ADAS and Autonomous Driving Tier 1 Suppliers Report, 2018-2019

-

May 2019

- Hard Copy

- USD

$3,200

-

- Pages:145

- Single User License

(PDF Unprintable)

- USD

$3,000

-

- Code:

LY006

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,500

-

- Hard Copy + Single User License

- USD

$3,400

-

ADAS and Autonomous Driving Tier 1 Suppliers Report, 2018-2019: Huge Investment, Increasing Orders, and Soaring Labor Cost

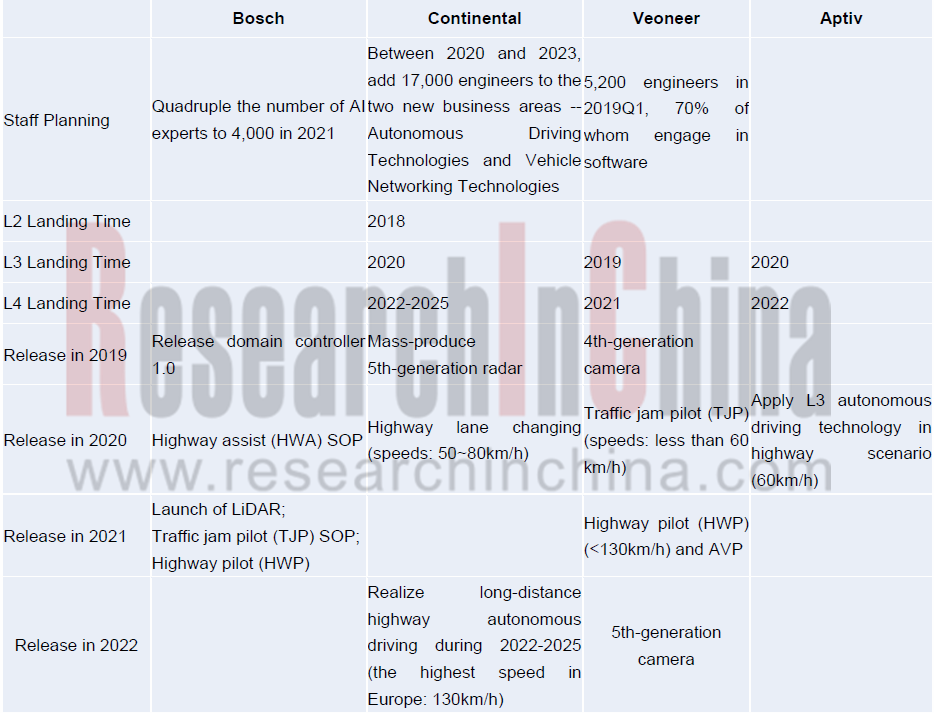

From the progress of the world’s main Tier1 suppliers in autonomous driving, it can be seen that the giants like Bosch and Continental are moving forward at their own pace in line with their timetable.

Traditional Tier1 suppliers are sparing no efforts in enlarging talent teams (especially software), developing ADAS/AD domain controllers, acquiring sensor firms and self-development, testing autonomous driving technology in various scenarios (industrial park, highway, parking, etc.), expanding autonomous fleets for road test, building test fields on their own or together with others, establishing operation and data management centers, and allying themselves with more partners.

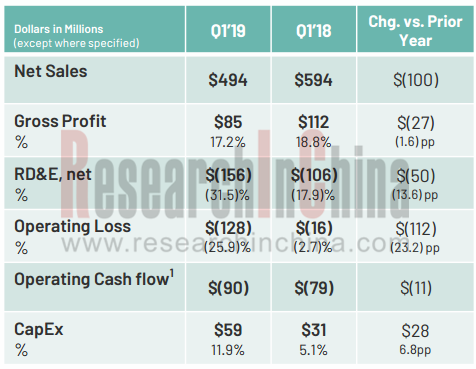

Tier1 suppliers suffer a slump in profits and even a bigger loss because of huge investment in autonomous driving, but there is good news that orders are increasing.

Veoneer’s operating loss for 2019Q1 jumped to USD128 million compared with USD16 million in 2018Q1; its R&D expenses rose to USD156 million from USD106 million in 2018Q1; capital expenditure surged from USD31 million to USD59 million largely for camera capacity expansion, according to Veoneer’s 2019Q1 financial results in the table above.

