Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more important

L2.5 and L2.9 have achieved mass production for vehicles running on the road, and mass production of L3 and L4 in limited scenarios has become a goal for OEMs in the next stage. In March 2022, the U.S. National Highway Traffic Safety Administration (NHTSA) issued final rules eliminating the need for automated vehicle manufacturers to equip fully autonomous vehicles with manual driving controls to meet crash standards. The United States is expected to introduce more important policies for autonomous driving in the future to guide L3/L4 autonomous driving on the road.

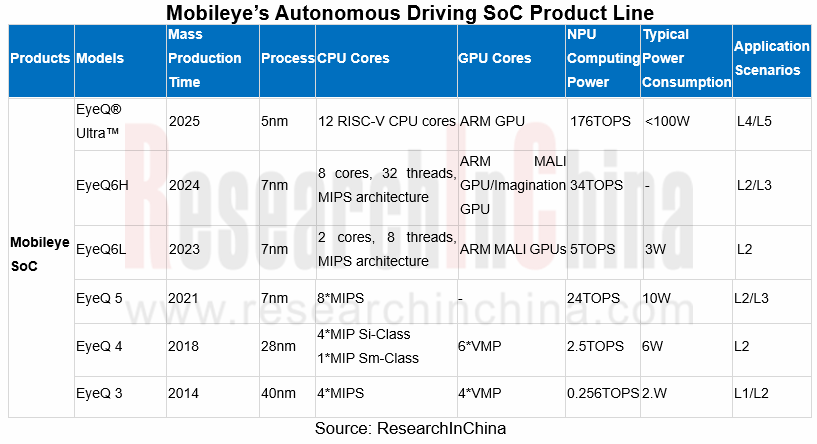

In this context, ADAS/autonomous driving chips have seen a wave of upgrades, and many chip makers have launched or planned to unveil high computing power chips. In January 2022, Mobileye introduced the EyeQ? Ultra?, the company’s most advanced, highest performing system-on-chip (SoC) purpose-built for autonomous driving. As unveiled during CES 2022, EyeQ Ultra maximizes both effectiveness and efficiency at only 176 TOPS, with 5 nanometer process technology. Although it looks less potent than chips from rivals Qualcomm and NVIDIA, the cost-effective and high-energy-efficiency EyeQ? Ultra? may still be favored by OEMs.

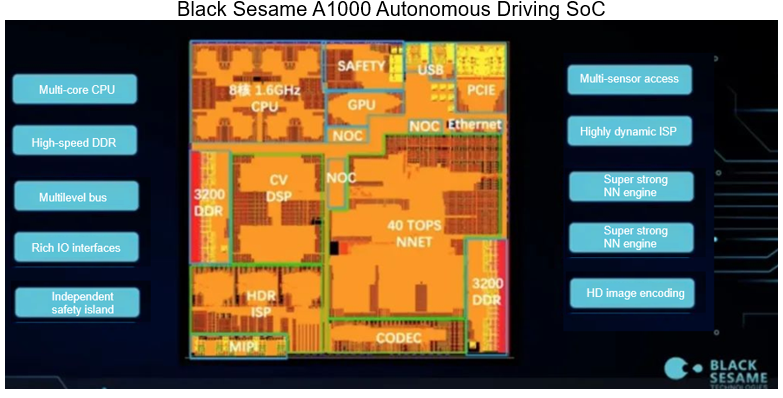

In addition to computing power, self-developed core IP is the focus of competition for major SoC vendors

SoC chips, which are mostly involved with heterogeneous design, include different computing units such as GPU, CPU, acceleration core, NPU, DPU, ISP, etc. Generally speaking, computing power cannot be simply evaluated from the chip alone. Chip bandwidth, peripherals, memory, as well as energy efficiency ratio and cost should be also taken into account. At the same time, the development tool chain of SoC chips is very important. Only by forming a developer ecosystem can a company build long-term sustainable competitiveness.

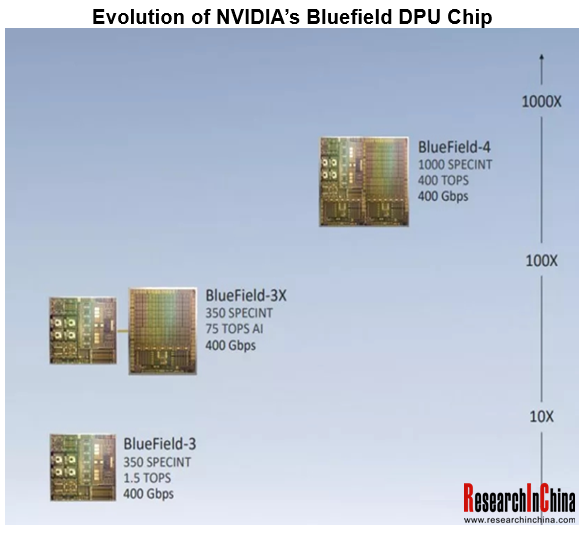

In chip design, the configuration of heterogeneous IP is crucial, and autonomous driving SoC chip vendors are constantly strengthening the research and development of core IP to maintain their decisive competitive edges. For example, NVIDIA upgraded its existing GPU-based product line to a three-chip (GPU+CPU+DPU) strategy:

