Research on automotive modularization: the creation of electric modular platforms, the reduction of the number of platforms, and the development of core platforms

The demand for low-cost and short development cycles of new models promotes the development of automotive modular platforms.

An automotive modular platform includes the design and assembly of all sub-systems of a car in a modular manner, and the standardized design and production of auto parts in the form of modules, and the final "assembly" according to the positioning of models.

Unlike the traditional automotive platform which is only for models at the same single level, the modular platform reduces R&D and production costs and shortens the development cycle of new models. At the same time, it facilitates to unify quality standards and improve the overall strength of products.

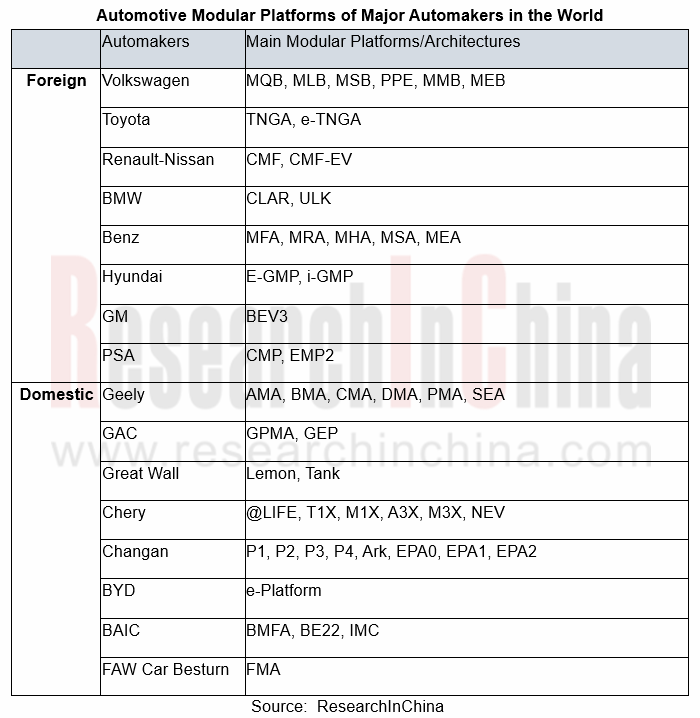

Since Volkswagen launched the MQB platform in 2012, international automakers (including Toyota, Renault-Nissan, Mercedes-Benz, BMW, etc.) and Chinese counterparts (like Changan, Geely, and GAC) have all released their own modular platforms, covering multiple levels and models.

It is an inevitable trend to build a dedicated modular platform for electric vehicles

At present, new energy vehicles have represented the main direction of the transformation and development of the global automotive industry. In 2020, 3.125 million new energy vehicles were sold worldwide with a year-on-year increase of 41.4%. The figure is expected to reach 15 million by 2026.

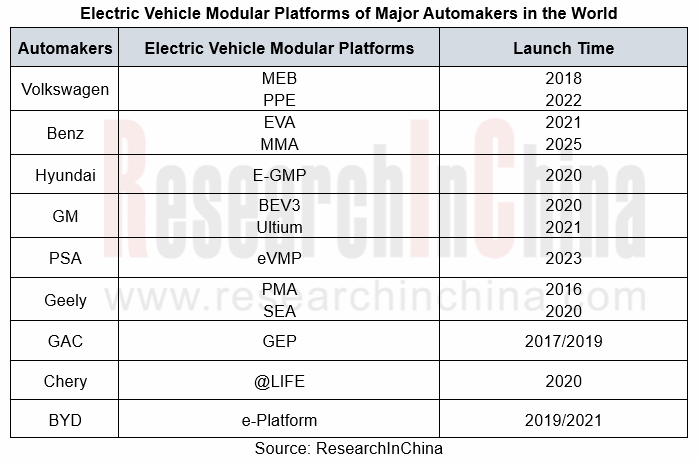

In this context, it is a mainstream trend to build a dedicated modular platform for electric vehicles. Compared with the oil-to-electricity platform, the modular platform features advantages like longer mileage and better safety. At present, most companies have launched or planned to launch their exclusive platforms for electric vehicles. In addition, companies including Volkswagen, Mercedes-Benz, and PSA that use the oil-to-electricity mode to produce new energy vehicles have also begun to study and unveil their own dedicated platforms for electric vehicles that are being developed.

Electric vehicle modular platforms are mainly proposed by traditional automakers that follow the product layout of the fuel vehicle model when manufacturing electric vehicles, but they are more inclined to build a wide range of electric vehicle product lines to meet the demand of different consumers in different market segments. Therefore, modular platforms extend to electric vehicles.

