Automated Parking Assist (APA) and Automated Valet Parking (AVP) Industry Report, 2021

Intelligent parking research: mass adoption of AVP will begin in 2023.

Our Automated Parking Assist (APA) and Automated Valet Parking (AVP) Industry Report, 2021 combs through technology routes, business models, products and solutions of major APA and AVP suppliers, and parking intelligence of OEMs.

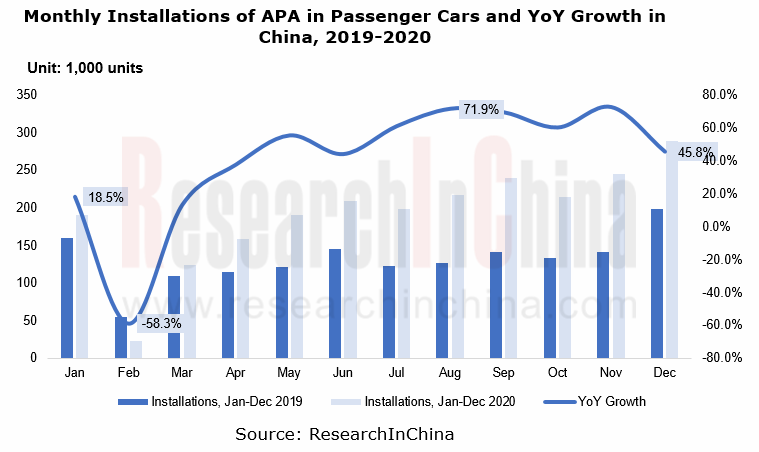

In 2020, the installation rate of APA reached 12.3%, 4.28 percentage points higher than a year ago.

According to ResearchInChina, in 2020, China had 2,308,000 passenger cars equipped with APA, an annualized upsurge of 46.4%, taking the installation rate of APA to 12.3%, up 4.28 percentage points versus 2019; in 2020, the installation rate of APA made a steady growth as a whole, but a decline in February due to the reduced passenger car sales caused by the COVID-19 pandemic.

? Wherein, among APA-enabled models that sell well, most are foreign brands like Mercedes-Benz, BMW and Buick.

? Fully automated parking assist (F-APA) and remote parking are major intelligent parking system solutions at present.

? In OEM market, L3 memory parking and L4 APA capabilities begin to become available to mid-to-high-end and luxury models.

For AVP single vehicle intelligence technologies, memory parking is firstly landed; at the parking lot end, AVP is firstly used in P3 and P4 parking lots.

Automated valet parking (AVP) allows a user who gets off at the designated drop-off point to send a parking instruction via the mobile APP to his/her car which will then drive itself to the parking spot without manual operation and monitoring; as the user gives a pick-up instruction on the APP, the car following the instruction will automatically go to the designated pick-up point; if several cars receive the parking instruction at the same time, they will wait to enter the parking space one after another automatically.

The study shows that AVP that renders vehicles more intelligent can promote vehicle sales, cut down 30% operating cost for parking lots, reduce 10% invalid traffic time in parking lots, and save 10-15 minutes in vehicle pick-up and returning.

The AVP market accommodates large numbers of players which mainly provide three technology solutions: single vehicle intelligence, parking lot intelligence, and vehicle-parking lot cooperation. Of them, single vehicle intelligence primarily supplied by Baidu and ZongMu Technology are most often used by OEMs. In September 2020, at Auto China, the full-size E-HS9 SUV BEV of New Hongqi started pre-sale. This model packs AVP system from ZongMu Technology.

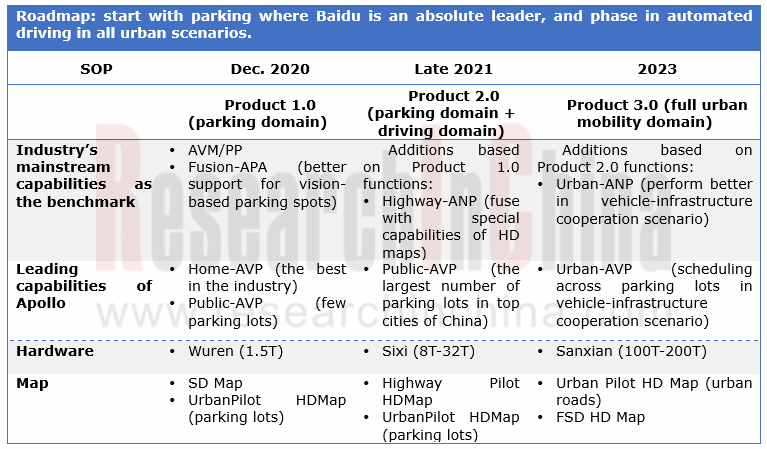

Baidu is a typical provider of AVP single vehicle intelligence solutions. The firm has planned the implementation route for AVP system from short distance to long distance, from easy to difficult. The memory parking (Home-AVP) is the first one to be landed.