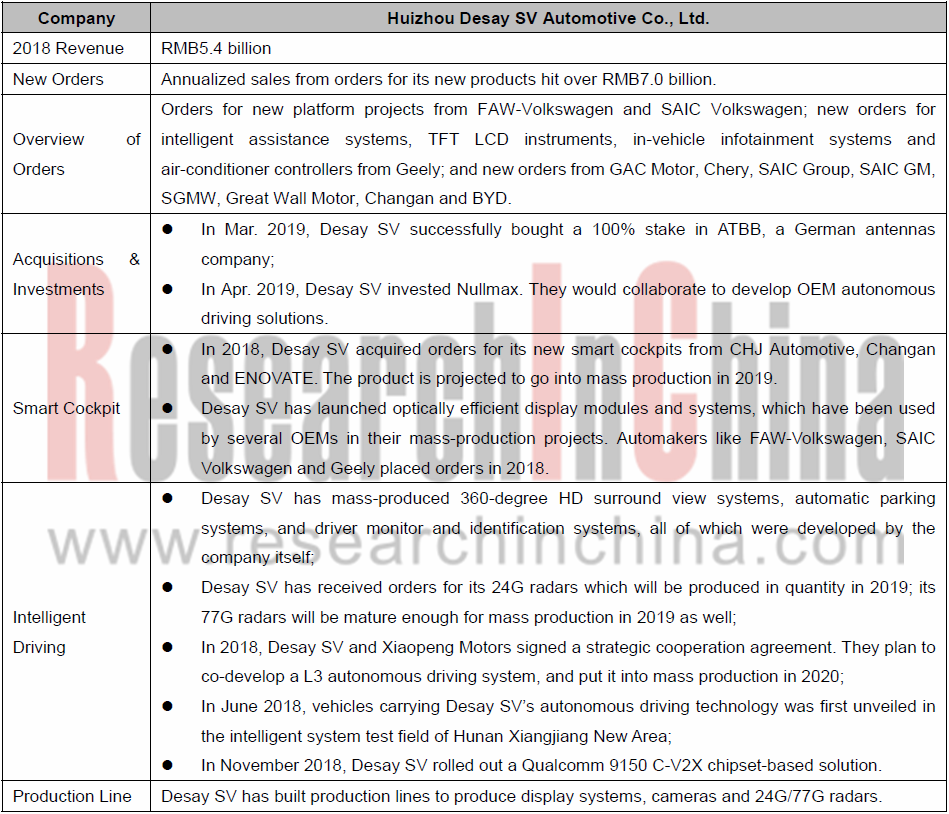

Among Chinese Tier1 suppliers, Huizhou Desay SV Automotive Co., Ltd., a leading player in ADAS and autonomous driving field, also sees its profit decline. The supplier’s operating results for 2019Q1 indicate that its net income attributable to the shareholders of the listed company stood at RMB43.54 million, a 72.82% plunge on an annualized basis, which was caused by a nosedive in China’s 2019Q1 automobile sales and the company’s huge investment in research and development of new technologies. In 2018, the company reported RMB5.4 billion in revenue, with annualized sales from orders for its new products outnumbering RMB7.0 billion.

