ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese commercial vehicle ADAS market.

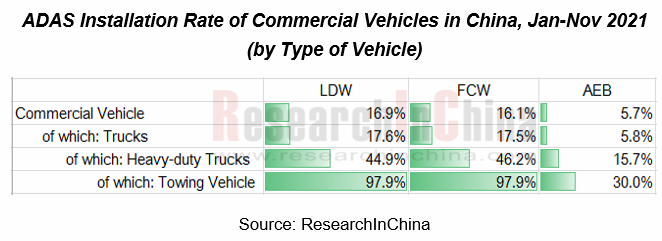

1. The overall installation rate of ADAS for commercial vehicle reached 17.3%, among which towing vehicle is where ADAS gets most used.

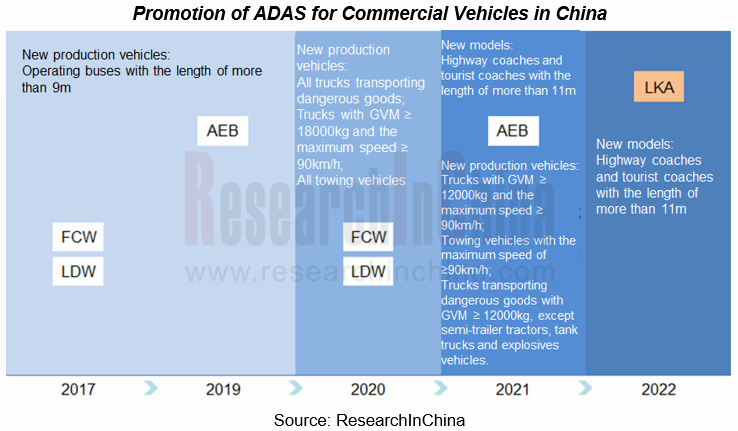

Towing vehicle and goods vehicle with GVM ≥12000kg shall be installed with FCW and LDW starting from May 1st, 2020 (delayed to September 1st due to the Pandemic). As from May 1st, 2021, towing vehicle with maximum speed above 90km/h, and cargo vehicles with GVM≥12000kg and peak speed above 90km/h need to be installed with AEB, according to policies such as " Safety Specification for Commercial Vehicle for Cargos Transportation – Part 1: Goods Vehicle", " Safety Specification for Commercial Vehicle for Cargos Transportation—Part 2: Towing Vehicle and Trailer", "Performance Requirements and Test Procedures for Advanced Emergency Braking System for Operating Vehicles".

Facilitated by the aforesaid policies, the rate of ADAS installations to heavy trucks and towing vehicle is on a rapid rise.

- In terms of FCW and LDW, Chinese trucks saw an installation rate of 17.5% and 17.6%, respectively, in Jan-Nov 2021, of which 46.2% and 44.9% for heavy trucks and up to both 97.9% for towing vehicle.

- As for AEB, Chinese trucks witnessed an AEB installation rate of 5.8% in Jan-Nov 2021, among which heavy trucks’ reached 15.7% and towing vehicles’ up to 30%.

In fact, towing vehicles are generally equipped with ADAS functions as required, so its market demand has got first invigorated. ADAS cost of commercial vehicle is expected to descend gradually amid the improving system integration, sensor performance progress, enhanced functional experience and large-scale production. Meanwhile, heavy-duty trucks will expectedly see a sharp rise in the rate of ADAS installations with the policy support, thus leaving more opportunities to Chinese suppliers of cost-efficient products.

2. Intense Competition among Suppliers with Unstable Market Structure

In the heavy-duty truck ADAS market, competition pricks up ever and the suppliers HiRain Technologies and Neusoft Reach stand in the first rank as concerns FCW and LDW installation, while Tsintel Technology, WABCO and Freetech lead the pack in AEB installations. The players in the second and third echelons, however, are striving upwards and competent enough to edge into the top list.

