Commercial vehicle industry is characterized by large output value, long industry chain, high relevance, high technical requirements, wide employment and large consumer pull, and is a barometer of national economic development. China is currently the world's largest single market for commercial vehicle sales, contributing nearly half of global sales each year. In 2022, Scania held the launching ceremony for the construction of the manufacturing base in Rugao, Jiangsu Province, and the launch of heavy truck joint venture between Daimler Benz and BAIC Foton, opening a new prelude to the industry.

With the technological revolution of "electrification and intelligence" of automobiles, commercial vehicle chassis also ushered in the technological change from conventional chassis, electric chassis to intelligent chassis. The future development of intelligent chassis technology, the construction of the industry chain and the layout of the supply chain will have a profound impact on the development trend of commercial vehicles.

As an important intersection of electrification and intelligence, the intelligent chassis has been highly valued by automotive industry and strongly sought after by capital in recent years, with a large number of companies entering and laying out a strong position to carry out related core technology.

The intelligent chassis for commercial vehicles is moving in step with "electrification, intelligence, software and sharing" and is showing the following trends:

Trend 1: Technological changes and business model changes to support the sharing of intelligent chassis for commercial vehicles

The efficient operation of logistics needs to be based on specialization of commercial vehicles, but the challenge of generalization in turn limits the ability to apply vehicles across industries, or will have an impact on vehicle utilization. The contradiction between specialization and versatility can be balanced in the future by the intelligent chassis installation and the separation of chassis, and the design of scenario-based installations and chassis standardization. Scenario-based installation, which can meet the professional requirements of each scenario in a differentiated way and maximize the use efficiency in the scenario; Chassis standardization meets the requirements of mass production for product standardization, thereby reducing production costs. The development of new energy and autonomous driving technology will accelerate the landing of standard chassis and provide technical support for the sharing development of commercial vehicle chassis.

The skateboard chassis highly concerned by the industry is expected to be implemented firstly in commercial vehicle field. The "wire-controlled technology, cell to chassis (CTC), casting of large chassis parts, corner module, battery replacement" promoted by the intelligent chassis of passenger cars or various application scenarios of commercial vehicles have been realized one by one.

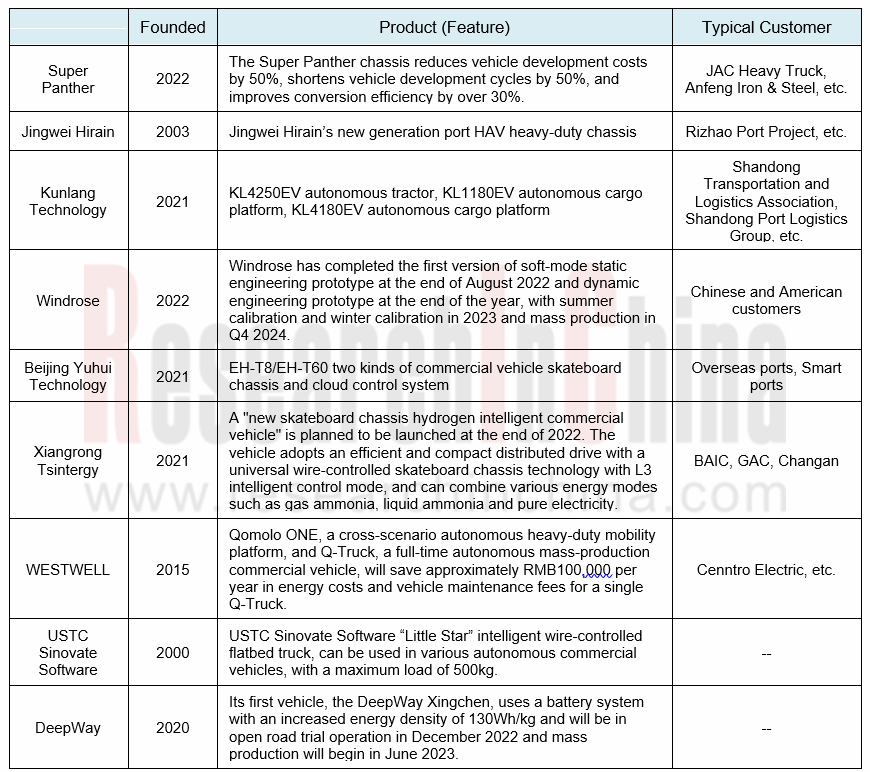

Trend 2: More and more start-ups focus on commercial vehicle chassis industry

Several domestic and foreign companies have already entered the commercial vehicle intelligent chassis track, including Gaussin, which has set up its headquarters in China to bring its latest pure electric and hydrogen truck technologies and products to the Chinese market in the form of a next-generation Skateboard Truck Platform.

