China Passenger Car Camera Market Report, 2019Q1

-

May 2019

- Hard Copy

- USD

$1,700

-

- Pages:73

- Single User License

(PDF Unprintable)

- USD

$1,500

-

- Code:

LY007

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$2,300

-

- Hard Copy + Single User License

- USD

$1,900

-

Passenger Car Camera Market: Front-view Monocular Camera Installation Soared by 71.7% in 2019Q1 from the Same Period Last Year.

In China, front view monocular camera is the one largely demanded in passenger car market, with its installations in 2019Q1 surging by 71.7% from the same period of 2018, according to our recent report -- China Passenger Car Camera Market Report, 2019Q1.

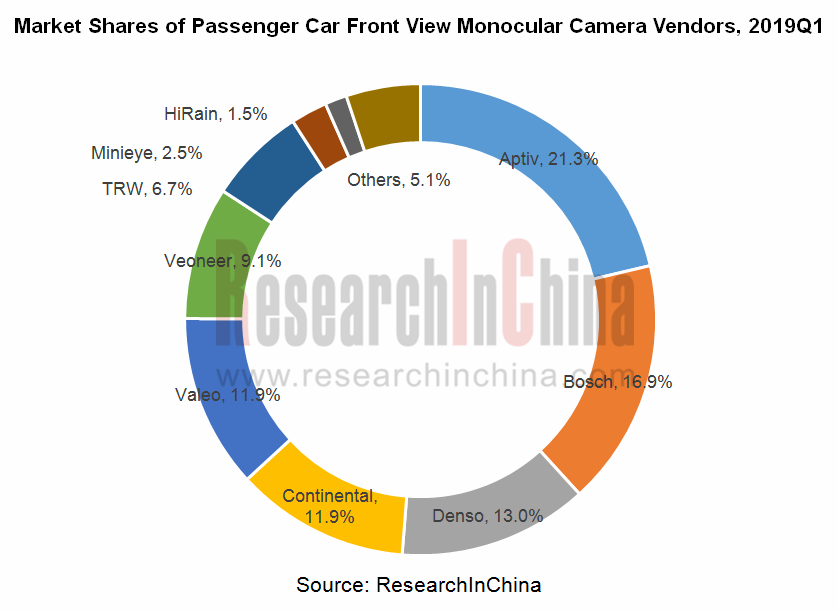

The top three players Aptiv, Bosch and Denso commanded 21.3%, 16.9% and 13.0% of the market, respectively.

Chinese vendors have made headway in ADAS camera field, among which Minieye and HiRain Technologies have entered the top ten monocular camera vendor list where the four radar monopolists, Aptiv, Bosch, Continental and Denso are also ranked, with respective market share of 2.5% and 1.5%.