Viewed from installation of FCW and LDW, HiRain Technologies and Neusoft Reach temporarily occupy the first tier in 2021.

Neusoft Reach: It provides those for commercial vehicle, including ADAS all-in-one, multi-in-one products and domain controllers, which serve the clients like FAW Jiefang, Dongfeng Liuzhou Automobile, Shaanxi Heavy Duty Automobile, Foton, Daimler, JAC and Hongyan. For instance, the all-in-one ADAS product "X-Cube" of the company, offers more than 10 functions such as FCW, LDW, LKA, AEB, ACC and TJA based on its unique deep learning and computer vision technologies as well as forward cameras to help drive around different obstacles and in various complex traffic scenes, while it can provide L2+ ADAS functions by integrating with radar.

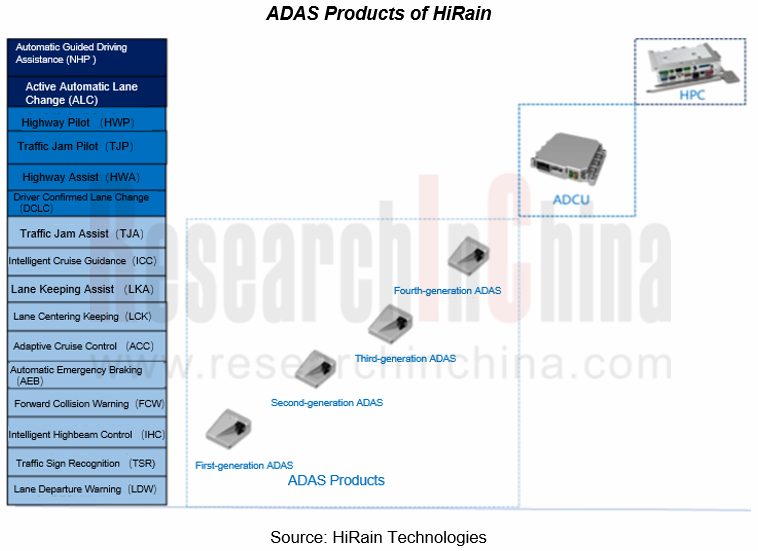

The ADAS of HiRain is built on Mobileye’s vision recognition solutions and Infineon AURIX ? platform, already undergoing four iterations since 2016, and with such merits as high integration, scalability and diverse interfaces, which can suffice for both passenger cars and commercial vehicles. HiRain has the passenger car customers encompassing FAW Hongqi, SAIC MAXUS, FAW Bestune, Roewe, MG, Geely, JMC and JAC, and its commercial vehicle clients include FAW Jiefang, Sinotruk and Shaanxi Heavy Duty Automobile.

Unlike AEB, the field of FCW and LDW availability onto commercial vehicle harbors many a player, with the possible step into the first echelon for the resourceful OEMs like Foton Zhibo and South Sagittarius Integration (SSI), and such competitors with rich technical know-how as MINIEYE and Freetech.

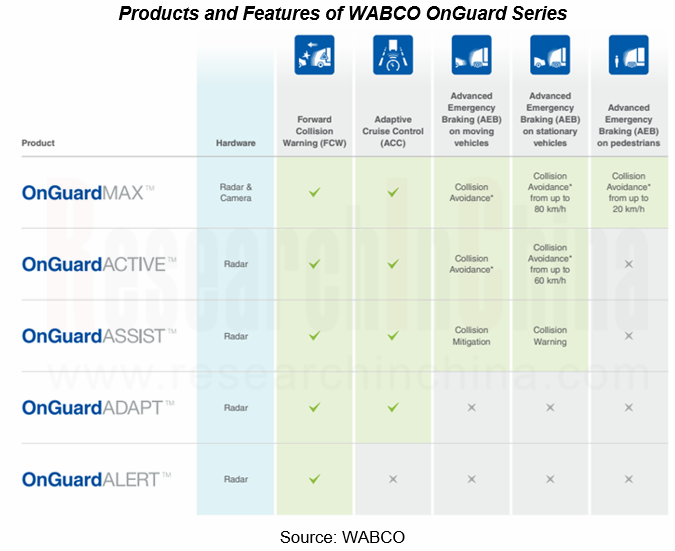

When it comes to AEB installation, WABCO, a foreign company, as well as TSINTEL Technology and Freetech, two Chinese peers, are in the first echelon.

