Global and China Electronic Rearview Mirror Industry Report, 2021-2022

Electronic rearview mirror research: the streaming rearview mirror installations soared by 73% in 2021.

This report combs through and summarizes the global and Chinese electronic rearview mirror markets, including status quo (installations and installation rate), function applications, development trends, suppliers’ products and market layout.

1. Overview of electronic rearview mirror

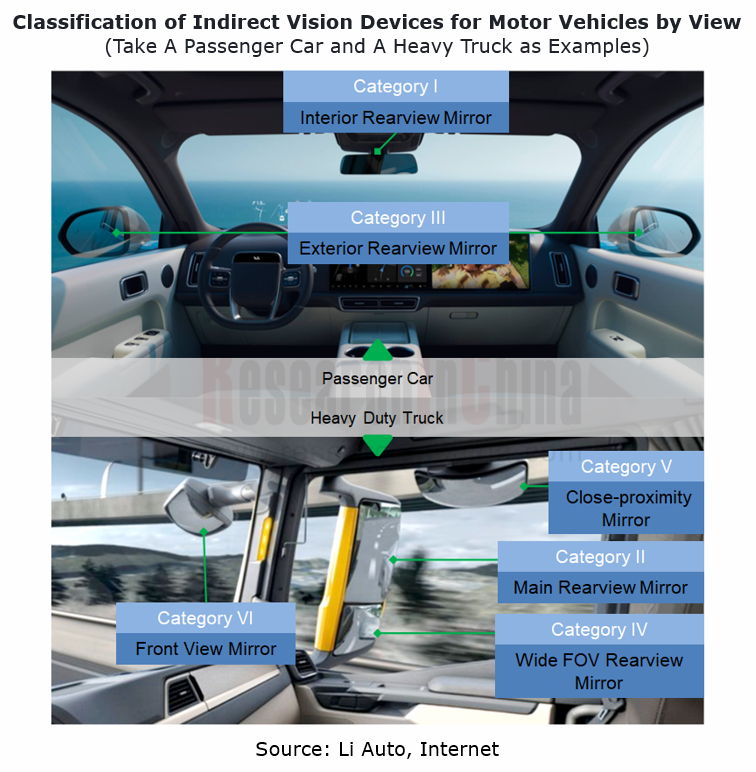

Before talking about electronic rearview mirrors, it first needs to state the classification of automotive indirect vision devices (providing the rear, side or front view of a vehicle). The new version of GB15084 explicitly divides the motor vehicle indirect vision devices into seven categories by view:

I: interior rearview devices

II/III: main exterior rearview devices

IV: wide FOV exterior view devices

V: close-proximity exterior view devices

VI: front view devices

VII: mirrors for Category L motor vehicles with at least a partially enclosed cab

Specifically on a vehicle, the figure below shows the classification of indirect vision devices by view.

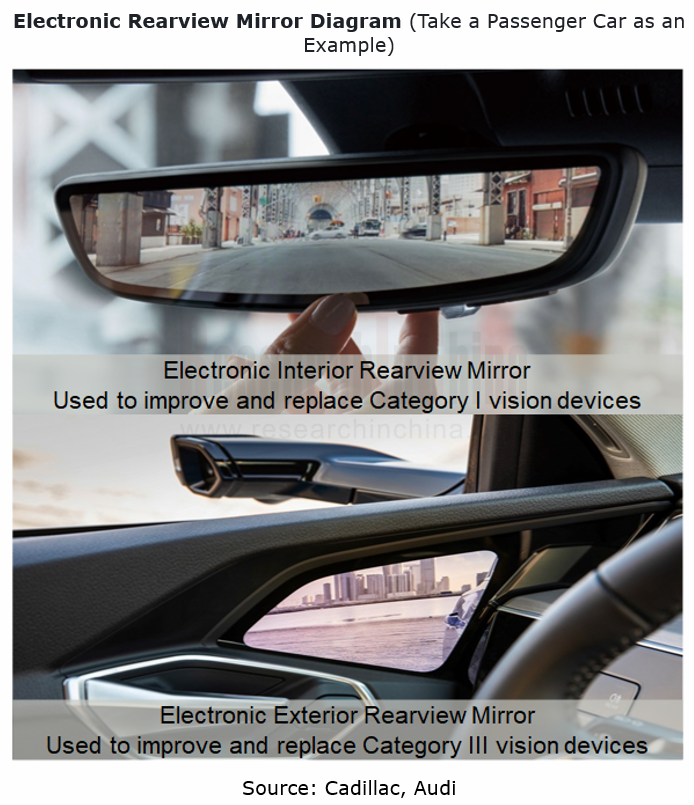

So what is an electronic rearview mirror? The electronic rearview mirror is a new type of indirect vision device. In the new version of GB15084, it is described as a "camera-monitor system" (abbreviated to as CMS), that is, "indirect vision device, a system composed of a camera and a monitor, can clearly see the rear, side or front of the vehicle within the specified field of view”.

