Automotive Software Providers and Business Models Research Report, 2022

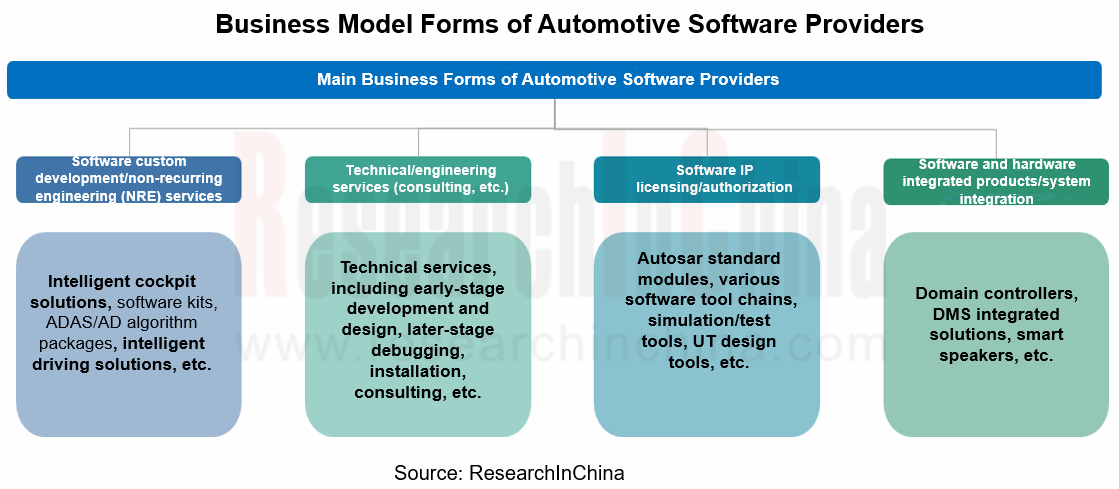

Research on software business models: four business forms and charging models of automotive software providers.

In an age of software-defined vehicles, automotive software booms, and providers step up their efforts to deploy various layers of software for a place in the software market. From the current layout of automotive software products and solutions, it can be seen that intelligent vehicle software business models include IP, solutions and technical services, and charging models are led by non-recurring engineering (NRE), software authorization/license, and royalty.

Through the lens of the product and solution layout of automotive software providers, currently their typical business forms are custom software development and design, technical services, software license/authorization, and system integration, varying slightly in charging models.

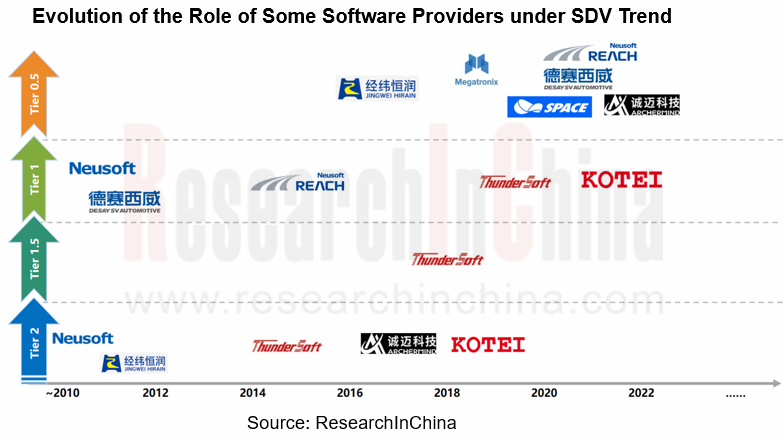

As software and hardware tend to be decoupled and layered, software becomes an independent core component product, and the automotive software industry chain is reshaped. The boundaries between Tier 1 and Tier 2 suppliers thus become ever more blurred, and even OEMs will develop their own hardware and software. Automotive software providers are transforming from Tier 2 into Tier 1 or even Tier 0.5 suppliers, with an increasingly high position in the industry chain.

The supply relationships between suppliers and automakers are changing as well. The conventional automotive supply chain has been broken, and the original chain-type "supply" model turns into a flat "cooperation" model. Players that have the ability to develop and integrate software and hardware are expected to become super suppliers, driving innovations and technology upgrades in the automotive industry.

Basic software layer: in the trend for modularization, standardization and platformization, suppliers and OEMs build closer relationships and more flexible cooperation models.