WABCO remains superior in electronic brake, stability and suspension control systems for commercial vehicles, and it was acquired by ZF in May 2020 and combined with ZF’s former Commercial Vehicle Technology and Commercial Vehicle Control Systems (CVCS) divisions to form Commercial Vehicle Solutions (CVS), a new division of ZF in January 2022. Its ADAS system is divided into three series: OnGuard, a collision mitigation system with features such as AEB and FCW; OnLane, a lane keeping assist system, with functions like LDW and LKA; OnSide, a blind spot monitoring system with BSD typical of it. The OEMs leveraging these systems are mainly FAW Jiefang, Sinotruk, Shaanxi Heavy Duty Automobile and JMC Heavy Duty Vehicle.

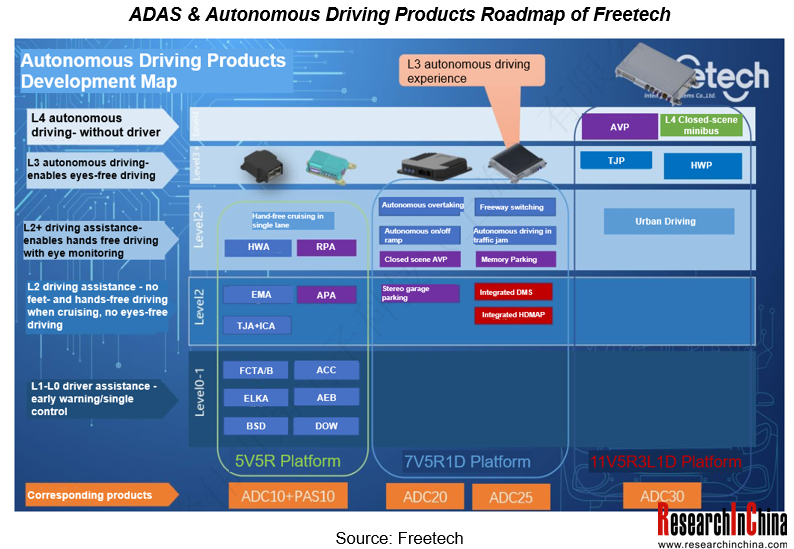

Freetech has the ability to develop full-stack technologies and system integration capabilities in ADAS hardware, software, algorithms, and integration. Based on proven L2 systems, Freetech can build mass production domain control architecture for platform-based R&D to ensure multiple product series developed in the same period and full lifecycle services. Freetech provides flexible, customizable and decoupled hardware and software services locally to OEMs, including next generation intelligent driving system platform with high performance, multiple sensor combinations covering camera, radar, assist and autonomous driving domain controller. Currently, Freetech has received the designated projects from and production cooperation with commercial vehicle makers such as Foton, Dongfeng, Shaanxi Heavy Duty Automobile, SAIC and Geely Commercial Vehicle, and it is advancing mass production for higher level of autonomy and for faster implementation.

In addition, Foton Zhibo, which is incorporated into the core technology system of Foton Motor, and Knorr-Bremse, which occupies a dominant position in the global commercial vehicle braking system, are temporarily ranked among the second echelon, but their potentials to ascend are enormous.