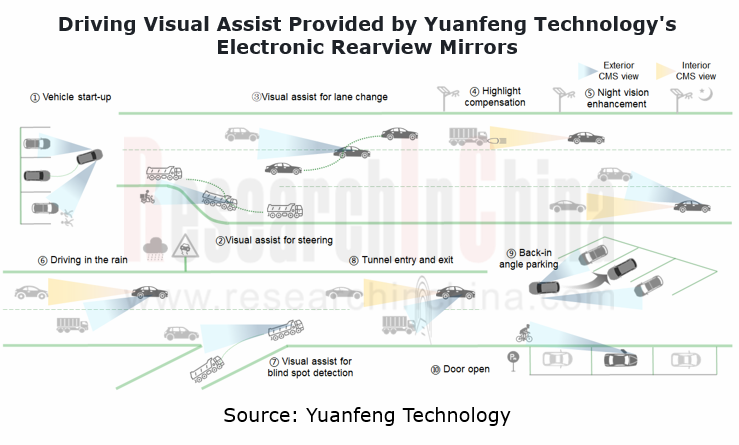

In terms of function, an electronic rearview mirror is roughly similar to a conventional optical mirror, but presents an image on the display instead of glass, bringing in more possibilities of enriching image information. As an improvement on and an alternative to the conventional Category I-VII view devices, CMS can deliver a wider and clearer rear view to the driver, eliminating the obscuring effect of rain, snow and fog on windows and mirrors. Overlaying a variety of driving assistance information, it also allows the driver to know much more about road conditions behind, making driving safer.

By installation position, electronic rearview mirrors are mainly split into interior and exterior types, of which interior electronic rearview mirrors are often called "streaming rearview mirrors".

2. The electronic rearview mirror market is soaring, but still in its infancy.

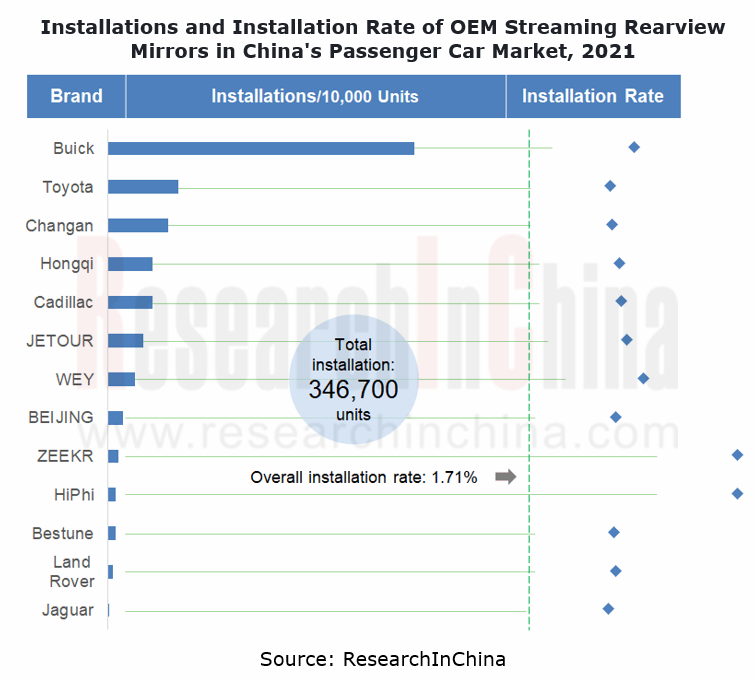

In April 2016, the 2016 Cadillac XT5 equipped with a streaming rearview mirror was launched on market. It was the first time that an OEM streaming rearview mirror appeared in the Chinese passenger car market. And then, auto brands like WEY, Buick and FAW (Hongqi, Bestune) also unveiled models with streaming rearview mirrors. As of May 2022, a total of 13 auto brands in China have marketed models carrying streaming rearview mirrors and achieved certain sales.

