Global and China Automotive Lighting Industry Report, 2013-2014

-

Sep.2014

- Hard Copy

- USD

$2,500

-

- Pages:130

- Single User License

(PDF Unprintable)

- USD

$2,300

-

- Code:

ZYW184

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,700

-

- Hard Copy + Single User License

- USD

$2,700

-

Global and China Automotive Lighting Industry Report, 2013-2014 covers the followings:

1. Global automotive industry and market

2. China automotive industry and market

3. Automotive lighting technology trends and LED industry

4. Automotive lighting market and industry

5.18 automotive lighting companies

The global automotive lighting market size hits approximately USD26 billion (including USD21.2 billion generated by OEM) in 2014, representing an increase of 8.8% over 2013. The growth of the OEM market is mainly driven by two factors:

First, the automobile shipment in China and the United States surges, especially the Chinese market has still maintained the growth rate of about 10% after the high-speed growth in 2013. Second, the extensive use of xenon lamps and LED raises the unit price.

By 2015, China’s economy will slow down further, so that the automotive market can not continue to grow at 10%, whilst the American market will also decelerate. The global automotive lighting market is estimated to be USD27.6 billion in 2015, up 6.2%.

The most important automotive lighting parts ------ headlights are commonly divided into the following categories.

First, halogen high and low beams equipped with reflecting bowls for most low-end automobile models.

First, halogen high and low beams equipped with reflecting bowls for most low-end automobile models.

Second, halogen high beams combined with reflecting bowls as well as xenon low beams installed with single projector lens adopted by Japanese and US-based mid-range cars due to low costs.

Second, halogen high beams combined with reflecting bowls as well as xenon low beams installed with single projector lens adopted by Japanese and US-based mid-range cars due to low costs.

Third, xenon high and low beams equipped with bi-xenon projectors used by German mid-range cars extensively.

Third, xenon high and low beams equipped with bi-xenon projectors used by German mid-range cars extensively.

Fourth, LED lights suitable for a small amount of top cars (such as Audi R8 and Mercedes-Benz S series) and a few mid-range cars.

Fourth, LED lights suitable for a small amount of top cars (such as Audi R8 and Mercedes-Benz S series) and a few mid-range cars.

Fifth, halogen high and low beams, but high beams combined with projector lens.

Fifth, halogen high and low beams, but high beams combined with projector lens.

In the global market, the second and third categories will seize 10% share each, while the fourth category 7% in 2016. However, unique Chinese consumers are keen on new technology and the luxury car sales volume growth rate is much higher than low-end models under the context of exacerbated wealth disparity, so the proportion of xenon lamps in China exceeds the global average level. The second category is expected to occupy about 13% share and the third category 14% in 2016.

The fast-growing Chinese market has stimulated producers to conduct massive capacity expansion. Hella’s Jiaxing Plant went into production in April 2014 and is expected to realize the design capacity (3 million headlights and 1.8 million taillights annually, including halogen, xenon and LED lights) in 2016, which doubles the current capacity.

The world's largest automotive lighting company Koito invested in building its third base in Xiaogan of Hubei Province in September 2014, following the ones in Shanghai and Guangzhou. The new base is expected to be put into operation in July 2016.

Valeo's Shenyang Plant will begin to run in December 2014, with the investment of USD100 million.

In early 2014, Magneti Marelli and CSGC Hubei Huazhong Photoelectric Science and Technology Co., Ltd, signed a a 50/50 joint venture agreement for the production of headlamps and rear lamps in Xiaogan, Hubei for motor vehicles in China. According to the planning, the production will commence in Q1 2015.

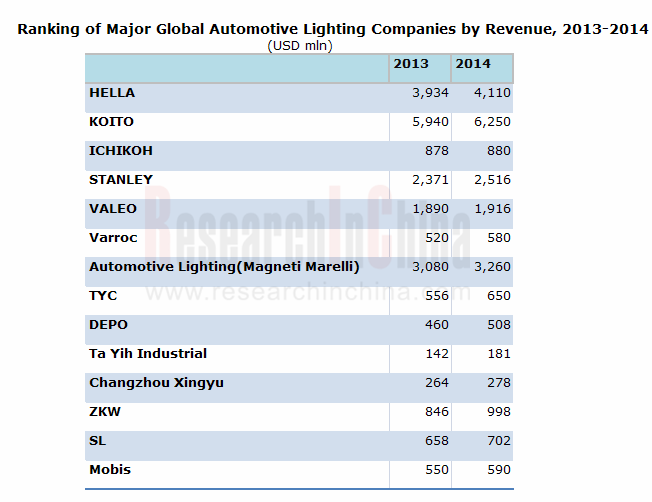

Koito develops soundly as the largest lighting supplier of Toyota and GM; meanwhile, its shipment to Volkswagen increases year after year. Unlike Koito who is good at lens design and manufacturing, Hella specializes in electronic manufacturing and mainly serves customers in Europe. The rising star ------ ZKW is one of main suppliers of Mercedes-Benz and Audi. TYC and DEPO target at the maintenance market and develop smoothly.

