China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

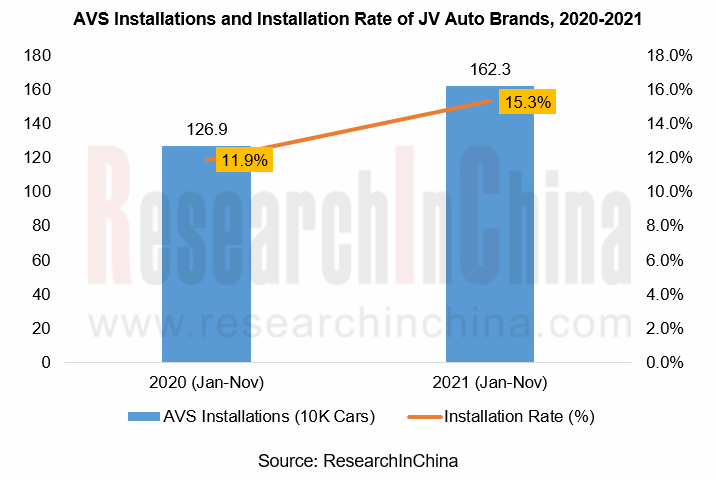

During January to November of 2021, a total of 4.266 million vehicles were installed with around view system (AVS) in China, a year-on-year upsurge of 49.2%, including AVS installations onto 1.623 million cars of joint-venture brands, sharing as high as 38.0% and a year-on-year increase of 27.9%; the installation rate was 15.3%, a rise of 3.4 percentage points on an annualized basis. Noticeably, the JV brands’ cars priced between RMB400,000 and RMB500,000 and installed with AVS constitute the largest portion 22.4% (364,000 units) of the total, according to ResearchInChina.

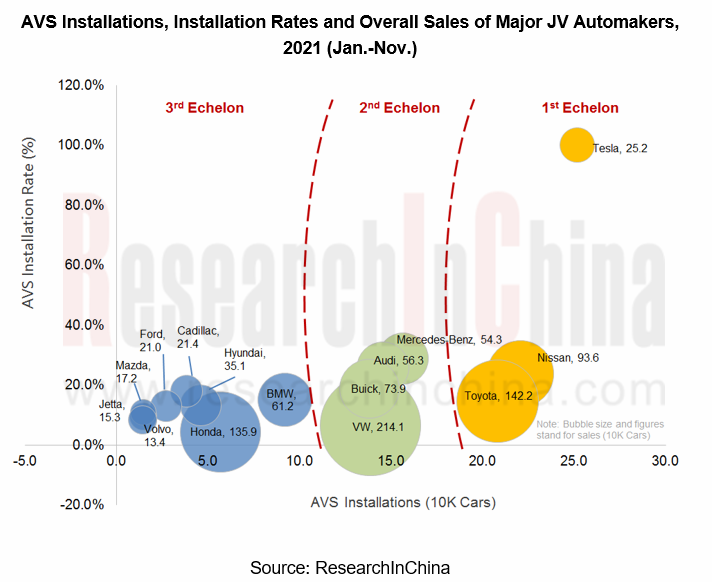

By brands, Tesla, Nissan and Toyota are in the first echelon as concerns AVS installations (onto more than 200,000 cars apiece), which is largely boosted by the best-selling models like Model Y, Model 3, RAV4 and QASHQAUI. The second echelon is home to Mercedes-Benz, Audi, Volkswagen and BUICK, with AVS installed to 100,000 to 200,000 cars each. In the third hierarchy, 92,000 BMW cars are configured with AVS, hopefully striding towards the second echelon. Concerning vehicle models, during 2021 (Jan.-Nov.), the top five vehicle models of joint venture automakers by AVS installations are RAV4 (133,000 units), Model Y (130,000 units) & Model3 (121,000 units), Mercedes-Benz E Class (100,000 units), and Qashqai (99,000 units).

AVP is on the cusp of massive implementation, and Tier1 suppliers are promoting the parking fusion solution earnestly.