The boom of intelligent cockpits and ADAS has favored the flourish of vehicle cameras in recent years, and streaming rearview mirror cameras are no exception. In 2021, there were 346,700 insured passenger cars (excluding imported ones) packing standard OEM streaming rearview mirrors in China, surging by 73.04% on the previous year. In 2021, the insured passenger cars in China totaled 20.328 million units, which meant the installation rate of streaming rearview mirrors in passenger cars was just 1.71%. The streaming rearview mirror market is still in its infancy.

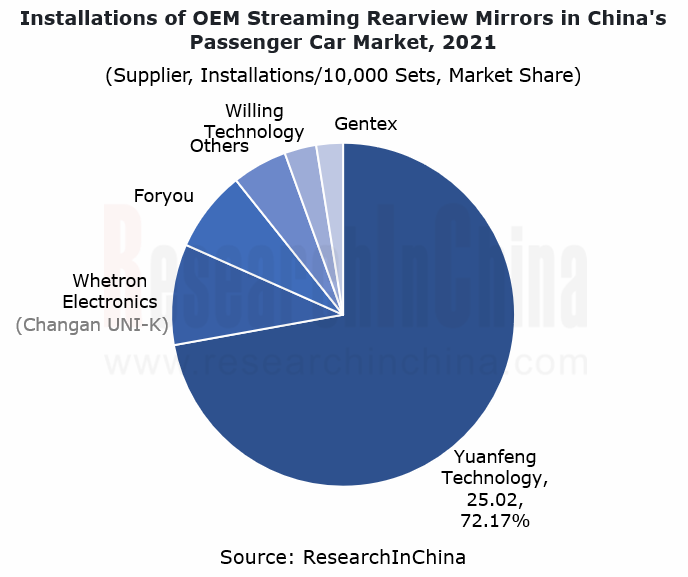

There are few streaming rearview mirror suppliers participating in the OEM market considering the current size, creating a relatively simple completive landscape. Our data show that Yuanfeng Technology is now the largest supplier of streaming rearview mirrors in the Chinese passenger car market, with an overwhelming market share of 72%.

Having undergone four iterations, Yuanfeng Technology’s streaming rearview mirror products subject to the international standard ECE R46 perform well in video latency, system stability, screen highlighting, lightweight mirror body, heat dissipation and other technical parameters, and have supported car models of Cadillac, Buick, Chevrolet, Great Wall Motor and Toyota, among other auto brands.

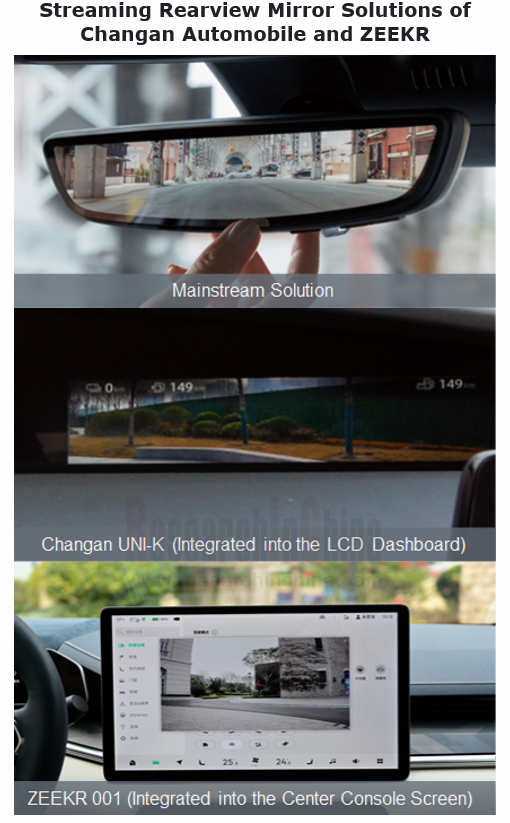

As for solution implementation, mainstream solutions change Category I vision device from a conventional optical mirror to a display, so as to maximally adapt to the driver's habit of seeing the rear view. Some OEMs also carry out a compromise, a solution of separating the Category I vision device from the image, that is, still using the conventional optical mirror to present the image collected by the streaming camera on the cluster screen or the center console screen. Examples include Changan UNI-K and ZEEKR 001.

