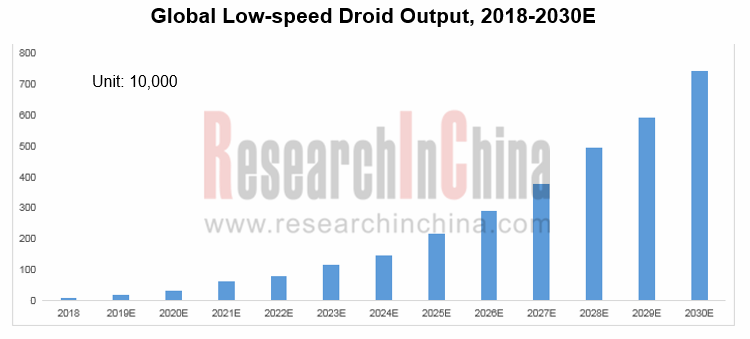

Given security, policies and legal risks, the commercialization of the autonomous driving technology will follow the route from low speed to high speed and from close to open. The current autonomous driving technology cannot enable autonomous vehicles to carry passengers, but it allows autonomous vehicles to gradually replace traditional vehicles and attain commercialization firstly in segments such as freight and closed parks where the technical requirements are relatively low. Therefore, the global low-speed droid industry will enter the high-speed development stage in the near future and seize the traditional commercial vehicle market. The global low-speed droid output will be estimated at 2.15 million units in 2025, with a CAGR of 58.7% compared with 2018; it will reach 7.42 million units in 2030, with a CAGR of 45.1% from 2018.

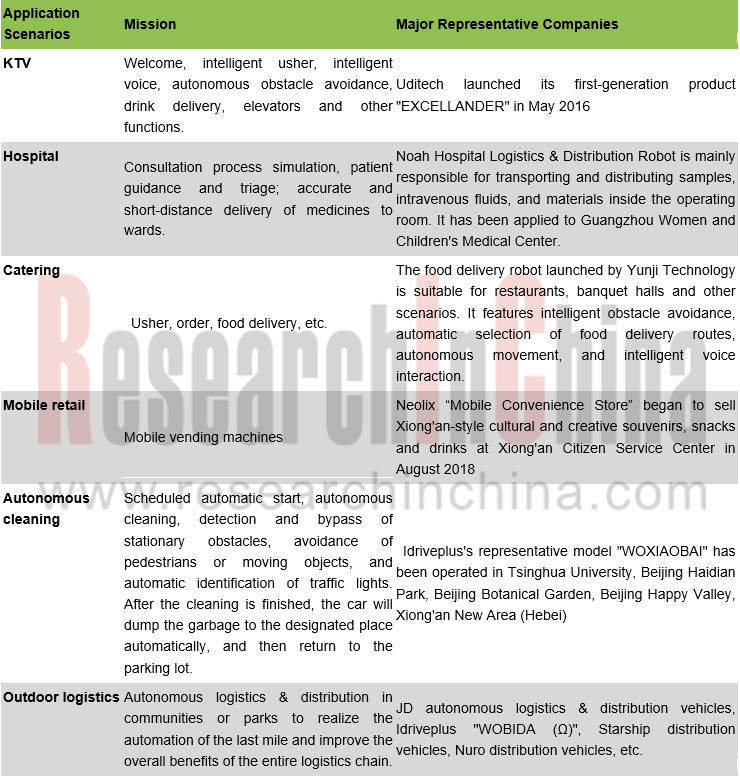

Currently, low-speed droids are mainly used in low-speed transportation in outdoor closed scenarios (such as autonomous cleaning vehicles + outdoor logistics vehicles) and indoor closed scenarios (mainly including catering, hotels, KTV / hospitals). At present, most manufacturers are only in the stage of testing or preliminary commercialization. This industry boasts huge potentials, so all players are trying to seize first-mover advantages in their respective application areas:

Global and China Low-Speed Droid Industry Report, 2019-2030 by ResearchInChina mainly highlights the followings:

Overview of low-speed autonomous driving industry (including definition, classification, application scenarios, implementation, etc.);

Overview of low-speed autonomous driving industry (including definition, classification, application scenarios, implementation, etc.);

Global and Chinese low-speed droid market size (including market size, market segments);

Global and Chinese low-speed droid market size (including market size, market segments);

Main low-speed droid technologies and trends (including mainstream configuration, important parts, and main technology trends, etc.);

Main low-speed droid technologies and trends (including mainstream configuration, important parts, and main technology trends, etc.);

Brief introduction, product overview, development paths, applicable cases and latest development of 19 domestic and foreign low-speed droid companies such as Nuro, Einride, Starship, Auto X, Udelv, Idriveplus, UISEE, Forwardx Robotics, SUNING, JD X Business Division, etc.

Brief introduction, product overview, development paths, applicable cases and latest development of 19 domestic and foreign low-speed droid companies such as Nuro, Einride, Starship, Auto X, Udelv, Idriveplus, UISEE, Forwardx Robotics, SUNING, JD X Business Division, etc.

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...