Global and China Automotive Audio and Infotainment Industry Report, 2014-2015

-

Oct.2015

- Hard Copy

- USD

$2,300

-

- Pages:95

- Single User License

(PDF Unprintable)

- USD

$2,100

-

- Code:

ZYW217

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,300

-

- Hard Copy + Single User License

- USD

$2,500

-

Global and China Car Audio and Infotainment Industry Report, 2014-2015 covers the following:

1. Global automobile market and industry;

2. China’s automobile market and industry;

3. Automotive infotainment development trends and supply chain

4. Automotive infotainment market and industry

5. Twenty-three key automotive Infotainment vendors

The definition of Infotainment is so vague that virtually all vendors have their own definition in this respect. In a broad sense, Infotainment includes simple Audio System (also known as Audio Infotainment) in low-end models and traditional in-vehicle navigation system in mid-end models. In a narrow sense, however, Infotainment contains HMI, Connectivity (WiFi\3G\LTE\Bluetooth\Mobile Phone), Telematics (Navigation\Alerts), Entertainment (Radio\Audio\Video), and ADAS (Cameras Display\Black box), that is to say, Hi-end Infotainment.

Today’s Hi-end Infotainment is the mainstream Infotainment in the future. The design of Infotainment software is becoming more and more complicated so much so that traditional Infotainment companies began to aggressively acquire software companies to stabilize their market position. In addition, Infotainment is also getting closer to ADAS. In January 2015, Harman acquired RedBend, an Israeli software company, for USD170 million and Symphony Teleca for USD870 million.

In 2015, Delphi spun off non-core Thermal and Reception businesses, purchased Hellermann Tyton and Ottomatika, and invested two start-ups: Tula and Quanergy. Quanergy mainly specializes in Lidar. In July 2015, Continental acquired Elektrobit. In future, more software enterprises will be acquired.

With the popularity of smartphones, the traditional single navigation system market has been severely squeezed and will be eliminated rapidly. In future, Infotainment is likely to integrate with Head Unit Display and contain the content displayed by Instrument Cluster and Climate Control as the core of Cockpit Electronics. Its control range will be extremely extensive and its display size will get quickly enlarged, to at least 12 inches.

In 2014, the market size of generalized Infotainment came to USD33.8 billion, and this figure is expected to hit USD36 billion in 2015. In contrast, the narrowly-defined Infotainment saw a market size of USD18.1 billion in 2014, and the scale is estimated to reach USD22.1 billion in 2015 and USD29.1 billion in 2017. The shipments of narrowly-defined Infotainment totaled 18.9 million units in 2014, and the estimated figures will be 24 million units in 2015, 31.8 million units in 2017, and 36.5 million units in 2020.

Japanese companies, though as overlords in Infotainment, are not adept at software and therefore are declining. This, coupled with the depreciated yen, has led to an obvious drop. By contrast, the German and US companies grow rapidly.