3. Electronic exterior mirrors: most automakers take a wait-and-see attitude.

Differing from streaming rearview mirrors, exterior rearview mirrors that play a hugely important role in daily driving safety walk on a bumpy road to electronization. Since the United Nations issued the UN-R6 regulation in June 2016, Europe, Japan, South Korea and India among other regions/countries have started to sell models equipped with electronic exterior mirrors. Today, although policies and regulations have helped to open up the electronic rearview mirror market for 6 years, only a few auto brands and models provide mass-produced OEM electronic exterior mirrors solutions.

Commercial vehicles:

Commercial vehicles:

Take Mercedes-Benz for example. Mercedes-Benz Trucks first introduced MirrorCam, a mass-produced electronic exterior mirror solution that was first applied to the flagship heavy-duty truck Actros. Mercedes-Benz adopts a conservative rearview mirror replacement strategy where only the main rearview mirror (Category II) and wide FOV rearview mirror (Category IV) are electronic, and the front view mirror and close-proximity exterior view mirror are retained. The Mercedes-Benz MirrorCam system is composed of two cameras and two 15.2-inch displays. Above the MirrorCam display are three manually adjustable virtual distance lines (moving left, reversing, and overtaking) to assist the driver in estimating the distance with the rear vehicle. At the same time, the MirrorCam display also integrates the warning information of Mercedes-Benz Sideguard Assist.

Just this past May, Mercedes-Benz Trucks upgraded its electronic rearview mirror MirrorCam to the second generation. Still using the single-camera solution, the second-generation looks more compact than the first-generation for the camera arms on each side have been shortened by 10cm, and displays clearer images.

Passenger cars:

Passenger cars:

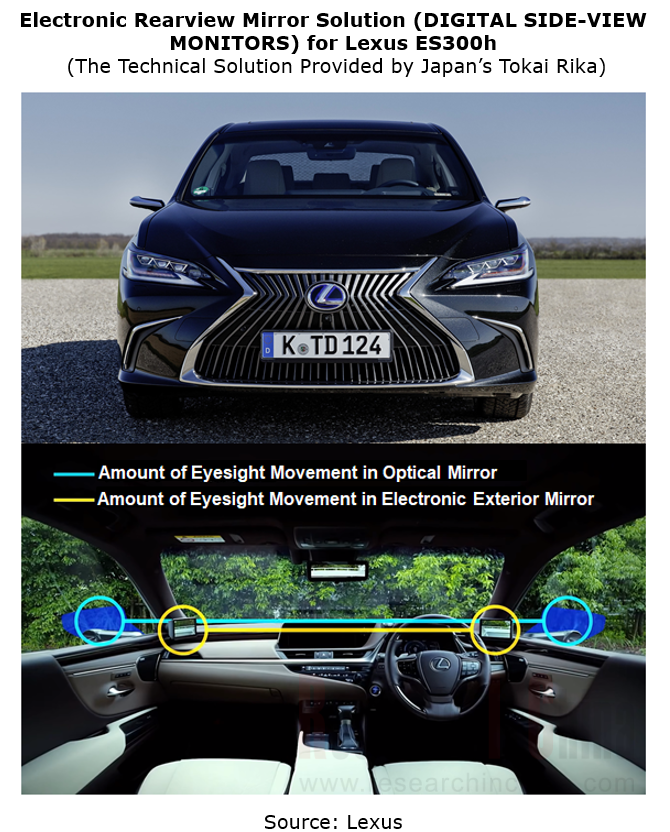

In terms of appearance and structure, the cameras and displays of electronic rearview mirrors for passenger cars are more compact and smaller than those for commercial vehicles. For example, Lexus, a luxury brand, was the first one to mass-produce the passenger car electronic exterior mirror (DIGITAL SIDE-VIEW MONITORS), and applied it to ES300h.

