Global and China Purpose Built Vehicle (PBV) and Robocar Report, 2022

PBV and Robocar research: new idea of building brick cars, a new car type for future mobility

Building brick cars moves the cheese of traditional OEMs.

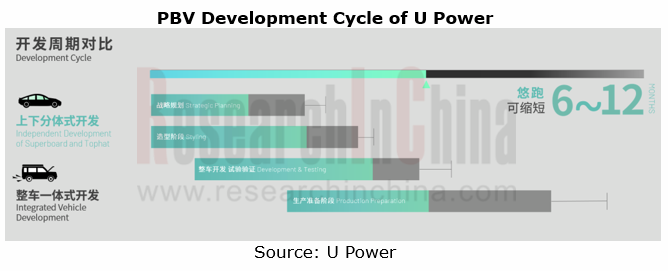

Purpose built vehicle (PBV) refers to special purpose vehicles based on small/medium-sized van or multi-box van. PBV suppliers adopt the approach of independent development of upper and lower vehicle bodies, and derive various vehicle types on the same chassis platform, meeting customization needs. Compared with conventional integrated vehicle development, such a development method has unique features below:

? Short development cycle and low cost

PBVs built on the same chassis don’t need repeated development, which shortens the start-of-production and time-to-market of new models. The standardized chassis components can also be reused, reducing manufacturing costs.

For example, the use of "UP Super Board" developed by Shanghai U Power Technology Co., Ltd. cuts down the orignal 2 or 3 years of vehicle R&D cycle to 12 months, and the R&D costs by up to 60%.

? Diversified PBV product forms

The flexible and changeable upper space of PBV allows a variety of product forms. For example, a PBV can be a logistics vehicle, a retail vehicle, a car, a bus, a sanitation vehicle, and so forth.

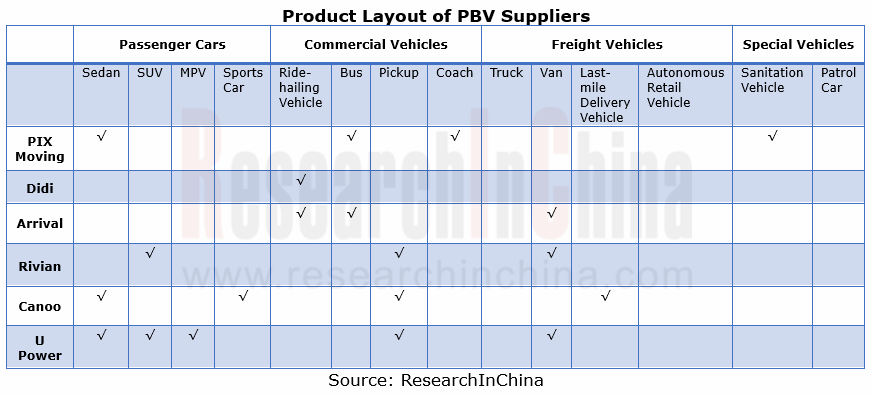

From the product layout of PBV suppliers, it can be seen that the product forms of PBV are led by three vehicle types: van, pickup and sedan. Wherein, PIX Moving enjoys the broadest range of product forms, involving four fields: passenger car, commercial vehicle, freight vehicle and special vehicle; U Power boasts the most abundant PBV product lineups and deploys five vehicle types, covering three fields: passenger car, commercial vehicle, and freight vehicle; with single PBV product form, Didi has only one product, D1, a customized car for the online ride-hailing mobility scenario. Didi plans to iterate a version every 18 months, to D3 in 2025 when 1 million units will be launched; and to remove the cockpit and realize autonomous driving in 2030.

? Diversified PBV profit models

Through the lens of business models, PBV suppliers often apply the To B model. Among them, PIX Moving, Arrival and Rivian employ both To B and To C models. For instance, PIX Moving starts with Robobus at the business end in a bid for quick commercialization, and will build a complete marketing system after launching consumer products.

As for manufacturing, all suppliers except for Didi have their own production bases. Didi partners with BYD to produce D1 at BYD’s base in Changsha city. In June 2021, Canoo started building a production line in Oklahoma, the US, and ceased the outsourcing contract with VDL Nedcar, opting to build cars by itself.

There are mainly three profit models: vehicle sales, rental, and software subscription & other value-added services. Didi and Arrival apply the rental model, but their rental schemes are different. Didi offers two rental schemes that target Didi drivers: half-year rental, with a monthly rent of RMB4,399; one-year rental, RMB4,299 per month. Arrival, however, aims at third-party lessors such as LeasePlan (in 2021, Arrival and LeasePlan signed a sales cooperation agreement for 3,000 vans). For profits, the supplier Canoo has begun to take into account both the subscription and vehicle sales models.

Is Robocar the ultimate form of PBV products?

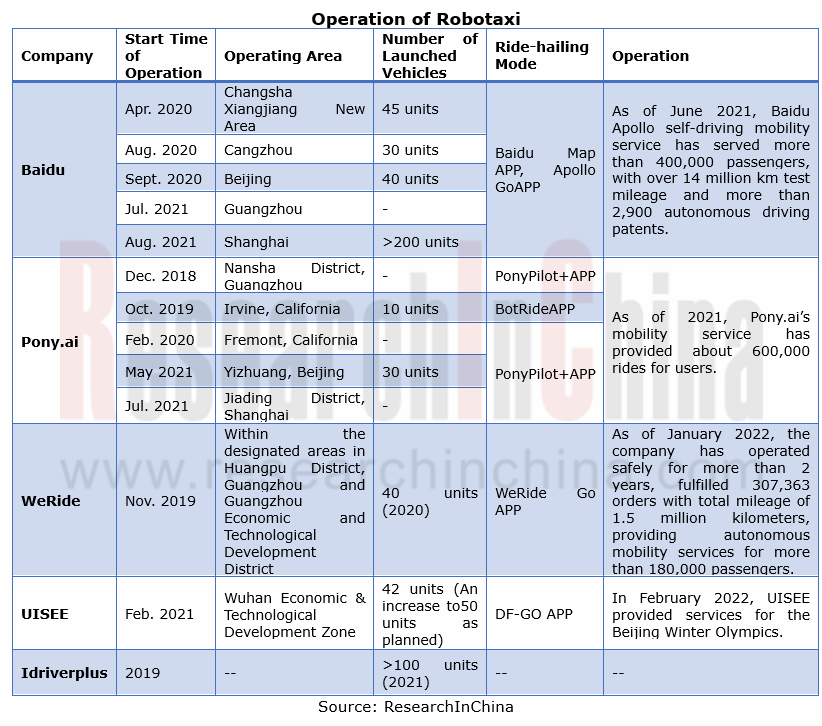

The new idea of building brick cars gives birth to diversified vehicle forms, including Robocar, a robot that looks like a vehicle, can move freely and is capable of L4 autonomous driving. The product forms of Robocars are led by Robotaxi and Robobus. At present, Robotaxies built by Baidu, Pony.ai, QCRAFT and the like have begun to run. In the future, Robocars will also be upgraded to L5 autonomy, competent enough to self-learn, make decisions independently, and adapt to a variety of complex scenarios and inclement weather like rain and fog, and they will completely replace humans by then.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...