Joint Venture Passenger Car Brands’ ADAS and Autonomous Driving Research Report, 2021

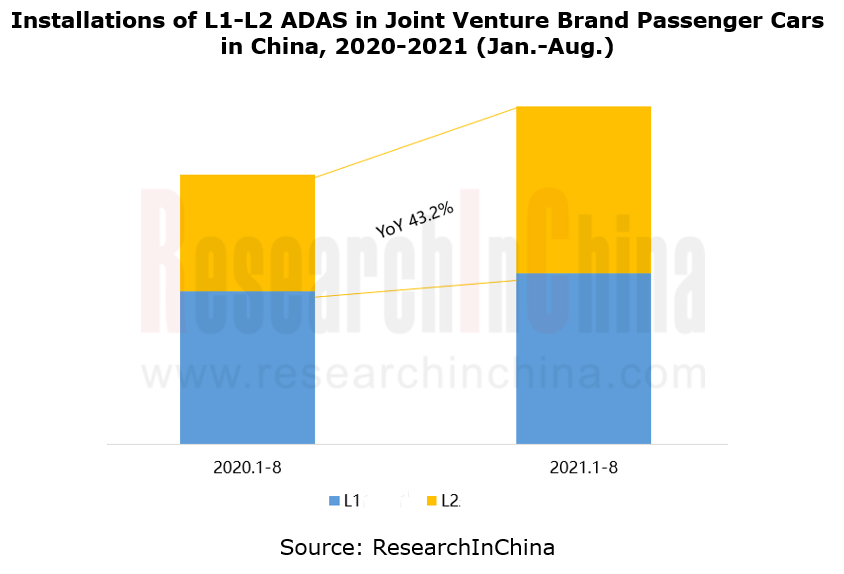

Joint venture brands’ ADAS research: the installations of L2 ADAS surged by 43.2% year on year.

In the first eight months of 2021, 3.87 million passenger cars of joint venture brands in China were equipped with ADAS, a like-on-like jump of 25.4%, with the installation rate up to 49.0%, up 4.9 percentage points. Wherein, the installations and installation rate of L2 ADAS increased by 43.2% and 5.1 percentage points from the same period of the previous year, separately.

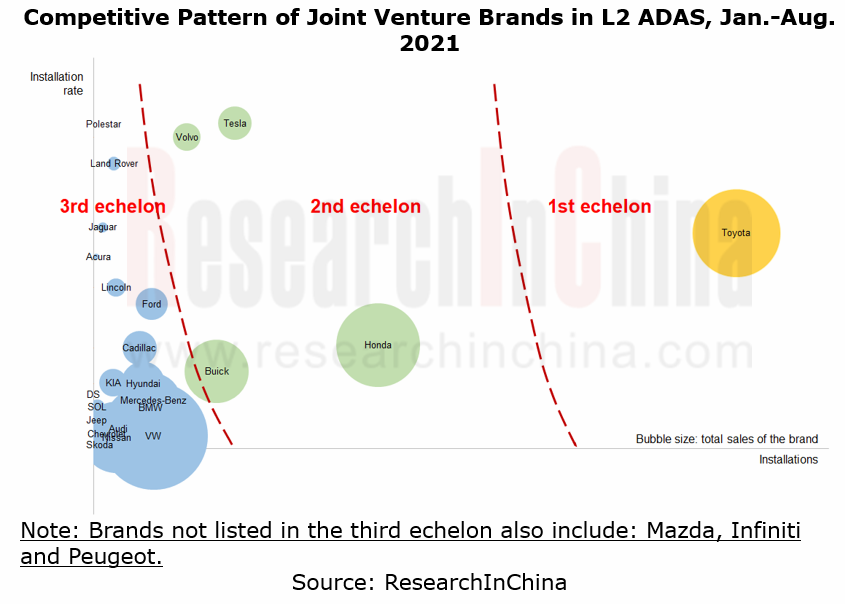

Toyota leads L2 ADAS market.

In the joint venture brands’ L2 ADAS market, Toyota is only first-echelon player, with the system installations far higher than its peers; Honda, Buick, Volvo and Tesla are in the second echelon.

