Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2021

-

Nov.2021

- Hard Copy

- USD

$4,000

-

- Pages:165

- Single User License

(PDF Unprintable)

- USD

$3,800

-

- Code:

LMM011

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$5,700

-

- Hard Copy + Single User License

- USD

$4,200

-

Chinese brands’ ADAS research: Lynk & Co, BYD, Haval and Geely are in the first echelon of L2

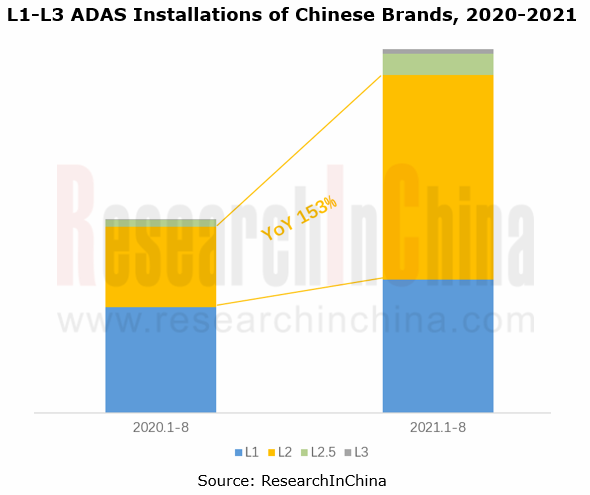

In the first eight months of 2021, more than 1.31 million vehicles of Chinese brands were equipped with ADAS, surging by 88.6% on a like-on-like basis, with an installation rate of 25.3%, up 5.7 percentage points compared with the same period of the previous year.

- The installations and installation rate of L2 ADAS, a segment in which Chinese brands vied for deployment, increased by 153% and 6 percentage points from the prior-year period, separately.

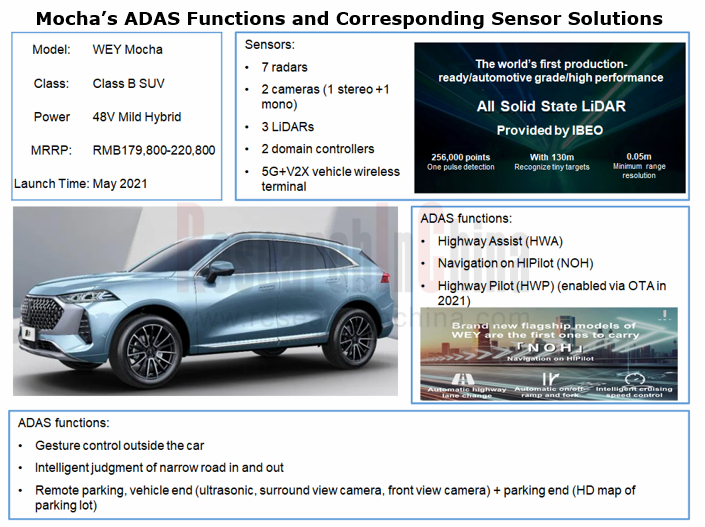

- The installations and installation rate of L2.5 ADAS increased by 227% and 0.8 percentage points. In 2021, a breakthrough has been made in mass production of L2+ ADAS for fuel-powered vehicles like WEY Mocha.