Small companies also embrace Wipac, India-based Fiem, Turkey-located Farba, Brazil-based Arteb, Magna in Canada, Grote in USA and Schefenacker of Germany.

1. Global and Chinese Automotive Market and Industry

1.1 Global Automotive Industry

1.2 Global Automotive Market

2. Chinese Automotive Market

2.1 Overview

2.2 Industry Analysis

2.3 Status Quo

3 Automotive Lighting Technology Trends

3.1 Profile of HID Xenon Lamps

3.2 New Headlight Technology

3.3 Typical Automotive Headlight Design

3.4 Headlight Design Trends

3.5 Laser Automotive Lighting

4 LED Automotive Lighting Industry

4.1 LED Automotive Lighting Market

4.2 Automotive Interior LED Lighting

4.3 Automotive Exterior LED Lighting

4.4 LED Industry Chain

4.5 Geographical Distribution of LED Industry

4.6 Ranking of Global Top 30 LED Companies by Revenue, 2012-2014

4.7 Taiwan LED Industry

4.8 Summary of LED Industry in Mainland China, 2013

4.9 Forecast for China LED Industry, 2014

4.10 White LED Patent

5. Automotive Lighting Industry and Market

5.1 Automotive Lighting Market Size

5.2 Global Automotive Lighting Industry

5.3 Global Automotive Lighting OEM System

5.4 China Automotive Lighting Industry

5.5 China's Automotive Lighting OEM System

6. Automotive Lighting Companies

6.1 Hella

6.1.1 Changchun Hella

6.2 Koito

6.2.1 Shanghai Koito

6.2.2 Guangzhou Koito

6.3 Ichikoh

6.4 Stanley

6.4.1 Guangzhou Stanley

6.4.2 Tianjin Stanley Electric Co., Ltd.

6.5 Valeo

6.6 VARROC

6.6.1 Changzhou Damao Visteon

6.7 Automotive Lighting (Magneti Marelli)

6.8 TYC

6.9 DEPODEPO

6.10 Ta Yih Industrial

6.11 Changzhou Xingyu

6.12 Jiangsu Tongming

6.13 ZKW

6.14 Liaowang Automotive Lamp

6.15 SL

6.16 Zhejiang Tianchong

6.17 Laster Tech

6.18 FIEM

7. Automotive Lighting LED Companies

7.1 Nichia Chemical

7.2 Toyoda Gosei

7.3 Philips

7.4 OSRAM

Sales Volume of Major Global Automobile Brands, 2010-2013

Production of Light Vehicles, 2011-2014

Production of Heavy Vehicles, 2011-2014

China's Automobile Output YoY Growth Rate by Type, 2008-2013

Sales Volume of Major Chinese Automobile Companies, 2013

Sales Volume of Independent Brand Automobile Companies, 2013

Monthly Sales Volume of Passenger Cars in China, Jan 2005-Aug 2014

Audi A6 3.5 FSI Headlamp

BMW 730Li Headlamp

Mercedes-Benz S320L Headlamp

Honda 9-generation Accord Headlamp

Peugeot 508 Headlamp

Global Sedan Headlamp Light Source Distribution, 2009-2016E

China’s Sedan Headlamp Light Source Distribution, 2009-2016E

Global LED Automotive Lighting Market Size, 2010-2016E

Geographical Distribution of Global LED Output Value, 2013-2014

Operating Margin of Taiwan LED Companies, 2012-2014

Global Automotive Lighting Market Size, 2010-2016E

Automotive Lighting System Supply Structure of Toyota, 2013

Automotive Lighting System Supply Structure of Honda, 2013

Automotive Lighting System Supply Structure of Nissan Renault, 2013

Automotive Lighting System Supply Structure of GM, 2013

Automotive Lighting System Supply Structure of Ford, 2013

Automotive Lighting System Supply Structure of VW, 2013

Automotive Lighting System Supply Structure of Hyundai, 2013

Market Share of Major Sedan Lighting Companies in China, 2013

Top 20 Automotive Light Companies in China by Sales, 2013

Koito’s Client Distribution, 2014

Major clients of Chinese Automotive Light Companies

Hella’s Milestone, 1899-2014

Hella’s Revenue and EBIT, FY2007-2014

Hella’s Organizational Structure

Hella’s Revenue by Division, FY2010-FY2014

Hella’s Revenue by Region, FY2007- FY 2012

Hella’s Revenue by Region, FY2013- FY 2014

Global Distribution of Hella's Staff

Hella’s Regional Market Coverage by End Customers, FY2013-2014

Koito’s Revenue and Operating Margin, FY2006- FY 2015

Koito’s Revenue by Region, FY2008- FY 2013

Major Vehicle Models Supported by Koito

Shanghai Koito’s Revenue and Operating Margin, 2004-2013

Ichikoh’s Revenue and Operating Margin, FY2006- FY 2014

