The automotive voice interaction market is characterized by the following:

1. In OEM market, 46 brands install automotive voice as a standard configuration in 2023.

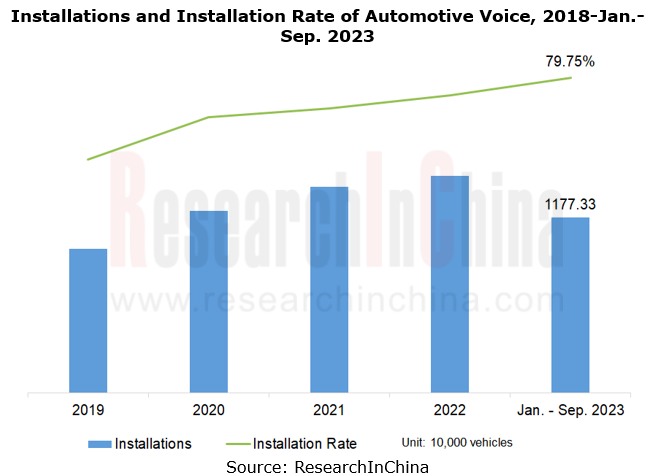

From 2019 to the first nine months of 2023, automotive voice saw rising installations and installation rate. In the first three quarters of 2023, nearly 12 million vehicles were pre-installed with automotive voice, with the installation rate of nearly 80%.

In 2023, there are 46 passenger car brands boasting automotive voice installation rate of 100%, including AITO, Avatr, HiPhi, Rising Auto, ZEEKR, Voyah, Li Auto, Lynk & Co, Tank, NIO, and Xpeng. In 2023, over 20 million vehicles are equipped with automotive voice, with the installation rate higher than 80%.

2. Automakers’ self-development of voice facilitates the reshaping of the voice supply chain.

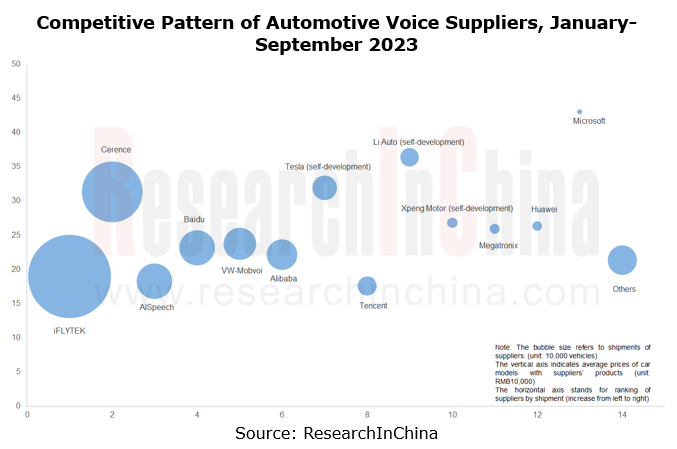

OEMs' differentiated demand for intelligent automotive voice and their preference for independent development enable Tier 2 vendors in the conventional voice supply chain to cooperate directly with OEMs. Boundaries between upstream, midstream and downstream of the industry chain tend to blur. For example, the direct cooperation of automakers like GWM, ZEEKR and Wuling with AISpeech improves their installation and intelligence levels of intelligent voice.

The change in industry chain relationships makes the automotive voice competitive pattern change accordingly. By installations from January to September 2023, AISpeech that supported more than 150 models of over 30 automakers ranked third.

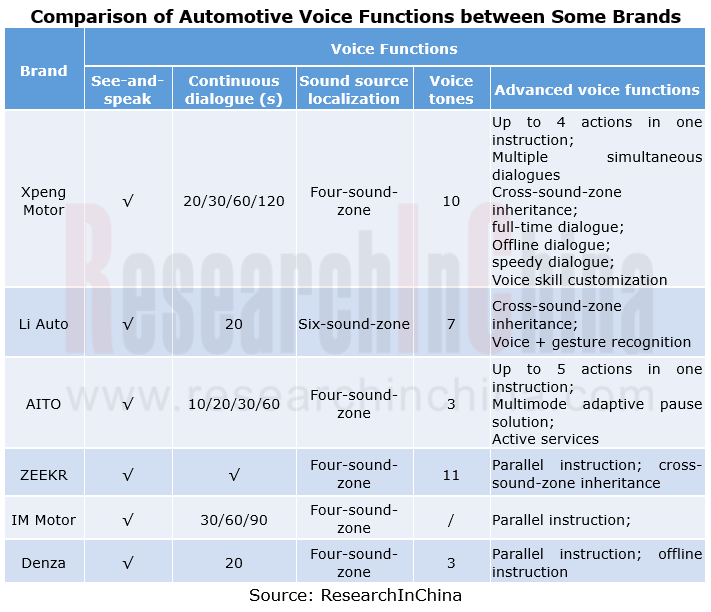

3. See-and-speak function becomes a standard configuration, and advanced functions such as parallel instruction, cross-sound-zone inheritance, offline voice, and out-of-vehicle voice are available on cars.