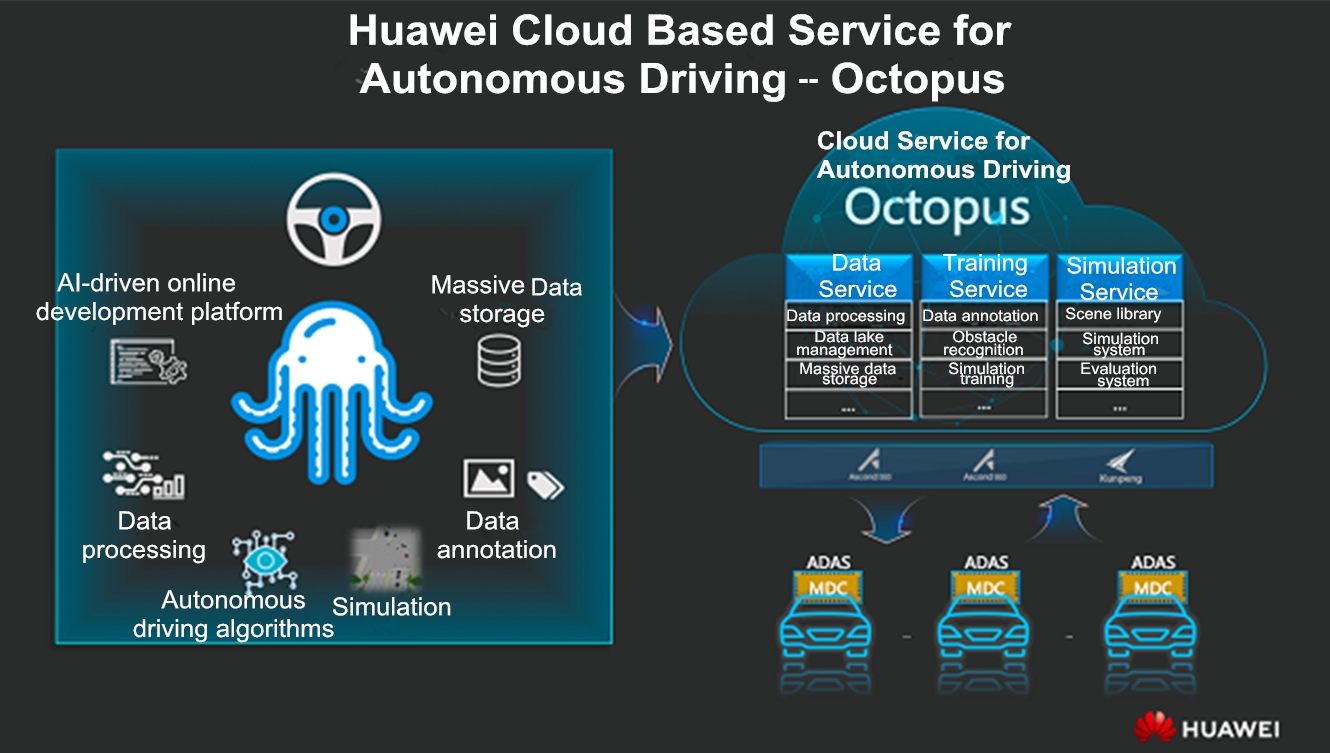

In April 2019, Huawei made its debut as a Tier1 supplier at Auto Shanghai, and exhibited solutions such as MDC, intelligent connectivity, Huawei Cloud (Octopus) and three types of sensors.

Huawei’s entry will intensify the already fierce competition among Tier1 suppliers of ADAS and autonomous driving solutions.

1 Comparative Analysis of Main ADAS and Autonomous Driving Tier1 Suppliers

1.1 Autonomous Driving System Is Divided into Three Levels

1.2 Autonomous Driving Planning, Commercialization Process and Development Features of Foreign Tier1 Suppliers

1.3 Product Layout of Foreign Tier1 Suppliers

1.4 Comparison of Foreign Tier1 Suppliers (including Revenue, Profit, Orders, Partners and Investment)

1.5 Planning Comparison of Foreign Tier1 Suppliers (including Personnel Planning, Launch Time of L2-L4, Products to Be Launched in 2019-2022)

1.6 Vision Product Investment Comparison of Foreign Tier1 Suppliers (Monocular, Stereo, etc.)

1.7 Radar Investment Comparison of Foreign Tier1 Suppliers (Millimeter Wave Radar, LiDAR, Ultrasonic Radar)

1.8 Other Technology Investment Comparison of Foreign Tier1 Suppliers (V2X, HD Map, High-precision Positioning, Domain Controller)

