Automotive voice market: The boom of self-research by OEMs will promote reform in the supply mode

Before the advent of fully automated driving, the user focus on driving, and voice interaction is still the most convenient and safest interaction mode in vehicles.

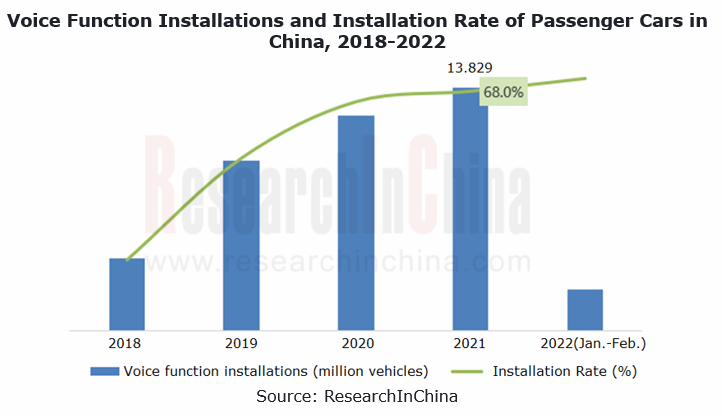

In 2021, over 13 million passenger cars in China carried voice feature, with a year-on-year increase of 13% and an installation rate of 68%. The market bore a rapid bullish trend.

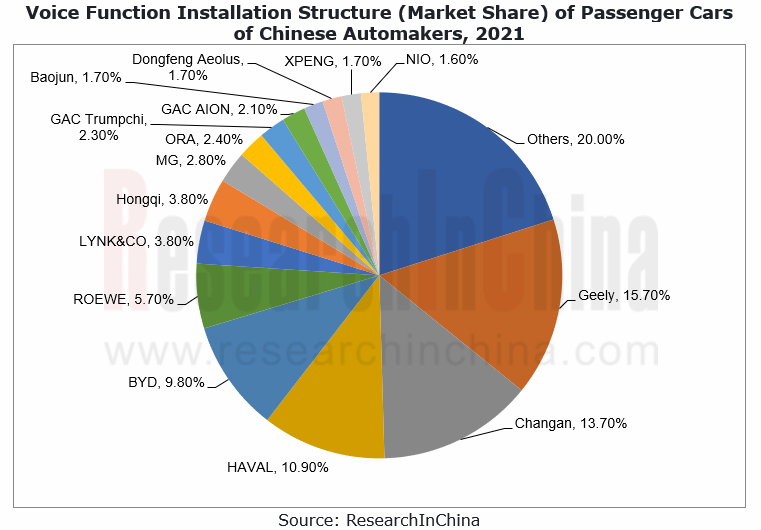

In 2021, more than 5.5 million vehicles of Chinese automakers were outfitted with voice feature, a year-on-year spike of 40.4%. Among the top four brands, BYD saw the voice installations soar by 151% on an annualized basis, and Haval’s rose 53% from a year earlier.

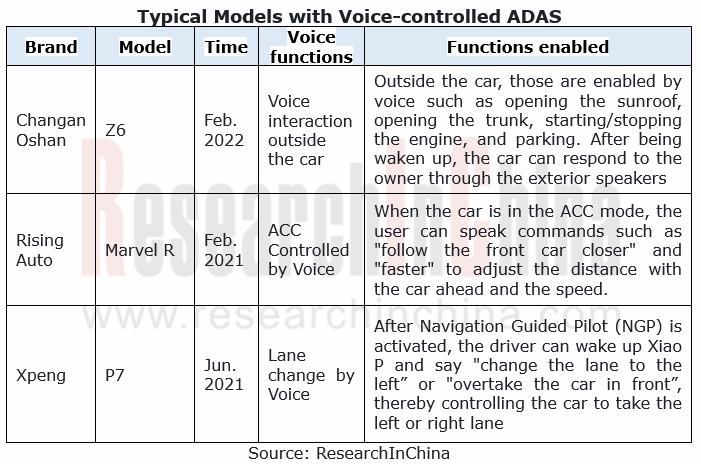

From IVI software to ADAS, voice-enabled functions continue to evolve

In terms of functionality, what is controlled by voice ranges from IVI software (music, navigation, etc.) to hardware (like seats, air conditioner), power systems (such as driving modes), and to ADAS (like ACC control). With more and more automotive interfaces, voice can control lane change, adaptive cruise, and parking.

