BYD CASE (Connected, Autonomous, Shared, Electrified) Layout and Strategy Research Report, 2020

Research on BYD's CASE (Connected, Autonomous, Shared, Electrified): Absence of software and operating system

As we all know, BYD excels in hardware.

BYD started with rechargeable batteries and forayed into automotive sector in 2003. It established a joint venture brand "DENZA" with Daimler in 2010, and accessed to the rail transit field in 2016. BYD has four business segments to date, including automotive, mobile phone components & assembly, rechargeable batteries & photovoltaic, and Skyshuttle.

What efforts have BYD made in CASE?

Electrification: with technical knowhow about core components

BYD boasts a full-fledged industry chain concerning vertical integration of core new energy vehicle components such as power batteries and electric drive systems. It ranks second in the Chinese power battery market by share, and released in March 2020 the next-generation power battery -- "Blade Battery”. Besides, it takes the second place in the Chinese IGBT market by share as the only Chinese automaker with a complete IGBT industry chain. Its IGBT4.0 has been up to the international mainstream technology level.

BYD’s latest e-Platform is divided into 5 standard modules:

- Three-in-one drive system -- a three-in-one module comprised of drive motor, electric control and decelerator;

- Three-in-one high-voltage system -- a three-in-one module encompassing high-voltage charging and distribution system on-board charger (OBC), DC-DC converter, and power distribution box (PDU);

- A low-voltage all-in-one PCB integrating various body controllers;

- A large intelligent rotating screen with "DiLink" system;

- A power battery module.

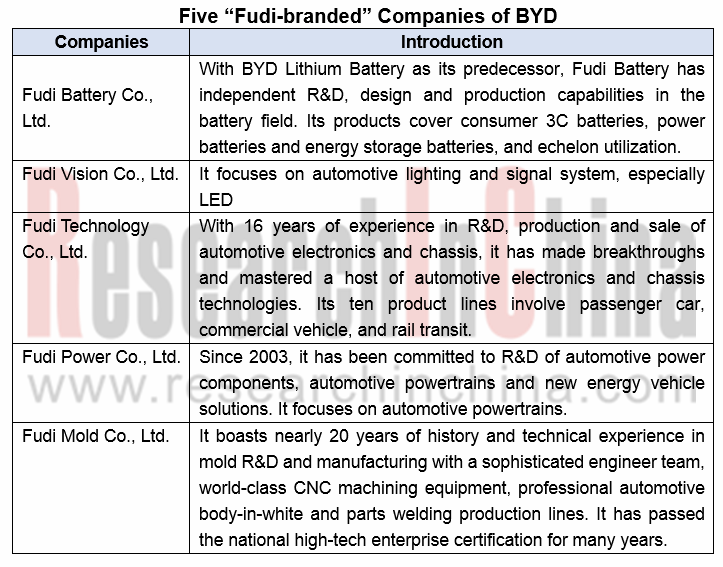

In March 2020, BYD established five “Fudi-branded” companies to spin off major new energy vehicle parts business.

BYD’s opening strategy has succeeded initially: the automakers like Changan Automobile, Changan Ford, and BAIC BJEV will adopt BYD’s ternary lithium/LiFePO4 batteries.

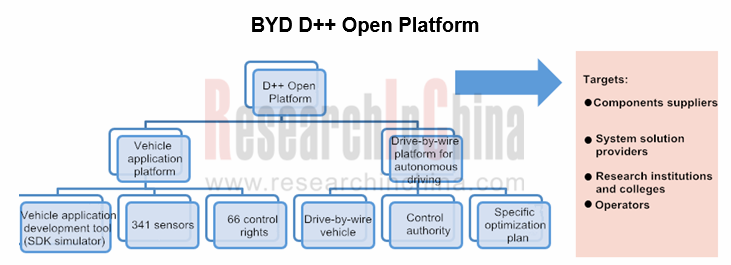

Regarding the opening strategy, BYD launched the D++ open platform covering intelligence and connectivity in 2018. By opening up 341 sensors and 66 control rights, it will create a standard platform for smart car hardware.

Intelligence: installation rate of ADAS is at the medium level in China

Among Chinese passenger car brands, BYD is positioned in the middle in terms of ADAS installation rate. In April 2020, BYD introduced DiPilot, a L2 driver assistance system (combining big data algorithms) which can learn driving habits of the driver. As concerns higher level of autonomy, BYD has yet to consider L3 development but its research and development of L4/L5 technologies is in the pipeline.

DiPilot has been installed in BYD Han, a model launched on market in July 2020. DiPilot packs 3 radars (1 in the front and 2 at the rear), 12 ultrasonic radars and 5 cameras (1 mono camera and 4 surround-view cameras). The system offers the following capabilities: automatic emergency braking, forward collision warning, adaptive cruise control, low-speed follow mode, traffic jam assist, DiTrainer self-learning, lane departure warning, lane keeping, blind spot detection and automatic parking, as well as vehicle OTA updates available for the first time.

Connectivity: installation rate of telematics remains low

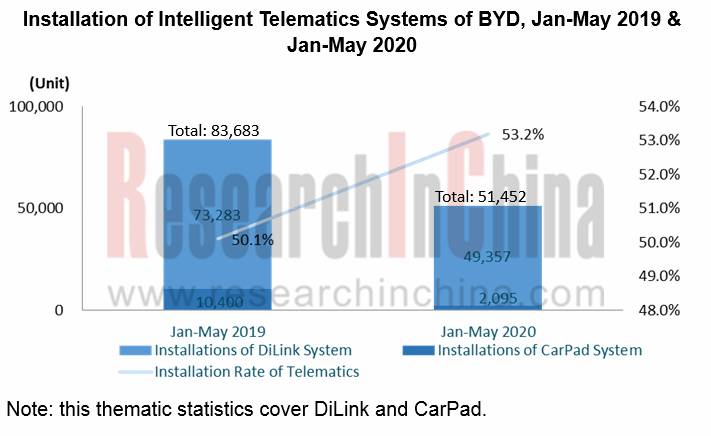

As for connectivity, BYD’s installation rate of telematics stood at 53.2% (including DiLink and CarPad) in the first five months of 2020, lower than other local auto brands such as MG, Roewe, WEY, Geely and Changan.