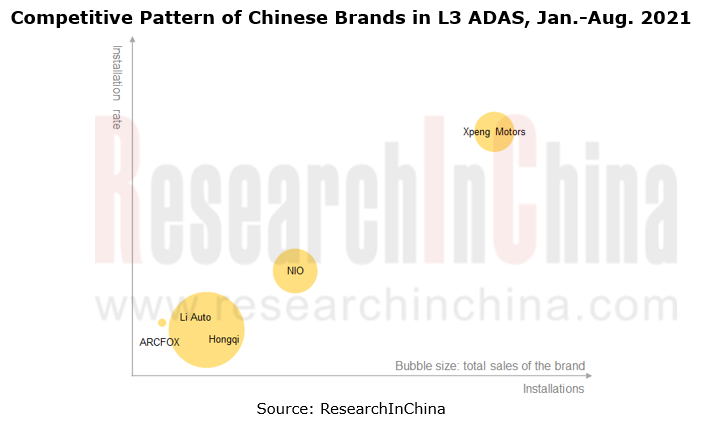

- L3 ADAS was installed in 17,000 vehicles, with an installation rate of 0.3%. Emerging carmakers such as Xpeng Motors, NIO, Li Auto and ARCFOX were the first ones to equip or demonstrate vehicles with L3 ADAS.

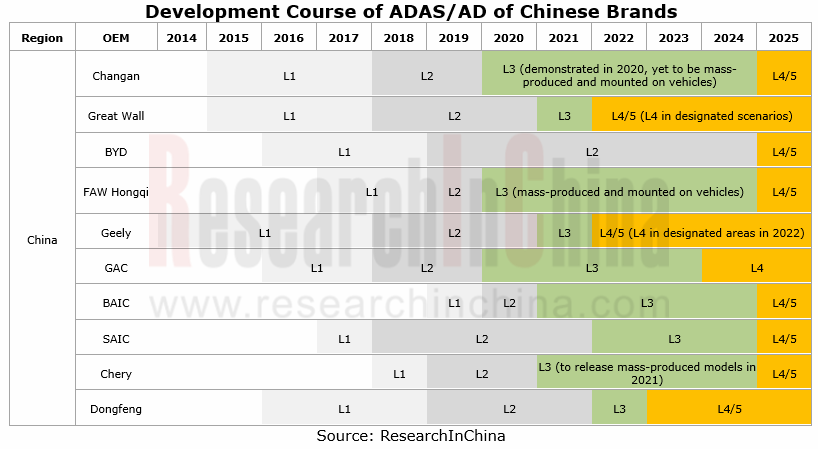

- The recent five-year plans of Chinese automakers show that the mass production of L4 autonomous vehicles in China may concentrate in 2025.

Lynk & Co and BYD have edged into the first echelon of L2 ADAS.

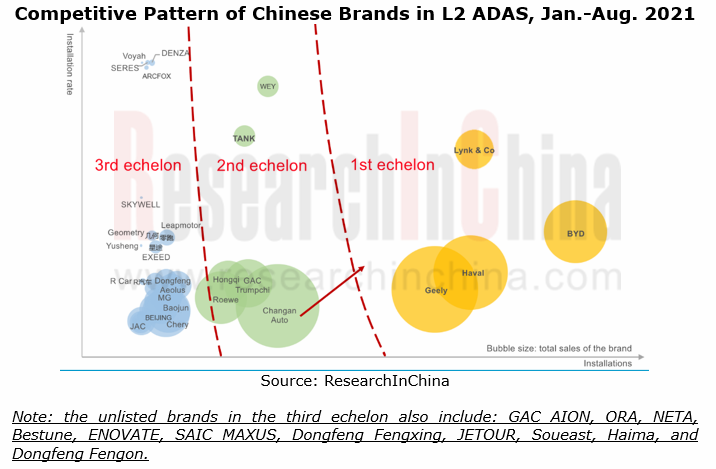

In the L2 ADAS market, Lynk & Co, BYD, Haval and Geely are first-echelon players, of which:

BYD is way ahead of its peers in L2 ADAS installations, which is credited to BYD Han, a model using a sensor solution of 1 front view camera + 3 radars + 4 surround view cameras + 12 ultrasonic radars;

Lynk & Co is among the top few in both installations and installation rate of L2 ADAS, mainly thanks to Lynk & Co 01 and Lynk & Co 03, both using 3R1V sensor solutions.

Changan Auto, GAC Trumpchi, Hongqi and Roewe are in the second echelon, with a bright prospect.

For example, by virtue of huge sale volume, UNI Series and AVATR brand as well as related technical strength, Changan Auto is very likely to boast far higher installations of L2.

