Global and China Commercial Vehicle Telematics Industry Report, 2021

In 2021, China’s commercial vehicle intelligent connected terminal industry heads in the following three directions.

The first-generation commercial vehicle intelligent connected terminals mainly for satellite positioning and monitoring became available on market due to policies. During decades of development, occupant entertainment capabilities have been added in addition to original functions such as position detection and driving analysis, so as to meet young drivers’ needs for intelligent connected cockpits. In future, “policies and domestic demand” will combine to promote the commercial vehicle telematics industry head in the following directions.

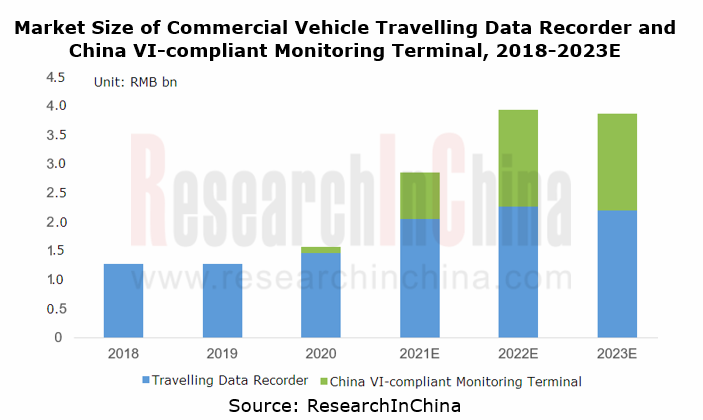

Trend 1: new national standards and new policies will contribute to a nearly RMB4 billion expansion of the market.

As the Chinese Phase VI Emission Standards (China VI) for commercial vehicles and the new version of the national standard Vehicle Traveling Data Recorder came into effect in the second half 2021, it is expected that the market will expand by nearly RMB4 billion.

1. Travelling Data Recorder

In February 2021, the Ministry of Public Security of China released the exposure draft of the Vehicle Traveling Data Recorder (GB/T 19056-XXXX). Compared with the old version, it adds such functions as audio and video recording, Wi-Fi communication, wireless public network communication, automatic timing, protective memory (disaster recovery), and driver identification and requires better positioning capability.

The new national standard is about to take effect on October 1, 2021. And then travelling data recorders will carry more functions but become much more expensive. It is expected that China’s travelling data recorder market will be worth more than RMB2.2 billion in 2023.

2. China VI-compliant Monitoring Terminal

From July 1, 2021 onwards, all homemade, imported and registered heavy duty diesel vehicles (including heavy and light trucks) must be subject to the Chinese Phase VI Emission Standards. According to the policy, vehicles are required to pack standard-compliant on-board terminals for remote emission management before leaving factory. As the standard is implemented, the penetration of China VI-compliant monitoring terminals in heavy, medium-sized and light trucks will reach 100%. It is predicted that the China VI-compliant monitoring terminal market will be worth more than RMB1.6 billion in 2023.

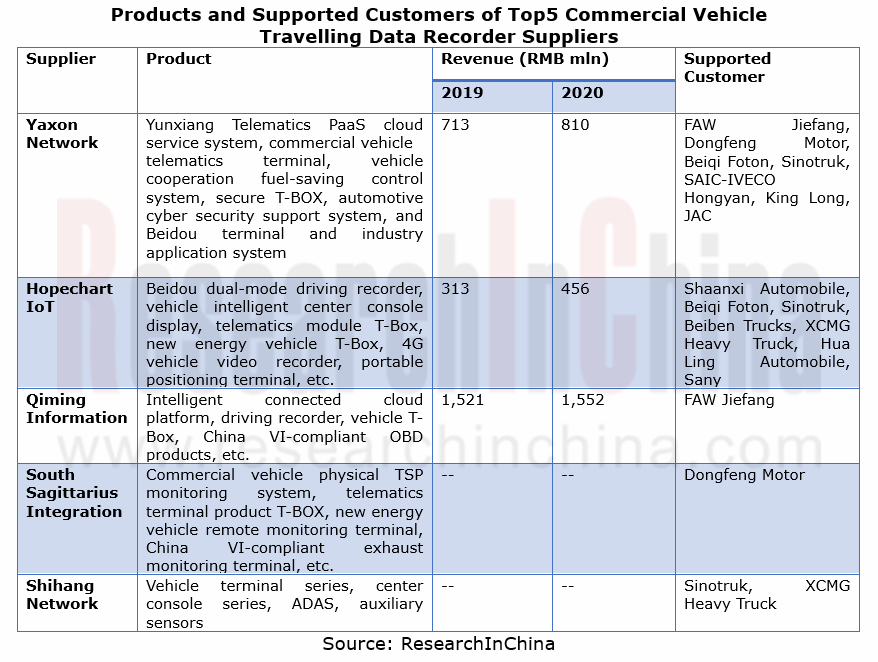

In 2020, the top five suppliers of commercial vehicle travelling data recorders were Xiamen Yaxon Network Co., Ltd., Hangzhou Hopechart IoT Technology Co., Ltd., Qiming Information Technology Co., Ltd., South Sagittarius Integration Co., Ltd. and Shanghai Shihang Network Technology Co., Ltd., together sweeping over 65% of the market.