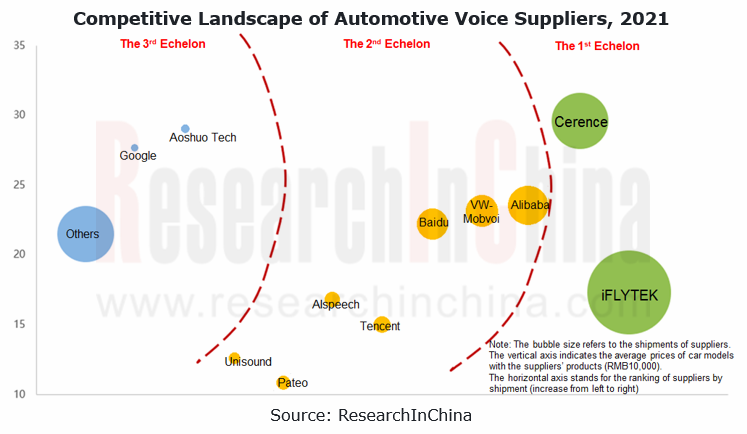

iFLYTEK and Cerence are the top two leaders

Among suppliers, iFLYTEK and Cerence are in the first echelon, together sweeping more than 70% market shares.

iFLYTEK shipped more than 7 million sets of voice products in 2021, a figure projected to outnumber 9 million sets in 2022 still as the largest supplier in the market.

iFLYTEK mainly serves Chinese carmakers, and the average unit price of models supported ranges from RMB150,000 to RMB200,000. In the OEM market, iFlytek’s voice products have been available in excess of 36 million vehicles, being merited as follows:

? iFLYTEK has delved in the automotive field for 19 years as the industry’s leader in multilingual automatic speech recognition (ASR), text-to-speech (TTS) and other technologies;

? The Feiyu (flying fish) system for automakers employs a software and hardware platform design, which can be reused by multiple models and be introduced rapidly to vehicle models with varying market targets, prices and configurations.

With superiorities in AI expertise, data accumulation as well as the software and hardware platforms that can offer custom-made services, iFLYTEK has become a heavyweight in the automotive voice industry. But other rivals should not be underestimated, especially Cerence (separated from Nuance, a world-renowned giant in intelligent voice).

In 2020, Geely’s China Euro Vehicle Technology (CEVT) and Great Wall Motor's strategic partner Bean Tech announced to select Cerence ARK to develop automotive voice assistants. NIO also proclaimed to introduce Cerence’s voice technology. Prior to this, these brands were all customers of iFLYTEK.

Cerence ARK is an end-to-end AI-powered automotive assistant solution that integrates interactive voice AI technologies such as environment-adaptive voice signal enhancement, custom wake-up words, random interruption of dialogue, multi-intent semantic understanding, wake-up-free multi-round dialogue, and cross-domain dialogue in support of context understanding. Cerence ARK is a turnkey automotive product that enables automakers to quickly develop, deploy and manage a fully localized automotive voice assistant.

In addition, Cerence supports more than 70 languages around the world, making it the best choice for Chinese brands to go overseas. Automakers such as SAIC, Geely, Wuling Motors, NIO and Hongqi have all used Cerence's voice technology in their overseas models.

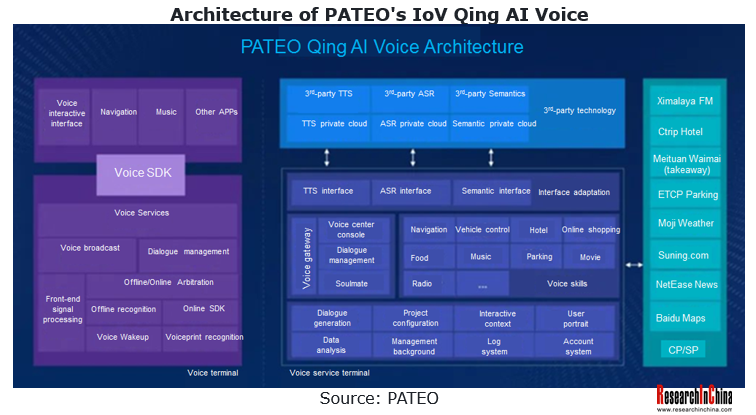

In addition to iFLYTEK, Cerence and the like that can provide OEMs with full-chain voice capabilities, some other suppliers provide a platform that can access the voice capabilities of all companies to satisfy customers who want to "enjoy the benefits of all players". PATEO's IoV Qing AI voice platform is just a reliable choice.

