Chassis-by-Wire Research: China’s Brake-by-Wire Assembly Rate Is only 2%, Indicating Huge Growth Potentials

With the mass production of L3-L4 autonomous driving, the necessity of Chassis-by-Wire has become increasingly prominent. What is the status quo of Chassis-by-Wire? What is the more advanced product form? Who will lead this market?

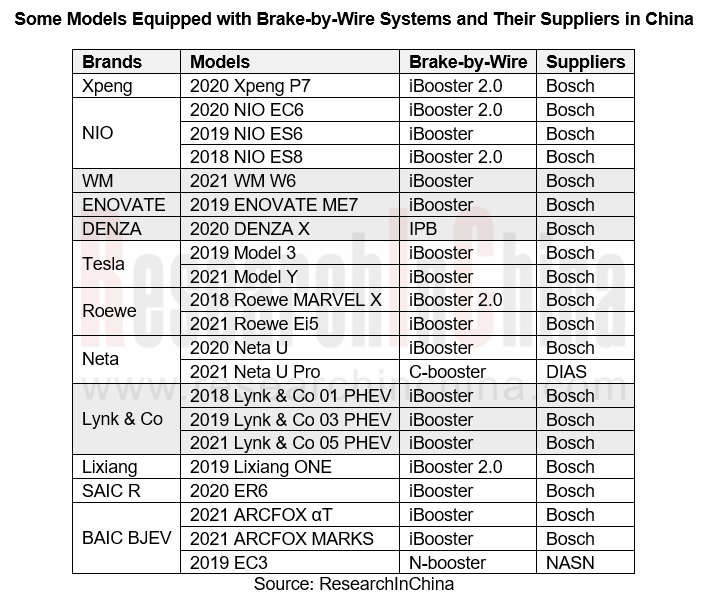

1. Brake-by-Wire takes the lead in mass production, and Bosch dominates the field

There are two key Chassis-by-Wire products: Brake-by-Wire and Steer-by-Wire. Brake-by-Wire has taken the lead in mass production thanks to the demand from new energy vehicles and L3 autonomous driving. China's Brake-by-Wire assembly rate was 1.6% in 2020, and it is expected to exceed 2.5% in 2021.

In 2020, Bosch's Brake-by-Wire products (iBooster, iBooster 2.0, IPB) seized a market share of over 90%, signaling an absolute dominant position.