Trend 2: connected terminals tend to be more integrated and the situation of “multiple terminals per vehicle” will be turn around.

Commercial vehicles are more applicable to autonomous driving scenarios than passenger cars, including ports, mines and highway platooning. Automakers vie for deploying related products. FAW Jiefang J7 L3 Super Trucks for logistics scenarios have been delivered to JD; Shaanxi Automobile Delong X6000 acquired China’s first national autonomous driving license for L4 heavy trucks. As high levels of automated driving are applied, commercial vehicles require telematics terminals to have better technical performance. For example, leading suppliers like Yaxon Network have introduced, tested and applied 5G V2X products.

Yaxon Network 5G OBU: integrate 5G mobile communication, GPS/BeiDou Navigation Satellite System (BDS), and V2X communication.

Yaxon Network 5G-V2X OBU supports Beidou centimeter-level high-precision positioning application. The device can collect all in-vehicle working condition data, location and traffic information, and communicates and interacts with off-vehicle equipment and data platforms via wireless communication modes like 4G/5G, V2X, WIFI and Bluetooth, building an omnidirectional network for V2V (vehicle to vehicle), V2P (vehicle to pedestrian), V2I (vehicle to infrastructure) and V2C (vehicle to cloud) communications.

Yaxon Network 5G OBU has been seen in Zhengzhou Financial Island V2X Project, Xiamen Port Autonomous Driving V2X Project, SAIC-GM-Wuling V2X Project, and Fujian Expressway V2X Project.

Hopechart 5G-V2X Product has undergone testing.

In regard to 5G-V2X R&D, Hopechart’s V-BOX has been tested and installed by OEMs. This product integrates V2V, V2I, 5G and Beidou/GPS satellite positioning modules. Hopechart also works with OEMs on development of an OTA platform which is connected to terminals for commercial vehicle OTA updates.

Trend 3: the increase of young drivers will fuel transformation of commercial vehicle occupant entertainment terminals.

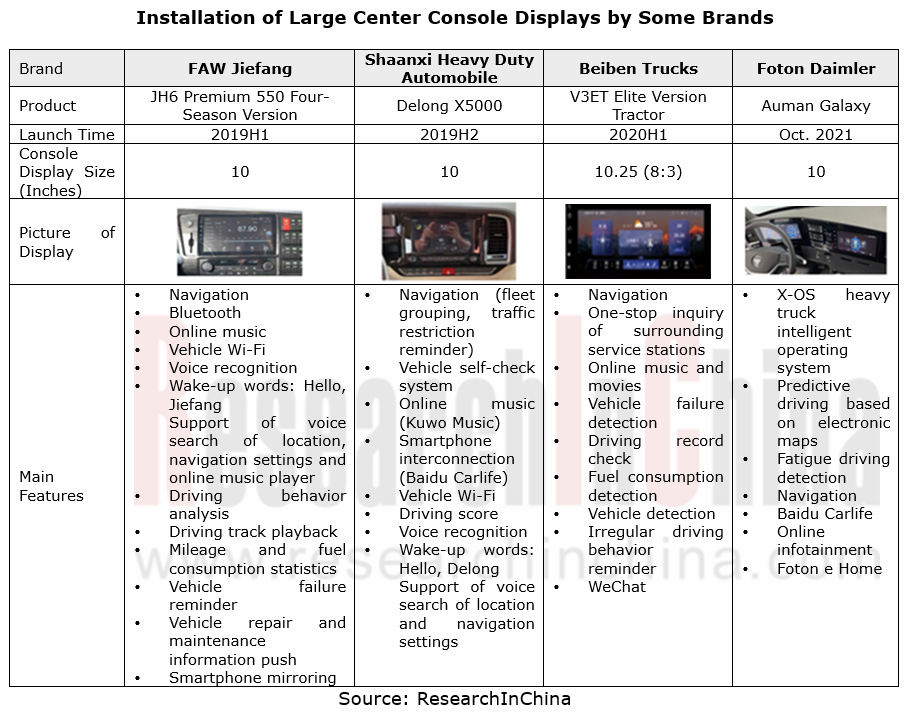

The rising demand for intelligent connected cockpits comes with the increase of post-80s and post-90s drivers. At present, capabilities such as large display, voice, online entertainment and smartphone mirroring hold the trend.

For example, in terms of product form, the mainstream large-size displays for commercial vehicles have been enlarged to current 10 inches from original 7 inches, and some auto brands have began trying to use 12-inch displays.

As for product features, mainstream functions of passenger cars, including online audio and video, voice recognition, remote control and smartphone mirroring, are making their way into commercial vehicles of manufacturers such as FAW Jiefang, Shaanxi Heavy Duty Automobile, Beiben Trucks and Foton Daimler, which have rolled out related products.

