Global and China Automotive Lighting Industry Report, 2021 combs through intelligence trends of automotive lighting, technology routes, laws and regulations for automotive lighting industry, competitive pattern of automotive lighting market, automotive lighting companies’ deployments in intelligence, and their intelligent lighting configurations for mid- and high-class vehicle models.

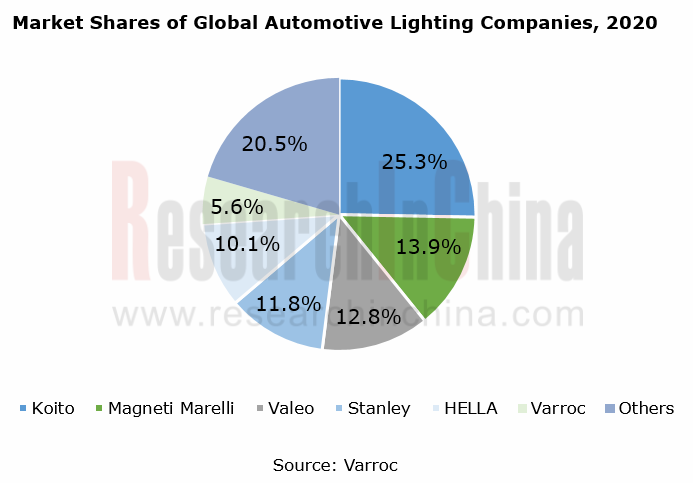

Global automotive lighting market is highly concentrated, and Koito is the champion.

Automotive lighting is a highly concentrated market where bellwethers play a dominant role, that is, there are “one superpower and several powers”. In the global automotive lighting market, European, American and Japanese manufacturers are the main players. In 2020, Japan-based Koito was positioned first with market share of 25.3%, Italy’s Magneti Marelli (13.9%) and France-based Valeo (12.8%) followed, three together sweeping 52% of the global market.

Global automotive lighting leaders vie more fiercely for new technologies:

---In September 2019, Koito rolled out BladeScan?ADB headlamp system which has been mounted on 2019 Lexus RX and 2021 Lexus LS.

---At CES 2019, Magneti Marelli introduced its third-generation Smart Corner lighting technology which can integrate with all types of sensors including LiDAR, radar, camera and ultrasonic radar. The company also displayed advanced LED lighting functions such as digital light processing (DLP) and adaptive driving beam (ADB).

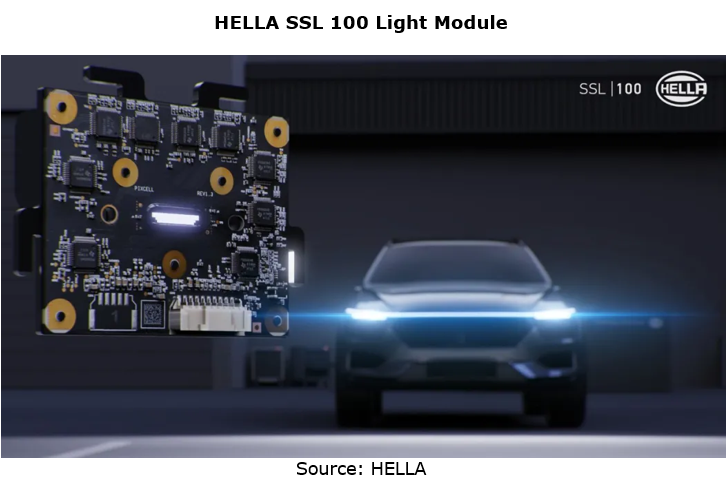

---In March 2020, Hella unveiled SSL 100 light module. The system offers up to 102 pixels, each of which can be activated independently, and controls light distribution via ECU to automatically turn on and turn off LED in a designated area. SSL 100 light module has been introduced into Chinese market and mass-produced at HELLA lamp plant in Jiaxing.

---In November 2020, the Human Centric Lighting (HCL) innovator Biological Innovations and Optimization Systems, LLC (BIOS), and Lumileds, joined forces to create a new SkyBlue? LED. BIOS SkyBlue Circadian rhythm technology used in the new product is a solution to technical challenges of HCL.

Not to be outdone, Chinese automotive lighting bellwethers have developed dynamically interactive lighting technology in the automotive CASE trend. For example, at Auto Shanghai 2021, HASCO Vision Technology displayed an intelligent interactive lighting system that consists of PML intelligent headlamps and ISD tail lights. The system can input user-defined texts, pictures and videos into the lighting domain controller which will then convert the content into elements and materials that the lamps can recognize to display the specific content and interact with the outside world. The system is mounted on Human Horizons HiPhi X. In 2020, Changzhou Xingyu Automotive Lighting Systems also managed to develop rhythmic taillights capable of welcoming, the second-generation ambient lights with public voice interaction function, gesture controlled indoor lamps, and pixel-type headlamp modules.

Demand for intelligent headlights increases, and six technology routes come to the forefront.