? Home-AVP: memory parking. From elevator to parking spot, learn one time; users summon or return cars outside using their mobile phones, and their cars can drive themselves;

? Public-AVP: from any pick-up or drop-off point in the parking lot, users park their cars anywhere in the parking lot, and the cars will automatically find a parking space; the summoned cars will drive themselves to the place designated by users;

? Urban-AVP: from pick-up or drop-off point at most 1km away from the parking space to the parking space, users can summon or return their cars at their will, and the cars will drive themselves.

Bosch is a typical parking lot intelligence solution provider. Together with Mercedes-Benz and the parking lot operator Apcoa, Bosch has deployed a set of AVP system for trial commercial operation at the car park P6 at Stuttgar Airport.

Vehicle-parking lot cooperation solution providers are led by Huawei. The solution is the hardest one to be commercialized for it is difficult to coordinate multiple stakeholders involved (e.g., property companies, independent parking solution providers, OEMs, and mobility platform operators).

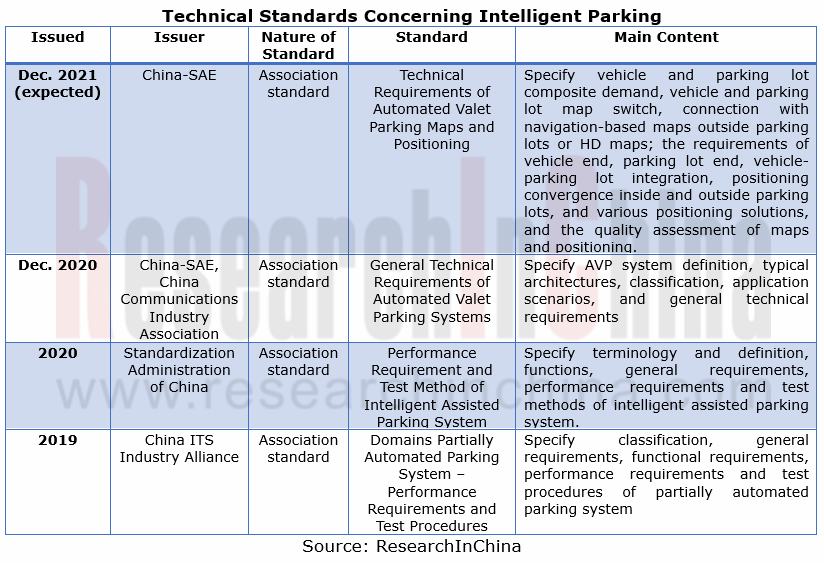

The General Technical Requirements of Automated Valet Parking Systems firstly defines parking lot standards.

In current stage, AVP standards are mainly formulated by associations. To fill the gaps in AVP industry standards in China and deal with the challenge of AVP compatible with multiple solutions, China-SAE and China Communications Industry Association introduced the General Technical Requirements of Automated Valet Parking Systems (T/CSAE156-2020) in December 2020.

The standard covers the three technology routes: single vehicle intelligence, parking lot intelligence and vehicle-parking lot cooperation. It has four parts of content: system definition, security application scenarios, general technical requirements of the system, and general technical requirements of testing.