A breakthrough has made in mass production of L2+ ADAS for WEY Mocha.

In the L2.5 ADAS segment, emerging brands like Li Auto and Xpeng Motors go ahead of others.

Among traditional brands, WEY Mocha holds a lead, having packed Highway Assist (HWA) and Navigation on HIPilot (NOH). In 2021, it is about to carry Highway Pilot (HWP) and L3 autonomous driving. What makes more sense for Mocha is its breakthrough in mass production of high-level ADAS for fuel-powered vehicles.

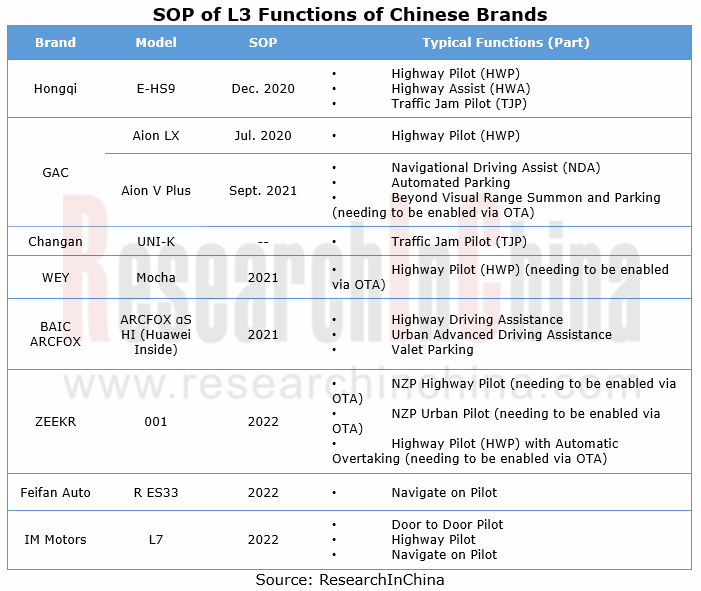

L3 ADAS has been demonstrated on multiple models or mass-produced for them.

In current stage, emerging brands are pacesetters in L3 ADAS, and traditional Chinese brands have completed technology layout:

FAW Hongqi, GAC AION, BAIC ARCFOX, etc. have mass-produced L3 ADAS for their vehicles;

Great Wall WEY Mocha is about to carry L3 functions in 2021;

Changan Auto, Geely (ZEEKR), Feifan Auto, IM Motors, etc. have reserved technologies;

JETOUR X Chery JETOUR built on the Kunlun Architecture is projected to pack mass-produced L3 advanced autonomous driving solutions.

One example is ARCFOX αS HI.

In April 2021, ARCFOX αS HI (Huawei Inside) co-built by BAIC ARCFOX and Huawei made a debut at the Auto Shanghai. The model carries Huawei’s advanced ADS, 3 96-channel LiDARs, 6 radars, 12 cameras, 13 ultrasonic radars, and Huawei chips with computing power of 400TOPS, delivering L3 autonomy and offering capabilities of highway driving assistance, urban advanced driving assistance and valet parking.

The mass production of L4 autonomous vehicles in China may concentrate in 2025.

- A number of brands such as SAIC, GAC and Geely have defined SOP of L4:

In June 2021, SAIC made it clear that it will produce L4 intelligent vehicles in quantities in 2025.

- In July 2021, GAC announced that GAC AION and Huawei co-developed a mid-to-large-sized intelligent SUV BEV with L4 autonomous driving functions, which is projected to be spawned in 2023.

- In October 2021, Geely specified that it will commercialize L4 autonomous driving in 2025 in the Smart Geely 2025.