In service-oriented architecture (SOA), automotive basic software is an embedded software platform used to enable decoupling of software and hardware for automotive systems, and providing software and hardware support for automotive system services. It is the key to realization of vehicle intelligence.

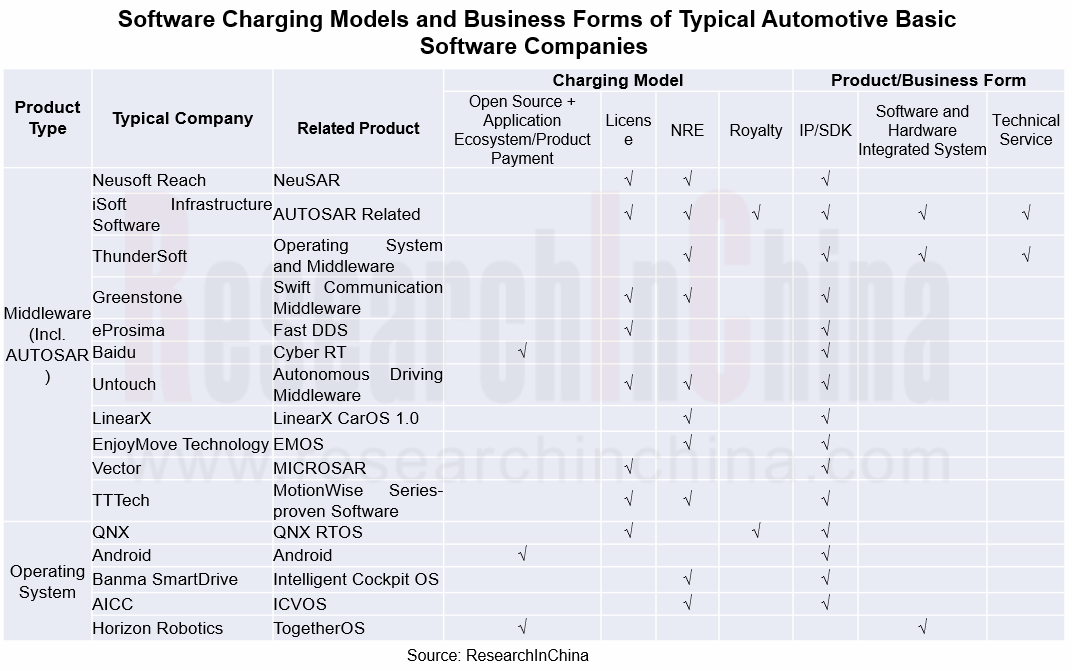

In addition to chip and hardware, basic software is the most basic underlying capability in the entire industry chain. Major suppliers double down on development and innovation of automotive basic software products such as operating system and middleware. As well as large foreign providers such as Vector, ETAS and EB, quite a few local software providers in China like Neusoft Reach, ThunderSoft, Jingwei Hirain, and iSoft Infrastructure Software under China Electronics Technology Group Corporation are also working to deploy automotive basic software products, especially middleware products, most of which are AUTOSAR standard-compliant products, and hybrid platform software solutions based on CP and AP architectures.