BYD rolled out DiLink, its new-generation intelligent center console system, in 2018. DiLink 3.0 version has become available after OTA updates and is first mounted on BYD Han. Features of DiLink include: compatibility with more than 3 million Android-based smartphone APPs, screen-split display, interaction with smart bracelet, smartphone NFC key, and in-vehicle camera. In BYD’s next step, face recognition will be added as scheduled.

Sharing: BYD is making attempts and plans to increase investment

BYD still lags well behind its domestic leading peers (e.g., Geely and SAIC) in shared mobility. At present, it not only provides new energy vehicles to local taxi companies but sets up two joint ventures with Didi.

Yadi New Energy Group (Shenzhen Didi New Energy Vehicle Technology Co., Ltd.) was co-funded by BYD (40%) and Didi (60%) in 2015, currently with the registered capital of RMB1.2 billion. The Shenzhen-based joint venture has set up over 20 wholly-owned subsidiaries in South China, Central China and East China, with most of its operations in cities like Shenzhen, Suzhou, Guangzhou, Shenzhen and Nantong. According to its announcement, the company recorded revenues of RMB128 million, RMB183 million and RMB939 million in 2016, 2017 and 2018, respectively, but made ever heavier loss during the three years, up to the loss-making RMB35 million in 2018.

In November 2019, BYD Automobile Industry Co., Ltd. and Beijing Xiaoju Intelligent Automobile Technology Co., Ltd. (“Didi Chuxing”) together invested to establish Meihao Mobility (Hangzhou) Automotive Technology Co., Ltd.. Of the registered capital of RMB1,285 million of the joint venture, BYD contributed 65% or RMB835 million, and Didi Chuxing contributed 35% or RMB450 million.

If for BYD establishment of Yadi New Energy Group is just a move to test the waters, founding Meihao Mobility shows that it pays more attention to mobility market and will seize the initiative in the market.

Predictably, BYD will invest more in shared mobility market, with Yadi New Energy Group and Meihao Mobility as a foundation.

Absence of software and operating system

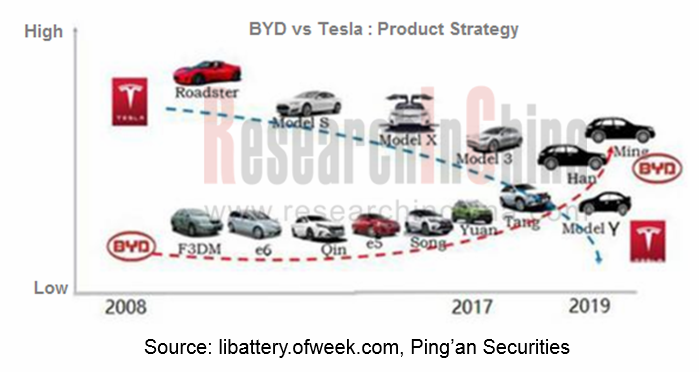

BYD remains the champion by new energy vehicle sales in China for many years, selling 247,800 NEVs in 2018, a bit above Tesla’s and ranking first worldwide. However, Tesla’s electric vehicle sales posted 366,000 units in 2019, compared with BYD’s 229,500 units, indicating a widening gap between them. From product strategies of theirs it can be seen that Tesla are turning from high-priced models to the low-priced ones, while BYD are developing vehicle models from low prices to high prices.

Entering 2020 when Volkswagen AG is frustrated in its reform in vehicle software and E/E architecture, most insiders become increasingly aware of Tesla’s strong power in software and architecture, the idea of software-defined cars are deeply rooted in people’s minds and traditional big auto brands are stepping up investments into software.

SAIC established a software branch –Z.ONE Software Company at the outset of 2020 and plans to enlarge its software team to 2,200 talents till 2023. In April 2020, Great Wall Motor set up a tier-first division “digitalization center” involving intelligent driving, smart cockpit, digital marketing platform, data middle platform, user operation platform, etc.

Like Tesla, BYD upholds the independent development of core components and system, and they differ in that Tesla is adept at both software and hardware and BYD is expert only in hardware, and that Tesla accomplished vehicle OTA long ago while BYD didn’t achieve vehicle OTA until 2020 (OTA success in the model Han).

Tesla has lavished tens of billions of dollars for building revolutionary E/E architecture, operating system, AutoPilot, and FSD chip for a decade. Is there any opportunity for BYD to start from scratch and address software inadequacies? It is really a hard nut to crack.

Fortunately, BYD is aided by Huawei Technologies since they are in the same city, Shenzhen.

BYD has collaborated with Huawei for a long time, particularly in 2019 when the United States posed sanctions on Huawei and Flextronics ceased its services for Huawei, BYD as the second largest mobile phone foundry service provider in the world took the place of Flextronics and is going all out to secure OEM production of Huawei mobile phones.

In 2020, BYD’s latest Han model get access to Huawei HiCar system and is packed with Huawei’s automotive 5G communication module and new-generation NFC key.

In future, BYD and Huawei are probable to have vertical cooperation in operating system, computing chip, E/E architecture, sensors, among others.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...