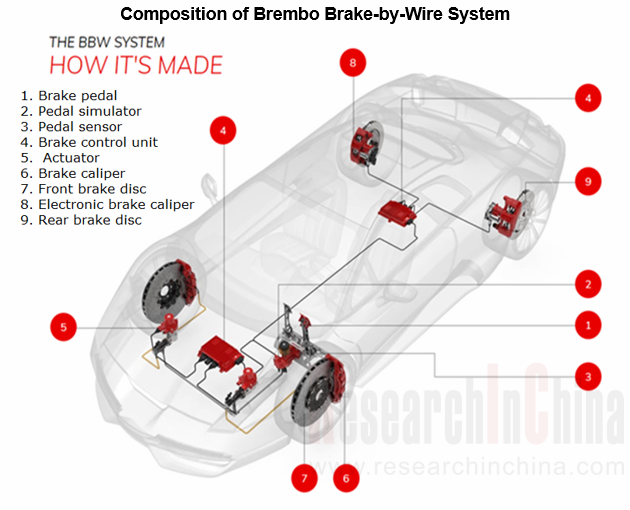

2. In the EMB era, Brembo, Mando, Haldex, and EA Chassis get a head start

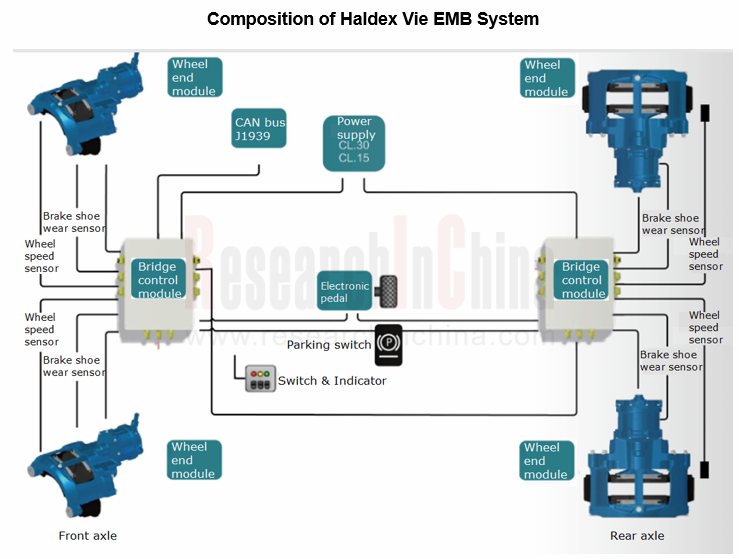

Currently, Brake-by-Wire is mainly divided into Electro-Hydraulic Brake (EHB) and Electro-Mechanical Brake (EMB).

? EHB evolves from the traditional hydraulic brake system. Compared with the traditional hydraulic brake system, EHB boasts a more compact structure and better braking efficiency. It is currently the main mass production solution of the Brake-by-Wire system. Bosch IPB/iBooster, Continental MK C1/MK C2, ZF TRW IBC, Bethel Automotive Safety Systems WCBS, etc. are all EHB solutions.

? EMB completely abandons brake fluid and hydraulic pipelines that are seen in the traditional brake system, but uses the motor to drive the brake to generate the braking force. It is a true Brake-by-Wire system and is expected to become the development trend.

At present, there are no mature EMB products on the market. Major foreign companies such as Brembo, Mando, and Haldex have displayed or released related products, and they may get a head start in future marketization.

In April 2021, Brembo released its Brake-by-Wire product at the Shanghai Auto Show. Brembo has been studying the Brake-by-Wire technology based on mechatronics since 2001.

Mando announced its Brake-by-Wire technology at CES 2021, which is composed of 4 units of EMB (Electro Mechanical Brake), mounted on “4-corner module (4 wheels)”, “E-Brake-Pedal (Electronic brake pedal)”, and DCU (Domain Control Unit).

In May 2020, Zhejiang Vie Science & Technology Co., Ltd. and Haldex invested RMB15 million each in establishing Suzhou Haldex Vie, which is dedicated to the production and sale of EMB products. The EMB launched by Haldex Vie targets the commercial vehicle market and can be used on city buses, coaches, trucks and tractors.

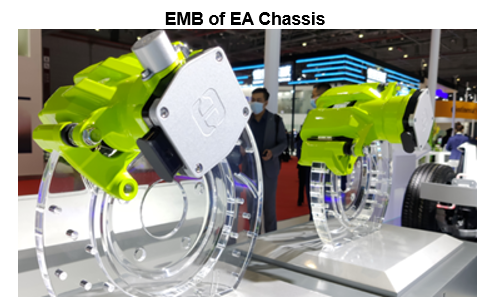

Among domestic automakers, EA Chassis, a subsidiary of Great Wall Motor, has researched EMB by itself and released related products during the 2021 Shanghai Auto Show.

3. Steer-by-Wire represents the next-generation development route

Compared with the booming Brake-by-Wire market, Steer-by-Wire seems too quiet. At present, only four production models of Infiniti adopt mechanically redundant Steer-by-Wire (namely Direct Adaptive Steering? (DAS)) from Kayaba.

DAS retains the mechanical transmission steering mode. When Steer-by-Wire fails, the driver can take over the control. But for autonomous driving, the backup & redundant technology roadmap of the electronic control system may be a better choice.

