Global Passenger Car Vision Industry Chain Report 2021

-

July 2021

- Hard Copy

- USD

$3,900

-

- Pages:210

- Single User License

(PDF Unprintable)

- USD

$3,700

-

- Code:

BHY004

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$5,600

-

- Hard Copy + Single User License

- USD

$4,100

-

ResearchInChina has released Global Passenger Car Vision Industry Chain Report 2021 to analyze and predict global camera technology and market trends, and conduct research on global mainstream camera vendors.

With policies support of governments worldwide, the rapid development of automotive intelligence has promoted the continuous growth of automotive cameras. The global passenger car camera market was worth USD7.02 billion in 2020, and is expected to hit USD19.26 billion in 2025.

In terms of segmented products, in-car surveillance cameras will be a growth engine in the future. In 2018, Japan's ``Preparation Outline for Autonomous Driving Systems'' required vehicles with autonomous driving functions to record steering wheel operations and the operating conditions of autonomous driving systems. The ADAS directive of "Europe on the Move" issued in 2019 stipulates that all new vehicles must be equipped with "Drowsiness Warning System" and "Distraction Recognition and Prevention System" from May 2022. In 2024, all vehicles in stock must be equipped with the above functions.

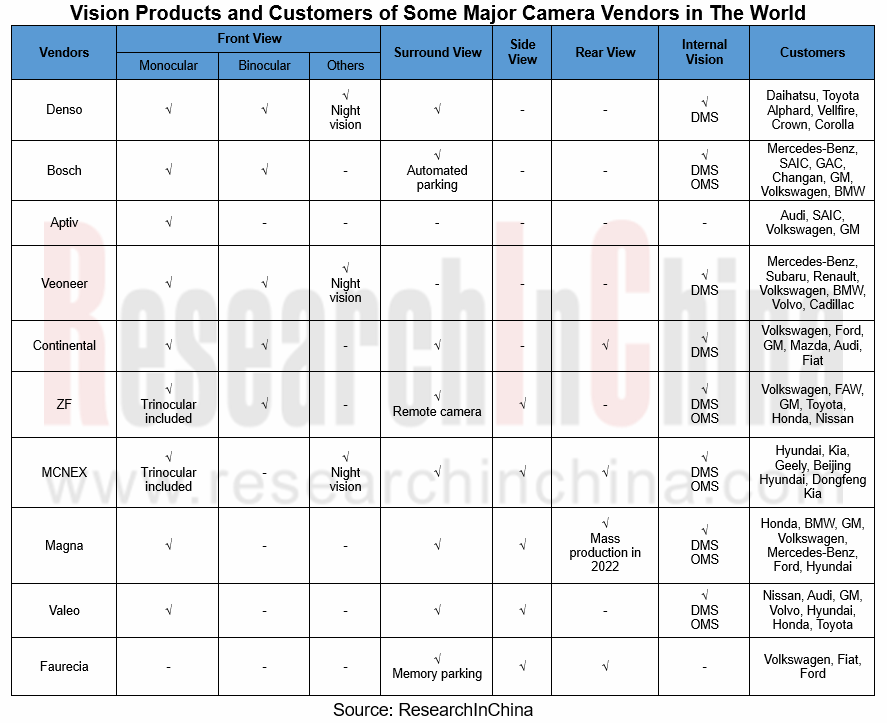

Endeavored by the government and policies, global camera vendors are following market trends and developing new products to meet the demand for advanced autonomous driving. On the one hand, they expand product lines and strive for a complete range of products. Denso develops electronic rear view mirrors based on monocular, binocular, night vision, surround view, internal vision and other products. Magna has already offered a variety of vision products such as Front View monocular cameras, surround view cameras, side view cameras, internal view DMS, internal view OMS, and internal view rear monitors. It plans to mass-produce interior rear view mirrors in 2022. Combined with cameras, mirrors and software products, the rear view mirrors feature a frameless design and can be electronically switched between traditional rear view mirrors and video displays which can customize the field of view.

On the other hand, enhanced visual recognition and algorithms are integrated with other products to offer diverse functions. In June 2021, ZF and CalmCar cooperated to develop an automated valet parking system based on surround view. The system includes ZF's four surround view 192° fisheye cameras, CalmCar's ultrasonic radar and 360° surround view perception software solutions. Bosch and Hyundai Mobis plan to produce the "in-car monitoring system combined with artificial intelligence" and the "high-performance image recognition technology based on deep learning" in 2022 separately.

