Automotive Vision Industry Chain Report 2019-2020 (I): Monocular Vision

Automotive Vision Industry Chain Report 2019-2020 (I): The front-view monocular camera market soared 95.6% year-on-year in 2019

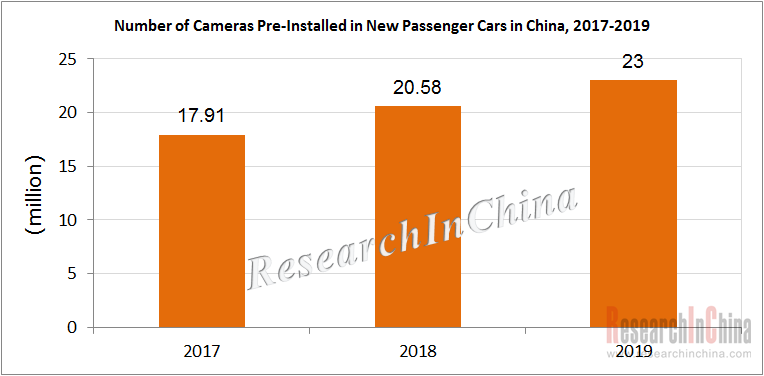

About 23 million cameras were pre-installed in new passenger cars in China in 2019, up 11.7% on an annualized basis, as is revealed by ResearchInChina.

Front-view monocular cameras and surround-view cameras grew by 95.6% and 23.9% year-on-year respectively, while both rear-view and side-view cameras dropped.

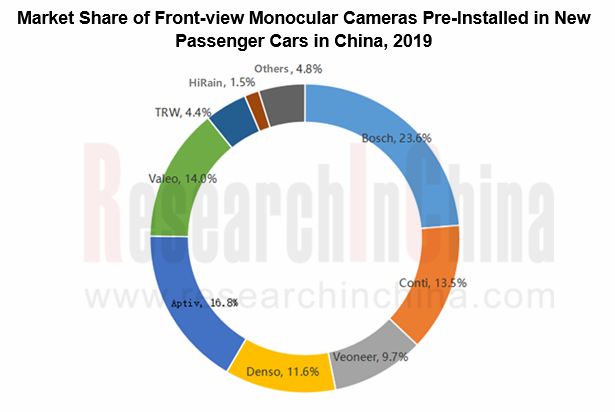

The Tier1 suppliers such as Bosch, Continental, Aptiv, Denso, Valeo, Veoneer, ZF, etc. occupy more than 90% share of the front-view monocular camera market, so that Chinese visual ADAS vendors that rarely ever break monopoly turn to focus on surround-view cameras, rear-view cameras, commercial vehicle vision ADAS and other markets.

Cameras find wider application in automobile, in forms of DMS, CMS, binocular stereo, tri-focal, night vision, etc., broadening the market space of automotive vision observably. In March 2020, Waymo unveiled its fifth-generation autonomous driving system with the synergy of 29 cameras in all around the body to see a road sign 500 meters away through the overlapped fields of view.

Driver Monitoring System (DMS)

For safer driving on roads, European Commission approved EU rules requiring life-saving technologies in vehicles. The advanced systems that will have to be fitted in all new vehicles are: intelligent speed assistance; alcohol interlock installation facilitation; driver drowsiness and attention warning; advanced driver distraction warning; emergency stop signal; reversing detection; and event data recorder (“black box”). Most of these technologies and systems are due to become mandatory as from May 2022 for new models and as from May 2024 for existing models.

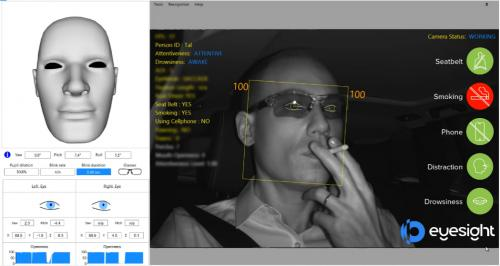

Over the past year, leading Tier1 suppliers and most visual ADAS startups have been developing DMS, especially the most active EyeSight, an Israeli start-up founded in 2005, provides driver monitoring, gesture recognition and user perception and analysis technologies.

On November 21, 2019, Eyesight announced new features for the company’s Driver Sense and Fleet Sense solutions to monitor the driver and detect driver distraction as a result of cell phone usage and smoking. The new features will be added to the company’s existing distraction and drowsiness detection capabilities to further mitigate driver distractions and prevent accidents.

In April 2020, Eyesight upgraded its platform for in-cabin sensing solutions to detect when drivers who wear face masks get distracted or feel fatigued behind the wheel. It has developed a set of AI algorithms that can keep track of drivers’ behavior behind the wheel when wearing masks, protection goggles or sunglasses. The company’s Driver Sense and Fleet Sense leverage IR sensors to analyze head position, eye openness, pupil dilation, blink rate, and gaze direction, in any lighting condition.

Camera Monitor System (CMS)

The spawned all-electric SUV Audi e-tron offers CMS as an option (EUR1,250). Lexus offers optional USD1,900 CMS. Honda e is the world's first model that provides CMS as a standard configuration. Tesla's first battery-electric pickup, Cyberruck, also uses CMS.

Models with CMS have much better night vision effects than the ones with traditional glass reversing mirrors.

Use in Cockpit Comfort System

Cameras are mainly used as the sensing components for ADAS. The popularity of telematics and smart cockpits help wider use of cameras in cockpit comfort systems.

For instance, Faurecia integrates smart devices such as cameras with recognition capabilities, Microsoft Connected Vehicle Platform (MCVP) and cockpit domain controllers as well as the hardware like traditional speakers, smart headrests and exciters embedded on the surface of vehicles to offer the user with personalized audio options and improve the sound conditions of the entire cockpit.

Automotive Vision Industry Chain Report 2019-2020 (I) -- Monocular Vision highlights:

Automotive vision industry chain at a glance

Automotive vision industry chain at a glance

Chinese passenger car camera market

Chinese passenger car camera market

Foreign automotive vision companies

Foreign automotive vision companies

Chinese automotive monocular vision solution providers

Chinese automotive monocular vision solution providers

Automotive Vision Industry Chain Report 2019-2020 (II) -- Binocular and Surround-view Cameras highlights:

Development trend of automotive vision industry

Development trend of automotive vision industry

Binocular vision companies

Binocular vision companies

Surround-view technologies and companies

Surround-view technologies and companies

Key automotive camera parts suppliers

Key automotive camera parts suppliers

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...