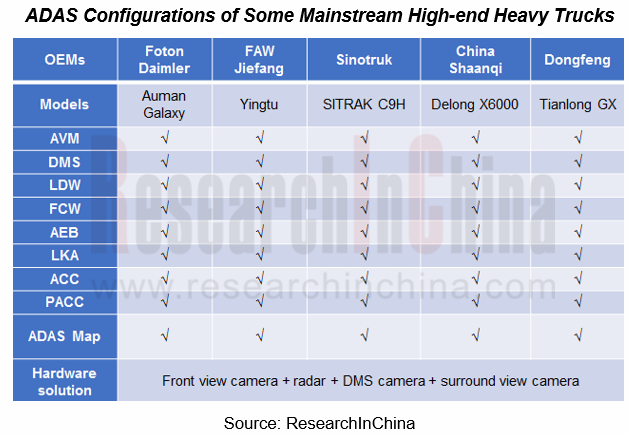

3. High-end Heavy Trucks Integrate More ADAS Features

In recent years, Chinese heavy truck manufacturers have successively deployed high-end products with state-of-the-art technologies. For example, Foton Auman Galaxy, FAW Jiefang Yingtu, Sinotruk SITRAK/Yellow River, etc., not only employ high-horsepower engines, AMT gearboxes of well-known brands and other excellent configurations, but also spare no effort to install many ADAS functions, such as LKA, ACC, PACC, etc., in a bid to achieve L2 autonomy. High-end heavy truck models can reflect the intelligence level of automakers and the strength of suppliers.

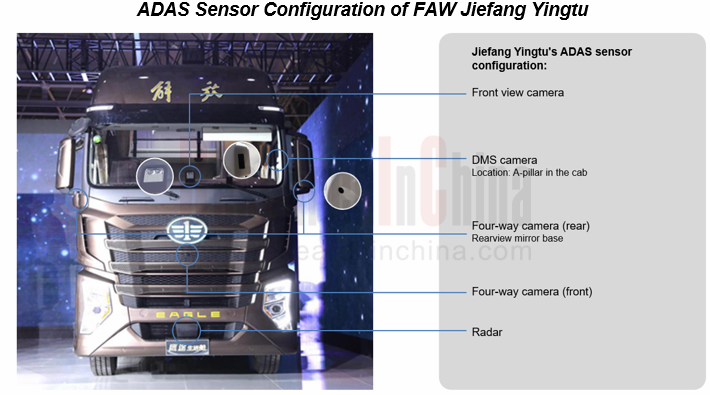

High-end heavy trucks of varied brands mainly leverage the solution of "front-view camera + radar + DMS camera + surround-view camera" to enable a variety of ADAS functions and maximize the driving experience and safety, according to the statistics from ResearchInChina.

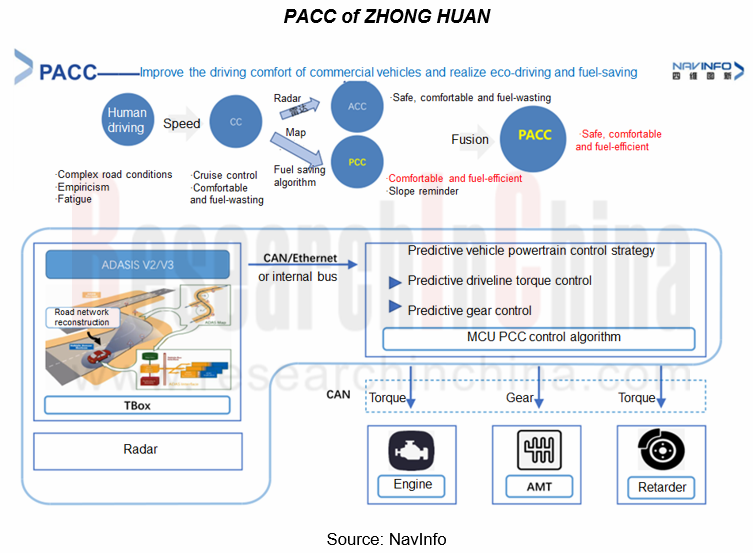

For example, FAW Jiefang unveiled a new high-end heavy truck "Yingtu" in December 2021. Based on sensors such as front-view stereo cameras, radars, and DMS cameras, it can realize AEB, ACC and other control-like ADAS functions, and also it enables PACC based on the solution of Zhonghuan Satellite.