- Toyota’s installations of L2 ADAS approached 700,000 units, driven by its hot-selling models like Corolla, Levin, RAV4 and Avalon, nearly 400,000 units more than the runner-up Honda. In terms of sensor solution, Toyota’s L2 ADAS adopted 1R1V and 3R1V solutions, over 90% of which were 1R1V;

- Volvo boasted a L2 ADAS installation of 95.6% and mainly used 1R1V and 3R1V solutions, of which 1R1V swept over 80%;

- The third-echelon players, Ford and Volkswagen have the potential to leap to the second echelon.

L3 ADAS of Honda and Mercedes-Benz has been approved for use in cars legally introduced on roads in their local markets.

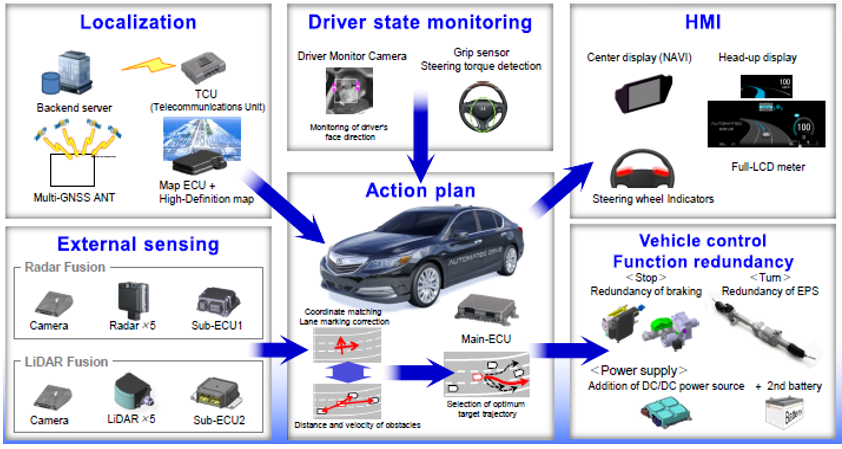

In March 2021, Honda introduced Honda SENSING Elite, a L3 automated driving system first mounted on Honda Legend, the world’s first L3 model legally introduced on roads. This L3 system employs the following sensor solution:

- 1 set of front view stereo cameras

- 4 surround view cameras

- 5 LiDARs (Valeo’s second-generation SCALA LiDARs, 16-channel)

- 5 radars

The sensor layout is shown below.

The composition of Honda SENSING Elite is as follows.

Honda Legend, the world’s first L3 autonomous model legally running on roads, is only available in Japan. Just 100 units have been launched on market for rental, not sold. The MRRP of JPY11 million (approximately RMB660,000) refers to only deposit. There is still no effective way for ordinary users to access L3 automated driving.