The emerging automakers represented by Tesla adhere to the principle of short product lines, and pay more attention to the design advantages of a single model and the software upgrade of the entire vehicle. Modular platforms are of little significance to them.

Fewer platforms and core platforms embody the development direction

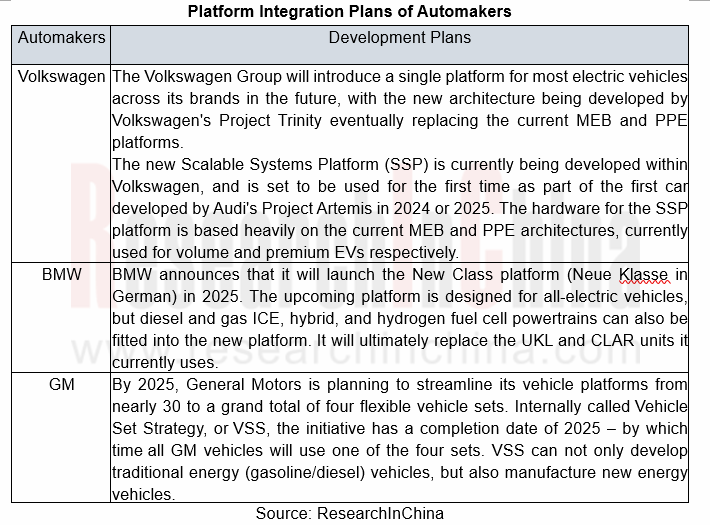

Under normal circumstances, automakers offer multiple modular platforms for different models, and each modular platform covers a limited range of models. In the future, they will focus on reducing the number of platforms, emphasizing core platforms, and raising the output of core platforms. The move will help further reduce costs and improve efficiency of R&D and production.

At present, Volkswagen, BMW, and GM have announced their platform integration plans. In the future, they will prioritize the development of core platforms instead of the existing multiple platforms.

Brand new E/E architecture pushes transformation of the profit model of automotive industry

While launching modular platforms, some automakers have begun to upgrade their E/E architectures to "domain integration" or even "centralized" style. For example, the Geely SEA architecture adopts a brand-new E/E architecture which integrates three domains, and it will introduce a centralized architecture in the future. In the future, with the development of modular platforms, it is expected that the E/E architecture of automobiles will be upgraded.

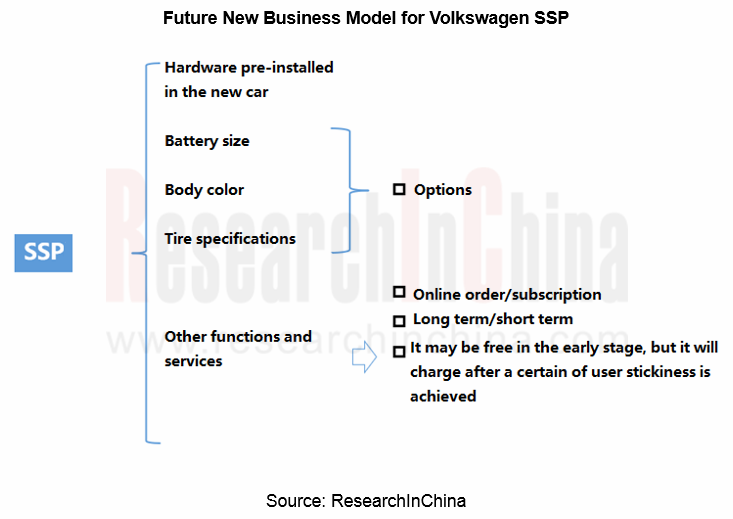

However, due to the adoption of the automotive E/E architecture, the on-board software system has to be re-integrated, which will gradually shift the profit model of the automotive industry from the hardware-oriented mode to the software and services-oriented mode. Currently, Volkswagen has stated that it will launch a new business model for the Scalable Systems Platform (SSP) in 2024.