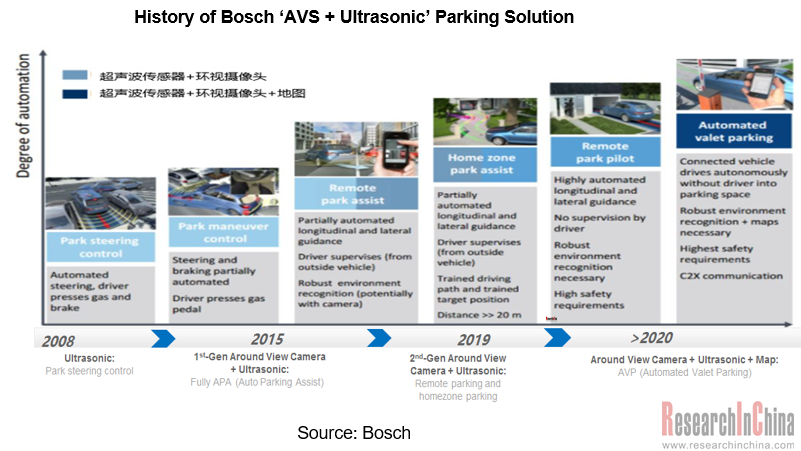

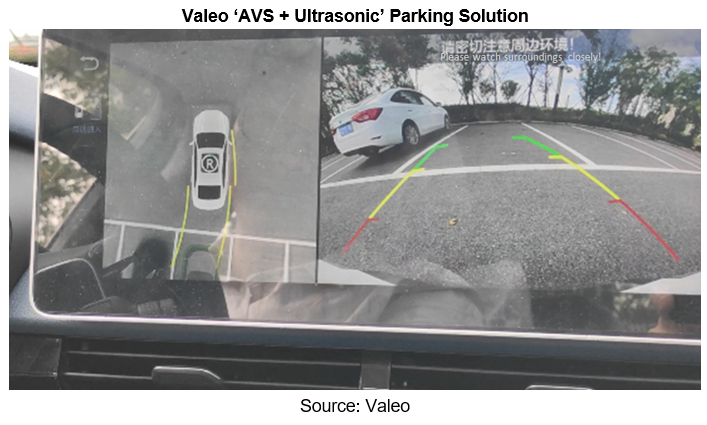

The parking system is evolving apace, amid the previous reversing camera system being increasingly replaced by AVS. The parking solution integrating AVS with ultrasonic sensors grows a popular trend. At the same time, the suppliers are forging partnerships with OEMs on faster mass production of AVP.

Take example for Bosch’s Home Zone Park Assist system exhibited during 2021 BOSCH Automobile & Intelligent Transportation Technology Innovation Experience Day, it does data fusion through 12 Bosch ultrasonic sensors together with an around view camera system made up of 4 near-range cameras, coupled with the reuse of 4 corner radars (driving assistance function), and successfully enables HPP (Homezone Parking Pilot) by software upgrades and without additional hardware sensors. Such parking solution has been available onto GAC AION V.

At the IAA Mobility held in Frankfurt in September 2021, Valeo and its partners NTT DATA and Embotech unveiled their joint AVP (Automated Valet Parking) solution that encompasses ECU, ultrasonic, radar and around view cameras, and dispenses with the costly LiDAR.

Progress of autonomous driving facilitates the around view camera market, and foreign parts suppliers beef up local cooperation.

The advances in autonomous driving technology come with the growing number of varied perception sensors in vehicle. Every car carries ten to fifteen cameras rather than one to five ones in the past, and even more in the future. Besides, the automotive CMOS image sensors get ever improved in pixel, from VGA to 1-megapixel, 2-megapixel and to date 8-megapixel.

To meet the market demand for around view cameras, ON Semiconductor as a leading supplier of automotive cameras CMOS image sensors has been in cooperation with many Chinese autonomous driving companies. In July 2021, the fifth-generation driverless system – AutoX Gen5, the outcome of joint efforts by ON Semiconductor and AutoX was launched, for which ON Semiconductor offered a total of 28 high-definition 8-megapixel image sensors AR0820AT and 4 LiDAR SiPM matrices, thus enabling 360-degree reversing image without any blind spots. Concurrently, ON Semiconductor also deepened its collaboration with Baidu Apollo and established a joint studio for image development with the latter, focusing on self-driving image perception solutions.

Sony, another leading supplier of image sensors, will provide NIO ET7 (to be delivered in March 2022, built on NT2.0 technology platform) and ET5 (to be delivered in September 2022) with the dedicated 3-megapixel high-sensitivity around view cameras. Compared with the 8-megapixel cameras previously used in ET7, this 3MP camera outperforms in dim light and the exterior rearview mirror is also added with ambient light compensation lamp that acts as a better enabler for 360-degree panorama imaging, transparent chassis, guard mode, park assist, etc.

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...