4. Trends of ADAS for Commercial Vehicles

Trend 1: ADAS functions of commercial vehicles will increase from 2022 to 2025

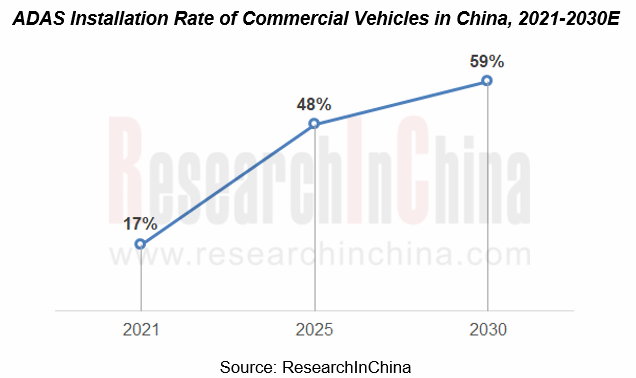

Adverse factors such as the COVID-19, the economic downturn, and the slowdown in GDP growth have impacted Chinese commercial vehicle market dramatically and dragged down ADAS shipments to some extent, but the overall upward trend remains unchanged. Driven by policies, regulations and market demand, the availability of L1-L2 will become the primary trend of ADAS for commercial vehicles in the short run. From the perspective of functions: China focused on promoting FCW, LDW and other functions in 2020 and before, advocated AEBS in 2021, and popularizes LKA in 2022.

Trend 2: Automotive sensors, domain controllers, X-by-wire systems and other technologies empower commercial vehicles

Referring to the development path of ADAS for passenger cars, technologies such as advanced environmental perception systems, control & decision-making systems, and chassis-by-wire will be gradually available onto commercial vehicles in the future.

In July 2021, Neusoft Reach launched a next-generation autonomous driving central computing platform, which supports multi-channel lidar, 16-channel high-definition cameras, radar, and ultrasonic to attain 360° perception redundancy of the whole vehicle. It can provide L3/L4 autonomous driving functions. The central computing platform is based on the open SOA and the basic software NeuSAR developed by Neusoft Reach. It enables the discovery and subscription of autonomous driving functions after the vehicle is launched, and provides OEMs with a perfect development environment and tool chains for secondary customization of self-driving applications, so that customers can rapidly develop differentiated products to form distinct competitive edges and perform self-training over the cloud to evolve by themselves in the full lifecycle of the autonomous driving system.

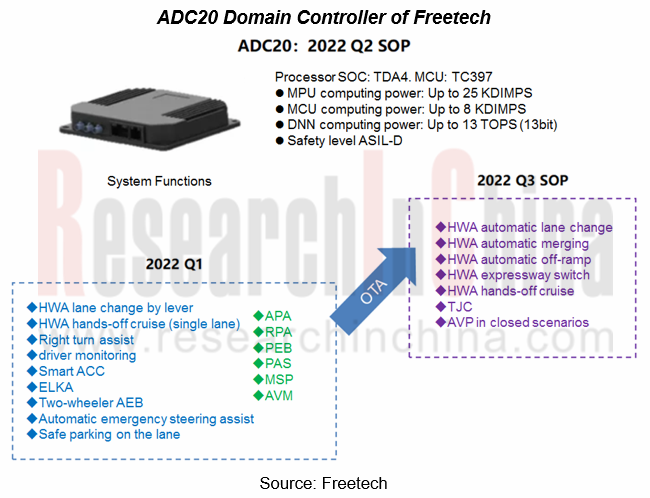

Freetech has rolled out three generations of ADAS domain control products that meet the market demand, including ADC20, ADC30 and ADC40, so as to satisfy full-stack intelligent driving solutions and the future L2-L4 autonomous driving scenarios. Particularly, ADC20 integrates driving domain controllers, parking domain controllers and DMS controllers to bring high-level ADAS functions into full play such as highway driving assist and navigation, fit for cost-sensitive commercial vehicles (light, medium and heavy trucks). Freetech’s ADC20 is compatible with low-configuration 1V1R, medium-configuration 1V3R, and high-configuration 5V5R. Cost-effective driving and parking integrated solutions provide worthwhile intelligent driving experience for fuel vehicles, medium and low-end models.