PATEO Qing AI is a voice platform with pluggable capabilities, which supports the access to ASR, NLU, and TTS capabilities of multiple enterprises, provides different voice services to different projects and models, freely configures functions, increases or decreases skills, and facilitates quick application. The platform favors a variety of integration methods of different systems (such as Linux and Android) and different terminals (vehicle and mobile phone).

At present, PATEO's Qing AI voice platform has been connected to the voice capabilities of Cerence, Baidu, AIspeech and iFlytek. It enables full-duplex voice interaction, multi-round dialogue, deep contextual memory and understanding, wake-up-free, “what you see is what you can say”, voice source positioning, voiceprint recognition, voice cloning and other functions. It has been seen in FAW VW, Dongfeng Motor, Wuling Motors (Silver Badge), BEIJING Auto, Geely, etc. The PATEO voice product carried by Voyah FREE supports four-tone-zone voice recognition, multi-round dialogue, navigation, music, car control, and “what you see is what you can say about setting interfaces”, greetings and other functions.

No matter how much suppliers offer, it cannot compete with the lucrativeness brought by "mastery of the core data"

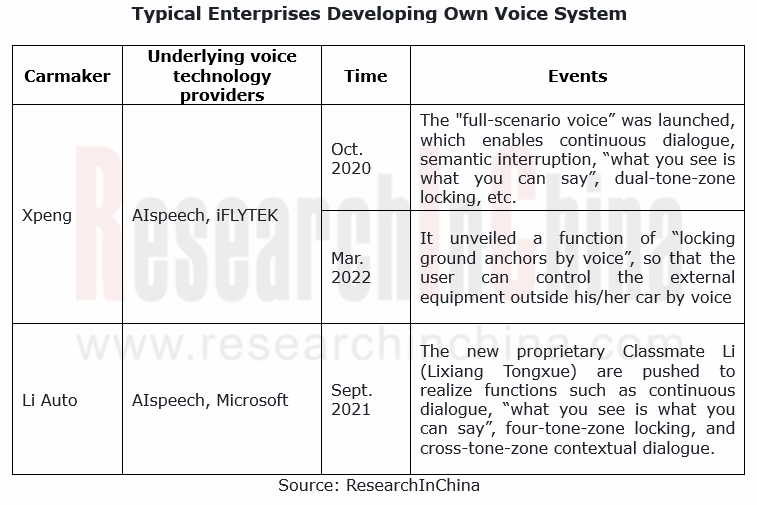

Although the solution packages of suppliers are fine, OEMs want more in terms of function differentiation, security guarantee of open automotive interfaces, quick response of OTA and user data. The OEMs represented by Xpeng and Li Auto have adopted the development model of "introducing the underlying technology of suppliers and developing their own voice system".

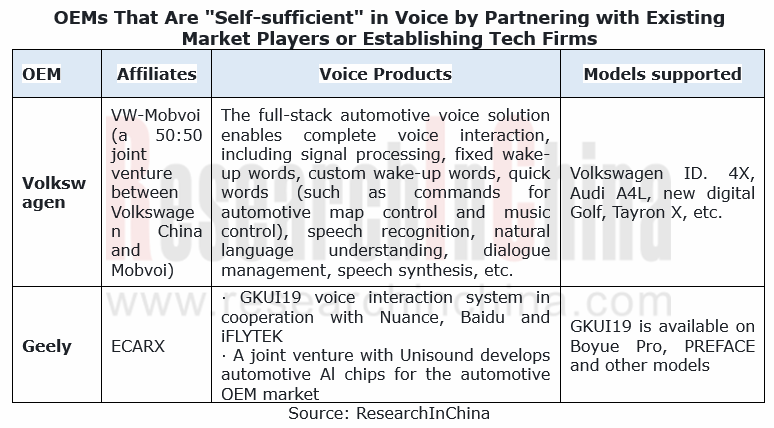

Like Xpeng and Li Auto vigorously developing voice on their own, Volkswagen, Geely, Great Wall Motor, etc. are sparing no efforts in self-developed voice by setting up subsidiaries.

In a nutshell, the mode of traditional OEMs applying suppliers’ solution packages has quietly transferred to the in-depth cooperation between OEMs (with more detailed needs) and technology providers (responsible for delivery). OEMs are not only demanders, but also technology suppliers and system integrators in the voice supply chain. For traditional voice suppliers, the "reform" has kicked off.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...