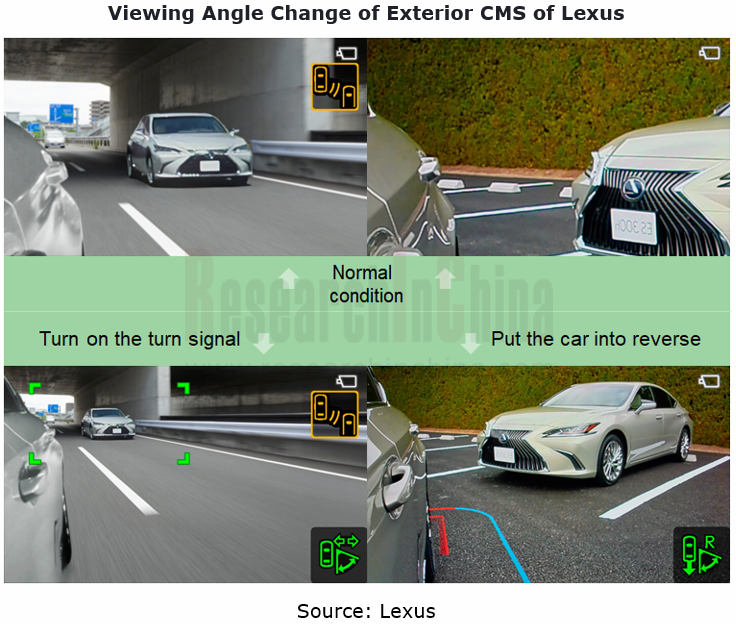

Lexus DIGITAL SIDE-VIEW MONITORS allows real-time switching of viewing angles in different driving conditions. For example, when the turn signal is on or the reverse gear is engaged, the viewing angle will automatically enlarge from an ordinary angle to a wide angle; ADAS warning capabilities, e.g., blind spot detection/blind spot monitoring are also integrated.

From the official configurations automakers released on their websites, it can be seen that electronic exterior mirrors for either commercial vehicles or passenger cars are mostly launched on market as an optional solution for consumers to choose. A set of passenger car electronic exterior mirrors costs RMB70,000-15,000, undoubtedly a prohibitive price for ordinary consumers. The technology research and development also needs lavish spending. At the "2022 OKOKOK Intelligent Cockpit Technology Exchange Online Forum", Fu Hongqiang, the general manager of Shanghai Yuxing Electronic Technology Co., Ltd., admitted that the research and development of electronic exterior mirror cameras alone costs at least RMB50 million.

4. Challenges exist, but the trend is unstoppable.

Electronic rearview mirrors remain far more superior to conventional optical mirrors, but face huge challenges such as high cost, low reliability and the driver's eyesight shift, which need companies to try hard to overcome. Moreover, the focal length of the camera and the depth of field of images make it easy for the driver to misjudge the distance with the rear vehicle.

In the long run, electronic rearview mirrors will act as an integral part of vehicle intelligence, but will not become a megatrend in the short term. Automakers can seize the initiative in capital investment and technology research and development. How to reduce product costs, how to improve stability and users' acceptance of electronic rearview mirror, and how to make them pay for and boldly accept this configuration are the knots companies need to undo.

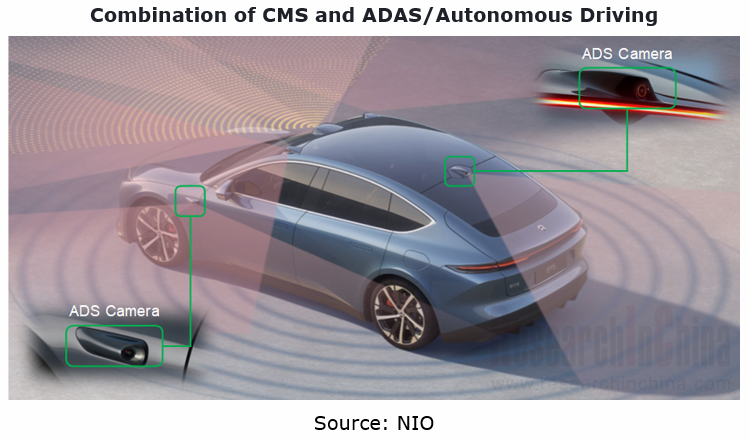

Trend 1: the combination of CMS and ADAS/autonomous driving

The electronic rearview mirror camera is installed near the conventional exterior rearview mirror or at the rear of the vehicle, two positions where the ADS camera is often located. Some functions of CMS overlap the blind spot monitoring/blind spot detection/ADS camera, both of which aim to acquire or detect road traffic conditions at the side rear of the vehicle and provide driving decisions for the driver/vehicle. The two are expected to be integrated considering product cost, function realization and air resistance.