In ResearchInChina's China Automotive Voice Industry Report, 2021-2022, "see-and-speak" was only installed by some emerging carmakers and leading Chinese independent brands, the longest continuous conversation duration was only 90 seconds, and dual-sound-zone recognition was still the mainstream solution.

In 2023, "see-and-speak" has become a standard configuration in emerging carmakers' flagship models, with up to 120-second continuous dialogue. Xpeng Motor has also introduced the "Full-time Dialogue at Driver’s Seat" function (when turned on, it allows the driver to see and speak when looking at the center console screen, without needing to wake up the content on the screen). Meanwhile, four-sound-zone recognition has become a new mainstream solution, and Li Auto and Xpeng Motor also introduced six-sound-zone recognition solutions.

In addition, more advanced voice functions became available on cars in 2023.

Parallel instruction: support up to 10 actions in one instruction;

Cross-sound-zone inheritance: available on models of Xpeng, ZEEKR, and Li Auto (cross-sound-zone inheritance: when a person finishes an instruction, if other passengers want to continue, they can trigger this function by saying "I want too").

Offline instruction: more controllable content. Jiyue 01 supports all-zone, full offline voice. In offline state, Jiyue 01 still enables extremely fast interaction with occupants.

Out-of-vehicle voice: this function in Changan Nevo A07 allows for voice control on trunk, windows, music, air conditioning, pull-out/in, and other functions; this function in Jiyue 01 allows for voice control on car/parking, air conditioning, audio, lights, windows, doors, tailgate, and charging cover.

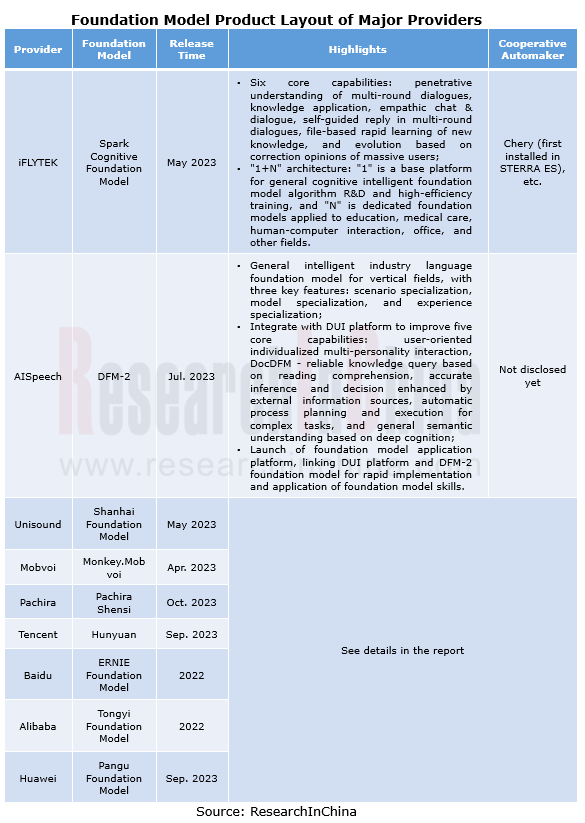

4. Voice interaction is the first stop for foundation models to get on vehicles in intelligent cockpit scenarios.

The boom of ChatGPT allows the related foundation model technology to rapidly extend from AI to all other sectors. In 2023, foundation models gain pace in automotive industry, and quite a few automakers are exploring the opportunities to implement foundation models in intelligent cockpit, intelligent driving and other scenarios.

In intelligent cockpit scenarios, voice interaction is the first stop for foundation models to get on vehicles. In February 2023, Baidu released a Chinese version of ChatGPT - ERNIE Bot, and brands like GWM, Geely, and Voyah followed; in April 2023, Alibaba disclosed that AliOS intelligent vehicle operating system has been connected to Tongyi Qianwen foundation model for testing, and will later be applied by IM Motors; in August 2023, in Huawei HarmonyOS 4.0, intelligent assistant Xiaoyi was connected to Pangu model for the first time, mainly to improve capabilities of intelligent interaction, scenario arrangement, language understanding, productivity and personalized service.

Besides conventional Internet companies, voice providers as important foundation model players such as iFLYTEK, AISpeech and Unisound have also launched related products.

iFLYTEK Spark cognitive foundation model has six core capabilities: penetrative understanding of multi-round dialogues, knowledge application, empathic chat & dialogue, self-guided reply in multi-round dialogues, file-based rapid learning of new knowledge, and evolution based on correction opinions of massive users;

AISpeech DFM-2 is an industry language foundation model with generalized intelligence. In the field of in-vehicle interaction, AISpeech integrates Lyra automotive voice assistant with DFM-2, which significantly improves capabilities in planning, creation, knowledge, intervention, plug-in, multi-level semantic dialogue, and documentation, and supports multi-modal, multi-intent, multi-sound-zone, and all-scenario multi-round continuous dialogues.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...