Ichikoh’s Revenue by Region, FY2007- FY 2014

Ichikoh's Distribution in the World

Ichikoh's Distribution in Japan

Major Vehicle Models Supported by Ichikoh

Stanley’s Main Products

Stanley’s Revenue and Operating Margin, FY2006- FY 2015

Stanley’s Assets and Liabilities, FY2010- FY 2014

Stanley’s Automotive Lighting Revenue and Operating Margin, FY2006- FY 2014

Stanley’s Revenue by Region, FY2008- FY 2014

Guangzhou Stanley’s Revenue and Operating Margin, 2004-2013

Valeo’s Revenue and Gross Margin, 2005-2014

Valeo’s Revenue by Division, 2009-H1 2014

Valeo’s EBITDA by Division, 2012-H1 2014

Valeo’s Clients by Region, 2007-H1 2014

Valeo’s Revenue in Asia by Country, H1 2013

Varroc’s Revenue by Product, FY2013

Revenue of Visteon’s Automotive Lighting Division, 2008-2010

Revenue of Visteon’s Automotive Lighting Division by Client, 2008-2010

Revenue of Visteon’s Automotive Lighting Division by Region, 2008-2010

Global Distribution of Technical Centers of Visteon’s Automotive Lighting Division

Global Distribution of Production Bases of Visteon’s Automotive Lighting Division

Major Vehicle Models Supported by Visteon’s Automotive Lighting Division

Global Distribution of Magneti Marelli

Revenue of Magneti Marelli by Product, 2013

Revenue and Operating Margin of Magneti Marelli, 2006-2013

Automobiles Equipped with Automotive Lighting

Lights Used by Mercedes-Benz S

Lights Used by BMW 4 Series

TYC’s Revenue and Operating Margin, 2005-2014

TYC’s Monthly Revenue and Growth Rate, Aug 2012-Aug 2014

Financial Status of TYC's Subsidiary in Mainland China, 2010

Financial Status of TYC's Subsidiary in Mainland China, 2011

Financial Status of TYC's Subsidiary in Mainland China, 2012

Financial Status of TYC's Subsidiary in Mainland China, 2013

DEPO’s Revenue and Operating Margin, 2006-2014

DEPO’s Monthly Revenue, Aug 2012-Aug 2014

DEPO’s Revenue by Region, 2009-2012

Financial Data of DEPO’s Subsidiary in Mainland China, 2012

Revenue and Operating Margin of Ta Yih Industrial, 2003-2014

Monthly Revenue and Growth Rate of Ta Yih Industrial, Aug 2012-Aug 2014

Distribution of Ta Yih Industrial

Industrial Products of Ta Yih Industrial

Clients of Ta Yih Industrial

Equity Structure of Changzhou Xingyu

Output of Changzhou Xingyu, 2012-2013

Revenue and Operating Margin of Changzhou Xingyu, 2007-2014

Client Structure of Changzhou Xingyu, 2007-2012

Distribution of Staff Positions of Changzhou Xingyu, 2012

Major Clients of Jiangsu Tongming

ZKW's Organizational Structure

Geographical Distribution of ZKW's Staff, 2014

SL’s Revenue and Operating Margin, 2008-2014

SL’s Revenue by Product, 2010-2014

Structure of Laster Tech

Revenue and Gross Margin of Laster Tech, 2008-2014

Monthly Revenue of Laster Tech, Aug 2012-Aug 2014

Revenue of Laster Tech by Business, 2011-2013

Products of Laster Tech

Fiem’s Revenue and Profit, FY2011-FY2014

Revenue Structure of Fiem by Product, FY2014

Fiem’s Manufacturing Unit

Fiem’s Major Clients

Revenue and Operating Margin of Nichia Chemical, 2003-2014

Revenue and Operating Margin of Toyoda Gosei, FY2006-2014

Revenue of Toyoda Gosei by Product, FY2006-2013

Revenue of Toyoda Gosei by Region, FY2006-2013

Revenue and Operating Margin of Toyoda Gosei in Asia-Pacific, FY2006-2013

Equipment Investment and Depreciation of Toyoda Gosei, FY2009-2014

% of R & D Expenditures of Toyoda Gosei, FY2009-2014

Lighting Revenue and EBITDA of Philips, Q4 2011-Q4 2013

Lighting Revenue of Philips by Application, H1 2014

Product Distribution of Lumileds

Distribution of Philips in China

Market Position of Philips in China

OSRAM’S Quarterly Revenue and EBITA Margin, Q1 2012-Q2 2014

Osram’s Revenue by Division, 20012-2014

Osram’s EBITA by Division, 20012-2014

Osram’s Revenue by Region, 20012-2014

Osram’s SP Revenue and EBIT, Q2 2012-Q2 2014

Osram’s OS Revenue and EBIT, Q2 2012-Q2 2014

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...