1 Status Quo of Chinese Brands’ ADAS Market

1.1 Installations and Installation Rate of ADAS Functions of Chinese Brands

1.2 ADAS Installations and Installation Rate of Chinese Brands: Overall Situation

1.3 L2 ADAS Installations and Installation Rate of Chinese Brands: Overall Situation

1.4 L2 ADAS Installations and Installation Rate of Chinese Brands: By Brand

1.5 L2 ADAS Installations and Installation Rate of Chinese Brands: By Vehicle Model

1.6 L2 ADAS Installations and Installation Rate of Chinese Brands: By Price

2 ADAS and Autonomous Driving Layout of Chinese Brands

2.1 ADAS Development Timelines of Chinese Brands

2.2 Comparison of L2, L2+ and L3 ADAS Solutions

2.3 L2 ADAS Layout: Functions and Solutions

2.4 L2+ ADAS Layout: Functions and Solutions

2.5 L3 ADAS Layout: Functions and Solutions

2.6 L4 ADAS Layout: Functions and Solutions

2.7 ADAS Partner Camps of Chinese Brands

3 Research on ADAS/Autonomous Driving of Chinese Brands

3.1 Changan Auto

3.1.1 ADAS Installation (by Brand/Model), 2021

3.1.2 14th Five-Year Plan

3.1.3 Vehicle Intelligence Strategy

3.1.4 Development Course of Autonomous Driving

3.1.5 Autonomous Driving Roadmap

3.1.6 Core Technologies of ADAS and Autonomous Driving

3.1.7 ADAS/AD Systems

3.1.8 Dynamic Deployments in Autonomous Driving, 2020-2021

3.1.9 Avatar’s Resources

3.1.10 Evolution Route of E/E Architecture

3.1.11 Autonomous Driving Tests

3.1.12 ADAS and Autonomous Driving Partners

3.1.13 Dynamic Deployments in Autonomous Driving, 2019-2021

3.2 Great Wall Motor

3.2.1 ADAS Installation (by Brand/Model), 2021

3.2.2 Autonomous Driving Strategy

3.2.3 Development Course of Autonomous Driving

3.2.4 Autonomous Driving Development: Stage 1

3.2.5 i-Pilot Smart Pilot System: System Architecture 1.0 and Hardware Solutions

3.2.6 Autonomous Driving Development: Stage 2

3.2.7 Layout and Autonomous Driving Plan of WEY

3.2.8 Autonomous Driving Development: Stage 3

3.2.9 Autonomous Driving Computing Platform: ICU 3.0

3.2.10 WEY Mocha, L2+ (Scalability to L3)

3.2.11 L4 Autonomous Driving Concept Model

3.2.12 L5 Autonomous Driving Concept Model

3.2.13 Autonomous Driving Tests

3.2.14 Autonomous Driving Partners

3.2.15 Dynamic Deployments in Autonomous Driving, 2018-2021

3.3 BYD

3.3.1 ADAS Installation (by Brand/Model), 2021

3.3.2 Autonomous Driving Development Strategy

3.3.3 Development Course of Autonomous Driving

3.3.4 Autonomous Driving Roadmap

3.3.5 D++ Open Platform

3.3.6 Typical Models on D++ Platform

3.3.7 L2 ADAS

3.3.8 Typical Model with DiPilot Intelligent Driving Assistance System: Han EV

3.3.9 Typical Models on E Platform 3.0

3.3.10 E/E Architecture

3.3.11 Autonomous Driving Tests

3.3.12 Autonomous Driving Partners

3.3.13 Dynamic Deployments in Autonomous Driving, 2019-2021

3.4 FAW

3.4.1 FAW’s ADAS Installation (by Brand/Model), 2021

3.4.2 Autonomous Driving Development Plan of FAW

3.4.3 Autonomous Driving Development Path of FAW Hongqi

3.4.4 ADAS Functions and Solutions of FAW Hongqi

3.4.5 FAW Hongqi’s Dynamic Deployments in Autonomous Driving, 2020-2021