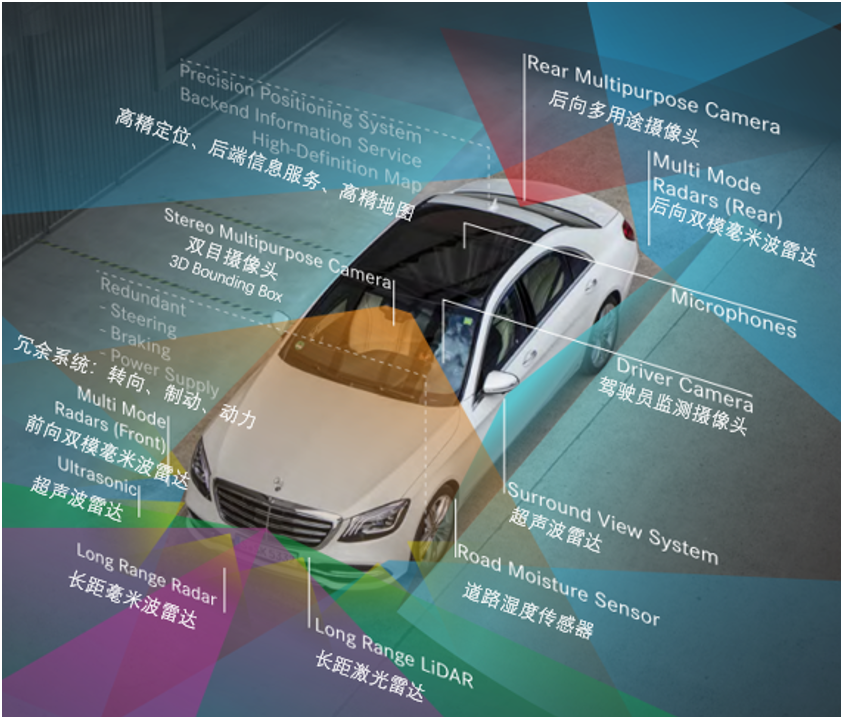

In December 2021, Mercedes-Benz DRIVE PILOT, a L3 autonomous driving system captured the approval for driving on roads from the German Federal Motor Transport Authority (KBA). This L3 system mounted on Mercedes-Benz EQS or S-Class will become available on market in 2022, which means ordinary users will use L3 autonomous driving function on 13,000km highways in Germany as early as the second half of 2022.

The sensor solution for Mercedes-Benz DRIVE PILOT is as follows:

- 1 LiDAR

- 4 angular radars

- 1 long-range forward radar

- 1 set of front view stereo cameras

- 4 surround view cameras

- 12 ultrasonic radars

- 1 wheel camera (working together with the rain sensor on the windshield to perceive whether it is rainy or not)

- 1 rear multi-purpose camera

- HD map

- Driver camera

The KBA has granted approval for Mercedes-Benz’s mass-production and sales of L3 autonomous cars on the basis of the technical regulation UN-R157, a UN Regulation on uniform provisions concerning the approval of vehicles with Regards to Automated Lane Keeping Systems, which was passed at World Forum for Harmonization of Vehicle Regulations of United Nations Economic Commission for Europe.

UN-R157 defines ALKS:

ALKS is a system than controls the lateral and longitudinal movement of the vehicle in the lane for extended periods without further driver command;

ALKS is a system than controls the lateral and longitudinal movement of the vehicle in the lane for extended periods without further driver command;

Limit to passenger cars (M1 vehicles);

Limit to passenger cars (M1 vehicles);

Limit to operational speed to 60 km/h maximum.

Limit to operational speed to 60 km/h maximum.

According to UN-R157 regulation, Mercedes-Benz DRIVE PILOT specifies that there is 10 seconds for the driver to disengage after sending the transition demand, a milestone in the history of “full disengagement of autonomous vehicle drivers”.

UN-R157, the world’s first binding international regulation on SAE L3 automation, has entered into force on January 22, 2021. Noticeably, the contracting states include states of the EU, UK, Japan, Korea and Australia. UN-R157 will provide reliable guidelines for automakers to develop L3 autonomous driving functions in major global markets.

GM and Ford among others will achieve L4 autonomous driving in 2022 at the earliest.

Volkswagen, GM, Ford and the likes develop L4 autonomous driving technologies by establishing subsidiaries or investing technology firms. They plan to first implement commercial L4 in online ride-hailing and logistics distribution.

Volkswagen will develop a new software platform in 2025 to support L4 autonomous driving, through its software subsidiary CARIAD (formerly known as Car.Software). In addition to CARIAD, Volkswagen and its investee Argo AI partnered and plan to achieve fully autonomous driving in 2025.

Cruise Origin, a fourth-generation L4 self-driving car co-launched by GM and its subsidiary Cruise, eliminates the steering wheel, accelerator and brake pedals and features layout of two bench seats that face inward. The car is projected to be spawned at Detroit-Hamtramck Assembly Plant starting in 2022.

In October 2020, Ford and Argo AI together unveiled a fourth-generation self-driving test vehicle refitted from Ford Escape Hybrid. They plan launch of the commercial autonomous service for online ride-hailing and logistics distribution in 2022.