For example, Yuanfeng Technology's electronic rearview mirrors, the exterior/interior CMS for commercial vehicles and passenger cars, detect the rear + side views, enhance the visual perception of the vehicle, and integrate ADAS functions.

Trend 2: the fusion of CMS interior/exterior rearview mirror images

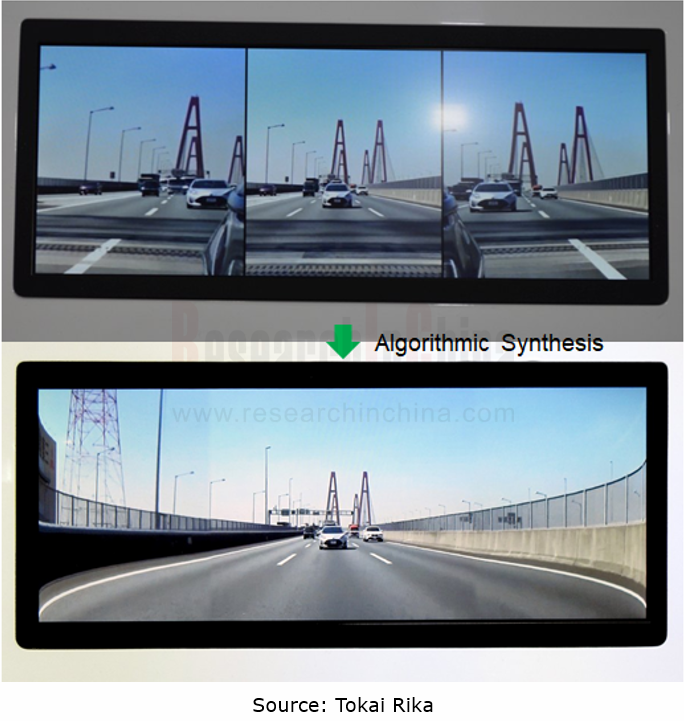

The way to display the side/rear view of the vehicle currently follows the conventional driving habits. The CMS screens are placed in the left, upper middle, and right in the front of the cockpit, with physical display splits. Technologically on the basis of retaining the traditional optical mirror, the images of the left rear, rear and right rear captured by the electronic exterior view mirror and the electronic interior mirror can be synthesized with algorithms, fused, and displayed on one screen.

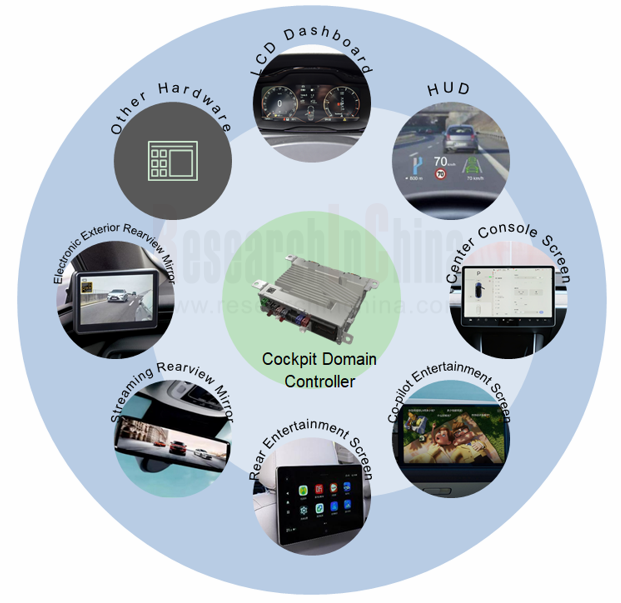

Trend 3: the combination of CMS and cockpit domain controller

As chip computing power improves and E/E architecture evolves, cockpits are integrating display solutions such as LCD cluster, HUD, center console screen, co-pilot entertainment screen and rear entertainment screen into intelligent cockpit domain controllers, in a bid to enable unified management in the same chip. The emergence of electronic rearview mirrors produces more data flows that need processing for the vehicle, and separate ECUs will further drive up the cost of the entire vehicle. Lower cost will be the key driving force to the adoption of cockpit domain controllers. Therefore, streaming interior rearview mirrors and electronic exterior rearview mirrors will also be no exception to such a management way.