1.9 Autonomous Driving Application Scenario R&D Comparison of Main Tier1 Suppliers (Minibus, City, Highway, Parking)

1.10 Autonomous Driving Test and Operation Comparison of Main Tier1 Suppliers (Test Field, Test Vehicle, Base, etc.)

1.11 Development Layout Comparison of Chinese Tier1 Suppliers

2 Tier1 Suppliers of ADAS and Autonomous Driving Solutions Worldwide

2.1 Bosch

2.1.1 Profile

2.1.2 Autonomous Driving Sensor

2.1.3 Autonomous Driving Positioning Solution

2.1.4 Decision: Domain Controller

2.1.5 Autonomous Driving Product Layout

2.1.6 Autonomous Shuttle

2.1.7 Autonomous Driving Partners

2.1.8 ADAS and Autonomous Driving in 2018-2019

2.2 Continental

2.2.1 Profile

2.2.2 Performance

2.2.3 Organizational Restructuring Will Be Completed by 2020

2.2.4 Sensors

2.2.5 Autonomous Driving Development Plan

2.2.6 Three Integrated Solutions for Autonomous Driving

2.2.7 CuBE and Seamless Driving & Delivery

2.2.8 Autonomous Driving Layout and Partners

2.2.9 Autonomous Driving Layout in 2018-2019

2.3 Aptiv

2.3.1 Profile

2.3.2 Revenue and Orders

2.3.3 Strategic Positioning

2.3.4 Multi-domain Controller

2.3.5 ADAS Sensor

2.3.6 Autonomous Driving Route

2.3.7 Autonomous Driving Solution CSLP

2.3.8 L4 Test Autonomous Vehicle

2.3.9 Cooperation with Lyft in Autonomous Driving

2.3.10 Expedited Layout in Autonomous Driving Industry Chain through Investments, Acquisitions and Collaborations

2.3.11 Autonomous Driving Layout in 2018-2019

2.4 Valeo

2.4.1 Profile

2.4.2 Sensor Product Layout

2.4.3 Sensing Solution

2.4.4 Three Autonomous Driving Systems and Technology Roadmaps

2.4.5 Cruise4U (Highway)

2.4.6 Drive4U (Urban Road)

2.4.7 Automated Parking System Park4U

2.4.8 Autonomous Driving Partners

2.4.9 Autonomous Driving Dynamics in 2018-2019

2.5 ZF

2.5.1 Profile

2.5.2 Product Layout

2.5.3 ZF Sensors

2.5.4 ProAI

2.5.5 Autonomous Taxi and IoT Platform

2.5.6 Autonomous Driving Partners

2.5.7 Autonomous Driving Dynamics in 2018-2019

2.6 Hyundai Mobis

2.6.1 Profile

2.6.2 Autonomous Driving Layout

2.6.3 Research Progresses of ADAS and Autonomous Driving

2.6.4 ADAS and Autonomous Driving Dynamics in 2018-2019

2.7 Veoneer

2.7.1 Profile

2.7.2 Development in 2018 and Outlook for 2019

2.7.3 Major Projects and Customers

2.7.4 Product Milestones

2.7.5 Autonomous Driving Layout

2.7.6 Vision Products and Functional Planning

2.7.7 Monocular Vision System

2.7.8 Zeus

2.7.9 Autonomous Driving Solutions

2.7.10 ADAS Partners

2.7.11 Planning for Autonomous Driving Development

2.7.12 ADAS and Autonomous Driving Dynamics in 2018-2019

2.8 Visteon

2.8.1 Profile

2.8.2 Operation (Worldwide) in 2018

2.8.3 Operation (China) in 2018

2.8.4 Positioning in the Autonomous Driving Industry Chain

2.8.5 Major Products

2.8.6 Autonomous Driving Domain Controller DriveCore

2.8.7 DriveCore Computing Platform: Compute

2.8.8 DriveCore Algorithm: Studio

2.8.9 DriveCore Middleware: Runtime

2.8.10 ADAS Development History and Autonomous Driving Roadmap

2.8.11 Three ADAS Segments and Features

2.8.12 L3/L4 Autonomous Driving Test

2.8.13 Autonomous Driving Schedule

2.8.14 Autonomous Driving Partners

2.8.15 Autonomous Driving Dynamics in 2018-2019

2.9 Magna

2.9.1 Vision Products

2.9.2 Visual ADAS

2.9.3 MAX4 Domain Controller

2.9.4 MAX4 for L4 Autonomous Driving

2.9.5 Autonomous Driving Dynamics

2.10 Denso

2.10.1 Revenue

2.10.2 Autonomous Driving Investment and R&D Layout

2.10.3 Millimeter Wave Radar

2.10.4 Denso Ten

2.10.5 ADAS and Autonomous Driving Dynamics

3 Tier 1 Suppliers of Intelligent Connected ADAS and Autonomous Driving Solutions in China

3.1 Baidu

3.1.1 Apollo Platform

3.1.2 Apollo Autonomous Driving Open Roadmap

3.1.3 Apollo Open Platform Progress

3.1.4 Apollo Partners

3.1.5 L4 Passenger Car Solution and Partners

3.1.6 L4 Autonomous Park Car Solution

3.1.7 Open Source of V2X CVIS Solution

3.1.8 Upcoming Commercial Packaged Solution

3.1.9 Autonomous Driving Progress

3.2 Tencent

3.2.1 AD Lab

3.2.2 Autonomous Driving Layout

3.2.3 Autonomous Driving Solution

3.2.4 Autonomous Driving Planning

3.3 Neusoft Reach

3.3.1 Profile

3.3.2 Product Line

3.3.3 ADAS

3.3.4 Autonomous Driving

3.3.5 Cooperation

3.4 Huawei

3.4.1 Intelligent Connected Vehicle Business

3.4.2 L4 Computing Platform

3.4.3 C-V2X Technology

3.4.4 Intelligent Connected Vehicle Partners

3.4.5 Octopus

3.5 Foryou Corporation

3.5.1 Automotive Electronics Business

3.5.2 R&D Planning in 2019

3.6 Desay SV

3.6.1 Profile

3.6.2 Intelligent Vehicle Revenue and R&D Investment

3.6.3 Development of Three Major Businesses

3.6.4 Future Development Strategy

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...