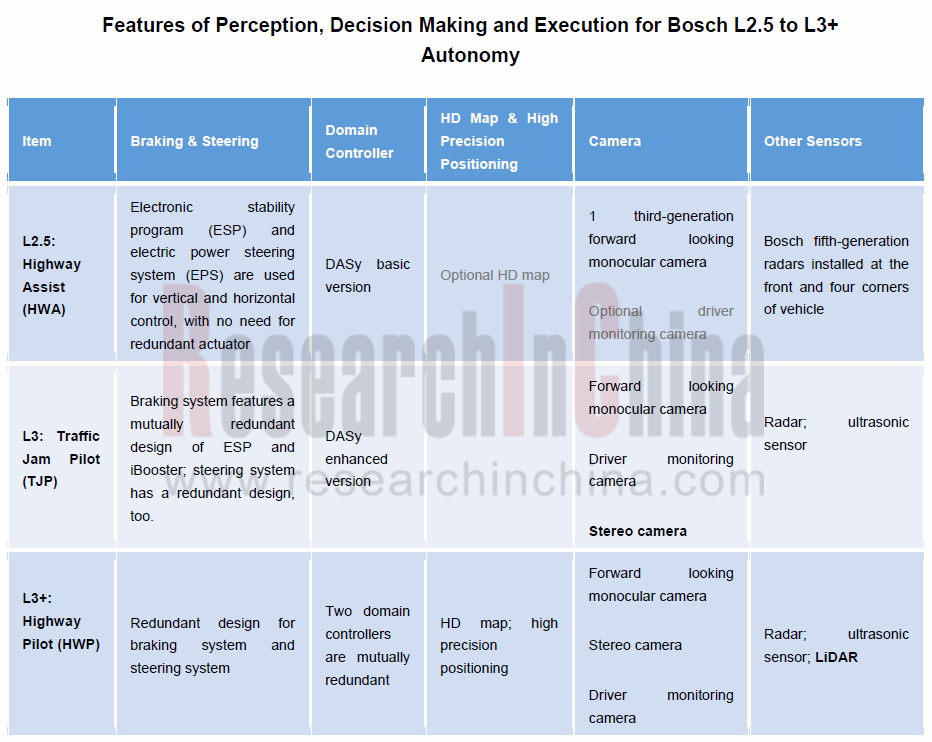

Bosch vision-based ADAS products grow fast in the Chinese market. In 2019Q1, the market share of its forward looking monocular cameras jumped to 16.9% compared with less than 10% in 2018. The mass-produced Chinese vehicle models packing Bosch L2 autonomy technology include: Geely Borui GE, Changan CS55, Great Wall VV6, Geely Binrui, SAIC Marvel X and SGMW New Baojun RS-5. Bosch expects more than 40 models with its L2 capability will be available on market in 2019.

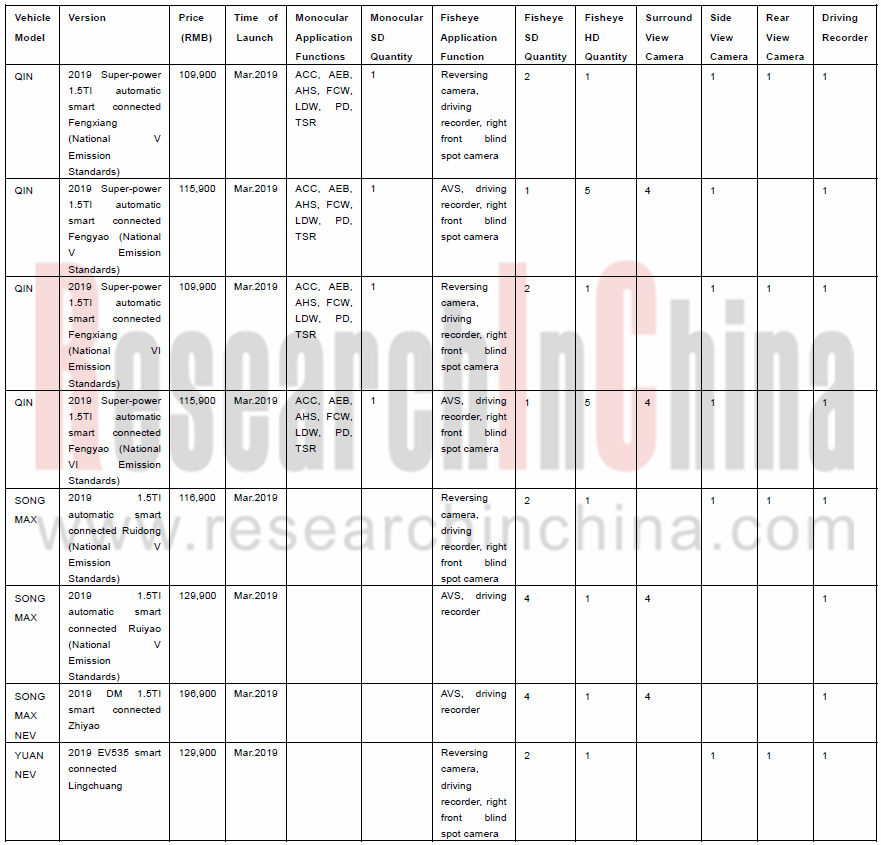

Of the 572 new car models launched in China in 2019Q1 (note: the number of models is counted based on configuration), SAIC rolled out the most, 66 models; BYD followed with 41 models having the most complete camera configurations.