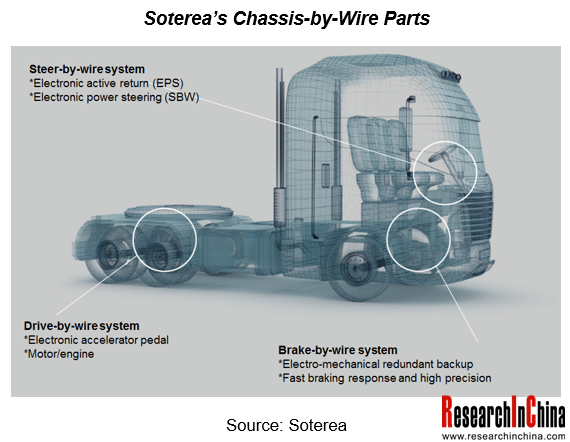

Based on the data accumulation in the aftermarket and the established chassis-by-wire products such as throttle-by-wire, steer-by-wire and brake-by-wire, Soterea works hard on "intelligent chassis-by-wire solutions".

Trend 3: PACC based on ADAS map has been a trump sought after by commercial vehicle manufacturers for saving fuel

Some data show that fuel costs account for 35% of the Total Cost of Ownership (TCO) of commercial vehicles. How to reduce fuel consumption has become a common concern for both suppliers and purchasers of commercial vehicles. At the end of 2020, China proposed the goal of having CO2 emissions peak before 2030 and achieve carbon neutrality before 2060. It is imperative for commercial vehicles, as a major fuel consumer and carbon emitter, to improve fuel efficiency and reduce fuel consumption. PACC (Predictive Adaptive Cruise Control) has apparent advantages in fuel saving and driving safety, so that it has become a technology sought after by OEMs.

Based on ADAS maps and ACC, PACC secures the information about the road ahead, such as slope, curvature and speed limit, then performs terrain matching, and controls the engine and gearbox pursuant to the optimal algorithm, hereby controlling the speed, gear, etc. as best as it can. The data from China Satellite Navigation and Communications Co., Ltd. (Zhong Huan) indicate that PACC can save fuel by 4%-8%.

PACC is mostly seen in many high-end heavy truck models as it requires the vehicle be equipped with ACC and ADAS map connectivity, but PACC will find more application in more models with advances in technology and cost reduction.

Trend 4: The integrated solution of ADAS+DMS prevails

Rationally reducing the vehicle cost while taking the policy into account and integrating "ADAS+DMS" as a packaged solution for marketing win popularity.

The policies of many provinces about “tourist chartered buses, buses between non-adjacent counties, and special road vehicles for transporting dangerous chemicals, fireworks, firecrackers and civilian explosives” emphasize DMS as a mandatory function for many commercial vehicles and operating vehicles. (In 2018, Jiangsu Province issued relevant documents on “tourist chartered buses, buses between non-adjacent counties, and special road vehicles for transporting dangerous chemicals, fireworks, firecrackers and civilian explosives”, indicating that "the above mentioned vehicles with the "Road Transport Certificate" should be installed with the active safety intelligent prevention and control system before December 31, 2020 and be connected to the government supervision platform. Besides, the configuration of was stressed.”)

For equipment vendors of ADAS integration solutions, a single DMS solution has meager profit. Integrating some ADAS functions with DMS device can further raise product premiums and yield more profits; at the same time, they can also provide one-stop services for automakers to help the latter slash time and testing costs.

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...