Super Panther is the first technology company in China to focus on intelligent chassis for new energy commercial vehicles. It is different from the "skateboard chassis" technology company for passenger cars, and will combine the ecological needs of logistics by creating a new chassis system to help transform the logistics industry in the new energy trend.

Trend 3: Intelligent chassis design for commercial vehicles is gradually becoming passenger car-oriented

The commercial vehicle chassis needs to be deeply integrated with intelligent cockpit, autonomous driving and powertrain in order to become a true intelligent chassis, which can actively control, adaptive and self-learning and can be OTA upgraded according to the user preferences to decide the character of the vehicle.

Trend 4: Intelligent chassis for commercial vehicles enables diversified fuel platforms

Daimler Benz GenH2 liquid hydrogen heavy truck chassis comes with two tanks for storing liquid hydrogen, each holding around 40kg of liquid hydrogen, and is matched with two 150kW fuel cell systems. The intensive test scenarios for Mercedes-Benz hydrogen fuel cell prototype are said to include internal test lanes and public roads, with the development goal of achieving a range of over 1,000km and being able to cope with flexible and demanding road conditions in heavy long-distance transport. Daimler Trucks plans to have hydrogen fuel cell trucks join the production model line-up in the next 5-10 years as well.

Due to the impact of technology and cost, trunk logistics vehicles are the short board of new energy development. How can we use mature technology and lower costs to help trunk logistics achieve low-carbon green transport? Geely's new energy commercial vehicles have undergone 17 years of R&D and have released a multi-motor central drive power chain and a new energy green methanol powered solution - the remote G2M methanol tractor.

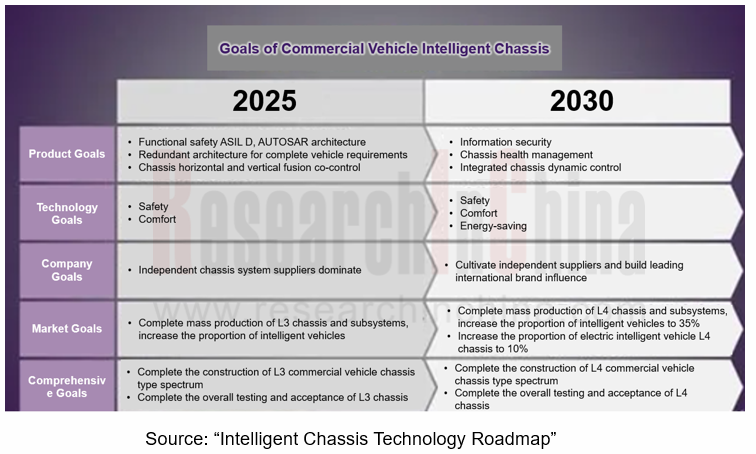

Trend 5: Goals and technical paths for development of intelligent chassis

According to the “Intelligent Chassis Technology Roadmap” published by the Electric Vehicle Alliance Wire-Controlled Working Group in 2021, the goals for the development of intelligent chassis for commercial vehicles are shown in the following diagram:

Goals in 2025: The intelligent chassis equipped with independent brands of braking-by-wire and steering -by-wire will be applied in batches in influential enterprises in the industry; The key technical indicators of the intelligent chassis have reached the international advanced level; The industrial chain of key components is independent and controllable.

Goals in 2025: The intelligent chassis equipped with independent brands of braking-by-wire and steering -by-wire will be applied in batches in influential enterprises in the industry; The key technical indicators of the intelligent chassis have reached the international advanced level; The industrial chain of key components is independent and controllable.

Goals in 2030: The initial formation of the brand effect of independent intelligent chassis and wire-controlled actuation of the automakers and parts enterprises; intelligent chassis in general to reach the international advanced level, key technical indicators to reach the international leading level; intelligent chassis to form a complete independent controllable industrial chain; cultivate internationally competitive enterprises.

Goals in 2030: The initial formation of the brand effect of independent intelligent chassis and wire-controlled actuation of the automakers and parts enterprises; intelligent chassis in general to reach the international advanced level, key technical indicators to reach the international leading level; intelligent chassis to form a complete independent controllable industrial chain; cultivate internationally competitive enterprises.

The key technology path for the intelligent chassis of commercial vehicles is: to cope with the demand of L3 autonomous driving, the chassis realizes subsystem redundancy, adopts distributed control structure, independent longitudinal and horizontal active control, and system health alarm; to cope with the demand of L4 autonomous driving, the chassis domain control realizes minimal backup of autonomous driving and collaborative longitudinal and horizontal control; to cope with the demand of L5 autonomous driving, the chassis domain control realizes full functional backup of autonomous driving and integrated longitudinal and horizontal collaborative control.

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...