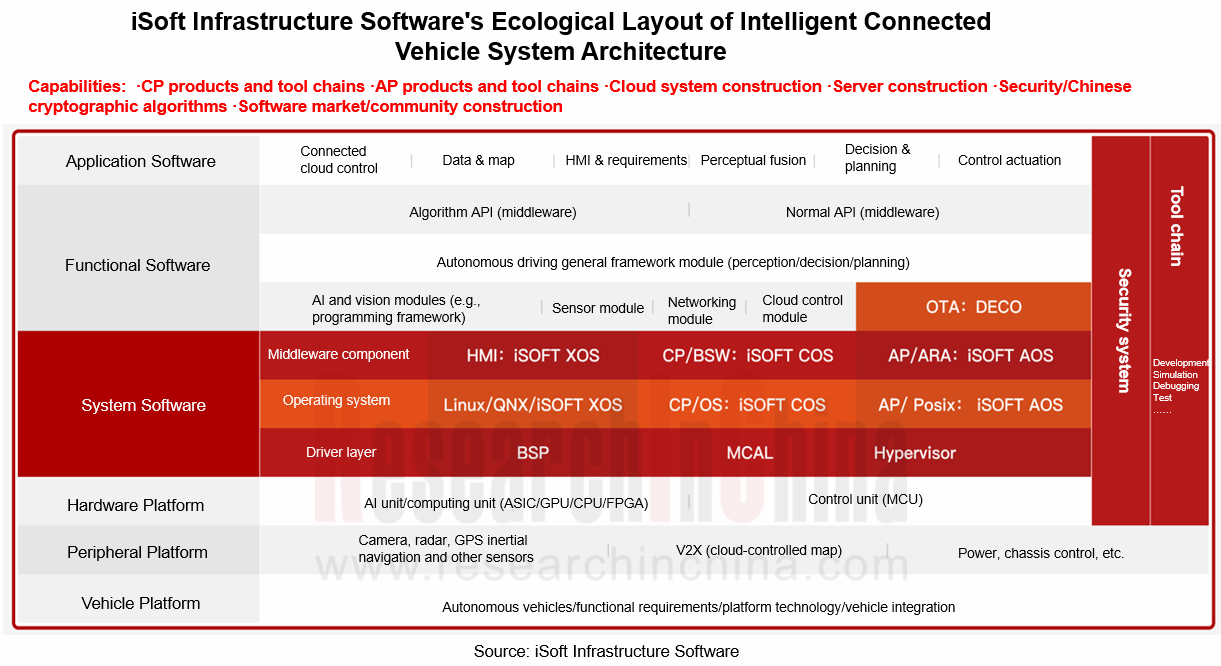

To meet the market demand in the trend for SDVs, iSoft Infrastructure Software provides AUTOSAR CP+AP integrated solution for the two scenarios, security domain and high-performance computing domain, and combines it with iSoft Cloud System to enable landing of intelligent connectivity. This solution is applicable to intelligent cockpit domain, vehicle control system domain and ADAS/AD domain. By standardizing the interfaces and architectures of different operating systems, underlying hardware, protocol software, etc., it enables service-oriented architecture. Meanwhile, for intelligent cockpit and ADAS/AD domains, iSoft Infrastructure Software is developing corresponding operating system kernels for a comprehensive layout of automotive basic software platform.

As concerns business model, iSoft Infrastructure Software positions itself as a Tier 2 supplier that adopts a model similar to VECTOR and concentrates on developing and applying basic software and tool chains. The "neutral" position allows the company to focus more on the R&D and application of vehicle basic software technology.