3.4.6 E/E Architecture of FAW Hongqi

3.4.7 FAW Hongqi’s Autonomous Driving Tests

3.4.8 FAW’s Autonomous Driving Partners

3.4.9 FAW’s Dynamic Deployments in Autonomous Driving, 2019-2021

3.5 Geely

3.5.1 ADAS Installation (by Brand/Model), 2021

3.5.2 Development Course of Autonomous Driving

3.5.3 Autonomous Driving Roadmap

3.5.4 ADAS/AD Systems

3.5.5 Parking System

3.5.6 Autonomous Driving Layout

3.5.7 Sustainable Experience Architecture (SEA)

3.5.8 Autonomous Driving Tests

3.5.9 ADAS/AD Partners

3.5.10 Dynamic Deployments in Autonomous Driving, 2019-2021

3.6 GAC

3.6.1 ADAS Installation (by Brand/Model), 2021

3.6.2 "1615" Strategy

3.6.3 Development Course of Autonomous Driving

3.6.4 Evolution Roadmap of ADAS Solutions

3.6.5 ADAS/AD Systems

3.6.6 L4/L5 Autonomous Driving Layout

3.6.7 Autonomous Driving Layout

3.6.8 Evolution of E/E Architecture

3.6.9 Autonomous Driving Tests

3.6.10 Autonomous Driving Partners

3.6.11 Dynamic Deployments in Autonomous Driving, 2019-2021

3.7 BAIC

3.7.1 BAIC’s ADAS Installation (by Brand/Model), 2021

3.7.2 Development of BAIC’s Autonomous Driving

3.7.3 Development Course of BAIC BJEV’s Autonomous Driving

3.7.4 Evolution Roadmap of BAIC's ADAS Solutions

3.7.5 ADAS/AD Systems of BAIC BJEV

3.7.6 BAIC’s Autonomous Driving Tests

3.7.7 BAIC’s Autonomous Driving Layout

3.7.8 BAIC’s Autonomous Driving Partners

3.7.9 BAIC’s Dynamic Deployments in Autonomous Driving, 2019-2020

3.8 SAIC

3.8.1 SAIC’s ADAS Installation (by Brand/Model), 2021

3.8.2 Autonomous Driving Plan of SAIC

3.8.3 Development History of SAIC’s Autonomous Driving

3.8.4 Evolution Route of SAIC's ADAS

3.8.5 Roewe’s ADAS Functions

3.8.6 Feifan's ADAS Functions

3.8.7 IM Motors’ ADAS Functions

3.8.8 SAIC’s L4 Autonomous Driving

3.8.9 SAIC’s Autonomous Driving Road Tests

3.8.10 SAIC’s Autonomous Driving Partners

3.8.11 SAIC’s Dynamic Deployments in Autonomous Driving, 2019-2020

3.9 Chery

3.9.1 ADAS Installation (by Brand/Model), 2021

3.9.2 Intelligence Strategy

3.9.3 Autonomous Driving Plan

3.9.4 Evolution of Autonomous Driving

3.9.5 ADAS Functions

3.9.6 EXEED’s ADAS Functions

3.9.7 Autonomous Driving Partners

3.9.8 Dynamic Deployments in Autonomous Driving, 2019-2020

3.10 Dongfeng Motor

3.10.1 ADAS Installation (by Brand/Model), 2021

3.10.2 Autonomous Driving Plan

3.10.3 Development Course of Autonomous Driving

3.10.4 Development Path of Autonomous Driving

3.10.5 ADAS/AD Functions

3.10.6 Voyah’s ADAS/AD Functions

3.10.7 Voyah’s E/E Architecture

3.10.8 Autonomous Driving Partners

3.10.9 Dynamic Deployments in Autonomous Driving, 2019-2020

China L2 and L2+ Autonomous Passenger Car Research Report, 2022

L2 and L2+ research: The installation rate of L2 and L2+ is expected to exceed 50% in 2025.So far, L2 ADAS has achieved mass production, and L2+ ADAS has seen development opportunities as the layout f...

Global and China L4 Autonomous Driving and Start-ups Report, 2022

L4 autonomous driving research: the industry enters a new development phase, "dimension reduction + cost reduction".