Automotive Smart Cockpit Design Trend Report, 2022

Research on design trends of intelligent cockpits: explore 3D, integrated interaction. ...

Commercial Vehicle Telematics Report, 2022

Commercial vehicle telematics research: three parties make efforts to facilitate the industrial upgrade of commercial vehicle telematics.

In 2022, China's commercial vehicle telematics industry cont...

Passenger Car Intelligent Steering Industry Research Report, 2022

Research on intelligent steering of passenger cars: The development of intelligent steering is accelerating, and it will be put on vehicles in batches in 2023

In September 2022, Geely and Hella joi...

China Charging / Battery Swapping Infrastructure Market Research Report, 2022

Research of charging / battery swapping: More than 20 OEMs layout charging business, new charging station construction accelerated

From January to September 2022, the sales volume of new energy vehic...

China L2 and L2+ Autonomous Passenger Car Research Report, 2022

L2 and L2+ research: The installation rate of L2 and L2+ is expected to exceed 50% in 2025.So far, L2 ADAS has achieved mass production, and L2+ ADAS has seen development opportunities as the layout f...

Global and China L4 Autonomous Driving and Start-ups Report, 2022

L4 autonomous driving research: the industry enters a new development phase, "dimension reduction + cost reduction".

L3/L4 autonomous driving enjoys much greater policy support.

...

Software-defined vehicle Research Report 2022- Architecture Trends and Industry Panorama

Software-defined vehicle research: 40 arenas, hundreds of suppliers, and rapidly-improved software autonomyThe overall architecture of software-defined vehicles can be divided into four layers: (1) Th...

Emerging Automaker Strategy Research Report, 2022 - Li Auto

Research on Emerging Automaker Strategy: the strategic layout of Li Auto in electric vehicles, cockpits and autonomous driving

Li Auto will shift from the single extended-range route to the “extended...

Commercial Vehicle Intelligent Chassis Industry Report, 2022

Commercial vehicle industry is characterized by large output value, long industry chain, high relevance, high technical requirements, wide employment and large consumer pull, and is a barometer of nat...

China TSP and Ecological Construction Research Report, 2022

TSP research: the coverage of TSPs has spread from IVI, cockpits to vehicles.

With the emergence of Internet of Vehicles, telematics service providers (TSPs) take on the roles of operation platforms,...

Global and China Automotive Seating Industry Report, 2022

Automotive seating research: automotive seating enjoys an amazing boom in the context of autonomous driving.

As autonomous driving develops, vehicles, a simple mobility tool, are tending to be positi...

Automotive Smart Surface Industry Research Report, 2022

Smart Surface Research: As an important medium for multimodal interaction, smart surfaces lead the trend of smart cockpits.Smart surfaces represent the development trend of automotive interiors and ex...

China Passenger Car Cockpit Multi and Dual Display Research Report, 2022

Cockpit multi and dual display research: 51.5% year-on-year growth in center console multi and dual display installation from January to July 2022

ResearchInChina released "China Passenger Car Cockpi...

China Automotive Cybersecurity Hardware Research Report, 2022

Cybersecurity hardware research: security chip and HSM that meet the national encryption standards will build the automotive cybersecurity hardware foundation for China.

1. OEMs generally adopt the s...

China Automotive Cybersecurity Software Research Report, 2022

Chinese in-vehicle terminal PKI market will be worth RMB1.89 billion in 2025.

The working principle of PKI (Public Key Infrastructure) is: the infrastructure that provides security services establish...

Global and China HD Map Industry Report, 2022

HD maps have been applied on a large scale, spreading from freeways to cities

According to ResearchInChina, more than 100,000 Chinese passenger cars were equipped with HD maps by OEMs in the first ha...

Automotive Software Providers and Business Models Research Report, 2022

Research on software business models: four business forms and charging models of automotive software providers.

In an age of software-defined vehicles, automotive software booms, and providers step u...

China Automotive Integrated Die Casting Industry Research Report, 2022

Integrated Die Casting Research: Upstream, midstream and downstream companies are making plans and layouts in this booming field

Automotive integrated die casting is an automotive manufacturing proce...