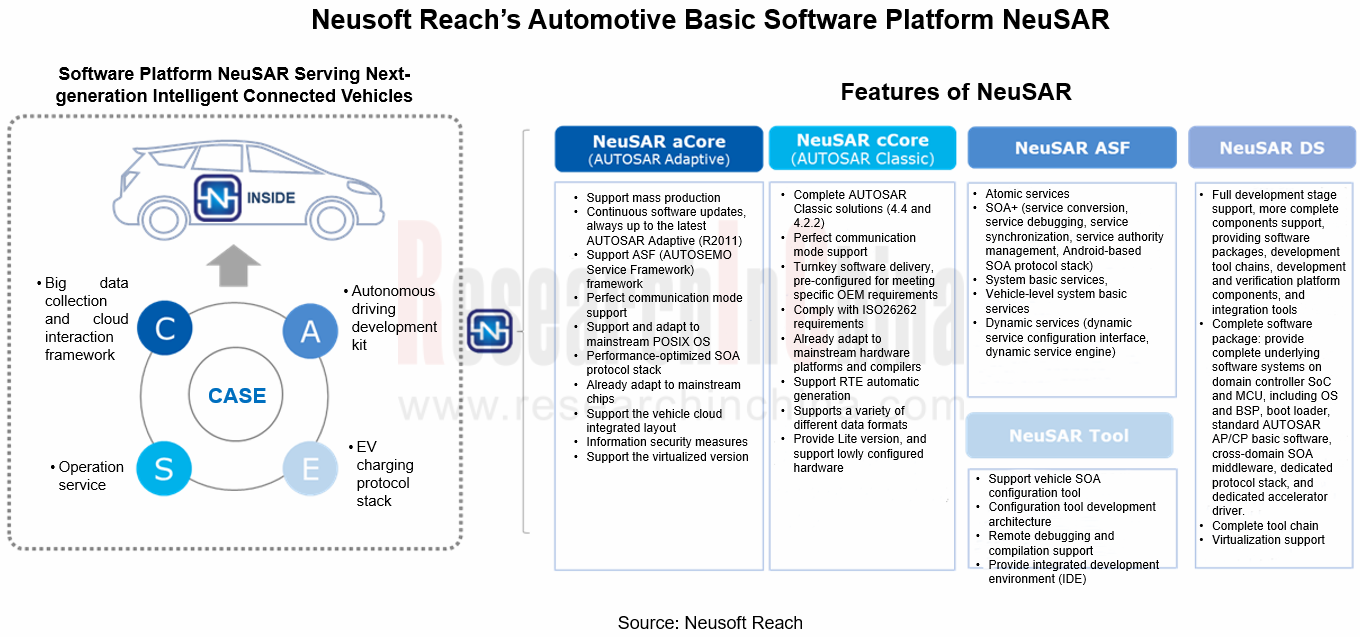

In 2018, Neusoft Reach introduced NeuSAR, China’s first self-developed automotive basic software platform product which complies with the latest AUTOSAR release. NeuSAR not only supports conventional ECU development but provides a wealth of basic software, middleware and development tools for software development based on domain control systems in new-generation E/E architectures. It is widely used in domain control systems such as autonomous driving, intelligent driving, chassis power, and body control in new-generation architectures, providing underlying software support for more personalized and intelligent application of the next-generation intelligent vehicles.

NeuSAR is composed of NeuSAR cCore, NeuSAR aCore, NeuSAR middleware, NeuSAR DS and NeuSAR tool chain. NeuSAR cCore subject to the latest AutoSAR Classic standard finds broad application in mass-produced ECUs of OEMs and many Tier 1 suppliers; NeuSAR aCore, the world's first commercialized AutoSAR Adaptive product, has been spawned and used in multiple autonomous driving domain controllers. The high compliance with the existing standards and the stability built through wide application make NeuSAR the preferred local AutoSAR product in the industry.

In 2020, under the guidance of Ministry of Industry and Information Technology, Neusoft Reach led the establishment of China Automotive Basic Software Ecosystem Committee (AUTOSEMO), aiming to help to create an independent controllable automotive basic software ecosystem.

In the trend for "software-defined vehicles", automotive software industry will usher in layering and modularization, and a number of professional middleware module suppliers will be born. It is hard for automakers to complete R&D of full-chain software modules. OEMs will purchase software and hardware separately, and select hardware (chips) according to vehicle model position and price planning. They will also partner with basic software companies, mainly operating system and middleware providers, to build software architecture and adapt to chips.

Application software layer: to answer differentiated and individualized needs, conventional suppliers transform the development model from turnkey solution into bilateral in-depth cooperation.

Based on SOA (service-oriented architecture), the business model of SaaS (Software as a Service) is introduced. On the one hand, it provides users with an immersive entertainment space to meet their needs for emotional, personalized scenes and multimodal interaction. On the other hand, it offers self-development space to OEMs, creating infinite possibilities.

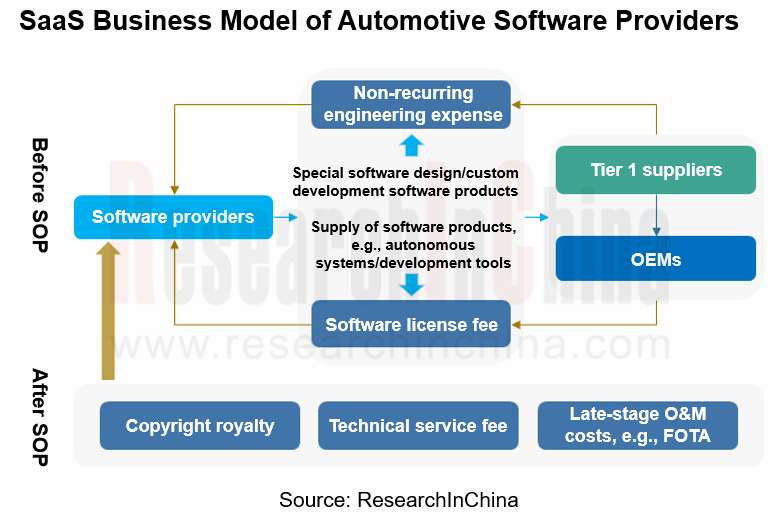

First of all, before mass production, automotive software revenue largely comes from non-recurring engineering project development fee and software license fee. Non-recurring engineering project development fee is that charged during development process from the special software design and custom development according to requirements of Tier 1 suppliers or OEMs to the final delivery of development results to customers. Software license fee is charged for the use of software products (systems or development tools) developed by software companies.