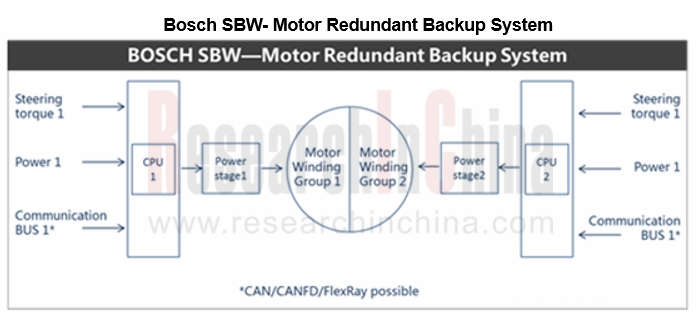

The electronic control system backup & redundant steering (SBW) uses multiple motor controllers at the actuator (steering mechanism) to achieve redundancy. At the steering wheel, multiple sensors are arranged to enable the redundancy of the input signal. Therefore, it can completely remove the mechanical connection between the steering wheel and steering gear. On this basis, it is possible for autonomous vehicles to let the steering wheel extend or retract, which can diversify the layout of the cockpit.

4. SBW will see mass production in 2022-2023, with Bosch and Mando taking the lead in layout

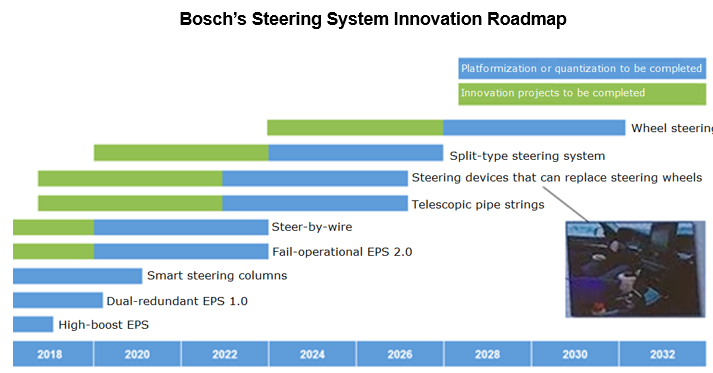

Currently, SBW is still dominated by foreign companies. Bosch, Mando, JTEKT, Nexteer, Schaeffler, etc. have taken the lead in the layout, and they will conduct mass production in 2022-2023.

Bosch will launch SBW- Motor Redundant Backup System in 2023

Bosch adopts the redundant backup technology roadmap for the electronic control system. Its Steer-by-Wire system was first unveiled at the 2019 Shanghai Auto Show, but the product is expected to be applied in 2023.

Mando will mass-produce Steer-by-Wire products in 2022

In January 2021, Mando unveiled its new vision based on safety and freedom, the “Freedom in Mobility”, at CES 2021. Under this vision, Mando demonstrated the “x-by-Wire” technology including Mando’s BbW (Brake-by-Wire) and SbW (Steer-by-Wire)

Mando built its SbW on a redundant E/E architecture and it can be continuously upgraded. It will be mass-produced at the Opelika plant in Alabama, North America, at first, in 2022.

Summary:

On the whole, companies that deploy Brake-by-Wire and Steer-by-Wire simultaneously are more likely to provide users with integrated Chassis-by-Wire solutions, and will grab more lucrative opportunities before autonomous driving is implemented. At present, such companies include Bosch, CNXMotion (a joint venture between Continental and Nexteer), ZF, Mando and other foreign companies, as well as Chinese companies like NASN.

In addition, China-based Great Wall Motor has also started its layout. It conducts independent research and development of Brake-by-Wire and Steer-by-Wire through its two subsidiaries, EA Chassis and HYCET. In 2023, Great Wall Motor will commercialize smart Chassis-by-Wire which integrates a new EEA, Steer-by-Wire, Brake-by-Wire, Shift-by-Wire, Throttle-by-Wire and Suspension-by-Wire to dabble in L4 autonomous driving.

Global and China Automotive IGBT and SiC Research Report, 2022

1. In 2025, China's automotive SiC market will be valued at RMB12.99 billion, sustaining AAGRs of 97.2%.

Silicon carbide (SiC) devices that feature the resistance to high voltage and high frequency ...