1 Global and China Automobile Market

1.1 Global Automobile Market

1.2 China Automobile Market

1.3 Latest Development of China Automobile Market

2 Infotainment Development Trends and Supply Chain

2.1 Definition

2.2 Development Trends

2.3 Infotainment and E-map

2.4 China’s Infotainment and E-map

2.5 Infotainment LCD Panel

2.6 Infotainment Semiconductor

3 Automotive Infotainment Market and Industry

3.1 Automotive Infotainment Market Size

3.2 Automotive Infotainment Industry

3.3 Chinese Automotive Infotainment Market

3.4 Supply Ratio of Global Infotainment Suppliers and Auto Makers

4 Global Automotive Audio and Infotainment Vendors

4.1 Harman

4.2 Continental

4.3 Pioneer

4.4 Foryou Corporation

4.5 Alpine

4.6 Clarion

4.7 Delphi

4.8 Visteon

4.8.1 YFV

4.9 Hangsheng Electronic

4.10 Panasonic Automotive Systems

4.11 Fujitsu Ten

4.12 AisinAW

4.13 Denso

4.14 Guangzhou Panyu Juda Car Audio Equipment Co., Ltd.

4.15 Hyundai MOBIS

4.15.1 Tianjin Mobis Automotive Parts Co., Ltd.

4.16 Coagent Electronics S & T Co., Ltd.

4.17 Shenzhen Soling Industrial Co., Ltd.

4.18 JVC Kenwood

4.19 Blaupunkt&Bosch

4.20 BOSE

4.21 Garmin

4.22 Desay SV Automotive

4.23 E-LEAD Electronic Co., Ltd.

Global Automobile Sales Volume, 2010-2015

Output of Global Light-duty Vehicles by Region, 2003-2015

China’s Automobile Sales Volume, 2005-2015

Annual Output of Vehicles (by Type) and YoY Growth in China, 2008-2015

Mercedes Benz S Class Cockpit

FLEXConnect In-Vehicle Infotainment Concept Car

TI’s Jacinto 6 Processor Diagram

TI’s Jacinto 6 Processor Data

Market Share of Global OEM Infotainment Map Suppliers (Excluding China), 2014

Operating Data of HERE, 2012-2014

Market Share of Major OEM In-vehicle Map Companies, 2015

Market Share of Aftermarket In-vehicle Map Companies, 2015

Infotainment Vendor vs LCD Panel Suppliers

Market Share of Major In-vehicle Display Screen Manufacturers, 2015

Market Share of Major Global Infotainment Display Screen Manufacturers, 2015

Infotainment Semiconductor by Type, 2013

Market Share of Infotainment Semiconductor by Suppliers, 2015

Global Automotive Infotainment Market Share, 2011-2018E

Infotainment Shipments, 2013-2020E

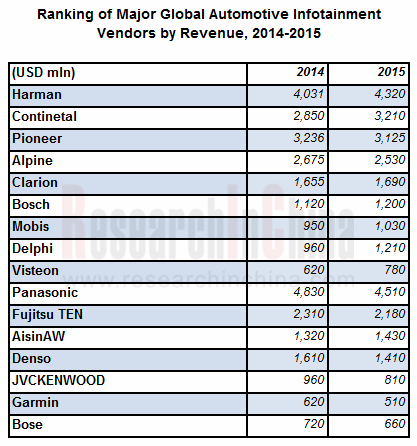

Ranking of Major Global Automotive Infotainment Vendors by Revenue, 2014-2015

Ranking of Major Global Audio Infotainment Vendors by Revenue, 2014-2015

China’s Automotive Infotainment Shipments, 2011-2018E

Market Share of Major Chinese OEM Automotive Infotainment Vendors, 2015

Market Share of Major Chinese OEM Audio-Infotainment Vendors, 2015

Supply Ratio of Toyota’s Major Automotive Infotainment Suppliers, 2014

Supply Ratio of Honda’s Major Automotive Infotainment Suppliers, 2014

Supply Ratio of Nissan’s Major Automotive Infotainment Suppliers, 2014

Supply Ratio of GM’s Major Automotive Infotainment Suppliers, 2014

Supply Ratio of Ford’s Major Automotive Infotainment Suppliers, 2014

Supply Ratio of Volkswagen’s Major Automotive Infotainment Suppliers, 2014

Supply Ratio of BMW’s Major Automotive Infotainment Suppliers, 2013

Supply Ratio of Mercedes Benz’s Major Automotive Infotainment Suppliers, 2014

Supply Ratio of Hyundai’s Major Automotive Infotainment Suppliers, 2014

Harman’s Revenue and Operating Margin, FY2004-FY2015

Harman’s Quarterly Sales and EBITDA Margin, FY2013-FY2015

Harman’s Revenue by Business, FY2010-FY2015

Harman’s Infotainment Backlog, FY2014-FY2015

Harman’s Infotainment Milestone

Harman’s Car Audio Customers

Harman’s Car Audio Backlog, FY2014-FY2015

Harman’s Revenue by Region, FY2006-FY2013

Structural Proportion of Harman’s Customers, FY2008-FY2015

Harman’s Revenue in China, FY2009-FY2014

Harman’s Major Car Audio Customers

Harman’s Manufacturing Bases Worldwide

Worldwide Distribution of Continental’s Automotive Interior

Continental’s Revenue and Operating Margin from Automotive Interior, 2007-2015

Revenue of Continental’s Automotive Interior by Region, 2009-2014

Continental’s Infotainment Milestone

Continental’s Infotainment Main Customer

Continental’s Infotainment Market Position

Pioneer’s Shipment by Product, FY2010-FY2016

Pioneer’s Structure Map

Pioneer’s Revenue and Operating Margin, FY2006-FY2016

Pioneer’s Operation Income Structure Breakdown, FY2014-FY2015

Pioneer’s Operation Income Structure Breakdown, FY2015/1Q-FY2016/1Q

Pioneer’s Revenue Breakdown by Segment, FY 2007-FY 2016

Pioneer’s Revenue and Operating Margin from Automotive Electronics, FY2007-FY2016

Pioneer’s Revenue Breakdown by Region, FY 2012-FY 2015

Pioneer’s Net Sales by Region, FY2016E

Pioneer’s Inventories, R&D Expenses, Capital Expenditures, Depreciation & Amortization, FY2016E

Pioneer’s Sales from Overseas Consumer Car Audio Products by Region, (CD/AV/Speakers)