After mass production, the software charging model will turn into "royalty fees", "technical service fees" and FOTA-based software upgrade fees. Wherein, the royalty fees are the single vehicle copyright fees charged according to the number of functional module IPs used by customers, and the shipments.

For automotive software companies, they can also charge fees sustainably just like infrastructure services such as water and electricity. One example is the SaaS model.

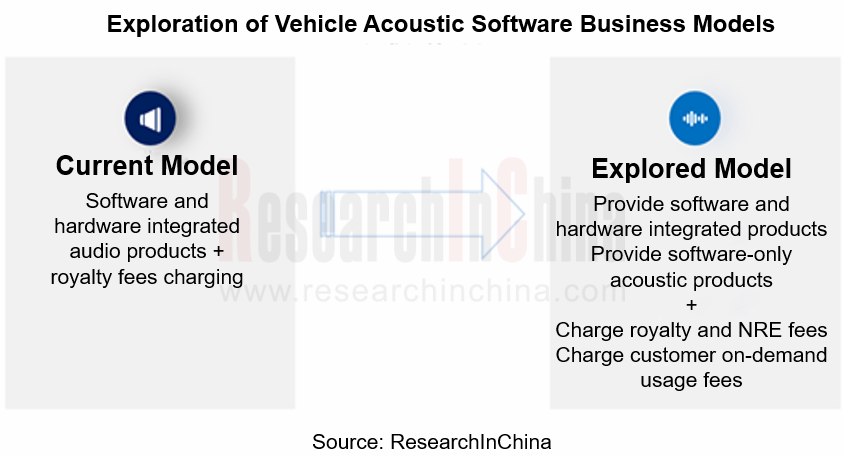

In the case of acoustic software OEM market, conventional automakers often choose products and toning services of acoustic components suppliers or electro-acoustic brands, while intelligent vehicle manufacturers tend to purchase products and services from acoustic components suppliers for the purpose of cost control, rapid iteration and standardized modular production, that is, a model that leaves automakers using their own or third-party toning modes for overall audio debugging

For example, in February 2022, Harman announced Software-Enabled Branded Audio, an on-demand software platform that offers consumers a user-friendly, affordable way to upgrade existing unbranded car audio experience with no additional hardware required.

Vehicle-cloud platform layer: under the new-generation infrastructures, enable the innovative model of vehicle-cloud co-construction and coordination.

As underlying infrastructures get improved, new-generation vehicle E/E architectures evolve, SOA-based design concept becomes widespread, cloud infrastructures are far more perfect, and cloud computing power becomes stronger, cloud computing has become a crucial productivity in the automotive industry. The vehicle-cloud integrated data drive will play a key role in the competition in the automotive industry.

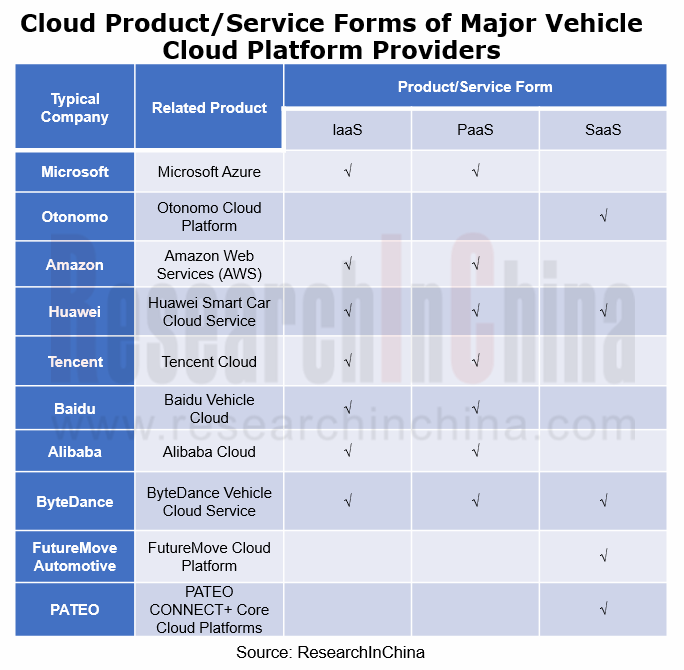

Vehicle cloud is a digital ecosystem platform for automakers to empower vehicle mobility and related intelligent services. Its service forms are divided into three types: IaaS, PaaS and SaaS. The IaaS layer is responsible for providing infrastructures related to computing, storage, network, CDN, security, disaster recovery and so forth in design, production and supply chain links; vehicle cloud services in the PaaS layer cover cloud platform architecture needed by after-sale links (such as call center, OTA, autonomous driving and telematics) and production design links (including analog, simulation, etc.); the SaaS layer involves sales and consumption of various function applications paid according to service time or amount of infrastructure.