In 2019Q1, BYD released 7 new cars in 41 models, including: 8 with monocular SD camera; 32 with fisheye SD camera; 26 with fisheye HD camera; 8 with around view camera; 24 with side view camera; 28 with reversing camera; 26 with driving recorder. Vision sensor configurations of some models are shown below.

This is quarterly report, are totally 4 issues a year, with annual subscription fee of USD6,000.

Reseller distribution is not allowed.

Preface

Research Background and Contents

Methodology

Terminology

1 Chinese Passenger Car Camera Market

Front-view Monocular and Stereo Camera Installations and Growth Rate in Chinese Passenger Car Market, 2019Q1

Front-view Monocular and Stereo Camera Installations to New Cars in China, Jan 2018 - Mar 2019

Proportion of Front-view Monocular Camera Installations to New Passenger Cars in China by Price, 2019Q1

Top 20 Brands by Front-view Monocular Camera Installations to New Passenger Cars in China, 2019Q1

Top 30 Models by Front-view Monocular Camera Installations to New Passenger Cars in China, 2019Q1

Front-view Monocular Camera Suppliers to New Passenger Cars and Their Share by Installations in China, 2019Q1

Front-view Monocular Camera Suppliers to New Passenger Cars and Their Installations and Share in China, 2018Q1-2019Q1

Camera Installations to New Cars and Installations by Position in China, 2019Q1

Proportion of Camera Installations to New Cars in China by Number & by Position, 2019Q1

Rear-view Camera Installations to New Cars and Growth Rate in China by Reversing Camera and Streaming Rear-view Mirror, Jan-Mar 2019

Rear-view Reversing Camera and Streaming Media Installations to New Cars in China, Jan 2018 - Mar 2019

Proportion of Reversing Camera Installations to New Cars in China by Price, 2019Q1

Top 20 Brands by Reversing Camera Installations to New Cars in China, 2019Q1

Monthly Surround-view Camera Installations to New Cars in China, Jan 2018 - Mar 2019

Proportion of Surround-view System Installations to New Cars in China by Price, 2019Q1

Top 20 Brands by Surround-view System Installations to New Cars in China, 2019Q1

Side-view Camera Installations to New Cars and Growth Rate in China, Jan-Mar 2019

Side-view Camera Installations to New Cars in China, Jan 2018 - Mar 2019

2 Installations and Dynamics of Automotive Vision Suppliers

2.1 Aptiv

2.1.1 Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.1.2 Recent Developments

2.2 Bosch

2.2.1 Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.2.2 Models Supported and Recent Developments

2.3 Denso’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.4 Continental’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.5 Valeo’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.6 Veoneer’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market

2.7 TRW’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.8 Gentex’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.9 HiRain’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.10 Minieye

Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

Recent Developments

3 Vision Sensor Configuration and Features of Chinese Automakers

3.1 Great Wall Motor

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

3.2 Geely

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

3.3 BYD

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

3.4 SAIC Passenger Vehicle

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

3.5 Chang'an Automobile

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

3.6 Hanteng Autos

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

3.7 Leapmotor

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4 Vision Sensor Configuration and Features of Joint Venture Brands

4.1 Beijing Benz

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.2 GAC Toyota

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.3 BMW Brilliance

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.4 SAIC Volkswagen

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.5 SAIC-GM

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.6 FAW-Volkswagen

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.7 FAW Toyota

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.8 Dongfeng Yueda Kia

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.9 Chery Jaguar Land Rover

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.10 Chang’an Mazda

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.11 Dongfeng Peugeot Citro?n

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.12 JMC Ford

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

5 Development Trends of Vision Sensor Industry

5.1 Development Trends of Visual Processing Chips

5.2 Development Trends of Software and Algorithms

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...