Finally, automotive vision should not only integrate autonomous driving functions, but also pay more attention to user experience. 3D surround view will prevail. For example, the new Valeo 360Vue? 3D surround view system gives not only the aerial view of the vehicle, but also a 3D view of the vehicle in the car. The driver can clearly see all obstacles and blind sports near the vehicle. In February 2021, Magna released the 3D surround view system, which can directly see the surrounding environment of the vehicle through the 360° surround view camera to help the driver park and move the vehicle in a narrow space. This system is mainly used in luxury vehicles. In addition, Chinese 3D vision company Smarter Eye is also developing a 3D surround view system.

1. Status Quo and Development Trends of Global Passenger Car Vision Industry

1.1 Overview of Passenger Car Vision Industry

1.1.1 Introduction to ADAS and Functions

1.1.2 Automotive Camera Classification and ADAS Functions Supported

1.1.3 Camera Structure and Imaging Principle

1.2 Status Quo and Development Trends of Global Passenger Car Vision Industry

1.2.1 Status Quo and Development Trends of Global Passenger Car Vision Industry

1.2.2 America’s Policies for Promoting the Development of Autonomous Driving

1.2.3 America Regards the Development of Autonomous Driving as a National Strategy

1.2.4 EU’s Policies for Promoting the Development of Autonomous Driving

1.2.5 EU Autonomous Driving Technology Development Roadmap

1.2.6 Germany's Autonomous Driving Policies are at the Forefront of the World

1.2.7 Policies, Regulations and Planning for Autonomous Driving in the UK

1.2.8 Japan’s Policies for Promoting the Development of Autonomous Driving

1.2.9 Japan’s Autonomous Driving Development Planning

1.2.10 Autonomous Driving Regulations and Policies in South Korea

1.2.11 Development Progress and Planning of Autonomous Driving in South Korea

1.3 Status Quo and Development Trends of Global Passenger Car Vision Product Technology

1.3.1 Multi-sensor Integration Will Be the Trend

1.3.2 Simplified Hardware, Central Integration of Computing Power

1.3.3 Binocular or Multinodular Solutions Will Gradually Replace Monocular Solutions

1.3.4 In-car Driver Monitoring Cameras Will be Included in Standard Configuration

2. Foreign Passenger Car Vision Companies

2.1 Meta-analysis of Foreign Passenger Car Vision Companies - Basic Information

2.2 Meta-analysis of Foreign Passenger Car Vision Companies - Products, Vision Customers, Development Directions

2.3 Denso

2.3.1 Profile

2.3.2 Revenue

2.3.3 Main Customers and Revenue

2.3.4 ADAS Products

2.3.5 Forward View Products

2.3.6 Binocular Stereo Vision Sensors

2.3.7 Driver Monitoring Cameras

2.3.8 DMS Application

2.3.9 Denso Ten 360° Surround View System

2.3.10 Customers and Dynamics of Vision Products

2.4 Bosch

2.4.1 Profile

2.4.2 ADAS Products

2.4.3 The Third-generation Front View Camera

2.4.4 The Third-generation Binocular Camera

2.4.5 The Third-generation Monocular Camera

2.4.6 360° Surround View System

2.4.7 In-car Monitoring System

2.4.8 Customers and Dynamics of Vision Products

2.5 Aptiv

2.5.1 Profile

2.5.2 Operating Data in 2020

2.5.3 Business Goals in 2021

2.5.4 ADAS Products

2.5.5 Single-camera Solutions, Sensor Fusion Solutions

2.6 Panasonic

2.6.1 Profile

2.6.2 Automotive Business Revenue in FY2021

2.6.3 Automotive Electronic Products Series

2.6.4 Automotive Vision Products - Rear View Cameras (1)

2.6.5 Automotive Vision Products - Rear View Cameras (2)

2.6.6 Automotive Vision Products - Driving Recorders

2.6.7 Automotive Camera Dynamics

2.7 Veoneer

2.7.1 Profile

2.7.2 Global Layout and Revenue

2.7.3 Products and Customers

2.7.4 Vision System

2.7.5 Night Vision System

2.7.6 DMS

2.7.7 ADAS Technology Released in 2021

2.7.8 ADAS Products Available in Vehicles in 2021

2.8 Continental

2.8.1 Profile

2.8.2 Global Layout and Revenue in 2020

2.8.3 ADAS Products

2.8.4 Vision Products

2.9 ZF

2.9.1 Profile

2.9.2 Revenue in 2020

2.9.3 ADAS Products

2.9.4 Vision Products