At present, vehicle cloud service providers mainly include: public cloud providers that offer IaaS and Paas layers, such as Baidu Cloud, Tencent Cloud and Alibaba Cloud; those that cooperates with cloud platform service providers and provides SaaS services, including telematics service providers like PATEO and FutureMove Automotive. The former ones charge according to goods and services provided; the latter charge for services.

Cloud will be an effective supplement to vehicle, so specialized cloud solutions and digital platform tools will be gradually introduced. The complete layout of vehicle and cloud products will empower "vehicle-cloud integration" in the automotive industry. Whether from cost reduction and efficiency improvement or safety and reliability, OEMs will fail to meet the needs just by independent construction. They will be bound to forge closer partnerships with cloud service providers to open up new scene maps together and thus realize co-construction and enabling, a two-way process in which OEMs and cloud service providers walk and grow in the same pace in achieving development goals.

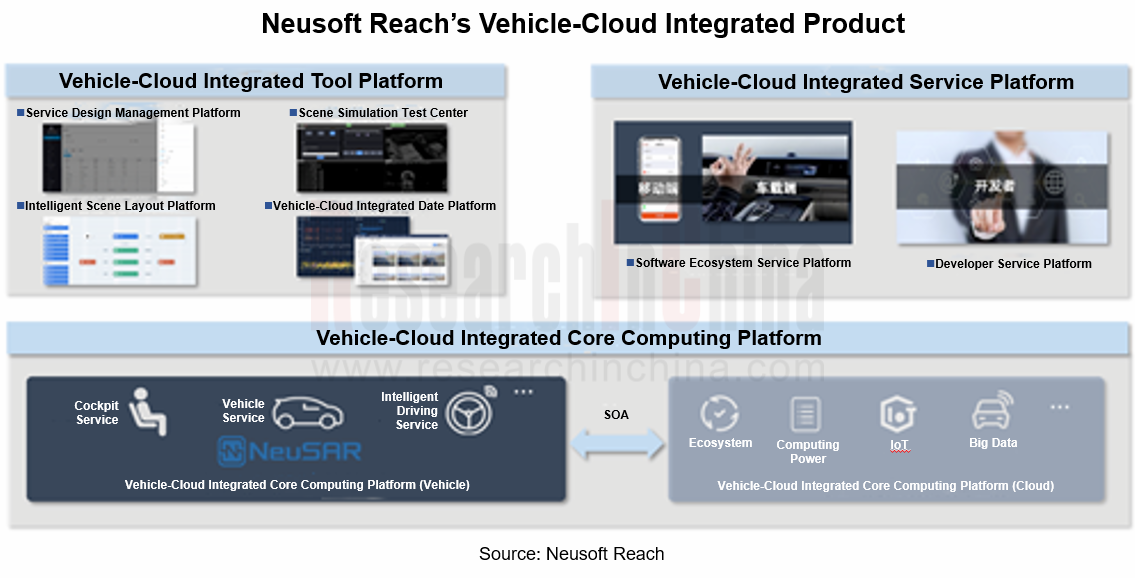

Neusoft Reach’s vehicle-cloud integrated platform is a self-developed intelligent software product for next-generation new E/E architectures. It is mainly composed of a vehicle-cloud integrated tool platform, a vehicle-cloud integrated core computing platform, and a vehicle-cloud integrated software ecosystem service platform, fully covering SOA-based design and development environment and runtime environment. The connection of in-vehicle capabilities and the reintegration of cloud big data and ecosystem service capabilities will quickly enable massive intelligent scene applications with a high degree of vehicle-cloud cooperation.

Neusoft Reach’s vehicle-cloud integrated product builds vehicle-cloud integrated intelligent vehicle digital bases based on the SOA design idea, and provides OEMs with full-stack SDV products and services, thereby improving brand value in the aspects of "uniqueness", "added value", and "evolvability".

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...