Passenger Car Chassis Domain Controller Industry Report, 2022

Chassis domain controller research: full-stack independent development, or open ecosystem route?

Chassis domain consists of transmission, driving, steering and braking systems. Conventional vehicle ...

China Automotive LiDAR Industry Research Report, 2022

LiDAR research: Chinese passenger cars will carry over 80,000 LiDAR sensors in 2022

1. The mass production of LiDAR is accelerating, and the installations are expected to exceed 80,000 units in 2022

...

China Autonomous Driving Data Closed Loop Research Report, 2022

1. The development of autonomous driving is gradually driven by data rather than technology

Today, autonomous driving sensor solutions and computing platforms have become increasingly homogeneous, an...

Overseas LiDAR Industry Research Report, 2022

LiDAR Research: Perception Algorithms Become the Layout Focus of Foreign Vendors

Amid a variety of technology routes in parallel, rotating mirror and flash solutions are adopted most widely during OE...

Smart Car OTA Industry Research Report, 2022

Smart car OTA research: With the arrival of OTA3.0 era, how can OEMs explore payment modes of SAAS?

Driven by the development of smart cars, China's OTA installation rate has been growing. According ...

Chinese Joint Venture OEMs’ ADAS and Autonomous Driving Report, 2022

Joint Venture OEM's ADAS Research: Joint venture brands lead in L2/L2.5 installation rate, but have not involved L2.9 for the time being

Following "Chinese Independent OEMs’ ADAS and Autonomous Drivi...

Global and China Hybrid Electric Vehicle Research Report, 2022

Hybrid Research: China Hybrid EV penetration rate will hit 22% within five years

With the development of automobile energy-saving and new energy technologies and the promotion of low-carbon emission ...

China Smart-Road Roadside Perception Industry Report, 2022

Top 10 roadside perception suppliers: quality suppliers come to the front in each market segment.

The growing number of roadside perception players comes with active industrial investment and financ...

China Passenger Car Brake-by-Wire and AEB Market Research Report, 2022

Brake-by-wire research: with an astonishing growth in installation rate, One-Box has commanded much more of the market.

In new energy vehicles, especially intelligent vehicles, the bake-by-wire techn...

Multi-domain Computing and Zone Controller Research Report, 2022

Multi-domain computing and zone controller research: five design ideas advance side-by-side.In the trend for higher levels of autonomous driving, intelligent vehicles pose more stringent requirements ...

Overseas ADAS and Autonomous Driving Tier 1 Suppliers Report, 2022

Overseas ADAS Tier1 Suppliers Research: The gap between suppliers has widened in terms of revenue growth, and many of them plan to launch L4 products by 2025Countries allow L3/L4 vehicles on the road ...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022

ResearchInChina released "Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022". This report combs through and summarizes status quo (installations, installation rate), function applicat...

China Passenger Car Electronically Controlled Suspension Industry Report, 2022

Research on electronically controlled suspension: four development trends of electronically controlled suspension and air suspension

Basic concepts of suspension and electronically controlled suspens...

China L2/L2+ Smart Car Audio Market Report, 2022

Car audio research: ranking of L2+ smart car audio suppliers by market share

The National Development and Reform Commission has upgraded the development of intelligent vehicles to a national strategy...

China Commercial Vehicle T-Box Report, 2022

TOP10 commercial vehicle T-Box suppliers: using terminal data to build telematics platforms will become a megatrend.

1. From the perspective of market size, the pace of popularizing T-Box accelerates...

Electric Drive and Power Domain Industry Report, 2022

Electric drive and power domain research: efficient integration becomes a megatrend, and integration with other domains makes power domain stronger.

Electric drive systems have gone through several ...

China Autonomous Retail Vehicle Industry Report, 2022

Research on Autonomous Retail Vehicles: Lower Costs Accelerate Mass Production with Ever-spreading Retail Scenarios Autonomous retail vehicles integrate technologies such as 5G, artificial intelligenc...