Modular body is expected to be mass-produced

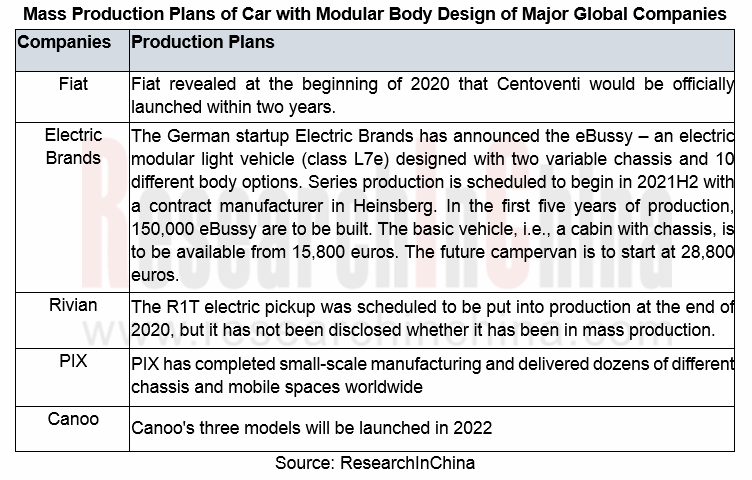

Modular body means that the combination of the same chassis and different modular compartments can be used in different scenarios to improve vehicle utilization. At present, traditional automakers and emerging technology companies including Fiat, Mercedes-Benz, Rinspeed, Rivian, Schaeffler, etc. have launched concept cars with interchangeable bodies.

Although most of the current modular cars are concept cars, some companies have put mass production on the agenda.

Autonomous Driving and Cockpit Domain Control Unit (DCU) Industry Report, 2022(II)

Domain Controller Research: Exploration of Five Business Models, Tier1, Tier0.5, Tier1.5 or ODM?

Automakers accelerate the mass production of new E/E architecture platforms, and the penetration rate...

Autonomous Driving and Cockpit Domain Control Unit (DCU) Industry Report, 2022 (I)

Domain Controller Research: Exploration of Five Business Models, Tier1, Tier0.5, Tier1.5 or ODM?

Automakers accelerate the mass production of new E/E architecture platforms, and the penetration rate...

China Minicar Industry Report, 2022

Minicars, also known as mini passenger cars, are suitable for short-distance transportation and are positioned as entry-level vehicles. Thanks to low cost, convenient parking and low usage cost, minic...

China Automotive Ultrasonic Radar and OEM Parking Roadmap Research Report, 2022

In 2021, ultrasonic radar shipments hit 100 million units, and intelligent parking became a crucial engine.1. In 2025, China’s ultrasonic radar installations will exceed 140 million units.

According...

DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022

DENSO CASE Research: The semiconductor business will help it go "from Toyota to the world”

ResearchInChina has released DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Resea...

China Roadside Edge Computing Industry Report, 2022

Roadside Edge Computing Research: how edge computing enables intelligent connected vehicles?

Policies and standards for roadside edge computing are implementing one after another, favoring the boom o...

Chinese ADAS and Autonomous Driving Tier 1 Suppliers Report, 2021-2022

Autonomous Driving Tier 1 Suppliers Research: the installation rate of L2 and above autonomous driving functions in passenger cars hit over 30% in 2022Q1.

In 2022Q1, the installation rate of L2 and a...

Global and China Electronic Rearview Mirror Industry Report, 2021-2022

Electronic rearview mirror research: the streaming rearview mirror installations soared by 73% in 2021.

This report combs through and summarizes the global and Chinese electronic rearview mirror mark...

Global and Chinese Automakers’ Modular Platforms and Technology Planning Research Report, 2022

Research on Automakers’ Platforms and Their Planning: the Strategic Layout Directions of 32 Automakers

At present, global automotive industry is in the midst of profound changes unseen in a century....

Automotive Intelligent Cockpit Platform Research Report, 2022

Research on Intelligent Cockpit Platforms: Intelligent cockpits rush into a new era of "cross-domain integration and layered software design"

Cockpit hardware platform field: Faster cross-domain inte...

Global and China Flying Car Industry Research Report, 2022

ResearchInChina has released “Global and China Flying Car Industry Research Report, 2022".

A flying car is a three-dimensional vehicle. Broadly speaking, it is a low-altitude intelligent autonomous t...

Global and China Passenger Car T-Box Market Report, 2022

Passenger car T-BOX research: T-Box OEM installation rate will reach 83.5% in China in 2025

ResearchInChina has published Global and China Passenger Car T-Box Market Report 2022 to summarize and ana...

Global and China Purpose Built Vehicle (PBV) and Robocar Report, 2022

PBV and Robocar research: new idea of building brick cars, a new car type for future mobility Building brick cars moves the cheese of traditional OEMs.

Purpose built vehicle (PBV) refers to special ...

China Automotive Voice Industry Report, 2021-2022

Automotive voice market: The boom of self-research by OEMs will promote reform in the supply mode

Before the advent of fully automated driving, the user focus on driving, and voice interaction is sti...

Global and China Automotive Emergency Call (eCall) System Market Report, 2022

Automotive eCall system: wait for the release of policies empowering intelligent connected vehicle safetyAt the Two Sessions held in March 2022, more than 10 deputies to the National People's Congress...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...