China In-Vehicle Payment Market Research Report, 2023 released by ResearchInChina analyzes and researches the status quo of China's in-vehicle payment market, components of the industry chain, layout of OEMs and payment platforms, consumer survey, and development trends.

①The market demand for in-vehicle payment is rising.

In-vehicle payment refers to the function allowing for payment through in-vehicle communication (e.g., SIM card and WiFi) and IVI system. In-vehicle payment enables car owners to pay for services such as parking, refueling, food ordering and shopping without getting off the car, bringing far more convenient and better experience to users.

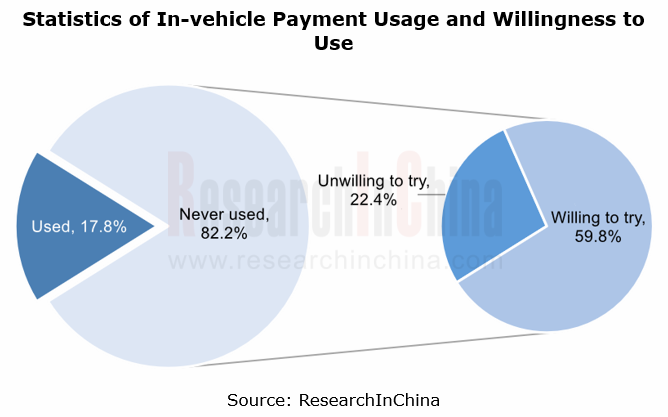

According to the survey by ResearchInChina, there are a relatively small number of people using in-car payment at this stage, making up only 17.8% of the total samples. Yet users' willingness to use this function is very high. 72.7% of the consumers who have not used in-car payment yet, or 59.8% of the total samples say they are "willing to try in-car payment".

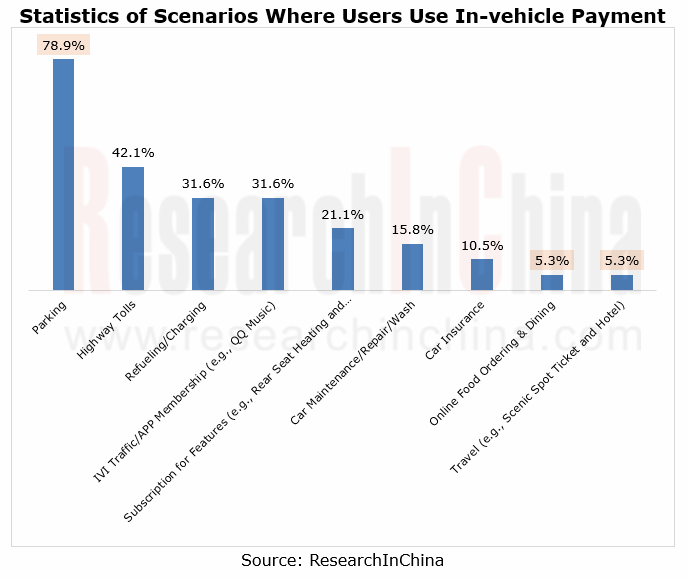

At present, users use in-car payment in such scenarios as parking, highway pass, refueling/charging, and purchasing IVI traffic and APP membership. Of the users who have used in-car payment:

- Up to 78.9% use in-car payment for parking;

- 42.1% use in-car payment for highway tolls;

- In-vehicle payment is also often used to pay for refueling/charging fees (31.6%), IVI traffic and APP membership (31.6%), feature subscription (21.1%), car maintenance/repair/wash (15.8%), and car insurance (10.5%);

- Fewer users use this function in the scenarios of online food ordering and dining (5.3%) and travel (5.3%).

②The in-vehicle payment industry chain is taking shape.

In terms of supply chain, in-vehicle payment involves two major segments: in-vehicle payment device and in-vehicle payment platform.

In-vehicle payment devices are led by communication devices (SIM card, communication module and T-Box), interaction devices (touch/voice/ face/gesture/fingerprint interaction), and authentication devices (security chip); in-vehicle payment platforms are primarily cloud platform, payment platform, IVI system, ecosystem service platform, ecosystem service provider, and OEM.

As companies in each industry chain segment worked to make layout in recent years, the in-vehicle payment market has kept growing, with the following two major features.

1. In-vehicle payment is available to more scenarios.

Foreign automakers including BMW, Mercedes-Benz, Honda and Hyundai, and Chinese automakers such as Great Wall Motor, Xpeng Motors, Geely, Chery and AITO have launched their in-car payment function. They have widely deployed this function in parking, refueling/charging and food ordering scenarios, and are also applying it on a small scale in car wash/maintenance/repair services, feature subscription, ticket booking and other scenarios.

For example, in October 2022, BMW added the BMW ConnectedDrive Store to its IVI system via OTA updates. It enables in-car payment for subscriptions, and 13 features such as front seat heating, steering wheel heating and Carplay through the IVI system.

2. Multimodal interaction is being added to in-vehicle payment.

At present, the most common in-car payment is scan to pay and password-free payment. As in-car multimodal interaction technology improves, face recognition, fingerprint recognition and voice recognition are becoming the new in-car payment interaction and authentication methods.

For example, Mercedes-Benz has added fingerprint recognition and authentication to its latest in-car payment system PAY+; Chery EXEED TX/TXL supports face verification payment, a function allowing users to pay for parking fees or shopping through face recognition. The addition of multimodal interaction makes in-vehicle payment more secure and convenient.

3. The ecosystem is a key factor affecting in-car payment.

In the mobile payment system, millions of iOS and Android developers have developed various applications and built very rich application ecosystems, meeting living, work and entertainment needs of consumers and making smartphones an indispensable terminal in users' life.

In the in-car payment system, financial institutions like China UnionPay and VISA have developed a series of in-car payment systems; Alipay, Banma Zhixing and Huawei among others have built a variety of vehicle ecosystem platforms and launched a range of in-car services covering parking, refueling, travel, shopping and other scenarios.

Compared with mobile payment, the in-vehicle payment ecosystem is still weak at this stage, only meeting the payment needs in specific scenarios. With the development of intelligent cockpit and high-level autonomous driving, drivers will be freed from driving tasks in specific scenarios and pay more attention to other in-car needs. At this time, creating an in-car living space and building a closed-loop ecosystem with payment as the entrance will become a big demand.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...