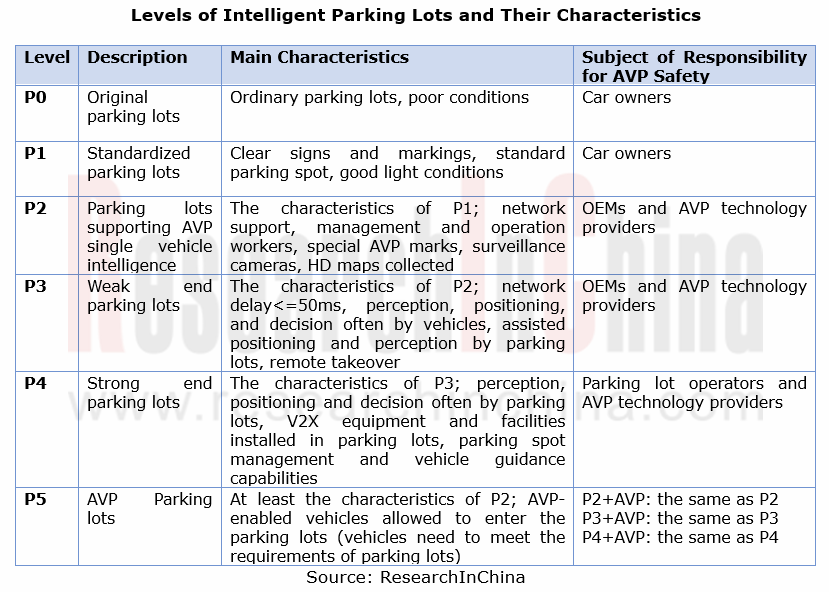

The General Technical Requirements of Automated Valet Parking Systems defines levels of intelligent parking lots: P0, P1, P2, P3, P4 and P5. . On this basis, we have extended interpretation of these levels, as follows:

According to the table above, P2 parking lots meet the conditions needed by AVP single vehicle intelligence; P4 parking lots are basically qualified for being AVP parking lots at the strong end; P3 parking lots meet the conditions of AVP parking lots at the weak end, with most CVIS solutions deployed in P3 parking lots.

Most insiders argue that CVIS is the future of AVP. After exchanges with experts, we believe any technology roadmap needs a subject of responsibility for safety, that is, who takes charge of the safety of AVP system, vehicle end or parking lot end? We think the subject of responsibility at the strong end should be parking lot operators and AVP technology providers, and at the weak end, the OEMs and AVP technology providers.

Application of AVP in P2 parking lots needs L4 intelligent vehicles which are however unlikely to be mass-produced shortly (before 2025). Even if P2 parking lots are built, there will be few vehicles available. So before 2025, parking lots (P3/P4) that support CVIS solutions have plenty of room for growth.

As a substandard of the General Technical Requirements of Automated Valet Parking Systems, the Technical Requirements of Automated Valet Parking Maps and Positioning is under discussion and expected to be drafted in December 2021. The study of other AVP substandards such as AVP parking lot communications, AVP test and memory parking is in the pipeline.

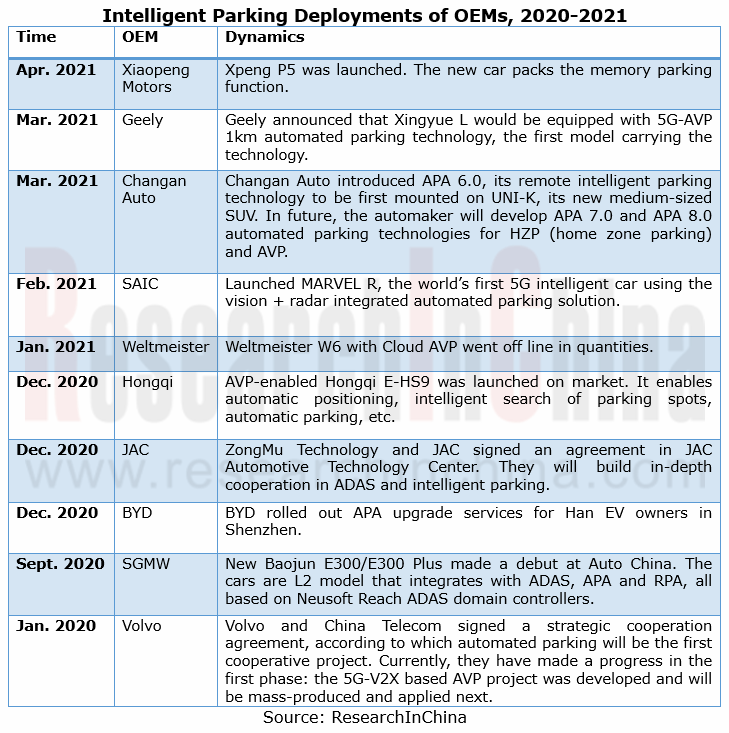

OEMs step up R&D of intelligent parking systems for mass production

OEMs are accelerating R&D of intelligent parking systems for mass production by way of independently developing or seeking external collaborations. Some OEMs like Weltmeister have achieved AVP for L4 automated driving in designated scenarios through working with Baidu; Geely with 5G-AVP technology enabling 1km autonomous parking will step into exploration of intelligent cloud based AVP; with a plan of trying to equip some of its models with memory parking function in late 2020, GAC has installed AVP function in some high-end and luxury models in 2021H1; Great Wall Motor and Baidu Apollo have worked together on mass production of AVP, and announced to spawn AVP-enabled vehicles in 2021.