? GPU: NVIDIA enjoys superiority in GPU and image processing derived from GPU;

? DPU: NVIDIA announced the completion of its acquisition of Mellanox Technologies, Ltd., an Israeli chip company, for a transaction value of $7 billion and launched the BlueField?-3 data processing unit (DPU). DPU is a programmable electronic component with the versatility and programmability of a central processing unit (CPU), dedicated to efficiently handling network data packets, storage requests or analysis requests;

? In terms of CPU, NVIDIA intended to acquire the semiconductor IP semiconductor ARM as an extension of its three-chip strategy, but it failed in the end. However, NVIDIA launched the Grace? CPU, an Arm-based processor that will deliver 10x the performance of today’s fastest servers on the most complex AI and high-performance computing workloads. NVIDIA's next-generation SOC, Atlan, is based on the ARM-based Grace CPU and Ampere Next GPU.

In terms of domestic vendors, Black Sesame Technologies has launched self-developed NeuralIQ ISP and DynamAI NN engine which is a deep neural network algorithm platform.

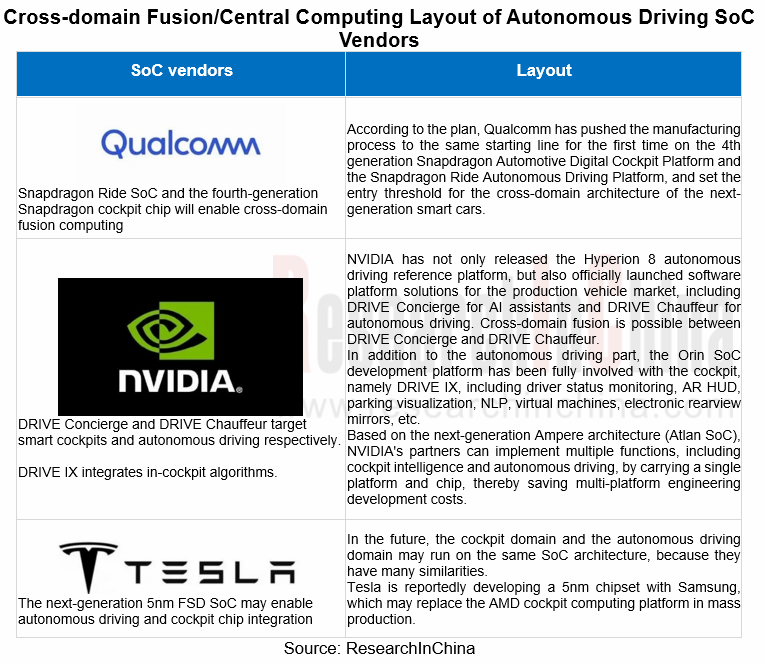

Cross-domain fusion and central computing platform chips will lead the evolution of the automotive EEA

Amid the evolution trend of the automotive EEA: "distributed architecture - domain centralized architecture - cross-domain fusion architecture - central computing platform", Tesla's latest version of Model X has achieved a certain degree of central cross-domain fusion computing. Model X's automotive central computing platform includes two FSD chips, an AMD Ryzen CPU chip and an AMD RDNA2 GPU. The FSD chip and AMD CPU/GPU chip communicate through the PCIe interface and are isolated from each other.

Integrating multiple chips such as CPU, GPU, and FSD into one SoC chip through Chiplet technology will further reduce the chip communication delay. Tesla has reportedly partnered with Samsung on a new 5nm chip for autonomous driving and cockpit SoC chip integration.

The industry’s giants like NVIDIA and Qualcomm have all begun to implement cross-domain integration of autonomous driving and cockpits. For example, NVIDIA has launched DRIVE Concierge and DRIVE Chauffeur for smart cockpits and autonomous driving respectively. DRIVE IX can realize the fusion of algorithms in the cockpit. Based on the powerful software stack tools, NVIDIA's next-generation Ampere architecture (Atlan SoC) will conduct the simultaneous control over autonomous driving and intelligent cockpit with a single chip.

In February 2022, Chinese SoC company Horizon Robotics announced that it will cooperate with UAES to preinstall and mass-produce cross-domain integrated automotive computing platforms.

SoC vendors accelerate the layout of autonomous driving AI data training

Autonomous driving datasets are critical for training deep learning models and improving algorithm reliability. SoC vendors have launched self-developed AI training chips and supercomputing platforms. Tesla has launched the AI training chip D1 and the "Dojo" supercomputing platform, which will be used for the training of Tesla's autonomous driving neural network.