2.10 MCNEX

2.10.1 Profile

2.10.2 Operating Data in 2018-2020

2.10.3 Global Business Distribution and Main Customers

2.10.4 Vision Product Layout

2.10.5 Vision Products

2.11 Magna

2.11.1 Profile

2.11.2 Operation in 2020 and Outlook

2.11.3 ADAS Hardware Products, Vision Product Customers

2.11.4 Vision Products

2.12 Valeo

2.12.1 Profile

2.12.2 Revenue in 2020

2.12.3 Vision Sensor Development History

2.12.4 Vision Product Overview

2.12.5 Vision Products

2.12.6 Partners

2.13 Faurecia

2.13.1 Profile

2.13.2 Revenue in 2020

2.13.3 Vision Products

2.14 Gentex

2.14.1 Profile

2.14.2 Revenue in 2020

2.14.3 Automotive Vision Products: Front View Cameras, In-car Cameras

2.14.4 Vision Products: FDM

2.14.5 Next-generation FDM

2.14.6 Automotive Vision Products: CMS

2.14.7 Automotive Vision Products: Hybrid CMS Cases, Vision Product Customers

2.15 First Sensor

2.15.1 Profile

2.15.2 Revenue in 2020

2.15.3 ADAS Product Layout and Application

2.15.4 Vision Products (1)

2.15.5 Vision Products (2)

2.15.6 Vision Products (3)

2.15.7 Vision Products (4)

2.15.8 Vision Product Customers Distribution

2.16 Hyundai Mobis

2.16.1 Profile

2.16.2 Product System and Software R&D Planning

2.16.3 ADAS Product Layout

2.16.4 Vision Products (1)

2.16.5 Vision Products (2)

2.16.6 Vision Products (3)

2.16.7 Customers and Dynamics of Vision Products

2.17 LG

2.17.1 Profile

2.17.2 Operating Data in 2020

2.17.3 Automotive Electronic Product Line

2.17.4 Vision Products: Front View Cameras, Panoramic Surveillance Image System

2.17.5 Customers and Dynamics of Vision Products

2.18 Ricoh

2.18.1 Profile

2.18.2 Operating Data in 2020

2.18.3 Vision Products: Binocular Modules and Application

2.19 Hitachi

2.19.1 Profile

2.19.2 Operating Data in FY2017-FY2021

2.19.3 ADAS Products

2.19.4 Vision Products: Binocular Stereo Cameras, Customers, Dynamics

3. Foreign key Passenger Car Vision Chip Companies and Other Companies

3.1 Mobileye

3.1.1 Profile

3.1.2 Revenue in 2020

3.1.3 Vision Chip Roadmap

3.1.4 Vision Chips: EyeQ5 and Customers

3.1.5 Vision System

3.1.6 Vision Algorithm

3.1.7 Target Recognition Technology

3.2 ON Semiconductor

3.2.1 Profile

3.2.2 Operation in 2020

3.2.3 Automotive Products and Partners

3.2.4 OEM Customers

3.2.5 Vision Chips: CMOS Image Sensors

3.2.6 CMOS Image Sensor: AR0138AT

3.2.7 CMOS Image Sensor: AR0220AT

...............

3.2.13 Vision Chips: Image Processors

3.2.14 Automotive Imaging Sensor System

3.3 OmniVision Technologies

3.3.1 Profile

3.3.2 Vision Products

3.3.3 Automotive Vision Products: Driver Monitoring System Parts

3.3.4 Automotive Vision Products: Parts for Autonomous Driving System

3.3.5 Automotive Vision Products: Display-based Image Sensor Parts

3.3.6 Automotive Vision Products: Parts for Surround View Video

3.3.7 Product Development History and Directions

3.4 Sony

3.4.1 Profile

3.4.2 Operating Data in 2020

3.4.3 Automotive CMOS Development History

3.4.4 Product Portfolio and Customers of Automotive CMOS

3.4.5 Automotive CMOS (1)

3.4.6 Automotive CMOS (2)

3.4.7 Automotive CMOS (3)

3.4.8 Image Sensor Development Plan

3.5 Samsung Electronics

3.5.1 Profile

3.5.2 Operating Data in 2020

3.5.3 ADAS Product Layout

3.5.4 Automotive Image Sensor - ISOCELL Auto

3.5.5 R&D of New Automotive Image Sensors

3.6 Texas Instruments

3.6.1 Profile

3.6.2 Operating Data in 2020

3.6.3 Vision Products: Monocular Vision Processing Chips

3.6.4 Vision Products: Surround View System Processing Chips

3.7 Xilinx

3.7.1 Profile

3.7.2 Operating Data

3.7.3 Application of Chips in ADAS

3.7.4 Vision Products

3.8 Cipia

3.8.1 Profile

3.8.2 Vision Technology

3.8.3 Vision System

3.8.4 Vision System: Cabin Sense

3.8.5 Solution: Fleet Sense

3.8.6 Dynamics of Vision Products

3.9 StradVision

3.9.1 Profile

3.9.2 Vision Products (1)

3.9.3 Vision Products (2)

3.9.4 Cooperation with Renesas

3.10 Foresight

3.10.1 Profile

3.10.2 Revenue and Expenditure in 2020

3.10.3 Vision Products

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...