Pioneer’s Car Electronics Sales Plan in Emerging Markets

Capacity of Pioneer’s Global In-vehicle Audio System Production Bases

Organizational Structure of Pioneer’s Car Audio in China

Balance Sheet of Foryou Corporation, 2012-2014

Revenue and Profits of Foryou Corporation, 2012-2014

Key Financial Indicators of Foryou Corporation, 2012-2014

Main Product Output of Foryou Corporation, 2012-2014

Revenue of Foryou Corporation by Business, 2012-2014

Customer Distribution of Foryou Corporation, 2013-2014

Alpine’s Revenue and Operating Margin, FY2006-FY2016

Alpine’s Revenue by Business, FY2012-FY2015

Revenue and Operating Margin of Alpine’s Car Audio Division, FY2006-FY2015

Alpine’s Infotainment Revenue and Operating Margin, FY2005-FY2015

Alpine’s Revenue Breakdown by Region, FY2005-FY2013

Alpine’s Revenue Breakdown by Region, FY2014-FY2015

Overview of Alpine’s Enterprises in China

Clarion’s Revenue and Operating Margin, FY2006-FY2016

Clarion’s Revenue Breakdown by Region, FY2009-FY2015

Distribution of Clarion’s Production Bases

Clarion’s Organizational Structure in China

Delphi’s Revenue and Operating Margin, 2007-2014

Delphi’s Revenue Breakdown by Product, 2009-2014Q1

Delphi’s Operating Margin by Segment, 2013-2014

Delphi’s Customer Distribution, 2010-2016

Delphi’s Revenue Breakdown by Region, 2010-2014

Delphi Electronics & Safety Segment Revenue Mix by product

Visteon’s Revenue and EBITDA, 2013-2015

Visteon’s Quarterly Revenue and Gross Margin, 1Q/2014-2Q/2015

Visteon’s Quarterly EBITDA, 1Q/2014-2Q/2015

Visteon’s Automotive Electronics Revenue by Product, 2013-2014

Visteon’s Automotive Electronics Revenue by Product, 2015

Visteon’s Automotive Electronics Revenue by Region, 2013-2015

Visteon’s Automotive Electronics Revenue by Customer, 2013-2014

YFV Organization

YFV Structure

Yanfeng Visteon Electronics Organization

Distribution of YFVE’s Production Bases

Revenue Breakdown of Visteon Electronics in China by Customer, 2015

Hangsheng Electronic’s Vehicle Infotainment Products

PAS’s Major Customers

PAS’s Revenue Breakdown by Region, FY2012

Panasonic’s Automotive Revenue by Product, FY2012

PASDL’s Organizational Structure

Fujitsu Ten’s Revenue and Operating Margin, FY2005-FY2015

Fujitsu Ten’s Revenue Breakdown by Segment, FY2005-FY2016

Aisin AW’s Revenue and Operating Income, FY2007-FY2016

AisinAW’s Navigator Output, FY2008-FY2016

AisinAw’s Car Navigation Market Share (Shipments)

Denso’s Revenue and Operating Margin, FY2006-FY2016

Distribution Proportion of Denso’s OEM Customers, FY2008-FY2015

Denso’s Revenue Breakdown by Product, FY2012-FY2015

Denso’s Revenue and Operating Income by Region, FY2014 vs FY2015

Denso’s Revenue and Operating Income by Region, FY2015 vs FY2016

Denso’s ADAS

Organizational Structure of Tianjin Mobis

Revenue and Operating Income of Coagent Electronics S & T, 2013-2015

Revenue Breakdown of Coagent Electronics S & T by Product, 2013-2015

Revenue Breakdown of Coagent Electronics S & T by Business, 2013-2015

Organizational Structure of Coagent Electronics S & T

Output and Sales Volume of Shenzhen Soling, 2011-2014

Revenue Breakdown of Shenzhen Soling by Channel, 2011-2014

Revenue and Operating Income of Shenzhen Soling, 2011-2015

Shenzhen Soling’s Financial Data, 2012-2014

Revenue and Operating Income of JVC Kenwood, FY2009-FY2016

Revenue Breakdown of JVC Kenwood by Segment, FY2008-FY2013

Revenue Breakdown of JVC Kenwood by Segment, FY2014-FY2015

Operating Income of JVC Kenwood by Segment, FY2014-FY2015

Automotive Electronics Revenue of JVC Kenwood, FY2008-FY2015

JVC Kenwood Result and Forecast Dealer-installed Navigation (Qty), FY2014-FY2018

Vehicle Models Using Bose Audio

Garmin’s Sales and Operating Margin, 2007-2015

Garmin’s Sales by Business, 2009-2015

Garmin’s Operating Income by Business, 2009-2015

Garmin’s Sales by Region, 2009-2014

E-LEAD Electronic’s Revenue and Gross Margin, 2009-2015

E-LEAD Electronic’s Monthly Revenue, Aug. 2013-Aug. 2015

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...