Intelligent headlights provide higher visibility for drivers in bad weathers to ensure driving safety. The data shows that the use of intelligent lamps helps to reduce 57%-74% traffic accidents at night. With the increasing demand, more and more intelligent headlights are installed in mid- and high-class cars. According to GMI Research and its public data, it is estimated that the global intelligent headlight market will be worth nearly USD6.84 billion in 2026 compared with USD4.83 billion in 2020.

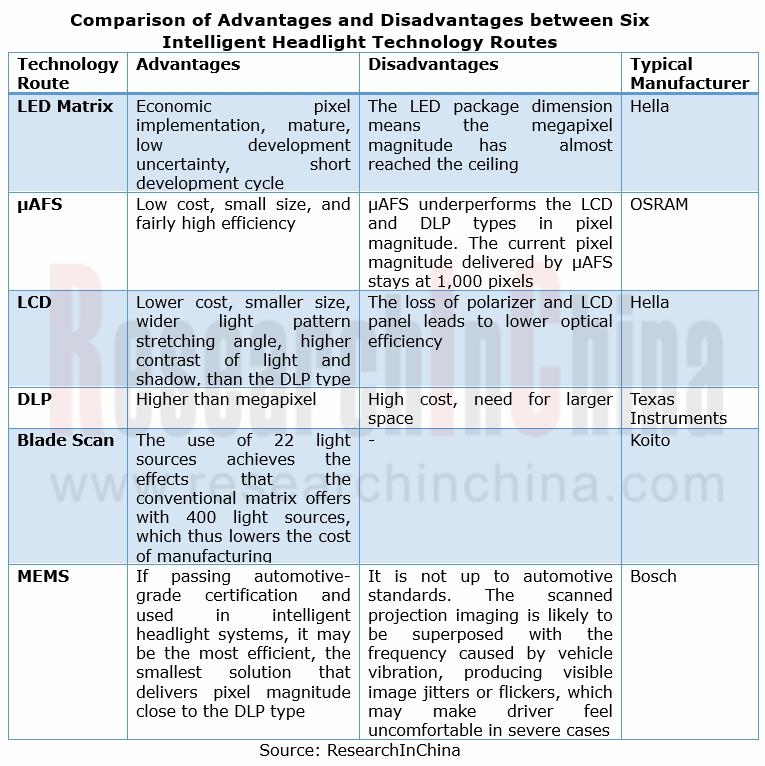

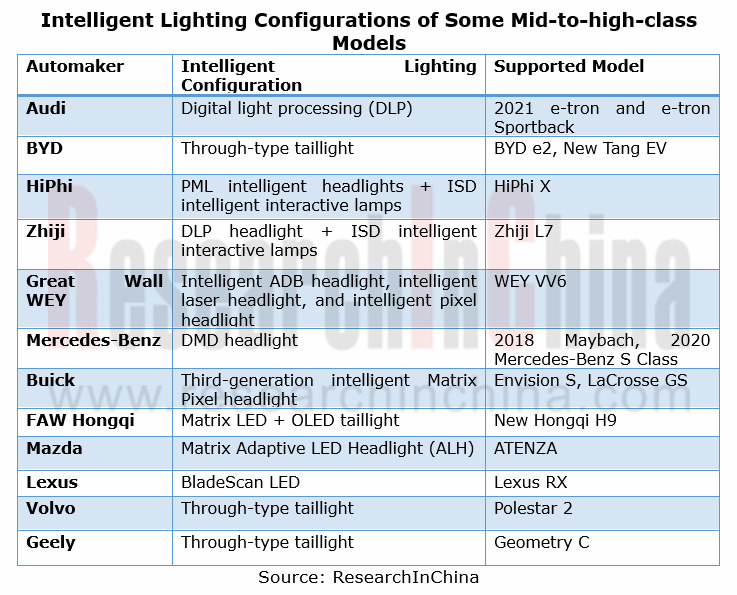

There are six intelligent headlight technology routes: LED Matrix, μAFS, LCD, DLP, Blade Scan and MEMS.

---As LED packaging technology matures and its cost falls, matrix ADB will still be the main implementation form of intelligent headlights which tend to sink from high-class car models to the lower-class.

OSRAM has introduced EVIYOS 1.0, the world’s first μAFS delivering 1,024 pixels on 4mm x 4mm SoC. OSRAM EVIYOS 2.0 offering 25,600 pixels is under development and will be rolled out in 2023.

DLP technology based on digital mirror device (DMD) is monopolized by TI. According to our statistics, there are a total of six DMD-enabled models including New Mercedes-Benz S Class, Great Wall VV6/VV7, and IM Zhiji. The more frequent interactions of vehicles with the outside world come with the development of intelligent connected vehicles. Automotive DLP technology allows light projections on ground to form various light patterns and icons so as to build a bridge to communicate with the outside world, and its high resolution helps to enable ADAS functions, for example, traffic sign lighting for recognizing traffic signs. Hence DLP technology will find broad application in intelligent connected vehicles.

Automakers play as “lighting factory” to accelerate the layout of intelligent lighting.