Autonomous Driving SoC Research Report, 2023

Research on autonomous driving SoC: driving-parking integration boosts the industry, and computing in memory (CIM) and chiplet bring technological disruption.

“Autonomous Driving SoC Research ...

China ADAS Redundant System Strategy Research Report, 2023

Redundant System Research: The Last Line of Safety for Intelligent VehiclesRedundant design refers to a technology adding more than one set of functional channels, components or parts that enable the ...

Intelligent Steering Key Components Report, 2023

Research on intelligent steering key components: four development trends of intelligent steering

The automotive chassis consists of four major systems: transmission system, steering system, driving ...

Automotive Digital Instrument Cluster Operating System Report, 2023

Digital Instrument Cluster Operating System Report: QNX commanded 71% of the Chinese intelligent vehicle cluster operating system market.

Amid the trend for the integration of digital cluster and cen...

800V High Voltage Platform Research Report, 2023

How to realize the commercialization of 800V will play a crucial part in the strategy of OEMs.

As new energy vehicles and battery technology boom, charging and battery swapping in the new energy vehi...

Automotive Intelligent Cockpit Platform Research Report, 2023

Intelligent cockpit platform research: the boundaries between vehicles and PCs are blurring, and there are several feasible paths for cockpit platforms.

Automotive Intelligent Cockpit Platform Resea...

Global and China Automotive Wireless Communication Module Industry Report,2023

Vehicle communication module research: 5G R16+C-V2X module, smart SiP module and other new products spring up.

In 2022, 4G modules swept 84.3% of the vehicle communication module market....

Intelligent Vehicle Cockpit-Driving Integration Research Report, 2023

Cockpit-Driving Integration Research: many companies are making layout and may implement it during 2024-2025.

1. What is the real cockpit-driving integration?

At present, automotive electroni...

Chinese Joint Venture OEMs' Telematics System and Entertainment Ecosystem Research Report, 2022

Telematics System Research 2: Baidu Family Bucket, Huawei and Tencent Become the Mainstream Ecosystems

ResearchInChina released Chinese Joint Venture OEMs' Telematics System and Entertainment Ecosyst...

China Automotive Digital Key Research Report, 2023

Automotive Digital Key Research: the pace of mobile phones replacing physical keys quickens amid the booming market

"China Automotive Digital Key Research Report, 2023" released by ResearchInChina co...

Automotive Camera Tier2 Suppliers Research Report, 2022-2023

1. The automotive camera market maintains a pattern of "one superpower and several great powers".

Automotive cameras are used to focus the light reflected from the target onto the CIS after refractio...

Emerging Carmaker Strategy Research Report, 2023 - NIO

Emerging carmaker strategy research: NIO is deploying battery swap and sub-brands for the knockout match in 2023.In 2022, the sales surged by 32.3% year on year, being concentrated in first-tier citie...

Nissan CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022-2023

Nissan CASE research: two leverages for Dongfeng Nissan to turn the tables. Introduction: since 2020, the declining sales of Dongfeng Nissan have exposed its problems in brand influence and product co...

China Automotive Gesture Interaction Development Research Report,2022-2023

Vehicle gesture interaction research: in 2022, the installations rocketed by 315.6% year on year.China Automotive Gesture Interaction Development Research Report, 2022-2023 released by ResearchInChina...

Automotive Power Management Integrated Circuits (PMIC) Industry Report, 2023

Automotive PMIC research: the process of domestic automotive PMICs replacing foreign ones in China in the “crisis of chip shortage”.

Automotive power management integrated circuits (PMIC) find broad ...

Automotive Cockpit SoC Research Report, 2023

Cockpit SoC research in 2023: Can X86 solutions returning to cockpit SoC challenge the “ARM+Google” mobile solution?

This report highlights the research on the products and plans of 9 overseas and 8 ...

AI Foundation Model and Autonomous Driving Intelligent Computing Center Research Report, 2023

New infrastructures for autonomous driving: AI foundation models and intelligent computing centers are emerging.

In recent years, the boom of artificial intelligence has actuated autonomous driving, ...

Automotive Microcontroller Unit (MCU) Industry Report, 2023

MCU Industry Research: Automotive high-end MCU will be still in short supply, and how OEMs can break the situation.

ResearchInChina has released "Automotive Microcontroller Unit (MCU) Industry Repor...