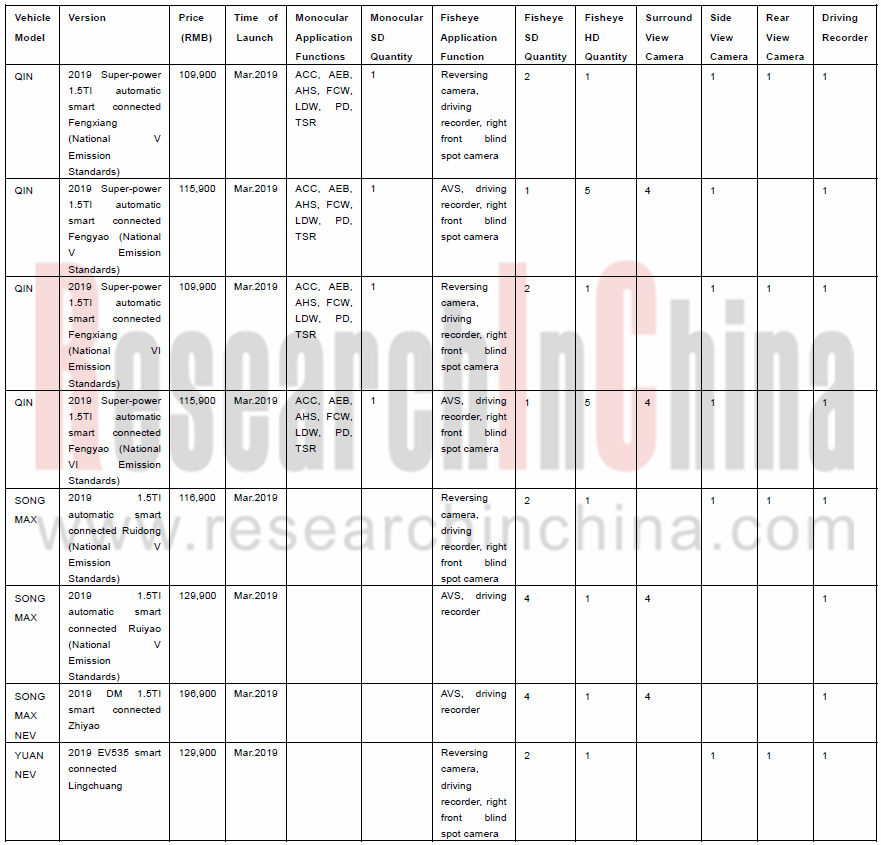

Of the 572 new car models launched in China in 2019Q1 (note: the number of models is counted based on configuration), SAIC rolled out the most, 66 models; BYD followed with 41 models having the most complete camera configurations.

In 2019Q1, BYD released 7 new cars in 41 models, including: 8 with monocular SD camera; 32 with fisheye SD camera; 26 with fisheye HD camera; 8 with around view camera; 24 with side view camera; 28 with reversing camera; 26 with driving recorder. Vision sensor configurations of some models are shown below.

This is quarterly report, are totally 4 issues a year, with annual subscription fee of USD6,000.

Reseller distribution is not allowed.

Preface

Research Background and Contents

Methodology

Terminology

1 Chinese Passenger Car Camera Market

Front-view Monocular and Stereo Camera Installations and Growth Rate in Chinese Passenger Car Market, 2019Q1

Front-view Monocular and Stereo Camera Installations to New Cars in China, Jan 2018 - Mar 2019

Proportion of Front-view Monocular Camera Installations to New Passenger Cars in China by Price, 2019Q1

Top 20 Brands by Front-view Monocular Camera Installations to New Passenger Cars in China, 2019Q1

Top 30 Models by Front-view Monocular Camera Installations to New Passenger Cars in China, 2019Q1

Front-view Monocular Camera Suppliers to New Passenger Cars and Their Share by Installations in China, 2019Q1

Front-view Monocular Camera Suppliers to New Passenger Cars and Their Installations and Share in China, 2018Q1-2019Q1

Camera Installations to New Cars and Installations by Position in China, 2019Q1

Proportion of Camera Installations to New Cars in China by Number & by Position, 2019Q1

Rear-view Camera Installations to New Cars and Growth Rate in China by Reversing Camera and Streaming Rear-view Mirror, Jan-Mar 2019

Rear-view Reversing Camera and Streaming Media Installations to New Cars in China, Jan 2018 - Mar 2019

Proportion of Reversing Camera Installations to New Cars in China by Price, 2019Q1

Top 20 Brands by Reversing Camera Installations to New Cars in China, 2019Q1

Monthly Surround-view Camera Installations to New Cars in China, Jan 2018 - Mar 2019

Proportion of Surround-view System Installations to New Cars in China by Price, 2019Q1

Top 20 Brands by Surround-view System Installations to New Cars in China, 2019Q1

Side-view Camera Installations to New Cars and Growth Rate in China, Jan-Mar 2019

Side-view Camera Installations to New Cars in China, Jan 2018 - Mar 2019

2 Installations and Dynamics of Automotive Vision Suppliers

2.1 Aptiv

2.1.1 Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.1.2 Recent Developments

2.2 Bosch

2.2.1 Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.2.2 Models Supported and Recent Developments

2.3 Denso’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.4 Continental’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.5 Valeo’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.6 Veoneer’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market

2.7 TRW’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.8 Gentex’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.9 HiRain’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.10 Minieye

Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

Recent Developments

3 Vision Sensor Configuration and Features of Chinese Automakers

3.1 Great Wall Motor

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

3.2 Geely

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

3.3 BYD

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

3.4 SAIC Passenger Vehicle

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

3.5 Chang'an Automobile

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

3.6 Hanteng Autos

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

3.7 Leapmotor

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4 Vision Sensor Configuration and Features of Joint Venture Brands

4.1 Beijing Benz

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.2 GAC Toyota

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.3 BMW Brilliance

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.4 SAIC Volkswagen

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.5 SAIC-GM

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.6 FAW-Volkswagen

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.7 FAW Toyota

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.8 Dongfeng Yueda Kia

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.9 Chery Jaguar Land Rover

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.10 Chang’an Mazda

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.11 Dongfeng Peugeot Citro?n

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.12 JMC Ford

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

5 Development Trends of Vision Sensor Industry

5.1 Development Trends of Visual Processing Chips

5.2 Development Trends of Software and Algorithms

Passenger Car Digital Chassis Research Report, 2026

Research on Digital Chassis: Leading OEMs Have Completed Configuration of Version 2.0 1. Leading OEMs Have Completed Configuration of Digital Chassis 2.0

By the degree of wired control of each c...

Vehicle Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2026

Multiple Mandatory Standards for Intelligent Vehicles in China Upgrade Functional Safety Requirements from Recommended to Mandatory Access Criteria In 2026, China has intensively issued and promo...

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...