To meet market demand, automakers also step up their efforts to deploy intelligent lighting. Audi has made long and frequent deployments in automotive lighting. In June 2020, Audi released New Q5, a new model carrying Audi’s latest intelligent OLED lighting technology, which makes Audi the first automaker digitalizing taillights into a display. Audi is working to develop flexible digital OLED.

Among Chinese automakers, BYD has developed automotive lighting independently since 2003. FinDreams Vision Co., Ltd. BYD established in 2019 is devoted to developing vision technology, motor vehicle lighting and signal system. Having been the first automaker to integrate automotive lighting vertically, BYD is working toward development of new technologies in automotive lighting and environment interconnection.

In addition, Mazda has also developed its adaptive LED headlight (ALH) technology.

As the technology advances, automotive lighting is no longer a simple lighting tool but will integrate with driving assistance functions, for example, combined with cameras to enable safer driving through high and low beam switch according to the objects ahead. In future, more intelligent, more interactive and safer automotive lighting will be demanded in a new age.

Chinese Joint Venture OEMs’ ADAS and Autonomous Driving Report, 2022

Joint Venture OEM's ADAS Research: Joint venture brands lead in L2/L2.5 installation rate, but have not involved L2.9 for the time being

Following "Chinese Independent OEMs’ ADAS and Autonomous Drivi...

Global and China Hybrid Electric Vehicle Research Report, 2022

Hybrid Research: China Hybrid EV penetration rate will hit 22% within five years

With the development of automobile energy-saving and new energy technologies and the promotion of low-carbon emission ...

China Smart-Road Roadside Perception Industry Report, 2022

Top 10 roadside perception suppliers: quality suppliers come to the front in each market segment.

The growing number of roadside perception players comes with active industrial investment and financ...

China Passenger Car Brake-by-Wire and AEB Market Research Report, 2022

Brake-by-wire research: with an astonishing growth in installation rate, One-Box has commanded much more of the market.

In new energy vehicles, especially intelligent vehicles, the bake-by-wire techn...

Multi-domain Computing and Zone Controller Research Report, 2022

Multi-domain computing and zone controller research: five design ideas advance side-by-side.In the trend for higher levels of autonomous driving, intelligent vehicles pose more stringent requirements ...

Overseas ADAS and Autonomous Driving Tier 1 Suppliers Report, 2022

Overseas ADAS Tier1 Suppliers Research: The gap between suppliers has widened in terms of revenue growth, and many of them plan to launch L4 products by 2025Countries allow L3/L4 vehicles on the road ...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022

ResearchInChina released "Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022". This report combs through and summarizes status quo (installations, installation rate), function applicat...

China Passenger Car Electronically Controlled Suspension Industry Report, 2022

Research on electronically controlled suspension: four development trends of electronically controlled suspension and air suspension

Basic concepts of suspension and electronically controlled suspens...

China L2/L2+ Smart Car Audio Market Report, 2022

Car audio research: ranking of L2+ smart car audio suppliers by market share

The National Development and Reform Commission has upgraded the development of intelligent vehicles to a national strategy...

China Commercial Vehicle T-Box Report, 2022

TOP10 commercial vehicle T-Box suppliers: using terminal data to build telematics platforms will become a megatrend.

1. From the perspective of market size, the pace of popularizing T-Box accelerates...

Electric Drive and Power Domain Industry Report, 2022

Electric drive and power domain research: efficient integration becomes a megatrend, and integration with other domains makes power domain stronger.

Electric drive systems have gone through several ...

China Autonomous Retail Vehicle Industry Report, 2022

Research on Autonomous Retail Vehicles: Lower Costs Accelerate Mass Production with Ever-spreading Retail Scenarios Autonomous retail vehicles integrate technologies such as 5G, artificial intelligenc...

China Passenger Car Driving and Parking Integrated Solution Industry Report, 2022

Driving and parking integrated solutions stand out in high-level intelligent driving, and the mass adoption is around the corner. According to ResearchInChina, in the first four months of 2022, China'...

Autonomous Driving and Cockpit Domain Control Unit (DCU) Industry Report, 2022(II)

Domain Controller Research: Exploration of Five Business Models, Tier1, Tier0.5, Tier1.5 or ODM?

Automakers accelerate the mass production of new E/E architecture platforms, and the penetration rate...

Autonomous Driving and Cockpit Domain Control Unit (DCU) Industry Report, 2022 (I)

Domain Controller Research: Exploration of Five Business Models, Tier1, Tier0.5, Tier1.5 or ODM?

Automakers accelerate the mass production of new E/E architecture platforms, and the penetration rate...

China Minicar Industry Report, 2022

Minicars, also known as mini passenger cars, are suitable for short-distance transportation and are positioned as entry-level vehicles. Thanks to low cost, convenient parking and low usage cost, minic...

China Automotive Ultrasonic Radar and OEM Parking Roadmap Research Report, 2022

In 2021, ultrasonic radar shipments hit 100 million units, and intelligent parking became a crucial engine.1. In 2025, China’s ultrasonic radar installations will exceed 140 million units.

According...

DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022

DENSO CASE Research: The semiconductor business will help it go "from Toyota to the world”

ResearchInChina has released DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Resea...