L3/L4 autonomous driving enjoys much greater policy support.

...

Software-defined vehicle Research Report 2022- Architecture Trends and Industry Panorama

Software-defined vehicle research: 40 arenas, hundreds of suppliers, and rapidly-improved software autonomyThe overall architecture of software-defined vehicles can be divided into four layers: (1) Th...

Emerging Automaker Strategy Research Report, 2022 - Li Auto

Research on Emerging Automaker Strategy: the strategic layout of Li Auto in electric vehicles, cockpits and autonomous driving

Li Auto will shift from the single extended-range route to the “extended...

Commercial Vehicle Intelligent Chassis Industry Report, 2022

Commercial vehicle industry is characterized by large output value, long industry chain, high relevance, high technical requirements, wide employment and large consumer pull, and is a barometer of nat...

China TSP and Ecological Construction Research Report, 2022

TSP research: the coverage of TSPs has spread from IVI, cockpits to vehicles.

With the emergence of Internet of Vehicles, telematics service providers (TSPs) take on the roles of operation platforms,...

Global and China Automotive Seating Industry Report, 2022

Automotive seating research: automotive seating enjoys an amazing boom in the context of autonomous driving.

As autonomous driving develops, vehicles, a simple mobility tool, are tending to be positi...

Automotive Smart Surface Industry Research Report, 2022

Smart Surface Research: As an important medium for multimodal interaction, smart surfaces lead the trend of smart cockpits.Smart surfaces represent the development trend of automotive interiors and ex...

China Passenger Car Cockpit Multi and Dual Display Research Report, 2022

Cockpit multi and dual display research: 51.5% year-on-year growth in center console multi and dual display installation from January to July 2022

ResearchInChina released "China Passenger Car Cockpi...

China Automotive Cybersecurity Hardware Research Report, 2022

Cybersecurity hardware research: security chip and HSM that meet the national encryption standards will build the automotive cybersecurity hardware foundation for China.

1. OEMs generally adopt the s...

China Automotive Cybersecurity Software Research Report, 2022

Chinese in-vehicle terminal PKI market will be worth RMB1.89 billion in 2025.

The working principle of PKI (Public Key Infrastructure) is: the infrastructure that provides security services establish...

Global and China HD Map Industry Report, 2022

HD maps have been applied on a large scale, spreading from freeways to cities

According to ResearchInChina, more than 100,000 Chinese passenger cars were equipped with HD maps by OEMs in the first ha...

Automotive Software Providers and Business Models Research Report, 2022

Research on software business models: four business forms and charging models of automotive software providers.

In an age of software-defined vehicles, automotive software booms, and providers step u...

China Automotive Integrated Die Casting Industry Research Report, 2022

Integrated Die Casting Research: Upstream, midstream and downstream companies are making plans and layouts in this booming field

Automotive integrated die casting is an automotive manufacturing proce...

Emerging Automakers Strategy Research Report, 2022--Xpeng Motors

XPeng Motors Strategy Research: Landing Urban NGP and Expanding Three Branch BusinessesXPeng P7 drives overall sales growth, and three new models will be launched from 2022 to 2023 to drive new growth...

Global Passenger Car Vision Industry Report, 2022

Foreign automotive vision research: leading Tier 1 suppliers vigorously deploy DMS/OMS, and vital sign detection becomes a standard configuration for OMS.

1. The revenues of major Tier 1 suppliers in...

China Automotive Vision Industry Report, 2022

China automotive vision research: DMS is booming, with the installations soaring 141.8% year-on-year

1. China will install 75.4 million cameras in 2025

According to ResearchInChina, China installed ...

C-V2X (Cellular Vehicle to Everything) and CVIS (Cooperative Vehicle Infrastructure System) Industry Report, 2022

C-V2X industry research: C-V2X was pre-installed in more than 20 production passenger car models, with a penetration rate of over 0.5%.

More than 20 production passenger car models were equipped wit...