On April 19, 2021, Foton Daimler unveiled Auman Galaxy at Auto Shanghai, a super heavy truck that packs 12.3-inch LCD dashboard, 10-inch center console display, and built-in Foton e Home System that offers capabilities like driving behavior analysis, vehicle status check and maintenance reservation. Auman Galaxy also carries X-OS, China’s first heavy truck intelligent operating system that enables a slump in fuel consumption and brings higher economic benefits.

Differing from passenger car telematics focusing on occupant entertainment, commercial vehicle telematics prefers lower cost and higher efficiency. As cockpit capabilities get improved, the connected devices for commercial vehicles may increase ADAS intelligent driving modules for improving computing force of cockpits, and combine AI and big data analysis technologies to identify driving behaviors, reduce driving risks and fuel consumption, and achieve efficient regulation.

China Automotive Lighting Market Research Report, 2022

Automotive lighting research: the penetration of ambient lights has reached 31%, and intelligent lighting is reshaping the third living space.

Favorable policies and consumption upgrade help automake...

Global and China Automotive IGBT and SiC Research Report, 2022

1. In 2025, China's automotive SiC market will be valued at RMB12.99 billion, sustaining AAGRs of 97.2%.

Silicon carbide (SiC) devices that feature the resistance to high voltage and high frequency ...

Passenger Car Chassis Domain Controller Industry Report, 2022

Chassis domain controller research: full-stack independent development, or open ecosystem route?

Chassis domain consists of transmission, driving, steering and braking systems. Conventional vehicle ...

China Automotive LiDAR Industry Research Report, 2022

LiDAR research: Chinese passenger cars will carry over 80,000 LiDAR sensors in 2022

1. The mass production of LiDAR is accelerating, and the installations are expected to exceed 80,000 units in 2022

...

China Autonomous Driving Data Closed Loop Research Report, 2022

1. The development of autonomous driving is gradually driven by data rather than technology

Today, autonomous driving sensor solutions and computing platforms have become increasingly homogeneous, an...

Overseas LiDAR Industry Research Report, 2022

LiDAR Research: Perception Algorithms Become the Layout Focus of Foreign Vendors

Amid a variety of technology routes in parallel, rotating mirror and flash solutions are adopted most widely during OE...

Smart Car OTA Industry Research Report, 2022

Smart car OTA research: With the arrival of OTA3.0 era, how can OEMs explore payment modes of SAAS?

Driven by the development of smart cars, China's OTA installation rate has been growing. According ...

Chinese Joint Venture OEMs’ ADAS and Autonomous Driving Report, 2022

Joint Venture OEM's ADAS Research: Joint venture brands lead in L2/L2.5 installation rate, but have not involved L2.9 for the time being

Following "Chinese Independent OEMs’ ADAS and Autonomous Drivi...

Global and China Hybrid Electric Vehicle Research Report, 2022

Hybrid Research: China Hybrid EV penetration rate will hit 22% within five years

With the development of automobile energy-saving and new energy technologies and the promotion of low-carbon emission ...

China Smart-Road Roadside Perception Industry Report, 2022

Top 10 roadside perception suppliers: quality suppliers come to the front in each market segment.

The growing number of roadside perception players comes with active industrial investment and financ...

China Passenger Car Brake-by-Wire and AEB Market Research Report, 2022

Brake-by-wire research: with an astonishing growth in installation rate, One-Box has commanded much more of the market.

In new energy vehicles, especially intelligent vehicles, the bake-by-wire techn...

Multi-domain Computing and Zone Controller Research Report, 2022

Multi-domain computing and zone controller research: five design ideas advance side-by-side.In the trend for higher levels of autonomous driving, intelligent vehicles pose more stringent requirements ...

Overseas ADAS and Autonomous Driving Tier 1 Suppliers Report, 2022

Overseas ADAS Tier1 Suppliers Research: The gap between suppliers has widened in terms of revenue growth, and many of them plan to launch L4 products by 2025Countries allow L3/L4 vehicles on the road ...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022

ResearchInChina released "Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022". This report combs through and summarizes status quo (installations, installation rate), function applicat...

China Passenger Car Electronically Controlled Suspension Industry Report, 2022

Research on electronically controlled suspension: four development trends of electronically controlled suspension and air suspension

Basic concepts of suspension and electronically controlled suspens...

China L2/L2+ Smart Car Audio Market Report, 2022

Car audio research: ranking of L2+ smart car audio suppliers by market share

The National Development and Reform Commission has upgraded the development of intelligent vehicles to a national strategy...

China Commercial Vehicle T-Box Report, 2022

TOP10 commercial vehicle T-Box suppliers: using terminal data to build telematics platforms will become a megatrend.

1. From the perspective of market size, the pace of popularizing T-Box accelerates...

Electric Drive and Power Domain Industry Report, 2022

Electric drive and power domain research: efficient integration becomes a megatrend, and integration with other domains makes power domain stronger.

Electric drive systems have gone through several ...