There is a common belief that the pace of AVP system testing will quicken to gear up for use in vehicles between 2021 and 2022, and the mass adoption of AVP system will begin in 2023.

For parking business models, parking lot operators, OEMs and AVP solution providers make profits by charging AVP subscription fee or pay-per-use billing. Parking lot operators also make benefits with value-added services derived from intelligent parking systems. An example is Bosch which combines electric vehicle automatic charging, autonomous washing of vehicles and express delivery to provide complete solutions for parking lot operators.

China Passenger Car Driving and Parking Integrated Solution Industry Report, 2022

Driving and parking integrated solutions stand out in high-level intelligent driving, and the mass adoption is around the corner. According to ResearchInChina, in the first four months of 2022, China'...

Autonomous Driving and Cockpit Domain Control Unit (DCU) Industry Report, 2022(II)

Domain Controller Research: Exploration of Five Business Models, Tier1, Tier0.5, Tier1.5 or ODM?

Automakers accelerate the mass production of new E/E architecture platforms, and the penetration rate...

Autonomous Driving and Cockpit Domain Control Unit (DCU) Industry Report, 2022 (I)

Domain Controller Research: Exploration of Five Business Models, Tier1, Tier0.5, Tier1.5 or ODM?

Automakers accelerate the mass production of new E/E architecture platforms, and the penetration rate...

China Minicar Industry Report, 2022

Minicars, also known as mini passenger cars, are suitable for short-distance transportation and are positioned as entry-level vehicles. Thanks to low cost, convenient parking and low usage cost, minic...

China Automotive Ultrasonic Radar and OEM Parking Roadmap Research Report, 2022

In 2021, ultrasonic radar shipments hit 100 million units, and intelligent parking became a crucial engine.1. In 2025, China’s ultrasonic radar installations will exceed 140 million units.

According...

DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022

DENSO CASE Research: The semiconductor business will help it go "from Toyota to the world”

ResearchInChina has released DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Resea...

China Roadside Edge Computing Industry Report, 2022

Roadside Edge Computing Research: how edge computing enables intelligent connected vehicles?

Policies and standards for roadside edge computing are implementing one after another, favoring the boom o...

Chinese ADAS and Autonomous Driving Tier 1 Suppliers Report, 2021-2022

Autonomous Driving Tier 1 Suppliers Research: the installation rate of L2 and above autonomous driving functions in passenger cars hit over 30% in 2022Q1.

In 2022Q1, the installation rate of L2 and a...

Global and China Electronic Rearview Mirror Industry Report, 2021-2022

Electronic rearview mirror research: the streaming rearview mirror installations soared by 73% in 2021.

This report combs through and summarizes the global and Chinese electronic rearview mirror mark...

Global and Chinese Automakers’ Modular Platforms and Technology Planning Research Report, 2022

Research on Automakers’ Platforms and Their Planning: the Strategic Layout Directions of 32 Automakers

At present, global automotive industry is in the midst of profound changes unseen in a century....

Automotive Intelligent Cockpit Platform Research Report, 2022

Research on Intelligent Cockpit Platforms: Intelligent cockpits rush into a new era of "cross-domain integration and layered software design"

Cockpit hardware platform field: Faster cross-domain inte...

Global and China Flying Car Industry Research Report, 2022

ResearchInChina has released “Global and China Flying Car Industry Research Report, 2022".

A flying car is a three-dimensional vehicle. Broadly speaking, it is a low-altitude intelligent autonomous t...

Global and China Passenger Car T-Box Market Report, 2022

Passenger car T-BOX research: T-Box OEM installation rate will reach 83.5% in China in 2025

ResearchInChina has published Global and China Passenger Car T-Box Market Report 2022 to summarize and ana...

Global and China Purpose Built Vehicle (PBV) and Robocar Report, 2022

PBV and Robocar research: new idea of building brick cars, a new car type for future mobility Building brick cars moves the cheese of traditional OEMs.

Purpose built vehicle (PBV) refers to special ...

China Automotive Voice Industry Report, 2021-2022

Automotive voice market: The boom of self-research by OEMs will promote reform in the supply mode

Before the advent of fully automated driving, the user focus on driving, and voice interaction is sti...

Global and China Automotive Emergency Call (eCall) System Market Report, 2022

Automotive eCall system: wait for the release of policies empowering intelligent connected vehicle safetyAt the Two Sessions held in March 2022, more than 10 deputies to the National People's Congress...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...