Besides, training algorithm models are becoming more and more important, including 2D annotation, 3D point cloud annotation, 2D/3D fusion annotation, semantic segmentation, target tracking, etc., such as the NVIDIA Drive Sim autonomous driving simulation platform, the Horizon Robotics "Eddie" data closed loop training platform, etc.

Foreign chip vendors:

? Tesla has launched Dojo supercomputing training platform, using Tesla's self-developed 7nm AI training chip D1 and relying on a huge customer base to collect autonomous driving data, so as to achieve model training for deep learning systems. At present, Tesla Autopilot mainly uses 2D images + annotations for training and algorithm iteration. Through the Dojo supercomputing platform, Autopilot can fulfill training through 3D images + time stamps (4D Autopilot system). The 4D Autopilot system will be predictable, and mark the 3D movement trajectory of road objects to enhance the reliability of autonomous driving functions.

? NVIDIA has announced NVIDIA Omniverse Replicator, an engine for generating synthetic data with ground truth for training AI networks. NVIDIA also has the most powerful training processor - the NVIDIA A100.

? The map data of Mobileye's REM has covered the world. In China, Mobileye has solved the compliance problem of map data collection in China through a joint venture with Tsinghua Unigroup. Intel acquired Moovit to enhance the strength and data differentiation of REM, extend the traditional HD map data from the roadside to the user side, start from the perception redundancy of assisted autonomous driving and improve the efficiency of path planning. Intel launched its self-developed flagship AI chip - Ponte Vecchio, which will spread to Mobileye's EyeQ6 (planned for mass production in 2023). In the field of AI and servers, Intel will challenge Nvidia with CO-EMIB technology.

Domestic chip vendors:

? In order to solve the long-tail problem of autonomous driving, Horizon Robotics has built a complete data closed-loop platform to iterate algorithms and improve system capabilities. Horizon Robotics has launched the "Eddie" data closed loop training platform.

? Huawei has introduced "Octopus" autonomous driving open platform, focusing on the four most critical elements of autonomous driving development - hardware, data, algorithms and HD maps to build a data-centric open platform which prompts closed-loop iterations of autonomous driving. Huawei's Ascend 910 competes with the NVIDIA A100 as the world's top AI training chip. Huawei has also launched the AI training cluster Atlas 900.

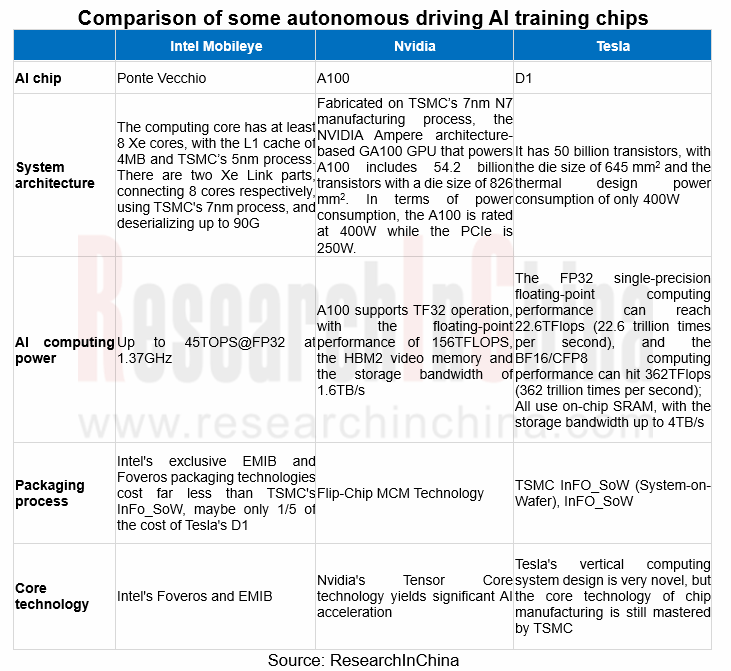

The world's leading autonomous driving AI training chips include: Intel Ponte Vecchio, NVIDIA A100, Tesla D1, Huawei Ascend 910, Google TPU (v1, v2, v3), Cerebras Wafer-Scale Engine, Graphcore IPU, etc.

Passenger Car Digital Chassis Research Report, 2026

Research on Digital Chassis: Leading OEMs Have Completed Configuration of Version 2.0 1. Leading OEMs Have Completed Configuration of Digital Chassis 2.0

By the degree of wired control of each c...

Vehicle Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2026

Multiple Mandatory Standards for Intelligent Vehicles in China Upgrade Functional Safety Requirements from Recommended to Mandatory Access Criteria In 2026, China has intensively issued and promo...

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...